Best Cashback on Car Insurance + How to Save on Car Insurance – £42 Cashback + £150 Saving

Is it possible to save a substantial amount (up to 50%) on Car Insurance and get the Best Cashback Deal at the same time? My answer is an absolute and definite yes to both. If you still have any reservations after reading How to Save on Car Insurance and get the Best Cashback Deal – £150 Saving + £42 Cashback, I think I will give it a second go in this post to dissipate any further doubts.

We do own a second car. I make use of one of them and my wife drives the other. Each one of us deal separately with the costs of keeping the motors (service, road tax, insurance, … , repairs), however, it is my job to take care of all paperwork related to the vehicles. As it happens, insurance for the second car was due in the first week of January 2022. A gentle renewal reminder was sent to me by post to let me know that an automatic charge would be debited on my account in early January for an amount very close to £400 (forgive me but I do not remember the exact figure and somehow I misplaced the paperwork; my records show that I paid £371.84 one year ago, so let me round it up for the purposes of this exercise).

Not the best time of the year after the Christmas expenditure hangover and I feel in no mood to easily part with my hard-earned cash. Fortunately for me, I have developed a method to keep a decent chunk of it for myself and collect cashback as free money simultaneously. Let’s get to it.

The Best Cashback on Car Insurance + Saving on Car Insurance Method. There are four steps to my System:

- Visit at least three different comparison websites and obtain quotes from each.

- Having selected the best quote or quotes, run searches on cashback websites to gauge available cashback deals.

- In addition to using comparison engines, run a query on comparison services from cashback websites to compare best package (switch saving + cashback reward).

- Saving and cashback reward considered to select Insurance Service, cancel old Policy and buy new Policy via cashback website.

If you are keen on saving on utility bills and insurance as well as collecting cashback in the process, my financial life is full of colourful examples that I am happy to share with you. In this regard, I have listed below a number of relevant posts for your interest:

How to Save on Car Insurance and get the Best Cashback Deal – £150 Saving + £42 Cashback

A £110 Cashback Reward for my New Broadband Contract

Home Insurance Switch £20 Savings + £45 Cashback

£100 Saving + £40 Cashback for Switching Energy Supplier

Step 1 – Obtain quotes from Comparison Websites

Top Tip: For a list of Motor Insurance Comparison Tools, please visit the C4N Toolbox.

This is the information gathering stage. I need to understand what the market has on offer for me to assess my options prior to committing to a purchase. To do that, I will be using insurance comparison websites. Reason being they make the leg work for me by asking them to run laser-focused queries on their databases to funnel down on the selected few from a pool of hundreds of insurer providers. To make it really count, I need to make sure that my information profile and my insurance selection criteria are true, accurate and consistent to give myself the better chance of obtaining: first, comparable results across the board, and second, competitive prices.

This works by answering their questionnaire and ticking on the relevant boxes according to my cover needs (ie: voluntary excess, no claims discount protection, courtesy car, legal cover, etc.). Going through the personal information and data gathering process plus repeating it four times (on an equal number of price comparison engines) might look like a time-consuming process. And it will be, at least the first time. However, the reward will come in the form of hundreds of pounds being saved. Quite literally. It is time well invested.

Do I need to do this every time I visit a price comparison website? Absolutely not. I sign up and store a profile that can be saved for future searches. This way, I only provide with my personal data once, and I would update my profile as of when required prior to searching for quotes.

Top Tip: sign up with price comparison websites and store your profile for future searches so that there is no need to introduce your personal information every time you are in need of a quote.

At this moment in time, the UK insurance comparison landscape is built around four main engines: Moneysupermarket, GoCompare, Comparethemarket and Confused. Having signed in and fine tuned my profile with all of them, all is left to do is to run queries and collect results. As for my filters and options, they will be: comprehensive cover, £250 voluntary excess and one-off annual payment; I will also tick on legal cover, courtesy car, windscreen damage cover and personal accident cover.

Screen shots for each one of the search results showing best quotes thrown by each individual query are captured as follows:

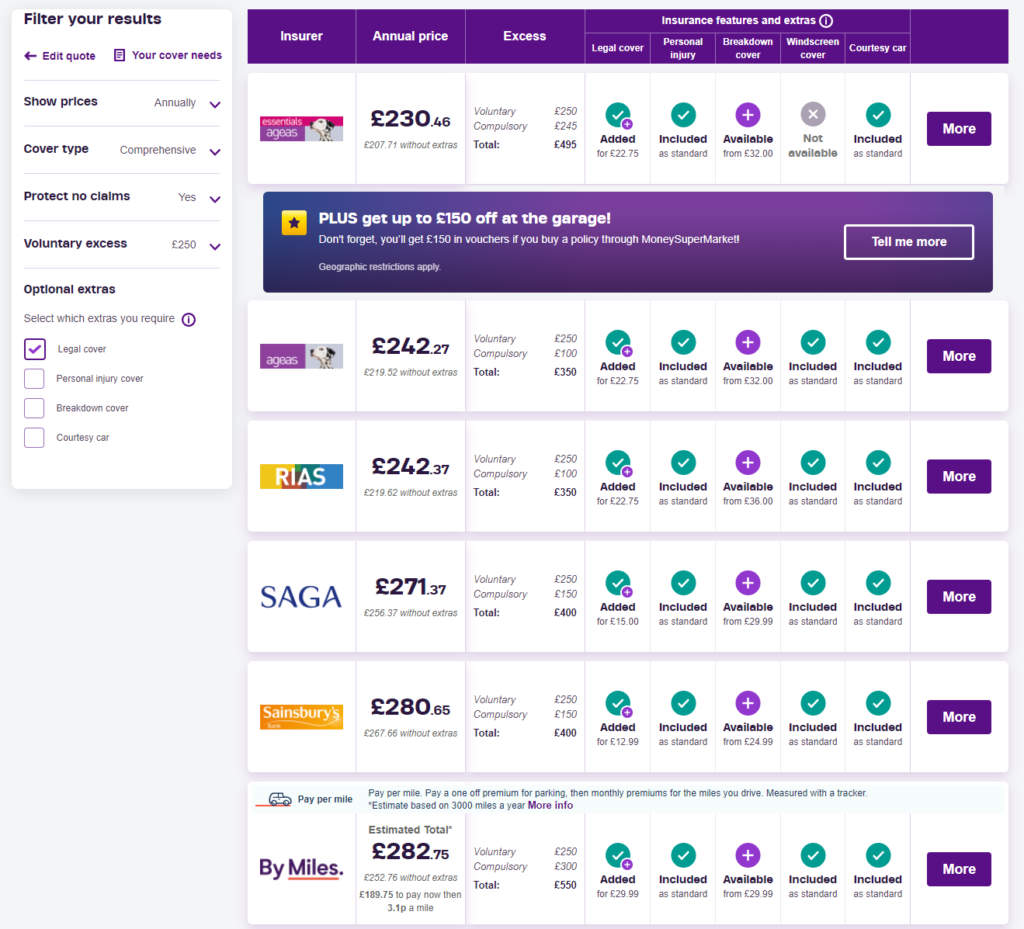

Quotes from Moneysupermarket:

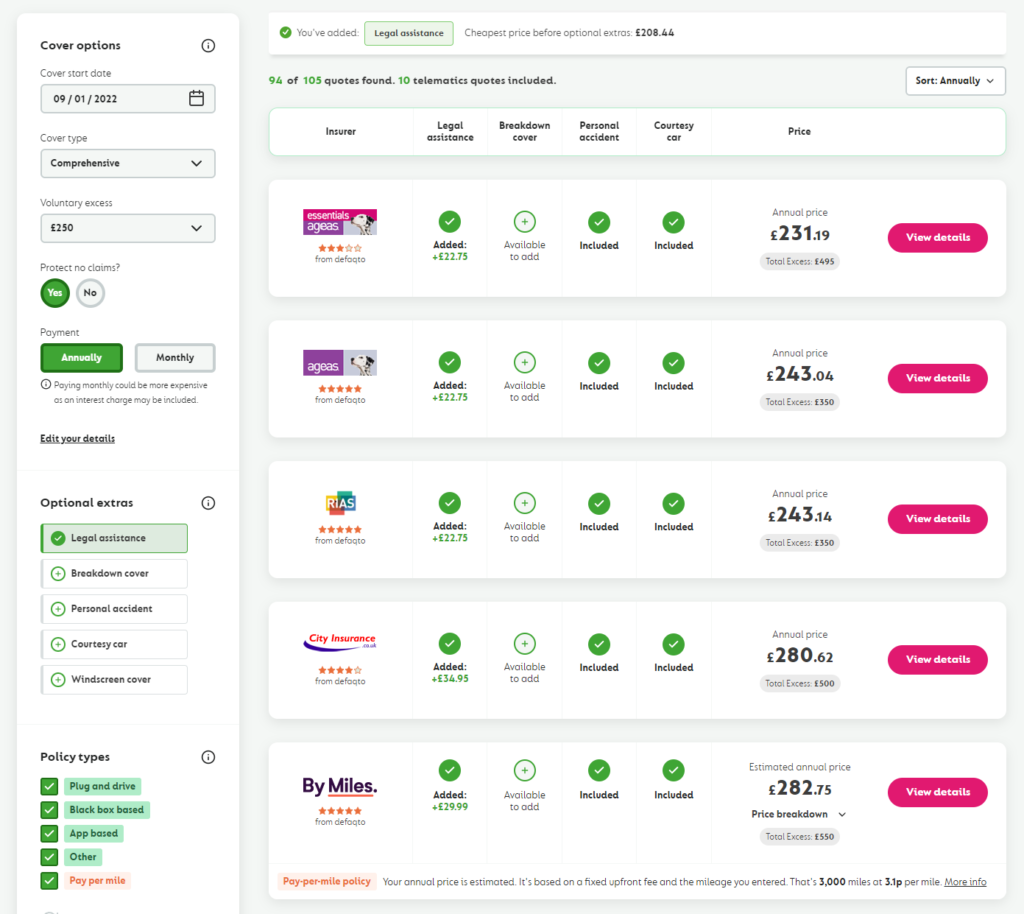

Quotes from GoCompare:

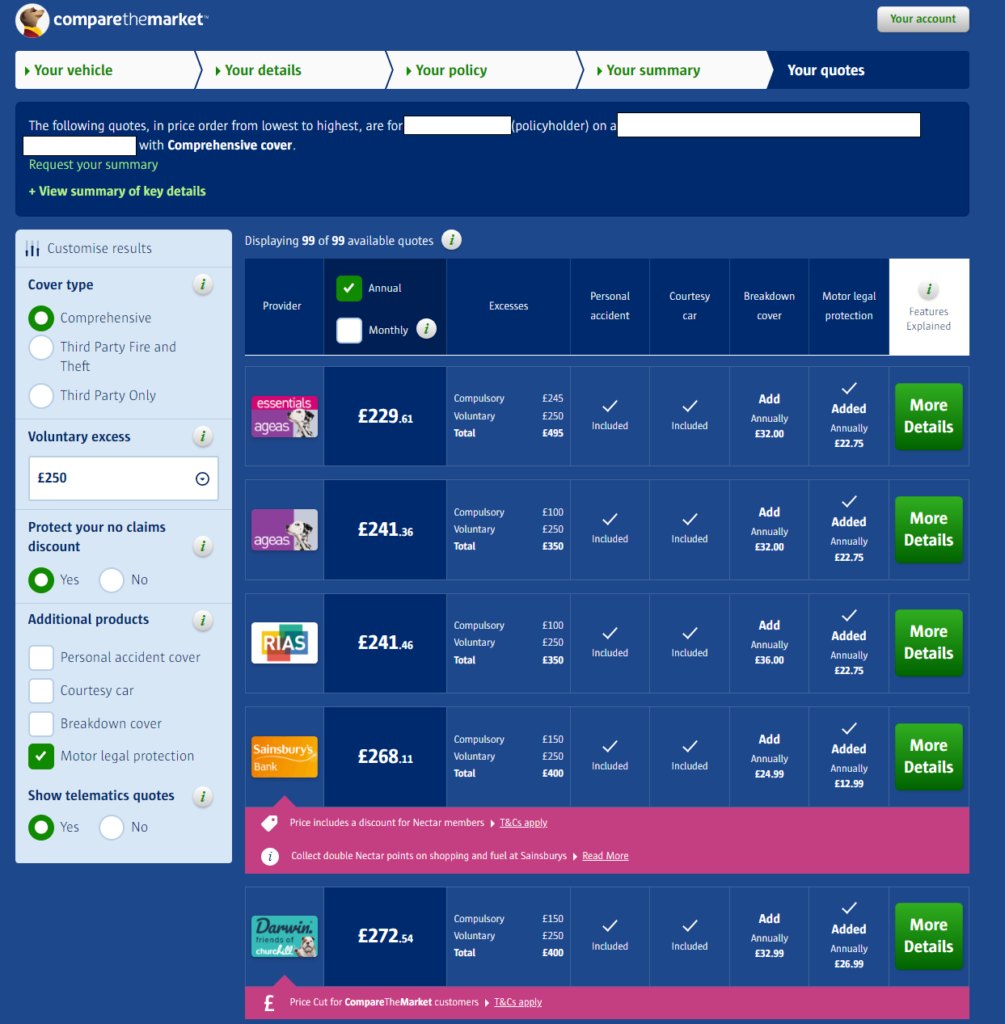

Quotes from Comparethemarket:

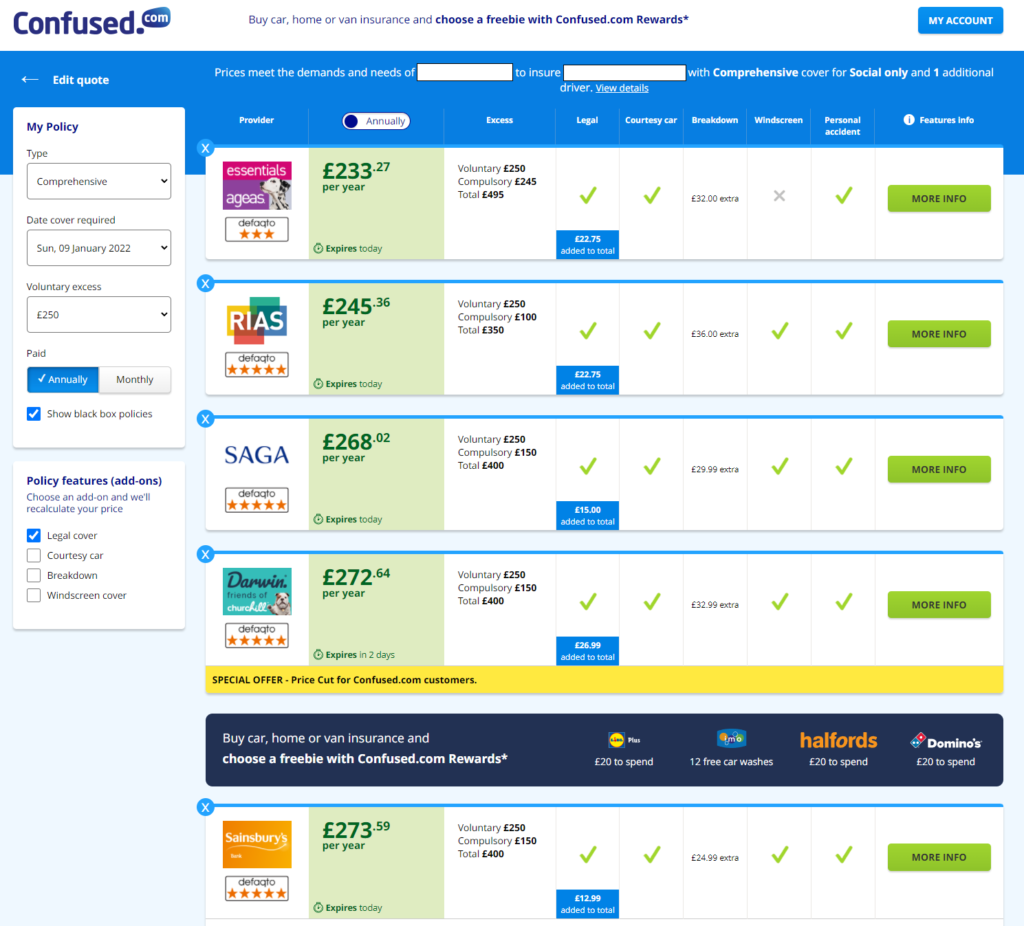

Quotes from Confused.com:

Each website will be requesting the same information from me but posed in a slightly different way. If I want to be able to compare apples with apples, it is crucial that my personal data is up to date, accurate and truthful. Not so difficult for me as these are words that define my personality (apologies for the bad joke but I could not help myself).

It is apparent that there are two main candidates presenting themselves at the top of the search results across all four websites: AGEAS and RIAS. My quotation price bracket: £229 to £245. Please bear in mind that it took me five minutes to save myself £150+ (40% cheaper than the renewal price). But I am still not happy. I am not quite finished yet.

Step 2 – Search cashback websites to gauge cashback deals

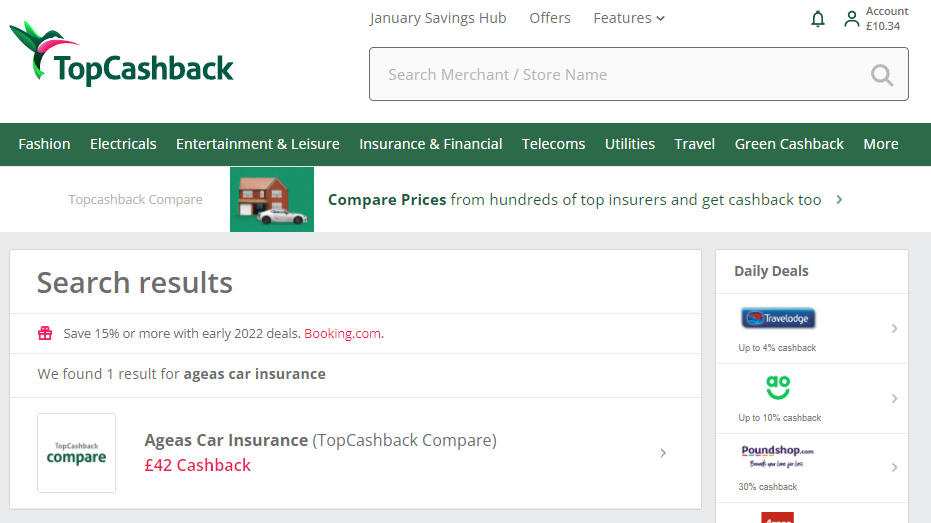

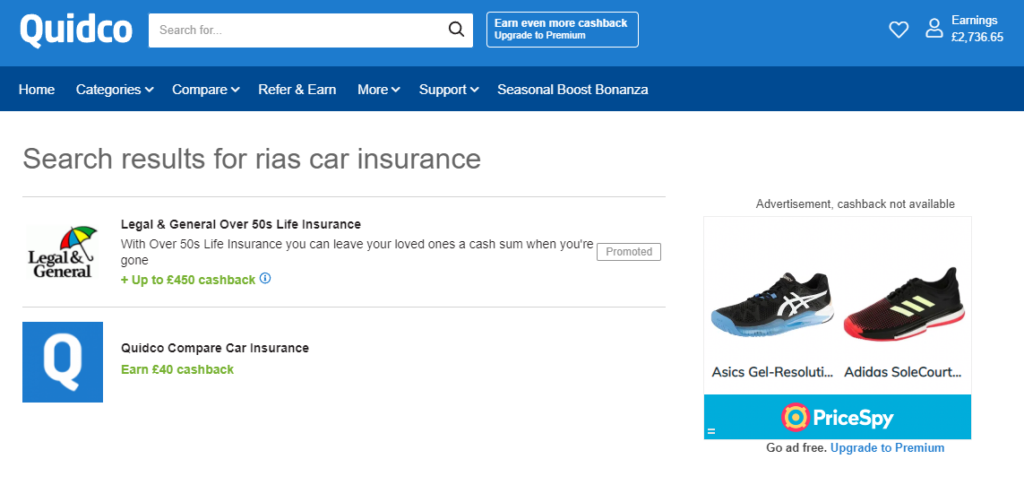

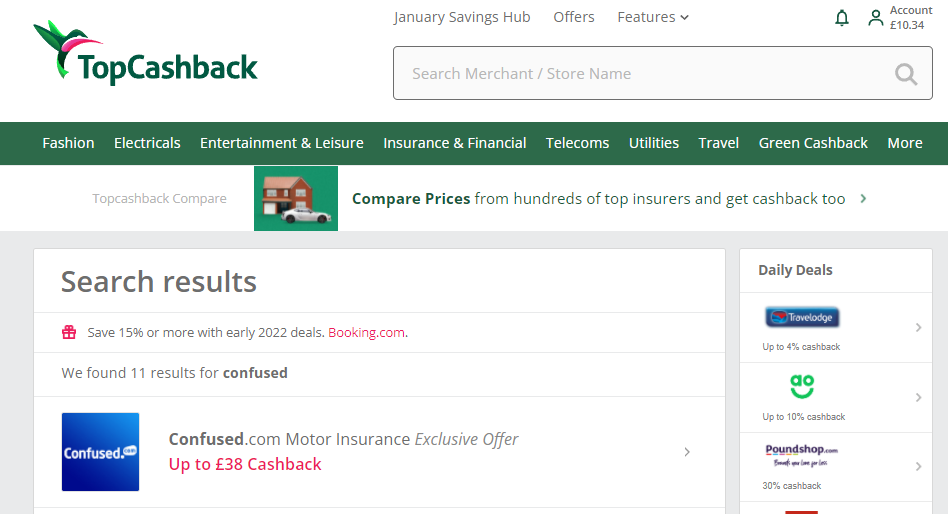

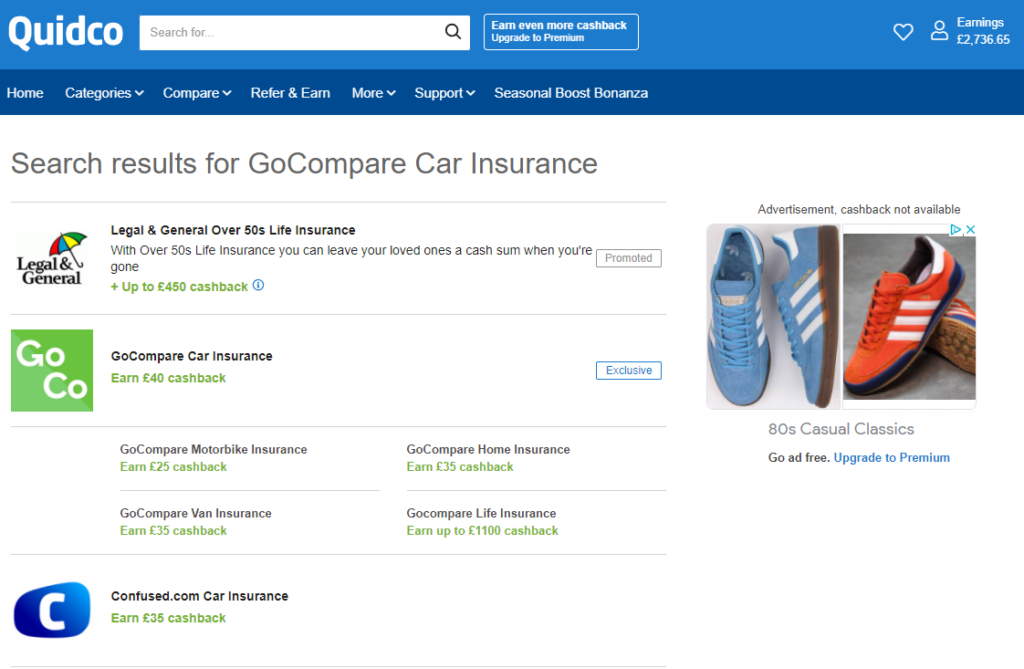

I know now that I will be switching car insurance providers. I have also shortlisted my choices from a potential of hundreds to just two. Can I get some cashback on top as Free Money? I most certainly can. If I want to find out though, I need to search Topcashback and

It seems that neither Quidco nor Topcashback offer individual cashback deals for AGEAS or RIAS, and if any, they will be embedded inside their own comparison services as the search results indicate (see screen shots). Time to progress to step 3.

Step 3 – Check comparison services on cashback websites to compare best package

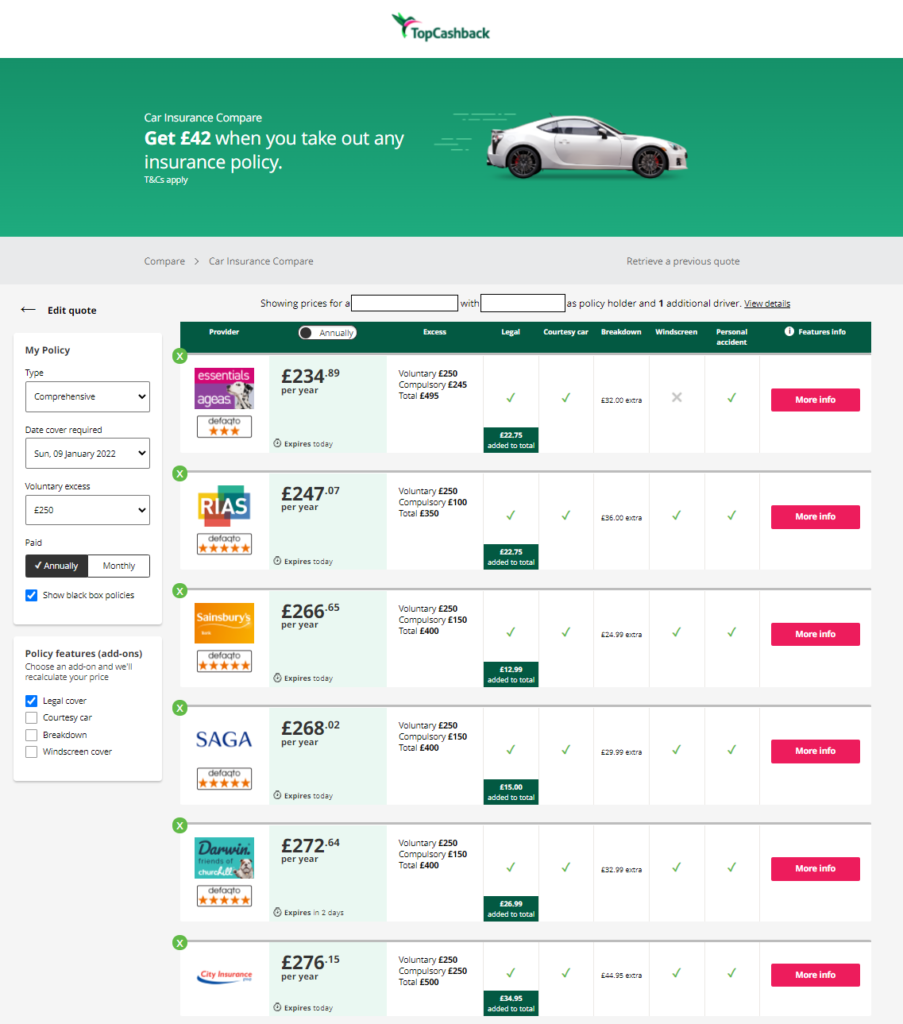

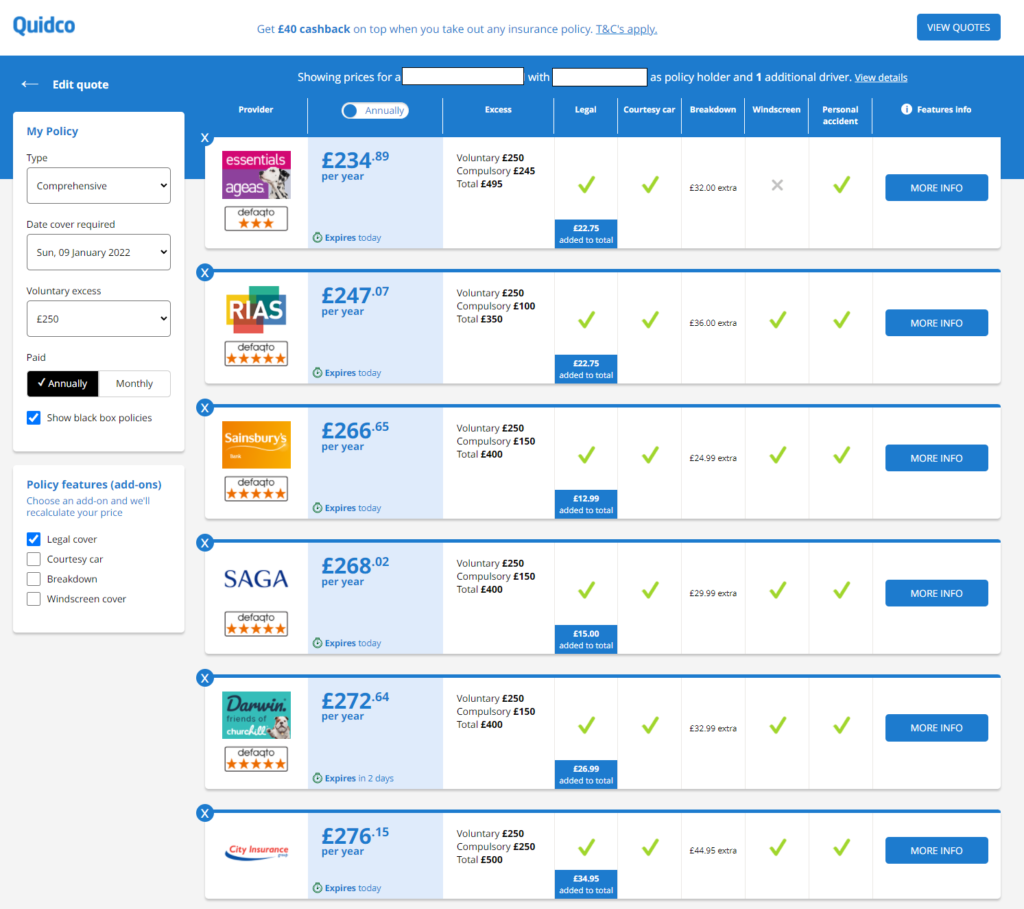

Cashback websites such as Quidco and Topcashback provide with car insurance price comparison tools. The idea is that the most competitive car insurance policy prices should be shown alongside an enticing cashback deal on top. Searching their engines is a must if we are to maximise our savings and reap some low hanging fruit Free Money as Cashback. After doing so, I have a strong suspicion that both cashback websites make use of the same software since both of them produced identical results as the screenshots below seem to suggest.

I am not surprised I am collecting the same results (AGEAS and RIAS) within a very similar premium price bracket (£235-£247).

I am going to pick the 5 stars appraisal awarded to RIAS by defaqto as my deciding factor tipping the scales in their favour against the 3 stars given to AGEAS. Having made my decision, the last question I need to answer is where to purchase it from in order to maximise my cashback reward. The final answer lies at the end of stage 4.

Step 4 – Buy new Car Insurance Policy via Cashback Website

Ok. So I am clear about the fact that I will be purchasing Car Insurance from RIAS for £245-ish. I just need to get the better cashback deal for myself. If I wanted to collect cashback from the comparison websites, I find that only GoCompare and Confused.com offer that choice. GoCompare would give me £40 cashback via Quidco and £37 via Topcashback, whereas Confused.com would pay £35 via Quidco and £38 via Topcashback. The other two options to be thrown into the mix come from the cashback websites themselves: Quidco will pay £40 and Topcashback £42.

I find it easier if I visualize my choices using a matrix.

| GoCompare | Confused.com | Cashback Comparison | |

| Via Quidco | £40 | £35 | £40 |

| Via Topcashback | £37 | £38 | £42 |

For the second time on the bounce, the winner is TopCashback Car Insurance Comparison Tool as it promises the highest cashback payout of £42.

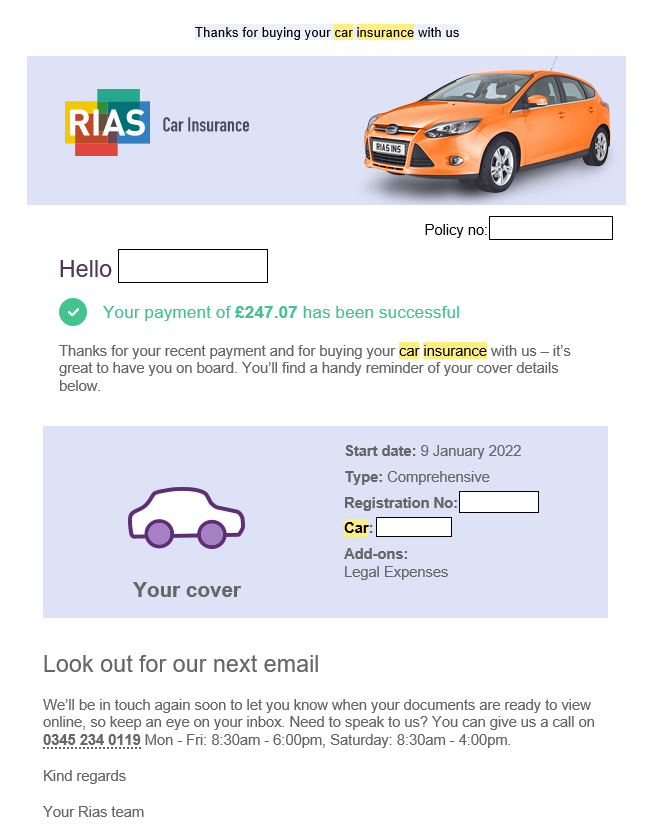

That’s it. End of the road. No more steps and no other considerations needed. I clicked on the Topcashback link and made a one-off payment for £247 on the RIAS website. Cashback will be tracked and paid in my bank account via BACS in a matter of weeks.

How much did I manage to save?

£400ish Renewal Quote – £247 = £153 approximately 40% cheaper. Adding the £42 cashback payment into the saving I will be halving the cost of my Premium to £205 or 50% cheaper.

It does feel good to save money and make money in one go. A thousand times better-off in my pocket than in someone else’s. Once I have learnt this process, it cannot be unlearnt. A smiling scenario if you do and a hair pulling scenario if you don’t. Ignorance is bliss for insurance companies. Not for me. Knowledge is power… and money.

Recent Comments