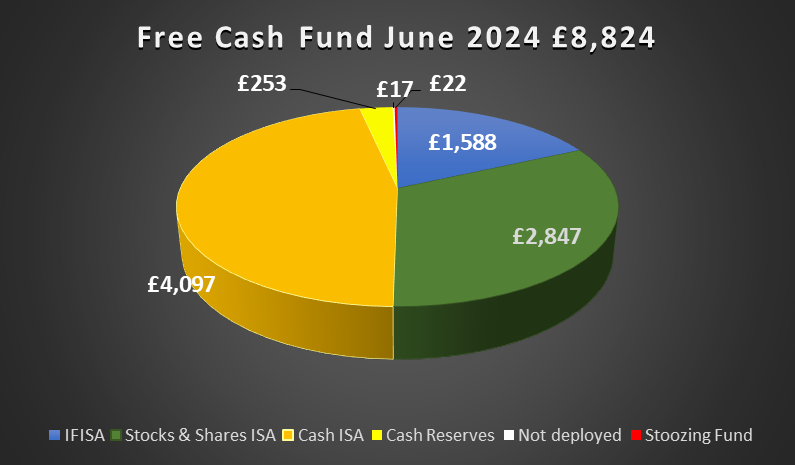

Free Cash Fund Value: £8,824 (+£607 ; +7.4%)

Investment Allocation Amount Deployed Current Value Diff % Diff IFISA £1,115 £1,588 +£473 +42.4% Cash ISA (60% of earnings) £3,960 £4,097 +£137 +3.5% S&S ISA (30% of earnings) £2,795 £2,847 +£52 +1.9% Cash Reserves (10% earnings) £820 £253 -£567 Not Deployed £17 £17 Stoozing Fund £2,500 £2,532 +£32 +1.3% Total £11,207 £11,334 £127 Liabilities (Credit Card Balance Transfer Repayments) -£490-£2,500 -£2,510 +£480 Net Value £8,217 £8,824 +£607 +7.4%

Investment Portfolio Value Moneybox Cash ISA £4,097 CrowdProperty IFISA £1,588 Foresters Stocks & Shares ISA £1,900 Moneybox Stocks & Shares ISA £502 Scottish Friendly Stocks & Shares ISA £195 Shepherds Friendly Stocks & Shares ISA £250 Cash Reserves £253 Not Deployed £17 Stoozing Fund +£22 Fund Value £8,824

Free Money Investment Allocation 60% Cash ISA ; 30% Stocks & Shares ISA ; 10% Cash Reserves Click here for Investment Strategy

Monthly Free Money Earnings Deployment Capital not deployed from previous month £52 Monthly Free Money Earnings £65 Total Capital available for deployment £117 Investment Allocation £60 Cash ISA ; £30 S&S ISA ; £10 Cash Reserves£17 Not Deployed

Investment Allocation Flows Previous Month Current Month Diff Source IFISA £1,415 £1,115 -£300 n/a Cash ISA (60%) £3,480 £3,840 +£360 +£300 IFISA +£60 Earnings S&S ISA (30%) £2,765 £2,795 +£30 +£30 Earnings Cash Reserves (10%) £810 £820 +£10 +£10 Earnings Not Deployed £52 £17 +£17 +£17 Earnings

Stoozing Fund Month Liabilities Repayment (1% Min £25) Investment Value Net Value Net Profit March 2024 £2,587.3 -£ £2,500.0 -£87.3 -£87.3 April 2024 £2,561.4 £25.9 £2,511.0 -£50.4 -£76.3 May 2024 £2,535.8 £25.6 £2,520.9 -£14.9 -£66.3 June 2024 £2,510.4 £25.4 £2,532.3 £21.9 -£54.9

See Stoozing Guide How to Make Free Money from Credit Cards

Cash Reserves Pot Flows Month Previous Monthly Earnings Repayments Pot Value April 2024 £270 +£30 -£25.9 £274.1 May 2024 £274.1 +£20 -£25.6 £268.5 June 2024 £268.5 +£10 -£25.4 £253.2

Bookmark & Subscribe

If you do not want to miss on any of it, please bookmark this page and subscribe to our newsletter for the latest developments, money making hints & tips, financial education and saving & investment strategies.

Recent Comments