May 2024 Free Money Earnings Report £188

Bank Rewards: £18

- Santander Lite Bank Account: £4

- Halifax Reward Account: £5

- Barclays Blue Rewards: £3

- RBS My Rewards: £3

- Natwest My Rewards: £3

Interest on Savings: £12

- Other Savings Accounts: £4

- RBS Regular Saver: £4

- Natwest Regular Saver: £4

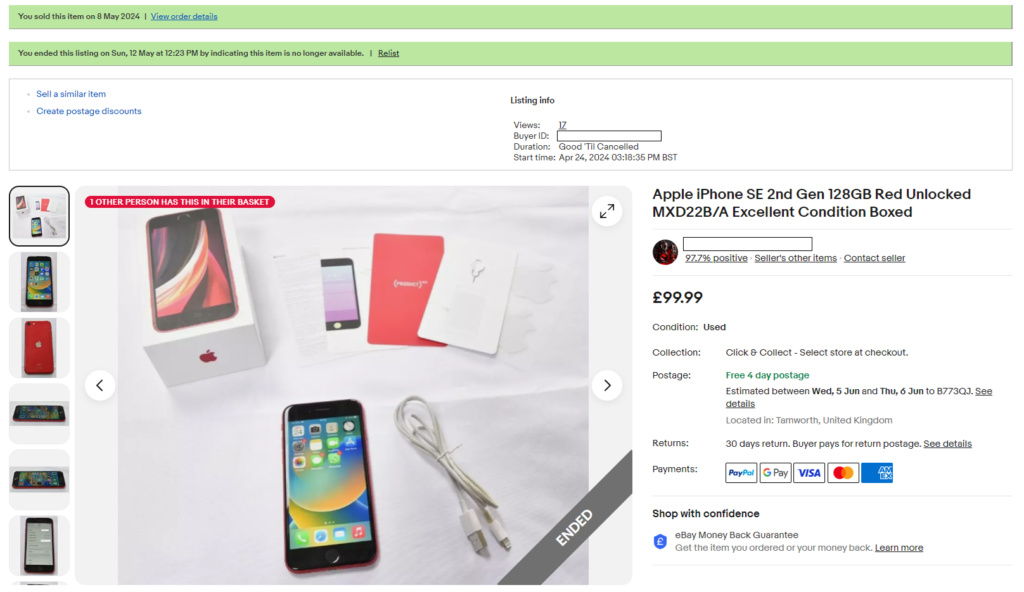

Decluttering Sales: £87

- Apple iPhone SE (2nd Gen): £87

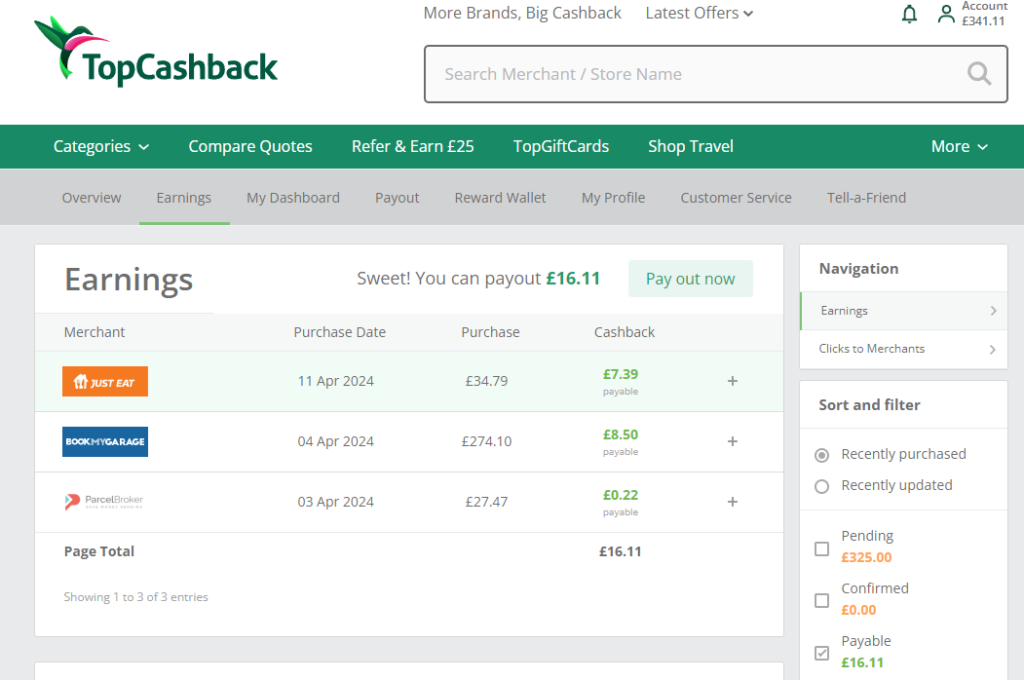

Cashback: £48

- TopCashback Casual purchases: £16

- AMEX Credit Card Cashback: £32

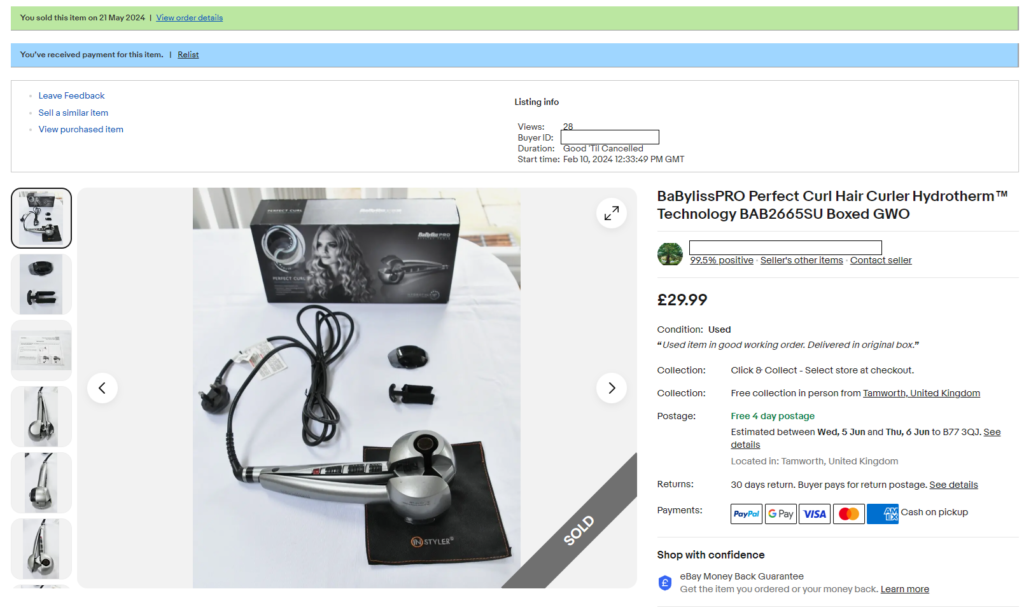

Freebies: £23

- Hair Curler: £23

| Month | Free Money Earnings | +/- Monthly Target (£125) | Accumulative | to Year End Objective (£1,500) |

| January | £219 | +£94 | £219 | £1,281 |

| February | £210 | +£85 | £429 | £1,071 |

| March | £185 | +£60 | £614 | £886 |

| April | £298 | +£173 | £912 | £588 |

| May | £188 | +£63 | £1,100 | £400 |

£188 Free Money in May 2024. Not outstanding but a decent performance for a single month. The graph shows five months on the bounce well over £125 target throwing a £220 as a monthly average value. Not only that, I also broke the £1k barrier to reach £1,100 accumulative. That is £400 away from a £1,500 annual objective. Optimistically, I can get over the finish line in a couple of months assuming average takings. Reality is, I need to make it happen one step at a time as I do not intend to defeat the purpose of the Free Money Principle: minimum to zero effort.

Bank rewards. No changes for better or worse. All my bank accounts have been credited with the monthly perk as per expectations bringing £18 into the pot. I am hoping to opt in for rewards back again with my second Halifax account at some point in August when the current rewards option expires (which I selected by mistake last year). Nothing I can do other than waiting for it to become available.

Interest on Savings. £12 pounds for the month. Sloooow progress. If anything, this figure is not going to be increased in the short/medium term since I need to withdraw some of my savings for their intended use. I just cannot magic money I am afraid so I need to content myself with what I have and stick to my savings plan. That’s that.

Decluttering Sales. It took a little bit longer than expected, but the second spare phone eventually shifted. On this occasion, a boxed iPhone SE in immaculate condition. After fees and postage, I collected £87 net profit. £409 from getting rid of clutter is not bad at all, however, I still need another £91 pounds to put it to bed. I will scavenge in the loft when I have the time. There should be plenty of stuff.

Cashback. £16 were made available for withdrawal in my TopCashback account. Half from casual purchases and the second half from having booked my car for servicing back in April. In addition, I got credited with £32 cashback in my AMEX account as a result of my spending activities using the credit card. These sums are not to be dismissed as negligible, quite the opposite, £210 since January are a relevant chunk of cash in this department. My plan is for this figure to increase. We’ll see.

Freebies. Last but not least, £23 from a freebie. A friend of my little girl gave her a curler thingy for which she had no use. To no surprise, it naturally found its way to my desk not necessarily because my thick mane is in need of any curling. Anyhow, a happy buyer was willing to pay the full asking price and I wasted no time in posting it away. Everyone is happy. Me in particular. Good to finally make a dent in the freebies stream but I still need £77 more to meet target. I am guessing I cannot leave it to chance entirely.

It is June by now and that signifies a half year already. I am 70% into my £1,500 annual objective with 7 months still to go. I have a feeling that there are plenty of free money making events to capture yet. Sure enough I will keep you guys posted. Bear with me.

Recent Comments