How to Invest the Free Cash Fund to target a 5% growth

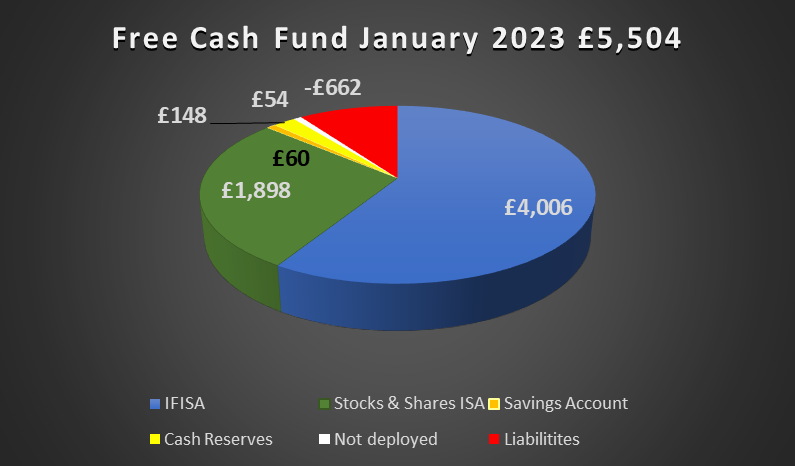

The Investment Strategy I devised back in January 2021 needs fine tuning. With a goal in mind of a 5% growth, I made the reasoned decision at the time to allocate all future Free Money Earnings into the following pots:

- 60% towards an IFISA Account (CrowdProperty).

- 30% in a Stocks & Shares ISA.

- 10% kept as Cash Reserves.

Free Money Earnings (Jan 2023): £5,254

Free Cash Fund Value (Jan 2023): £5,504 (+£250 ; +4.8%)

Even though numbers show that I have achieved a 4.8% return, the current economic scenario is dramatically different than the one we were presented with two years ago. Inflation hit double digits in 2022 and as a direct result, interest rates climbled gradually from practically 0% to 3.5%. Consequences are that money on credit is more expensive, but on the positive side, savings accounts offer now atractive risk free returns. My point is that if a similar return is available with the added benefit of not risking my capital, then it is not financially savvy to keep my moneys in a risk attached investment. This reasoning is explored in full detail in my post 5% Savings Accounts are back. Time to ditch my CrowdProperty IFISA?

The answer to that question was a resounding and categorical yes and to make it happen, two actions needed to be in place:

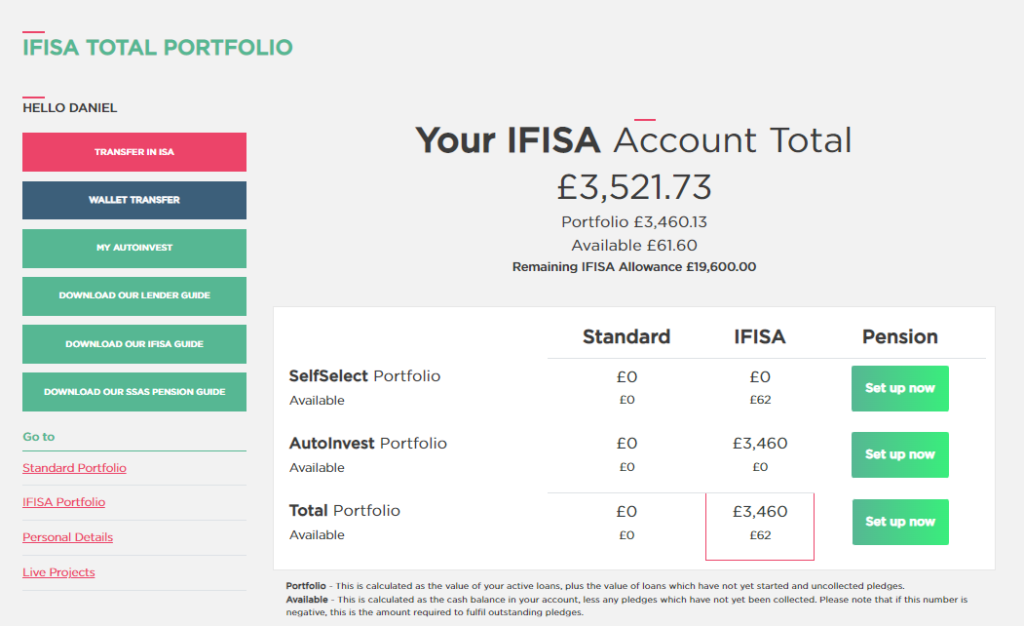

- I need to establish a flow of money from my CrowdProperty IFISA account towards a Cash ISA account.

- All future 60% pot allocations will be directed towards the Cash ISA.

As for the first action, I turned off the autoinvest feature, I also will hold the matured loans into a wallet in view to transferring them out. I expect this process to take months, but the live loans will keep generating interest in the interim until they are fully made available as cash.

As for the second, I will need to search for a Cash ISA offering a 4%-5% return.

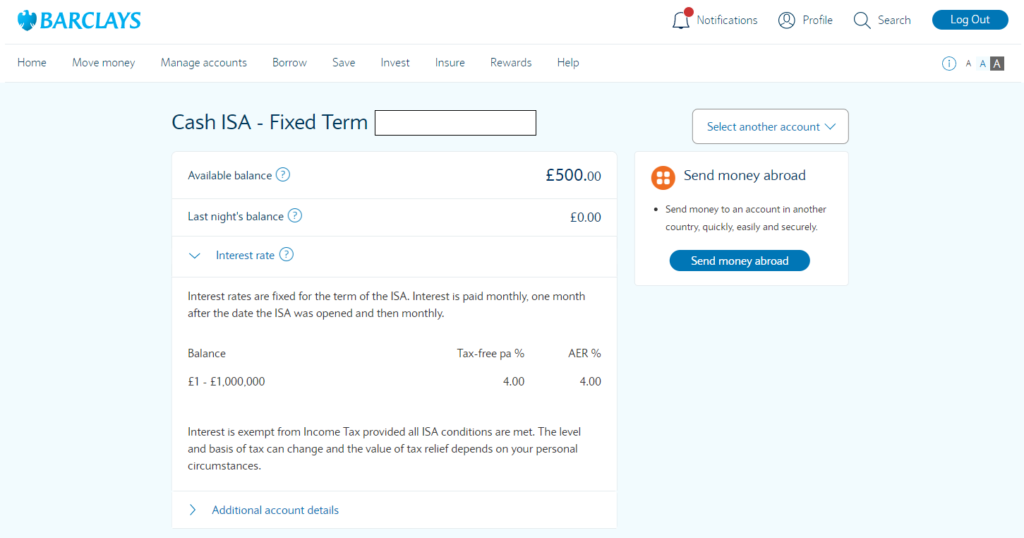

I am using the only competitive savings account product available at this moment in time to keep my own savings and collect the interest payments as free money (Barclays Rainy Day Saver Account @5.12%). Monthly regular savings accounts although offering 5% interest rates are not suitable for my needs: I will not be able to save lump sums and the constraint of a maximum deposit per month translates into lower annual returns. After some research I found that the best option available is on the Barclays portfolio: Cash ISA Fixed Term @ 4%. Having a number of Barclays products under the same umbrella, it took me literally two minutes to apply and be accepted for this account.

Since the decision was made to stop using the CrowdProperty IFISA back in December 2022, a £500 sum has been drip fed into the cash wallet and is available for withdrawal. I proceeded to transfer this money into the Barclays Cash ISA alongside the £60 Free Money January earnings allocation.

Replacing an IFISA for a Cash ISA might look like a small change but I deem it as a relevant enough and a significant modification in my Investment Strategy.

My goal of a 5% return on investment remains unchanged. As regards to Free Money pots allocation, for every £100 of Free Money gathered, the break down will be as follows:

- £60 Cash ISA @ 4% = £2.40

- £30 Stocks & Shares ISA @ 8%-10% = £2.60

- £10 Cash Reserves

That is the Plan in a nutshell. All things going well and raising £1,500 Free Money each year over the next two years, I will expect to see a number between £9,000 and £10,000 in the Free Money Fund at the end of year 4. Wish me luck.

Recent Comments