5% Savings Accounts are back. Time to ditch my CrowdProperty IFISA?

Recent increases in interest rates by the Bank of England are bad news for mortgage payers but good news for savers. The race is on and there are a number of financial institutions offering risk free returns of up to 5% in exchange of depositing my ‘hard-earned’ Free Money and/or my hard-earned Money. This is a new scenario for which I need to understand my options and if need be, reassess my investment strategy.

Time to analyse the performance of my CrowdProperty IFISA Account in order to understand whether or not is worth keeping my Free Money proceeds in that Investment given the new risk free options just being made available.

CrowdProperty IFISA Performance over the last 12 months (December 2021 to November 2022).

Numbers do the talking and I just need to listen. In this sense, I need them to tell me what the actual performance of my CrowdProperty IFISA has been over time. To find an answer, I have compiled the following table to capture monthly contributions as well as growth in the last twelve months.

| Month | Previous Month Value | Contributions | Growth | End of Month Value |

| Dec 2021 | £2,639 | £60 | £3 | £2,702 |

| Jan 2022 | £2,702 | £60 | £12 | £2,774 |

| Feb 2022 | £2,774 | £120 | £10 | £2,904 |

| Mar 2022 | £2,904 | £60 | £11 | £2,975 |

| Apr 2022 | £2,975 | £60 | £5 | £3,040 |

| May 2022 | £3,040 | £240 | £7 | £3,287 |

| Jun 2022 | £3,287 | £60 | £15 | £3,362 |

| Jul 2022 | £3,362 | £60 | £12 | £3,434 |

| Aug 2022 | £3,434 | £- | £9 | £3,443 |

| Sep 2022 | £3,443 | £180 | £15 | £3,638 |

| Oct 2022 | £3,638 | £120 | £17 | £3,775 |

| Nov 2022 | £3,775 | £180 | £15 | £3,970 |

I have made an overall contribution of £1,140 from December 2021 to November 2022. The net growth excluding contributions has been £131. The latest value recorded has been £3,970.

Actual Yield December 2021 to November 2022 £131/£3,970 = 3.30%

Better than nowt percent interest but far from being classed as impressive, particularly considering that inflation has hit double figures in 2022. But let me create another iteration to put things into perspective this time assuming that monthly growths would have been sustained for a full calendar year without additional contributions.

| Month | Previous Month Value | Growth | 12 Projection | Projected Yield |

| Dec 2021 | £2,639 | £3 | £36 | 1.36% |

| Jan 2022 | £2,702 | £12 | £144 | 5.33% |

| Feb 2022 | £2,774 | £10 | £120 | 4.33% |

| Mar 2022 | £2,904 | £11 | £132 | 4.55% |

| Apr 2022 | £2,975 | £5 | £60 | 2.02% |

| May 2022 | £3,040 | £7 | £84 | 2.76% |

| Jun 2022 | £3,287 | £15 | £180 | 5.48% |

| Jul 2022 | £3,362 | £12 | £144 | 4.28% |

| Aug 2022 | £3,434 | £9 | £108 | 3.15% |

| Sep 2022 | £3,443 | £15 | £180 | 5.23% |

| Oct 2022 | £3,638 | £17 | £204 | 5.61% |

| Nov 2022 | £3,775 | £15 | £180 | 4.77% |

Let’s have a closer look at these numbers:

- Highest yield projection: 5.61% in October 2022.

- Lowest yield projection: 1.36% in January 2021.

- Average yield projection: 4.07%

Incredibly disappointing and a far cry from the promised ‘up to 8% returns’ they advertise. Pure and simple maths are telling me vastly differently than their claim. In addition, let’s not forget that this is not a risk free investment.

Decision time. Should I keep my Free Money in a CrowdProperty IFISA Pot?

The short and straight answer is an absolute and definite NO, and the logic behind it is that I will be loosing out if I do for two main reasons:

- Opportunity cost: 5% vs 3.30% or £203 vs £131 gains per year in real terms for my £3,970 Free Money Pot.

- Risk element: zero risk vs unknown risk.

So you may ask, why have I kept money in a CrowdProperty IFISA so far? Again, this is not a closed but rather an open question comprising a number of line items to ponder. I feel that I need to answer this questions for my own personal benefit since I find value in gathering my thoughts in order to understand my reasoning and fine tune my decision making process. Going back to main thread, let me summarise the following pointers:

- 2008 looks like a distant memory in the past. A financial meltdown with no precedent triggered a 14 year span of 0% interest rates. On practical personal terms, I found no incentive to place money in savings accounts as there were no returns.

- I have had more than decent profits using Peer to Peer platforms in the past (such as the now defunct Ratesetter). All it was required to wipe them out for good was another once in a lifetime event such as a World Pandemic. Point been made is that I had high hopes on CrowdProperty taking that baton and producing similar yields (see post Investing my Free Money in a Peer to Peer IFISA Account). Unfortunately, it does not seem to be the case.

- Lastly, I deem these funds as Free Money and as a result, I am more inclined to risk them in search of better than average returns. I am happy to explore new investment vehicles.

I need to move the CrowdProperty IFISA Funds across to a 5% Savings Account. What is the Plan?

First things first. Where is the money going and why?

Most of the 5% Savings Accounts on offer come with a sting on the tail. That is that the monthly deposits are capped (£150 to £300 depending on the provider) and the total money in deposit generating interest is limited to a few grand (tipically £5,000). That is not necessarily bad but not ideal and somehow restricting if I have the money available to save as of now.

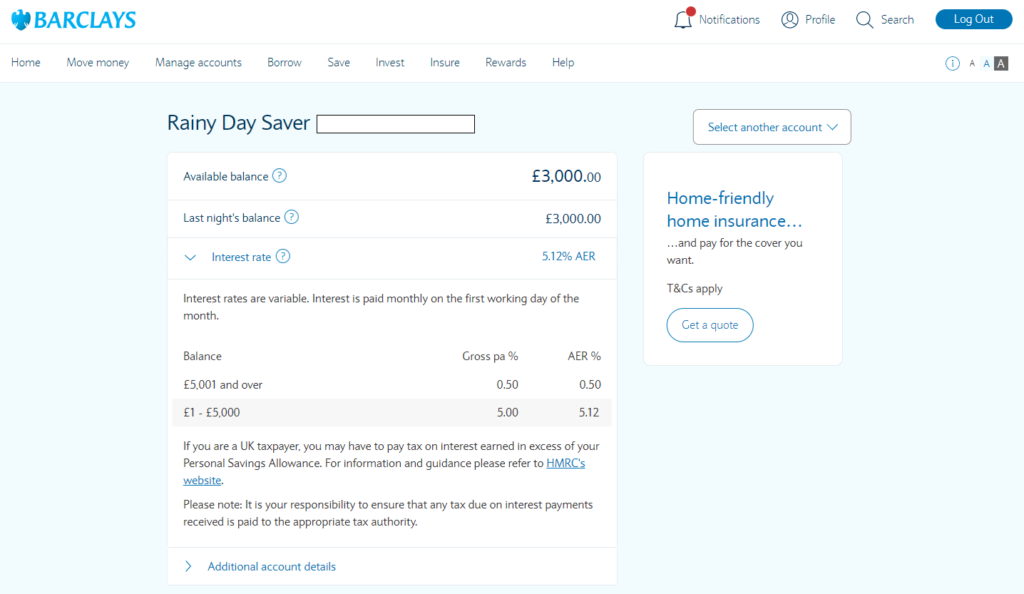

The only contender in a position to meet my requirements at the time of writting (December 2022) is Barclays Blue Rewards Rainy Day Savings Account. This account will allow me to deposit up to £5,000 generating a 5.12% interest. Yes, I will also open other savings accounts elsewhere and will place my own money in there, but as regards as to my Free money, it will be kept at Barclays.

At this point I need to remind myself that I am not a rich person. In other words, the HMRC will not come after me because I will not be gathering over £1,000 interest earnings per year (£1,000 is set as the tax free threshold for interest gains).

Second. What is the process to withdraw money from my CrowdProperty IFISA?

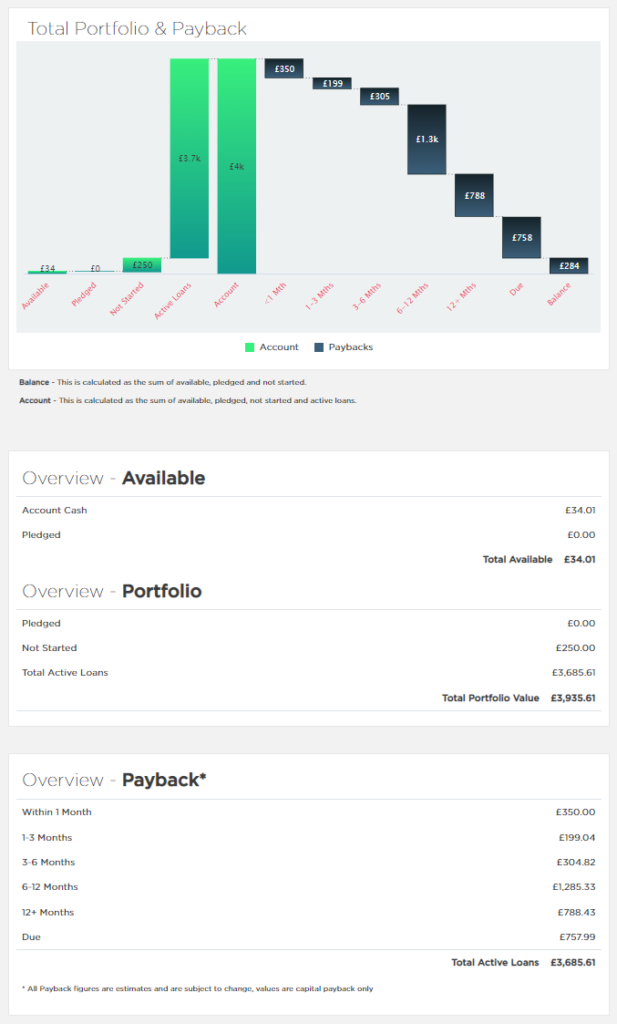

CrowdProperty does not offer the option to sell my loans to other investors. On the light of this, it seems that I am stuck with them in the short/medium term and I will have no choice but to wait until all my loans mature. How stuck am I exactly?

My loan portfolio shows that £758 are due shortly, I will be paid £350 back within a month, another £200 over the next three months and another £300 within three months after that. I will need to wait six to twelve months for £1,300 back and a year to recoup the remaining amount. Well, I am not desperate and during the maturation period there will be interest payments. That is a positive to me. Until then, I will take action as follows:

1. I will stop making any further IFISA contributions and divert any future Free Money earnings towards my Barclays Savings Account.

2. I will withdraw funds (capital repayments + interests) from my CrowdProperty IFISA as soon as loans mature and transfer them to my Barclays Savings Account.

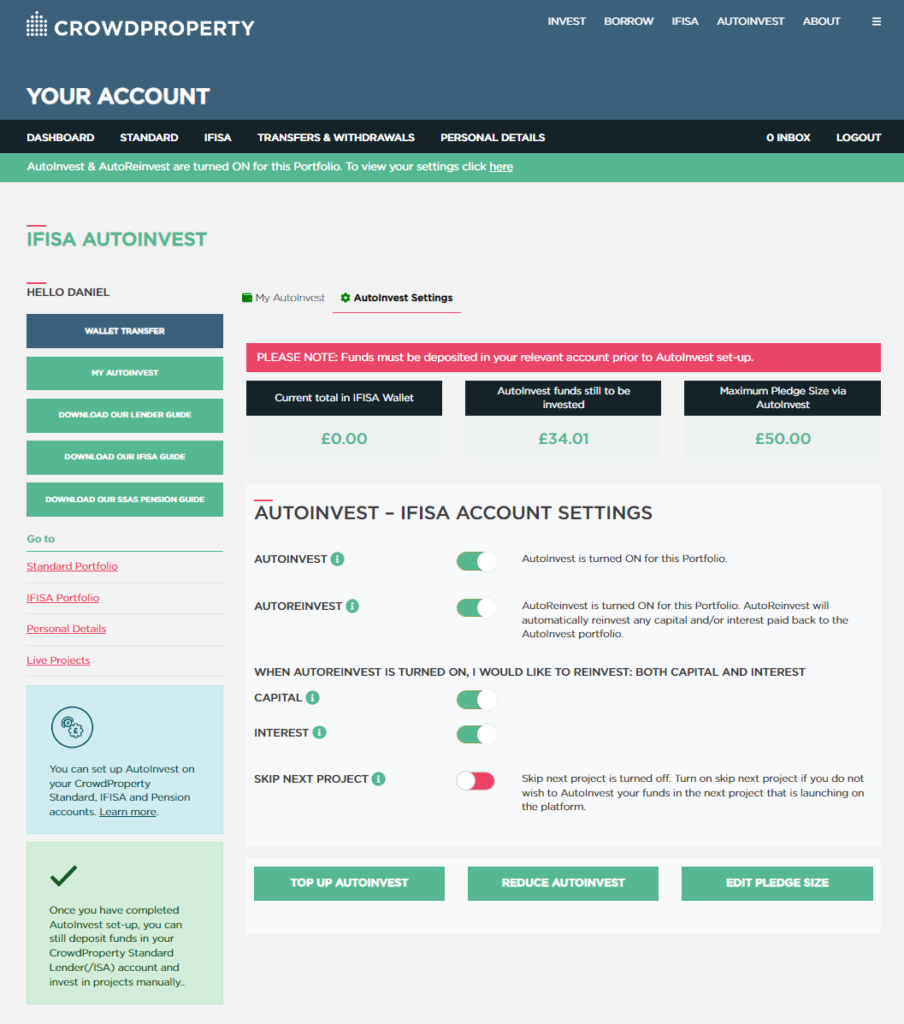

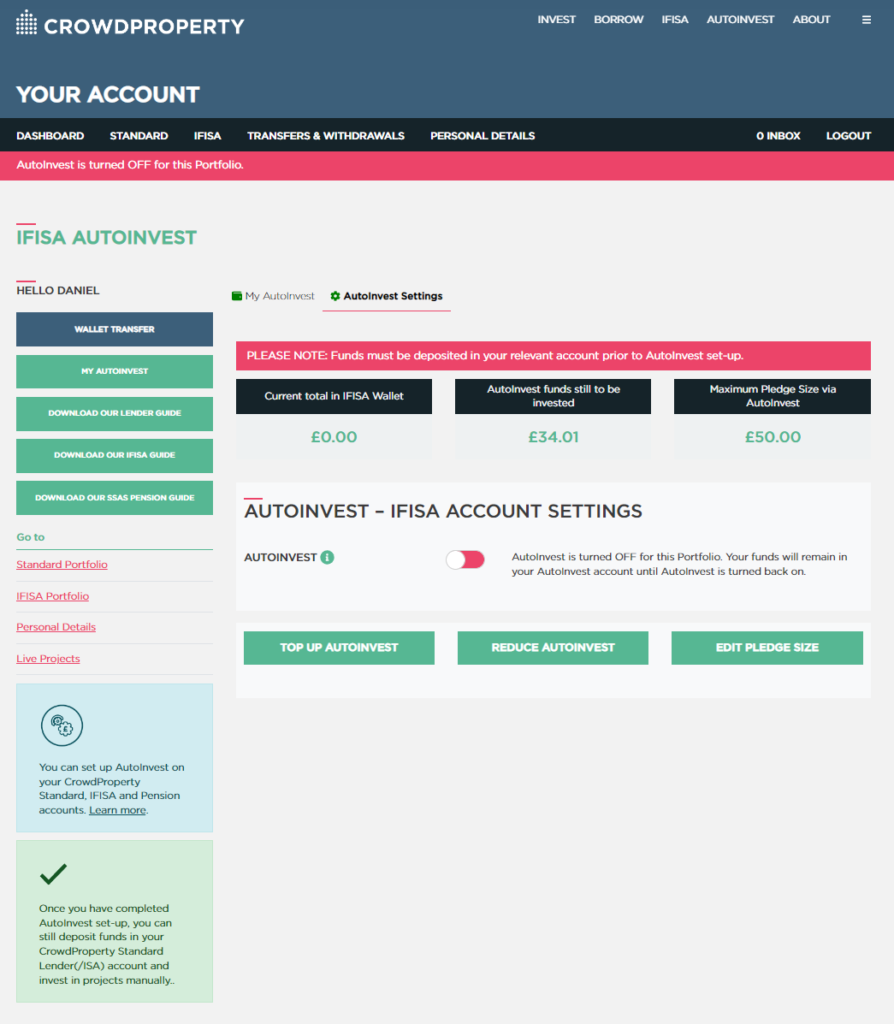

In order to satisfy these requirements I need to turn Autoinvest off so that repayments do not get back into the loan loop. Moneys will be kept in deposit in the CrowdProperty wallet. As soon as they are made available for withdrawal, I will transfer them across to my Barclays Savings Account.

Next steps.

I have now set things in motion as the above pics show. There is one last issue to address though, and that is how much money to deposit in my Barclays account to maximise interest payments. My expectation is that £1,600 from the CrowdProperty IFISA will be paid back over the next three months and transferred across. In addition, any Free Money earnings from now on will be saved in my Barclays account as well. On this basis, I think is safe to assume that £2,000 Free Money will find its way into the Savings account in the short term. According to this calculation, I see fit to use my £3,000 Personal Emergency Fund to take advantage of interest payments. The idea is to gradually fill the £2,000 gap up to £5,000 with Free Money cash flows. I feel comfortable with this Plan.

On the other hand, my Investment Strategy for 2023 will differ significantly from the approach I have taken in 2021 and 2022. I need to adapt and make the most of the opportunities available to me at any given time. Looking forward to the New Year Challenge.

Recent Comments