A £927 Tax Refund and Investing in Peer to Peer IFISAs

Surprised and pleased by the news I got from my accountant. Contrary to my expectation, I received a tax refund. It seems that I have paid too much tax over the last year, and as a result, I am owed back some of it. Specifically, I will be more than happy to have £927 pounds back. Elated is the right word to be fair. Never thought I would qualify for a tax return in my lifetime but there you have it. Straight back into my bank account. The first impulse would be to indulge myself or my family or at least spend some of it. The fact is that I have conditioned myself into classing this money as Free Cash. It was never expected. I did not actively work for it. It is not needed and I can do without it. Tick. Tick. Tick and tick. It might look a bit regimental to the outsider but this is the self-discipline that I have adopted. Any freebies or unexpected cash, will automatically qualify as Free Money and will be added to my Free Cash Fund. No exceptions. My line of thought is: if I am not demanding with myself, who will?

It is a nice chunk meaning that I will almost double my Free Money contributions for the year in one go. It is not a one-off though and I am sure that it will not be the last. I sold my old banger, my conservatory and all kinds of furniture in the past. The sizeable proceeds went straight into the Fund. This is no different. It also means that I can now take my Investment Strategy a step further. I am now in a position to invest the minimum requirement of £1,000 in a Peer to Peer platform tax free via my IFISA account.

Let’s not forget that I devised my Strategy with this very goal in mind from the outset but the £1,000 barrier forced me to keep that portion of the fund in my Moneybox General Investment Account. I was hoping that by the end of the year I might have been ready to accrue that figure, and hence, I would have been able to transfer the grand from my Moneybox GIA to my ZOPA IFISA. Well, this cash inflow is precipitating things for the better and my intention is to take the necessary steps to move away from GIA to IFISA.

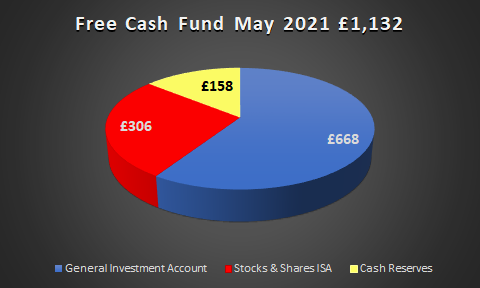

Before taking any action, let’s have a quick recap of where we are now.

Free Money Accrued (May 2021): £1,058

Free Cash Fund Value: £1,132 (+£74 ; +6.99%)

Free Cash Fund Investment Allocation: GIA: £668 ; Stocks & Shares ISA: £306 ; Cash Reserves: £158

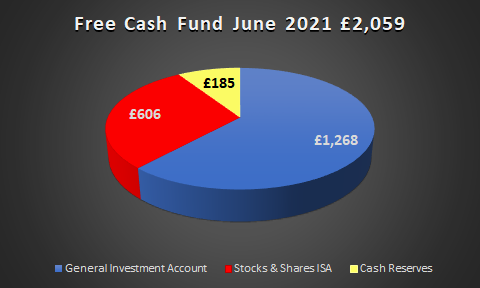

The £927 get distributed like this: £600 towards GIA, £300 towards S&S ISA, and the remaining £27 towards the Cash Reserves Pot.

Free Money Accrued (after £927 Tax Refund): £1,985

Free Cash Fund Value: £2,059

Free Cash Fund Investment Allocation: GIA: £1,268 ; Stocks & Shares ISA: £606 ; Cash Reserves: £185

Figures talk and they say that I am well over the £1,000 IFISA minimum deposit requirement. I should now make a move and transfer £668 from my GIA back to my current account to then deposit £1,268 in my ZOPA IFISA. So, I do proceed to log in into my ZOPA account. I navigate through the options to end up finding myself one click away from submitting an order to make a deposit. And then… a message on the screen announces that ZOPA will be taking no additional funds for the time being due to the demand for their investment products outweighing their capabilities to allocate money. In other words, they cannot deal with the amount of money they have in their hands and they do not accept additional deposits for the time being. As a consolation, they offer the option to join their queue. Should there be an opportunity to invest with them in the future, I will receive a notification. Don’t call us. We will call you.

I am now pondering my options. The rule is that I can only invest in one IFISA account per Financial Year. I have IFISA accounts with ZOPA and with Funding Circle. Funding Circle seems to be in the same boat as ZOPA. They are not accepting additional funds until further notice for allegedly identical reasons. Nothing to loose in joining the ZOPA queue but I am not entirely sure that I am ready to wait until further notice.

I will keep the 60% allocation of the Fund in my Moneybox GIA until there is an opportunity to transfer that portion of the Fund to an IFISA Peer to Peer account. That opportunity will present iself either passively, when someone decides to open the door for me, or actively, by me seeking for alternative P2P IFISA providers. I am not the passive type so I will hit the keyboard shortly in search of a suitable provider.

I really miss the now defunct Ratesetter. They were absolutely great and they provided nice returns to me over the years. Unfortunately, the pandemic took them out of the picture. Real shame. Anyhow, no point in dwelling in the past. On the positive side, I do not let myself forget that just six months back, I aimed for £1,000 Free Money as an objective for the year. It is Mid June at the time of writing these lines and I have £2,000 in Free Cash. I honestly and truly did no expect this performance. I know I will get where I want to be step by step, one day at a time. I trust that you enjoy this Journey as much as I am.

Recent Comments