£2,405 up to the Second Quarter of 2021 – Time for a Review

It has been eight months since I re-started my Free Money earnings activities. As I mentioned before throughout the Blog, I did approach this area of my personal finances rather informally in the past. It was at the beginning of this year (2021) that I decided to bring some structure into it by first, keeping and updating an online diary of my progress (this very Blog) and second, by conducting myself in a business-like manner setting up indicators and reviewing my earnings against objectives set. Let me recap on this 4-step process below:

- Objectives set.

- Update indicators to quantify progress.

- Understand performance gaps vs objectives.

- Take action to close relevant gaps.

This process is most certainly not new, however, it is my choice whether or not to apply it and/or to be regimental or relaxed about it. I do not believe that a casual approach will make it work so I guess the decision has been made for me to some extent, which makes things somehow easier.

Step 1 – Objectives Set

We need to recap on the objectives, tools and breakdown allocation in terms of Free Money contribution to Baseline this process. A summary is shown below:

2021 Objective: £1000 Free Money.

Tools: Bank rewards, cashback deals & rebates, eBay & casual sales, promotional sign-ups, interests over savings and any other unexpected source of free cash (Freebies).

Objective Breakdown:

- Banks rewards and interests: £250.

- Cashback: £250.

- Promotions: £200.

- No longer needed items sales: £300.

For a more detailed explanation of the system and the identification of free cash sources, click here.

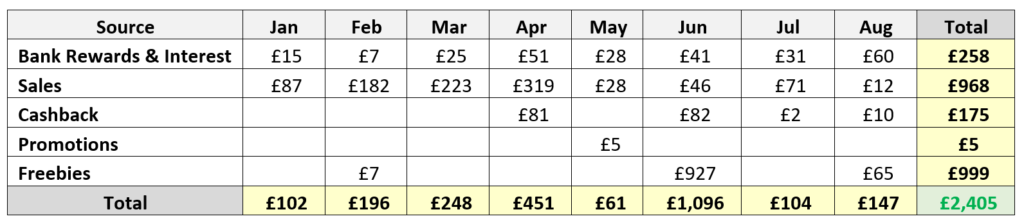

Step 2 – Update indicators to quantify progress

How do we know if we have achieved our objectives or if there is a gap to be bridged? To answer this question, it is a must to measure and record our progress over time. The Free Money Earnings Spreadsheet helps me track my money in-flows by source on a monthly basis. As per Income Reports, the numbers for the first eight months of the year are shown below:

What information can we extract from these figures?

- We have obviously achieved and surpassed our objective for the year by £1,405. We made 2.4 times more Free Money than projected.

- Freebies are a completely unexpected but strong contributor to earnings accounting for 40% of the total.

- Leaving Freebies out of the picture, Sales account for 60% of Earnings suggesting that I heavily rely on them to deliver Free Cash.

- Promotions contribution is almost negligible at this stage.

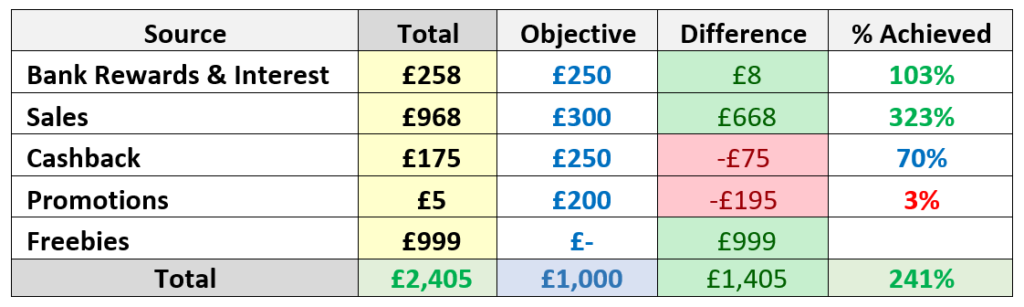

Step 3 – Understand performance gaps vs objectives

Next step is to measure line item totals against objectives by taking away accumulative sums from objective value set. These figures will allow us to allocate a progress indicator percentage. See summary table below:

How can these numbers be interpreted?

We have achieved our Free Money objectives for Bank Rewards & Interest and Sales just eight months into the Year. Mind due, a period of negative interest growth can occur but on the other hand, Bank Rewards are almost like passive income. All things remaining equal, I can expect £18+ per month over the next few months or £72 more by the end of the year.

Sales are just a chapter of its own. I set my fishing rod and I am just gathering the rewards. Semi-passive income. 3 times over objective meaning I can focus on the underperforming items.

If I manage to keep the cashback earnings trend which works out at about £22 per month on average, I should be able to reach my objective by the end of the year. It does not work as a continuous money in-flow though, since cashback is transaction based and is plotted in peaks and throughs. It will take a non-avoidable expenditure to reach target but that is to be expected.

Promotions are a disappointment at the moment. We are experiencing a drought period and I just cannot magic them. They come and go like buses and this falls outside my circle of influence. I am certain that sooner or later they will start popping up. I just need to wait for right one to come by. Well in the red at this moment in time.

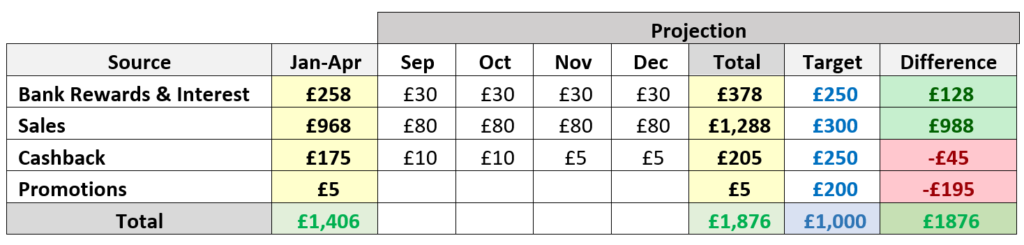

Step 4 – Actions to close Gaps vs Objectives

Two areas of focus: cashback and promotions. One I can influence and the other one I cannot.

As for cashback, I have £20 in the pipeline. If it comes to fruition, another non-avoidable expenditure (ie: insurance or utilities) will settle the record. I have already identified the perfect candidate (Broadband) and have it lined up.

The promotions will come. It is not a matter of if, it is a matter of when. I have alerts set up and I will be ready to pounce on them as soon as they show up. Patience is key. No active action I can take for the time being other than getting myself ready for when they crop up.

If I keep the Free Cash coming in over the next four months at the same rate as it kept flowing in from January to August (see projection table above), I will be very close to my revised target of £3,000 Free Money Earnings for the year. I honestly do not believe that this goal is too far reached. I am most definitely aiming for it.

Recent Comments