How to Save on Car Insurance and get the Best Cashback Deal – £150 Saving + £42 Cashback

In this post I will describe step by step my method on how to save on Car Insurance and get the Best Cashback Deal at the same time. The best of both worlds can definitely be achieved leading to substantial savings. In my particular case, I managed to halve the cost of my Premium and collect a £42 cashback reward on top. Allow me to start from the beginning.

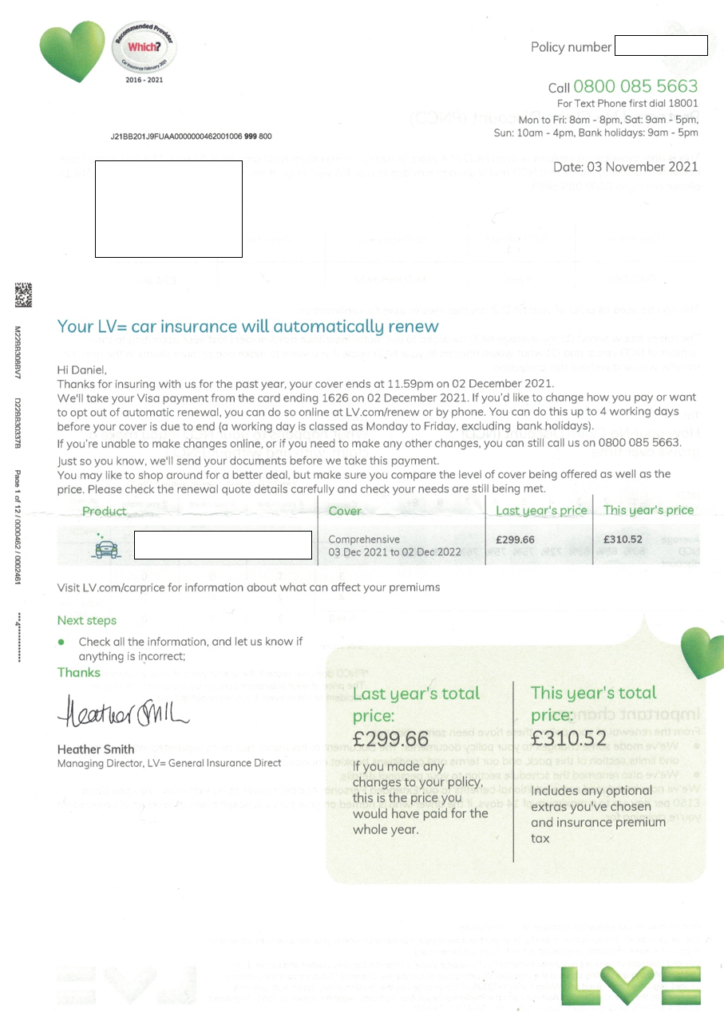

An automatic renewal notice letter from my Car Insurer arrived by post in early November. Other than making sure no details in my Policy need updating, the letter confirms that my credit card will be charged by £310 on the insurance expiration date in order for my cover to be extended for another year. Nothing out of the ordinary. Just standard procedure. In the light of this lovely event, I am presented with two options: a) do nothing and accept their price; b) shop around, find myself the best possible deal and gather some free money in the process by collecting cashback. In all fairness, option a is the most comfortable and easy one to go for. By contrast, option b is the most entertaining and rewarding one. Time to find out why.

In the no so distant past, I would have tossed the notice around and carried on with my daily routine. Nowadays, I have a different (and very much b option biased) mindset: I see Car Insurance as another unavoidable expense I sure enough should be cashing back from.

Having made my decision beforehand, it is not a matter of checking whether or not I can save some money but rather ascertaining the overall size of the saving. On this basis, the questions that I need to answer are: one, how much I can save by switching insurance providers, and two, how much cashback I can extract from the purchase itself. This post is about providing answers to both questions by means of following a standard logic I systematically use for insurance purchases. There are four steps to my method:

- Visit at least three different comparison websites and obtain quotes from each.

- Having selected the best quote or quotes, run searches on cashback websites to gauge available cashback deals.

- In addition to using comparison engines, run a query on comparison services from cashback websites to compare best package (switch saving + cashback reward).

- Saving and cashback reward considered to select Insurance Service, cancel old Policy and buy new Policy via cashback website.

For more information on how to save on utility bills and insurance as well as collecting cashback, please visit my previous posts:

A £110 Cashback Reward for my New Broadband Contract

Home Insurance Switch £20 Savings + £45 Cashback

£100 Saving + £40 Cashback for Switching Energy Supplier

Step 1 – Obtain quotes from Comparison Websites

For a list of Motor Insurance Comparison Tools, please visit the C4N Toolbox. The goal at this stage is no other than to obtain the best quote or quotes available in the market by searching the insurance supplier databases on price comparison engines. The key is to provide with accurate and up to date personal information as well as the chosen premium services criteria (ie: courtesy car, legal cover, etc.) in order for the engine to do its job and funnel down relevant results for us. It might look like a comprehensive questionnaire and a time-consuming process, but the rewards will greatly offset the time invested (5 minute per query).

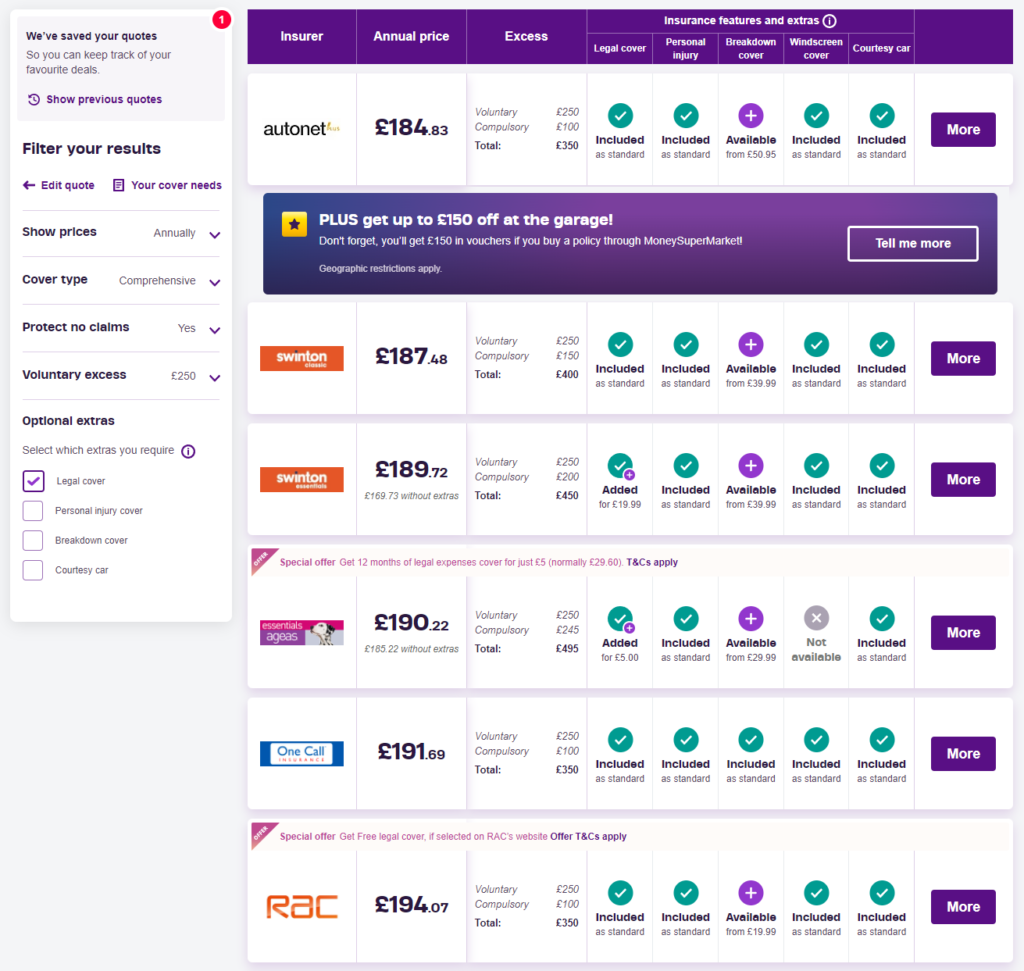

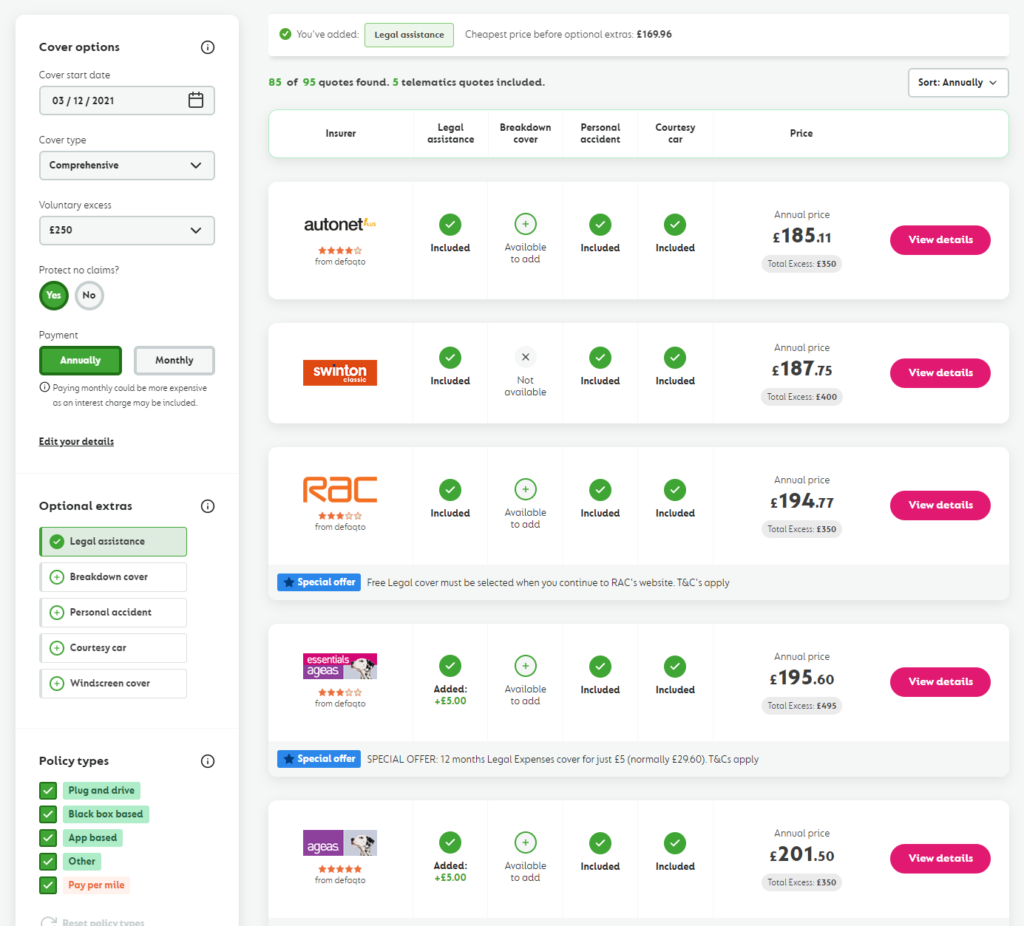

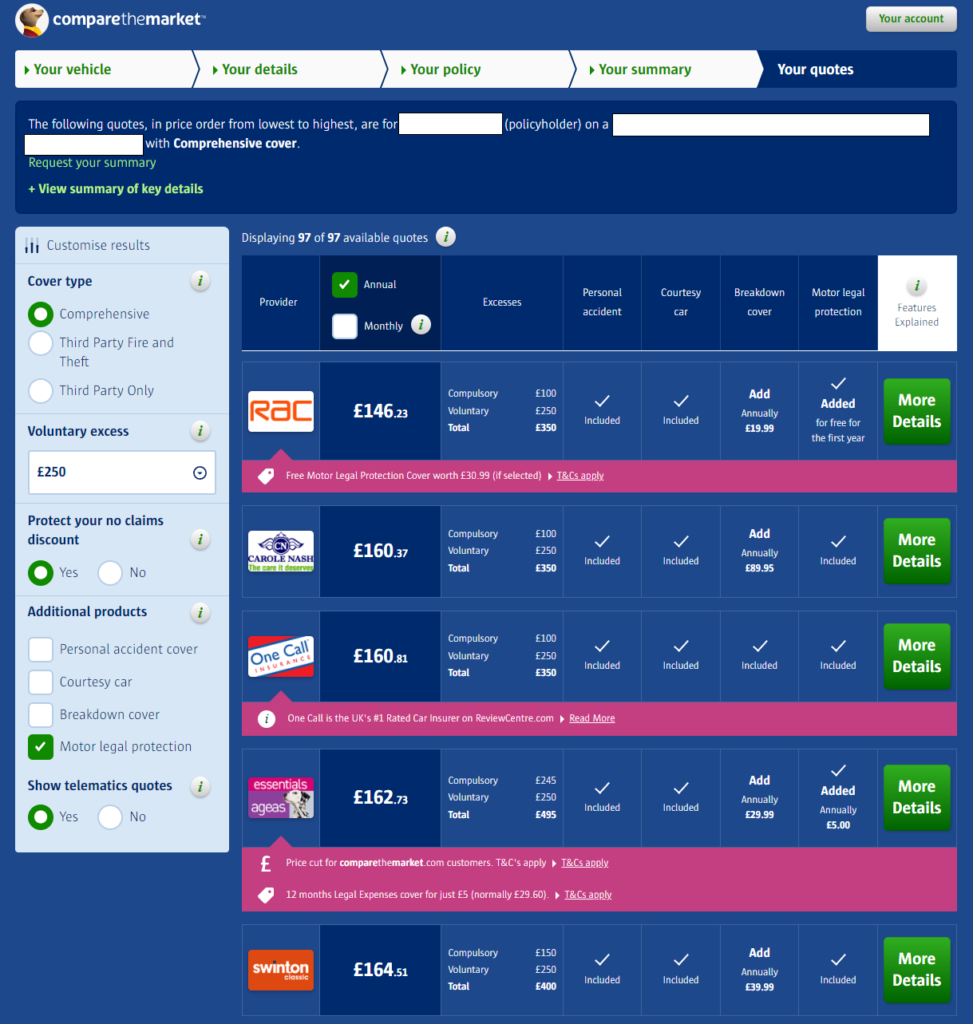

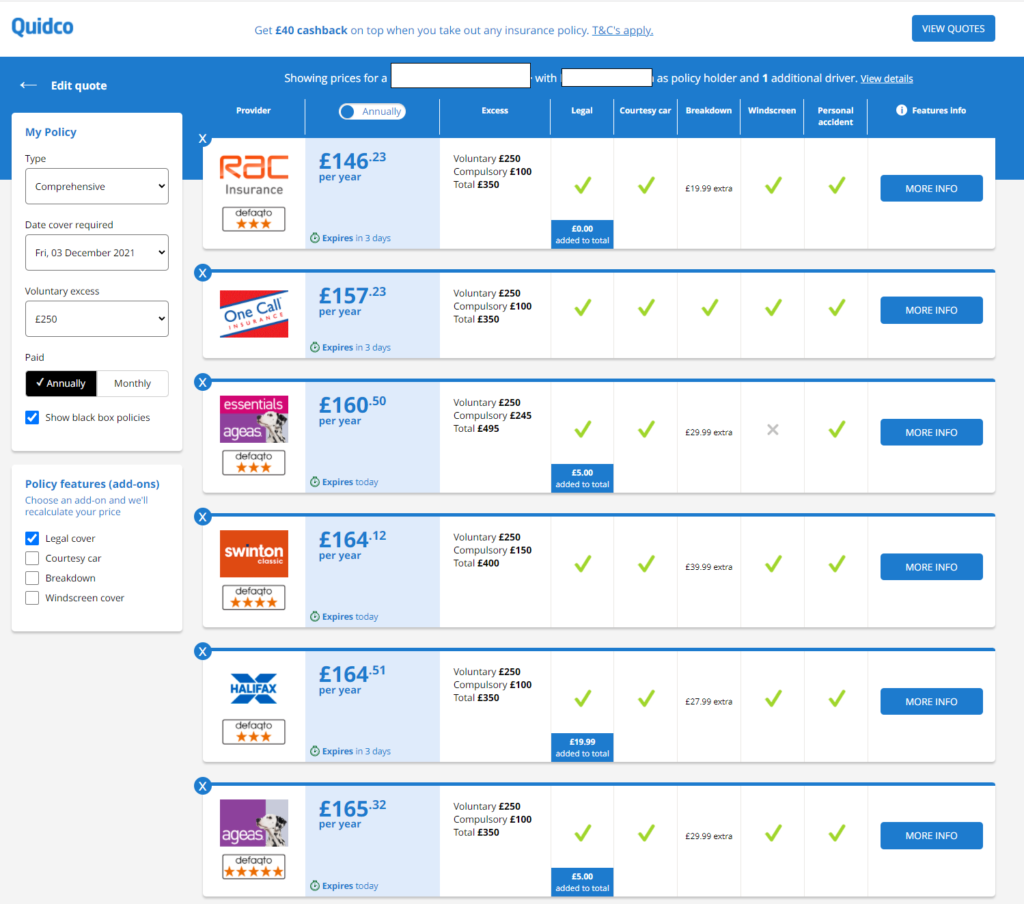

In this particular instance, I decided to run queries at Moneysupermarket, Gocompare, Comparethemarket and Confused. My aim is to identify a pattern and to short list a number of insurers based on a pool of common results across all four comparison websites.

My default options are: comprehensive cover, £250 voluntary excess and one-off annual payment. Secondary options: legal cover, courtesy car, windscreen damage cover and personal accident cover.

I have captured screen shots for each one of the search results to show best quotes thrown by each individual query:

Quotes from Moneysupermarket:

Quotes from GoCompare:

Quotes from Comparethemarket:

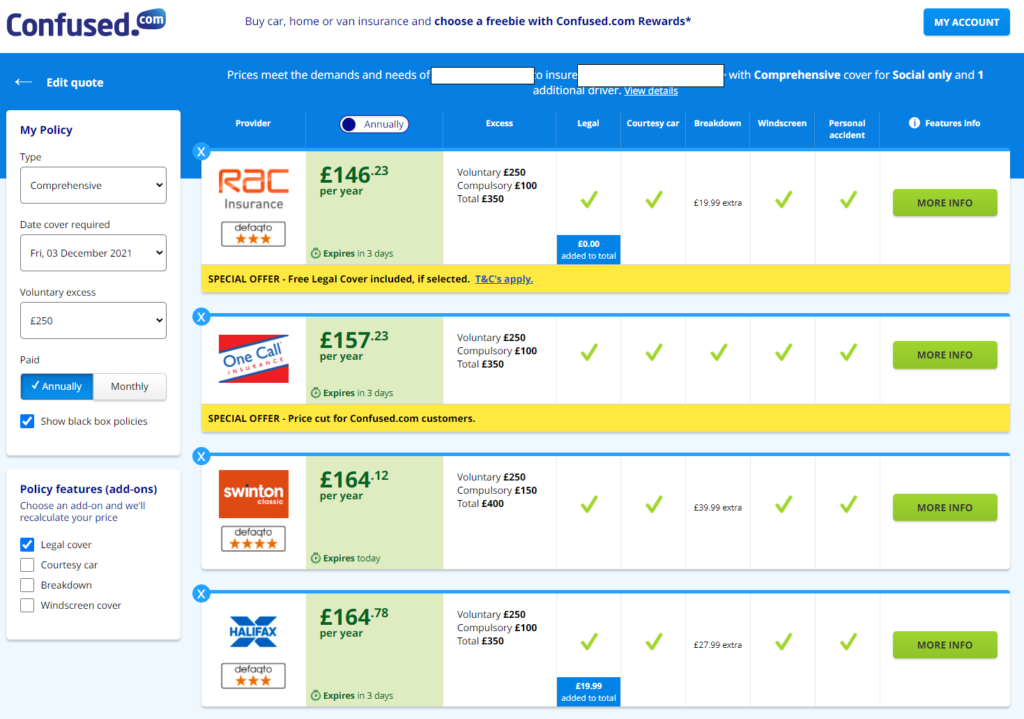

Quotes from Confused.com:

I am following a script to tackle a theme with slight variations. What I mean is that I am essentially introducing the same information as it is required from me in a different format by each site. Truthful, accurate and up to date data must be supplied for best results. I am double checking at every step of the process to avoid spurious quote prices and an inefficient use of my precious time. After collating data supplied, I am already surprised at the price differences I am finding between Moneysupermarket and Gocompare versus Comparethemarket and Confused. £40 difference or approximately 20% cheaper. Quite significant at this point.

The other crucial piece of information to consider is the fact that I have potentially saved myself £164 just by conducting this simple exercise. Should I decide to go for the cheapest quote shown, I would cut my insurance premium by half from £310 to £146 (a 52.9% reduction to be precise). Not a bad result by my standards. All I needed to do was just ask/query.

Step 2 – Search cashback websites to gauge cashback deals

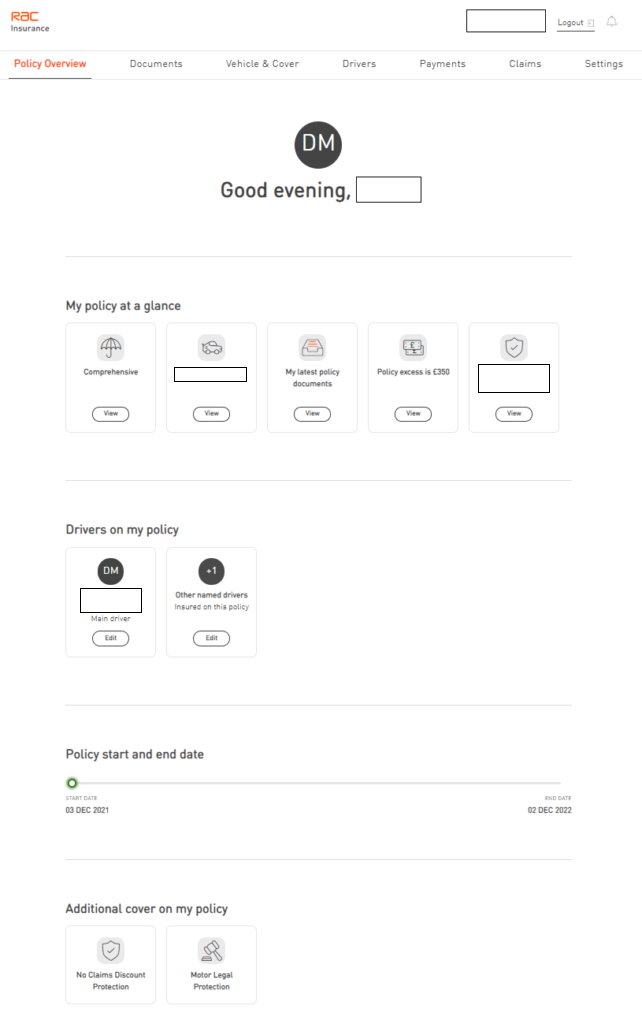

There are two known facts for me by now: first, I will be switching car insurance most likely halving my costs in the process whilst keeping the same level of coverage, and second, being a satisfied and loyal RAC Breakdown Cover customer for a number of years, I feel inclined to purchase Car Insurance from them despite the 3 star appraisal across the board.

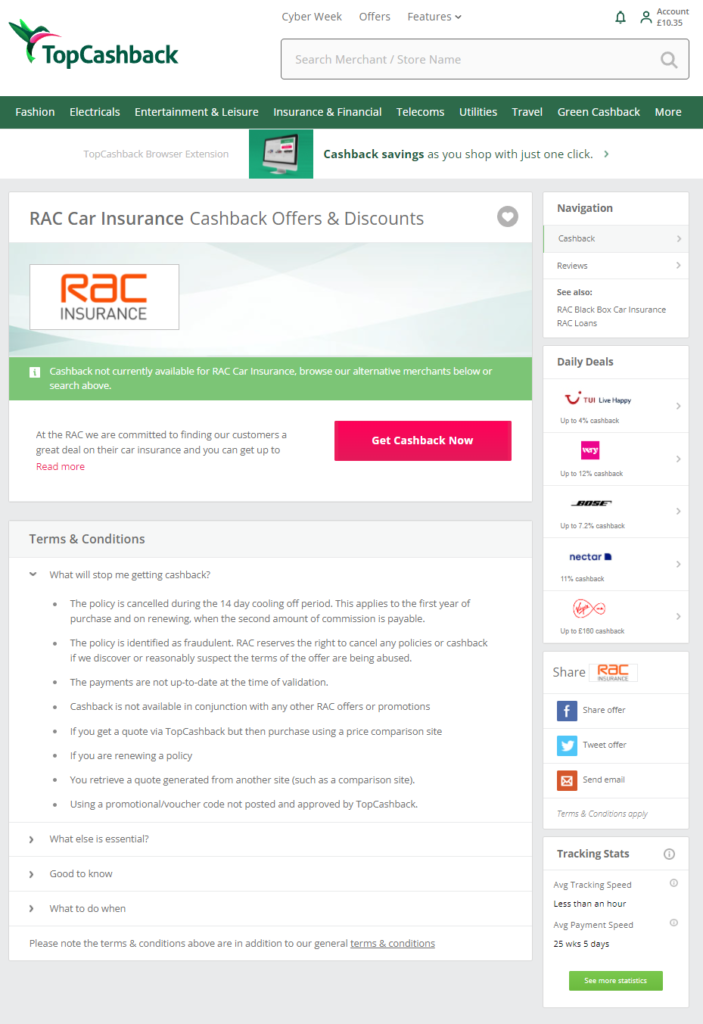

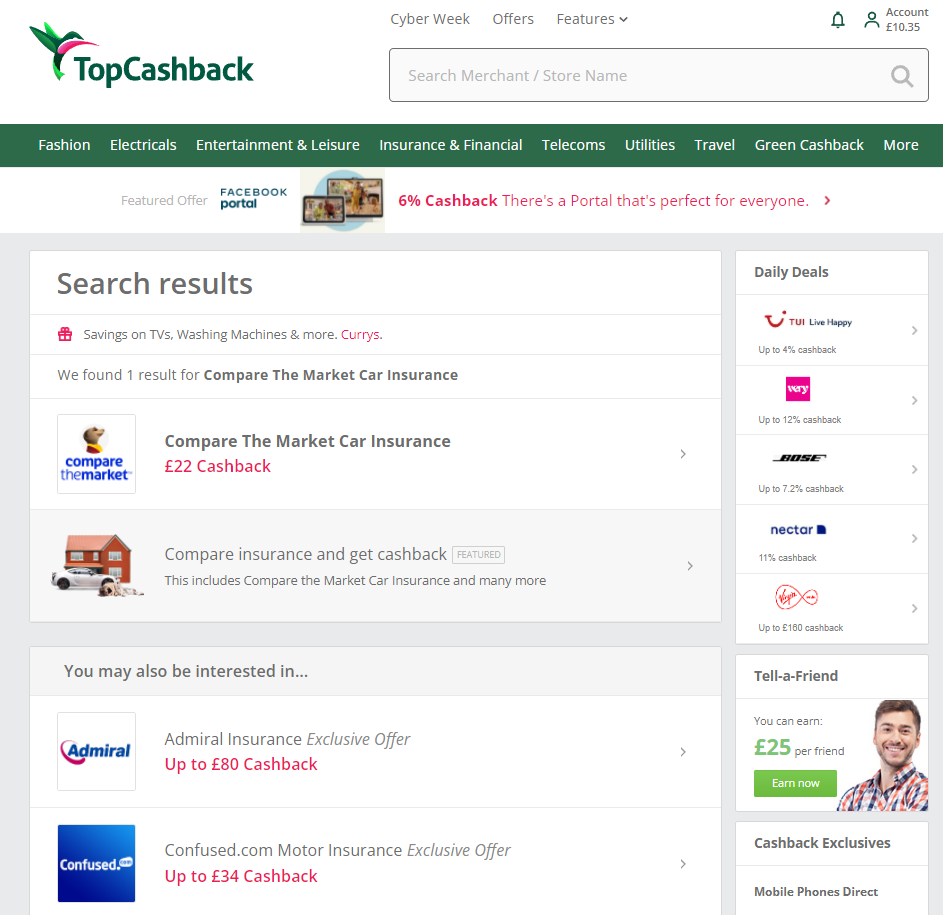

The second stage is about understanding how much cashback (if any) I can collect by switching to my preferred choice (RAC in this case). I will need to search cashback deals on Quidco and Topcashback to find out.

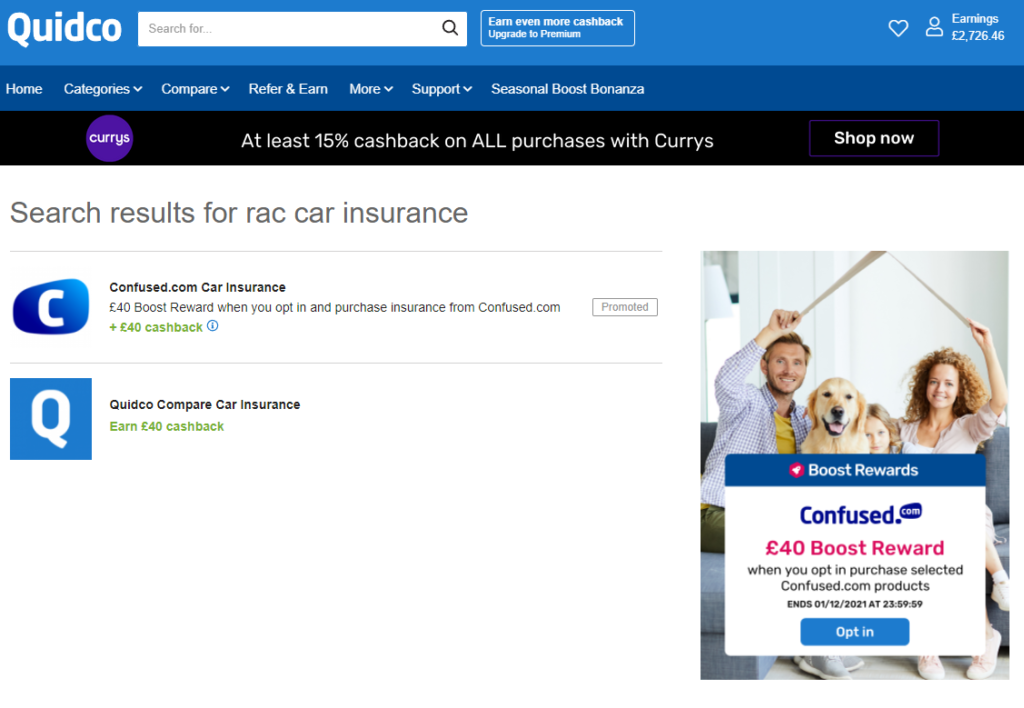

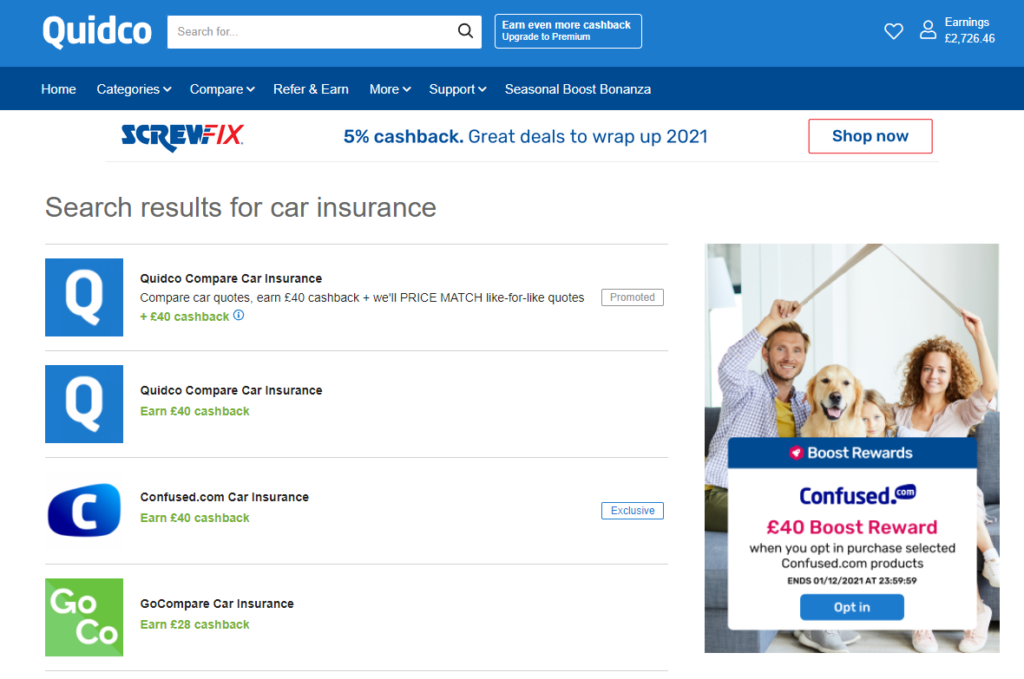

Neither Quidco nor Topcashback offer cashback deals for RAC Car Insurance as a merchant at the time of my search. Quidco results strongly suggests that any cashback deals will be embedded inside their own engine or via Confused.com comparison services potentially unlocking a £40 cashback reward.

Step 3 – Check comparison services on cashback websites to compare best package

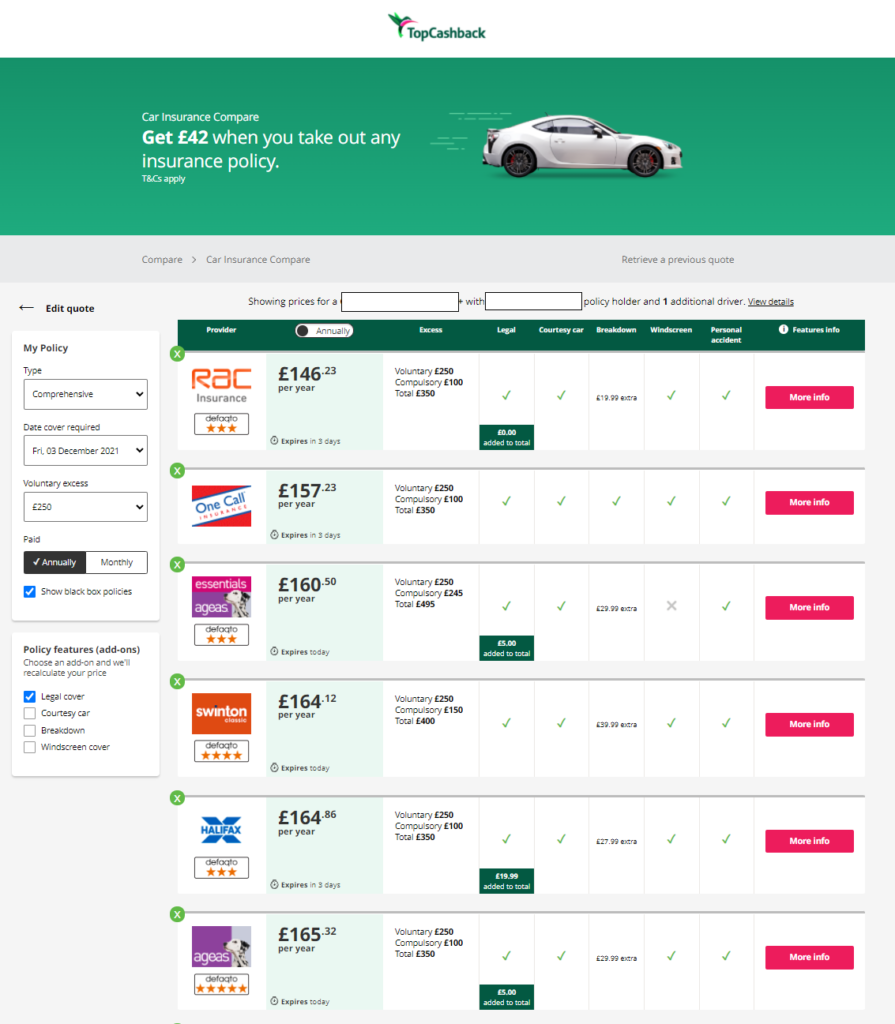

Cashback websites such as Quidco and Topcashback feature their own car insurance price comparison tools. The advantage is that they provide not only with the best price, but also a cashback incentive on top. So they are definitely worth checking. After searching their merchant databases, both of them delivered identical results for my criteria (see screenshots below).

As we approach the end of stage three, there is an obvious piece of information to point out: Comparethemarket, Confused.com, Quidco and Topcashback all offer the same quote of £146.23 from RAC Car Insurance. Which one should I choose? Let’s move on to stage 4.

Step 4 – Buy new Car Insurance Policy via Cashback Website

Let me compile in a matrix the cashback reward to be expected from my four finalists:

| Comparethemarket | Confused.com | Cashback Comparison | |

| Via Quidco | £0 | £40 | £40 |

| Via Topcashback | £22 | £34 | £42 |

The winner is Topcashback Car Insurance Compare Tool as it delivers the highest cashback payout of £42. I just need to finalize the process by retrieving the quote results from Topcashback and click on the link to RAC Car Insurance. From then on, I would proceed to confirm my insurance selections and complete payment on their website. All things going well, the transaction will be tracked and the cashback will be recorded on my Topcashback earnings within hours.

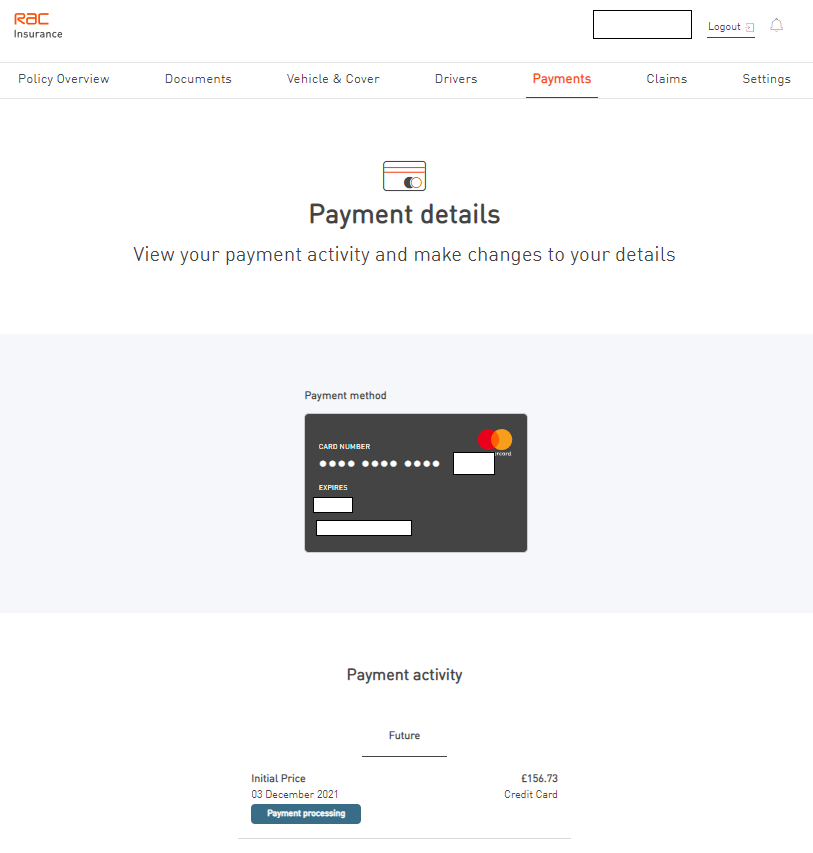

After a minor upgrade to the Policy I was tempted with, the final price paid for my insurance premium was £156.73 which equates to a £310.52 – 156.73 = £153.79 Saving approximately 50% cheaper. I should also be able to collect £42 Cashback on top. For my purposes, that £42 reward qualifies as free money, however, if I was to consider it as an additional saving once credited into my bank account, it would have meant that I would have paid £114.73 for a fully comprehensive policy with all the extras, £195.79 less than the renewal price originally quoted or a 63% saving.

In my modest opinion, opportunities like this just cannot be afforded to be missed specially if you take into consideration the simplicity of the process and the readily available tools at our disposal. The take away is that Comparing the Comparison Sites pays off. Handsomely. Hopefully, you’ll agree with me.

Recent Comments