Home Insurance Switch £20 Savings + £45 Cashback

Savings + Cashback from Home Insurance Switch

My Home Insurance is due at the beginning of May. After checking my records, I will be making an entry in my calendar for the 9th of May. If I take no action, on that date my credit card will be charged automatically by my current insurance provider. I am not expecting a price reduction from last year’s £161 Policy cost, so I can reasonably assume a renewal for a figure of £160 upwards. Is it possible to get a better deal and collect some Free Money as Cashback in the process? Time to hit the keyboard and find out.

As detailed in my previous post for Energy Supplier Switch, the method I will use comprises four basic steps:

- Visit three different comparison websites and obtain quotes from each.

- Having selected the best quote, search cashback websites to find out about available cashback deals.

- Check comparison services on cashback websites to compare best package (switch saving + cashback reward).

- Cancel old policy and buy new one via cashback website.

There are two saving elements from this method: first, a reduced Home Insurance Premium costs and second, the cashback reward attached to purchasing the Policy. I will work the overall saving out and summarize at the end of the post.

Step 1 – Obtain quotes from Comparison Websites

For a list of home insurance comparison tools, you can visit the C4N Toolbox. Once on the comparison website, I will need to provide with the relevant information in order for the comparison engine tool to produce the search results. It is a somewhat comprehensive questionnaire but also a straightforward process requiring around five minutes to complete. I have run queries at Moneysupermarket, Gocompare and Comparethemarket. I have captured screen shots for each one of them to illustrate best results supplied:

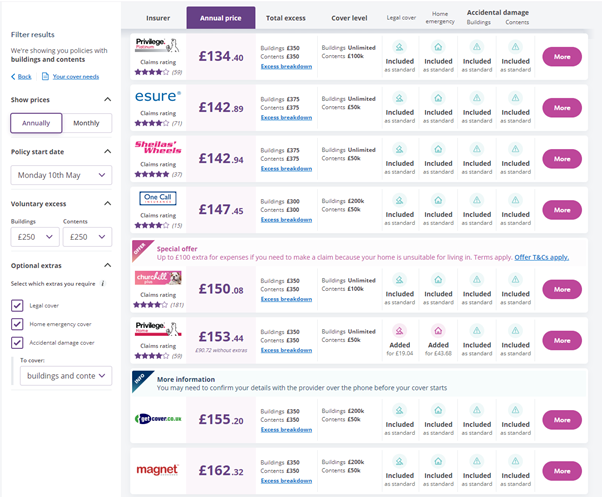

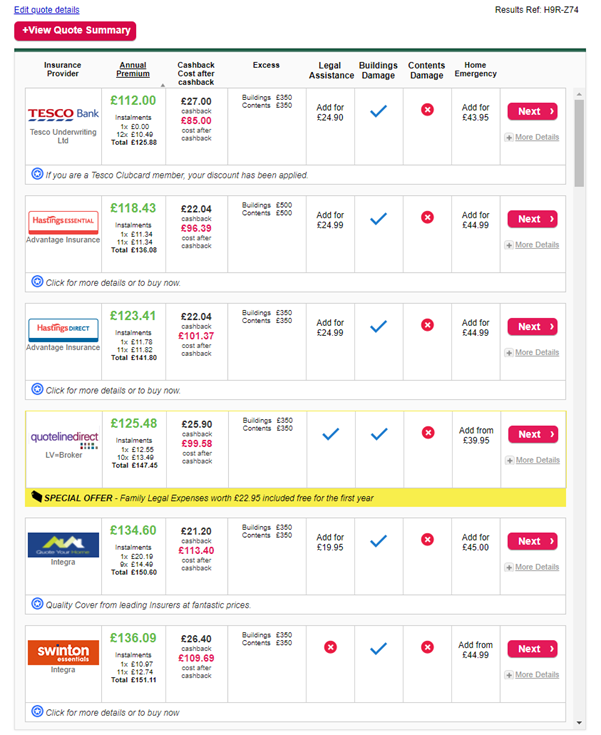

Quotes from Moneysupermarket

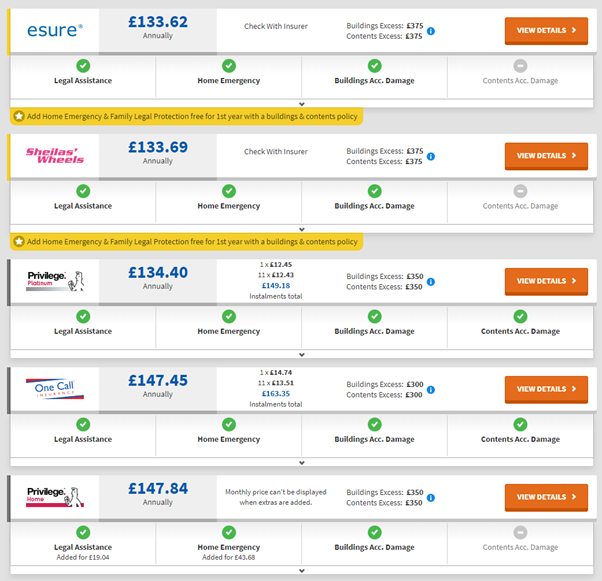

Quotes from Gocompare

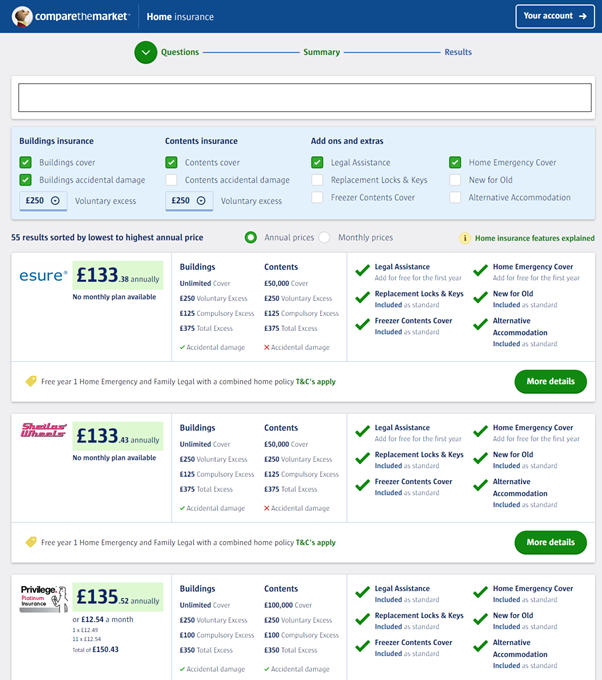

Quotes from Comparethemarket

For my selected set of options (buildings & contents cover, legal assistance, home emergency cover and buildings accidental damage), I consistently obtain similar results within a £5-£10 bracket. These are: esure, Sheila’s Wheels and Privilege.

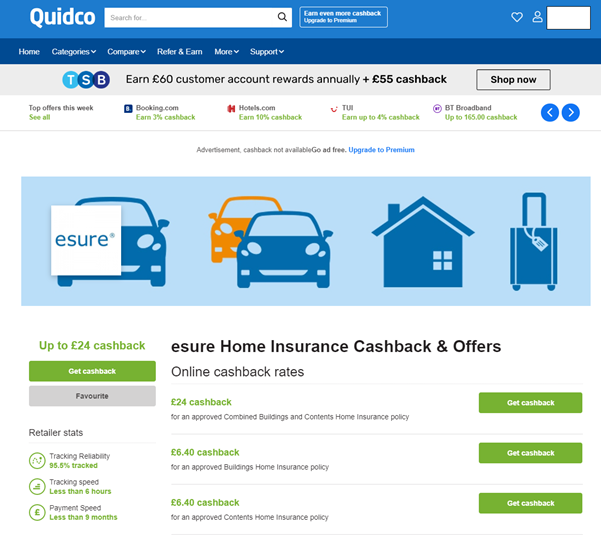

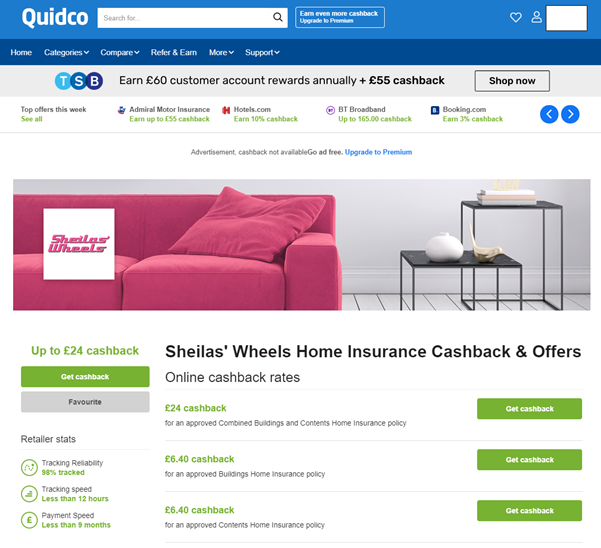

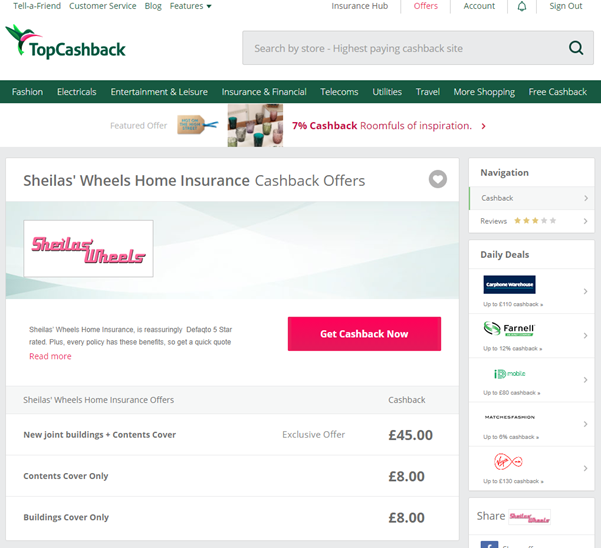

Step 2 – Search cashback websites for best cashback rates

I am fishing for a saving, meaning I will be purchasing a new Home Insurance Policy regardless, as not doing so will imply me being locked in a more expensive Premium for the same level of cover. If I am able to secure the cheapest quoted price found so far, I will be quids-in saving £30 already. However, is it possible to further my savings by collecting cashback once the transaction is completed? I will need to search Quidco and Topcashback for my Top 3 results to find out.

No cashback offers for Privilege Insurance were available at the time of writing. However, what has become quite apparent is the difference in cashback rates. They are significant with Topcashback offering an exclusive offer of £45 against £24 from Quidco. £21 higher or almost 100% more. That goes to show the strength of this method as the decisions are made automatically along the way. So far, I have narrowed down my providers from three to two and my cashback options to just one.

Step 3 – Check comparison services on cashback websites to compare best package

Quidco home comparison service offers a flat cashback rate of £28 on top of the best quote. That is to say, that it will be extremely unlikely for its engine to produce a quotation £17 cheaper than the ones I have already found just to match Topcashback. In other words, I will not bother with Quidco Compare.

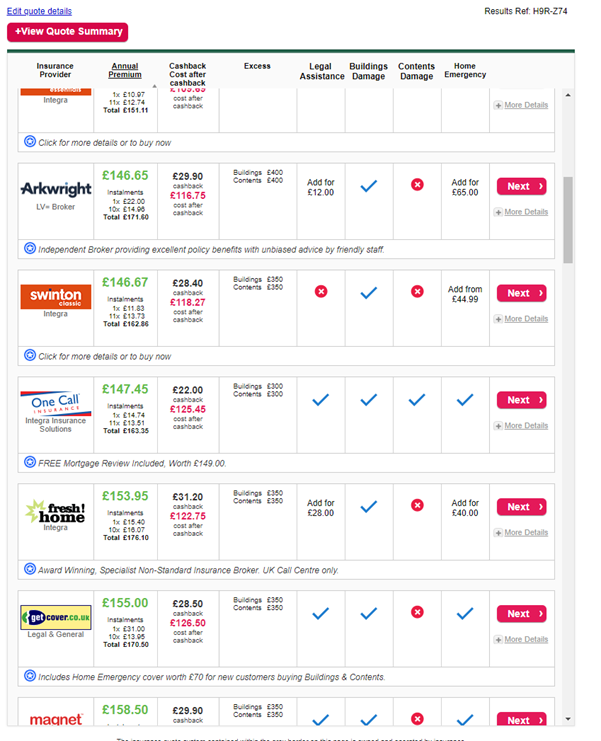

By contrast, and since I will be buying insurance through Topcashback, it is definitely worth checking their comparison service just in case a cheaper quote than the ones I already have happens to show up in the results. On this basis, after typing my data away, I was presented the following results:

Just a little bit disappointed because the top line items did not take into consideration my selection and also they were not improvements in terms of what I already had. I needed to keep scrolling down to find all my selected boxes ticked at £147 (see pic below).

Step 4 – Buy new Policy via Cashback Website

I have now reached the end of the road. My decision-making process had selected for me esure as the insurance provider with an expected premium policy price from £133 to £145 (£20-£30 saving over renewal). I also will buy through Topcashback expecting up to £45 cashback reward on top of my £20 saving. Time to finalise the process by completing the purchase.

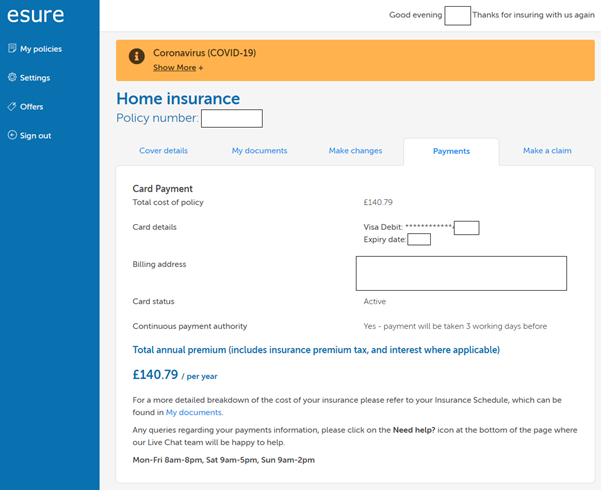

Eventually, I bought my Home Insurance Policy on esure’s website via Topcashback for a grand total of £140.79. Not the cheapest figure I was quoted initially but close enough and within the average price bracket I was expecting.

That translates into a saving of £20 (£161 – £141). I just need to wait for cashback confirmation to calculate the overall saving figure. Potentially £45 cashback adding up to £65 or 40% cheaper. Happy since I managed to get myself a nice deal. In addition, a decent enough hourly rate for approximately 30 minutes work.

The cashback reward will automatically qualify as Free Money for the simple reason that it comes as a bonus for a task that I would have tackled with or without considering the incentive. To me, this exercise clearly illustrates the opportunities to gain free cash from regular events. I am definitely not short of them in my personal life.

Recent Comments