Best Cashback on Home Insurance + How to Save on Home Insurance – £32 Cashback + £48 Saving

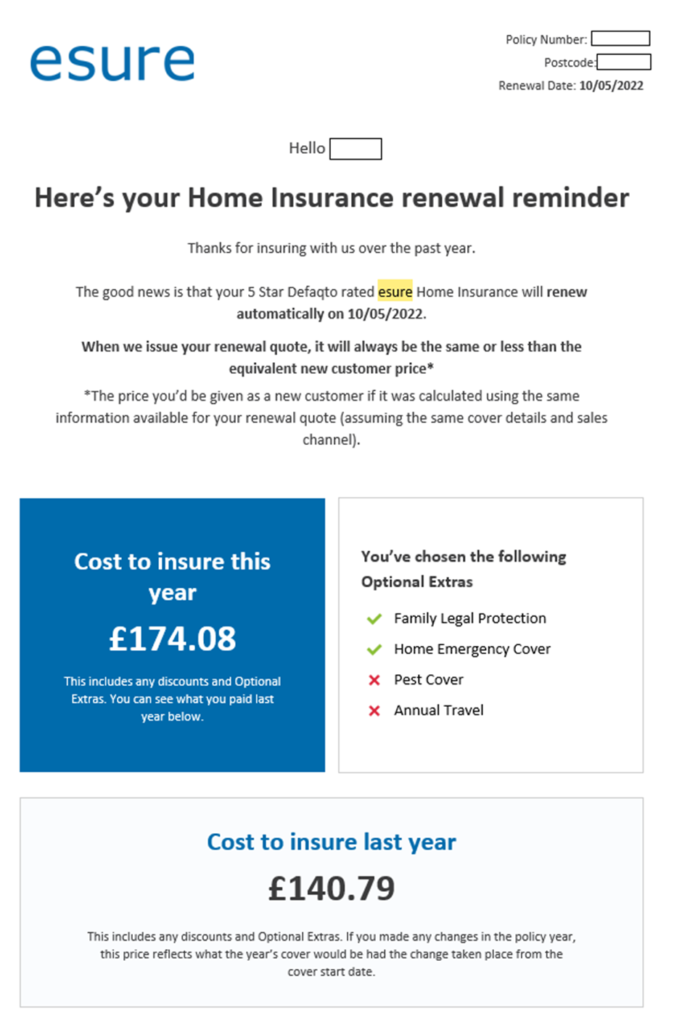

A gentle email reminder from my home insurance provider come through back in April. They had the kindness of capturing the renewal quote and the previous year cost to insure in the same piece of news for me. The renewal quote meant an increase of £34 in comparison to last year from £140 to £174. That is a hefty jump of 24% for no obvious reason to me. As it happens, I am presented with the red pill/blue pill choice scenario once again. I can do nothing and pay up, or I can fish for a better deal saving a bit money and gathering some cashback as free money in the process. I don’t think of myself as the One, but it goes without saying that the second option is a much easier pill to swallow. I will not need a visit to the Oracle to get a hint of what happens next. I just know the Path. Let’s do this.

This time last year, I saved £20 and collected £45 more in cashback (see post Home Insurance Switch £20 Savings + £45 Cashback). The challenge now is to get as close as or beat these figures if possible. Experience and method are on my side. I will not get awarded any originality prizes but I have no intention of deviating from a tried and tested script.

The Best Cashback on Home Insurance + Saving on Home Insurance Method. There are four steps to my System:

- Visit at least three different comparison websites and obtain quotes from each.

- Having selected the best quote or quotes, run searches on cashback websites to gauge available cashback deals.

- In addition to using comparison engines, run a query on comparison services from cashback websites to compare best package (switch saving + cashback reward).

- Saving and cashback reward considered to select Insurance Service, cancel old Policy and buy new Policy via cashback website.

I can do this in my sleep and I have lost count of how many times I have done it before, however, this will be my sixth since documenting my Journey in this very Blog. I have compiled a list for your interest below:

Best Cashback on Car Insurance + How to Save on Car Insurance – £42 Cashback + £150 Saving

How to Save on Car Insurance and get the Best Cashback Deal – £150 Saving + £42 Cashback

A £110 Cashback Reward for my New Broadband Contract

Home Insurance Switch £20 Savings + £45 Cashback

£100 Saving + £40 Cashback for Switching Energy Supplier

Step 1 – Obtain quotes from Comparison Websites

Top Tip: For a list of Home Insurance Comparison Tools, please visit the C4N Toolbox.

I need to get a feel for what the market has on offer at this particular moment in time in terms of prices and spread. It is neither sensible nor time effective to check every insurance provider on a one by one basis so that I make use of price comparison websites to then compare the results from the different comparisons. Hope this makes sense. Idea is to build a pool of data relevant enough to my needs and the use this information to select a handful of candidates meeting my criteria.

As always, I have existing accounts with the main price comparison websites so that I only need to update my profile as of when and I can also retrieve previous quotes in view to fine tuning my search criteria if I wish to do so. It saves a decent chuck of time and simplifies the process significantly.

Top Tip: sign up with price comparison websites and store your profile for future searches so that there is no need to introduce your personal information every time you are in need of a quote.

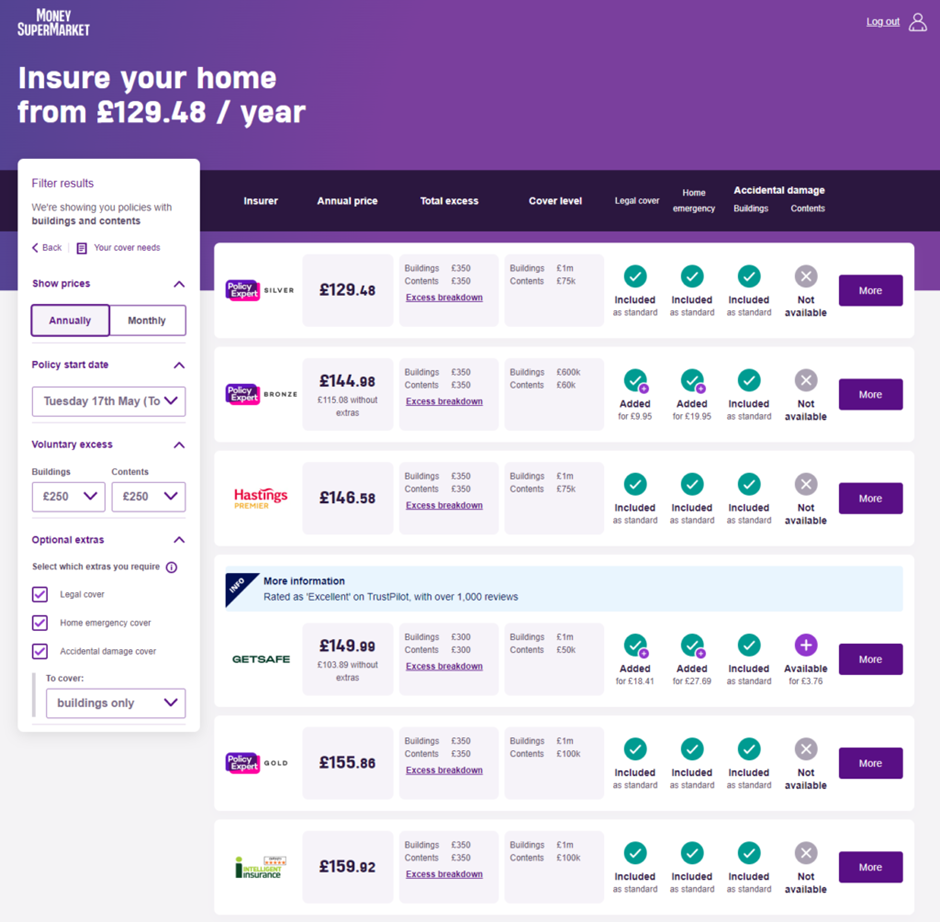

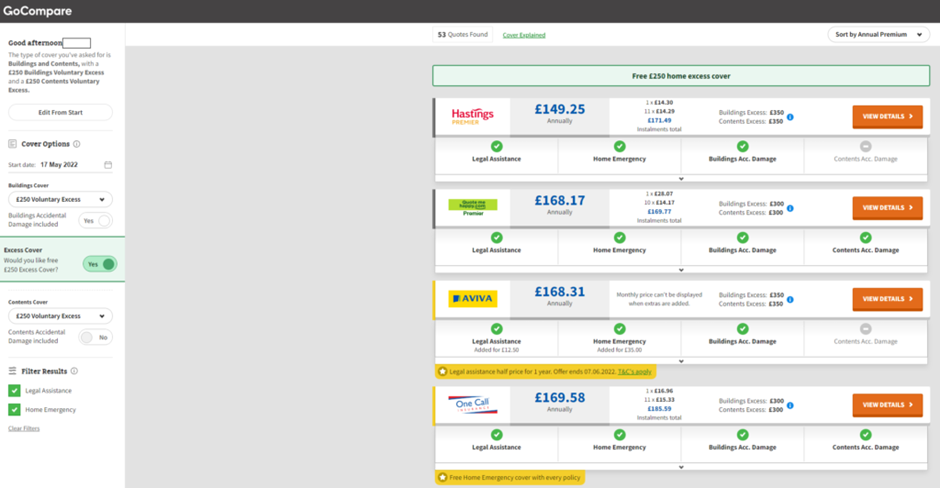

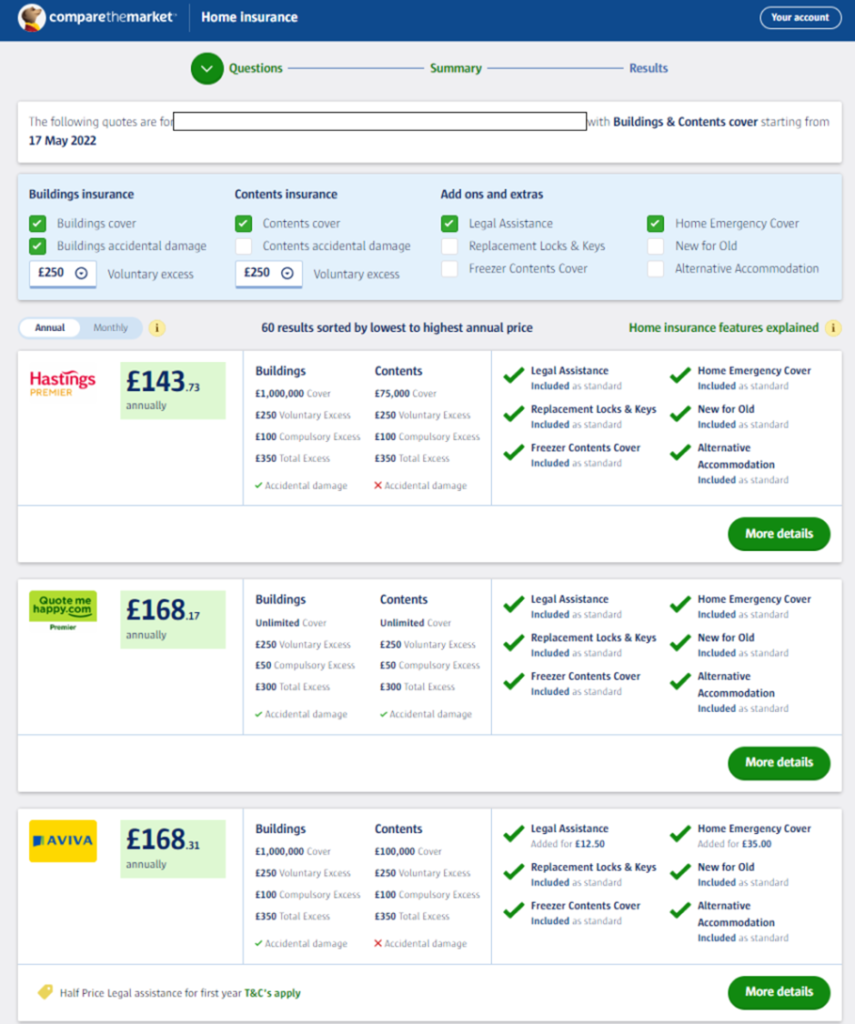

I use four main insurance comparison engines: Moneysupermarket, GoCompare, Comparethemarket and Confused. My task is to sign in, update my info if needed and select my filters prior to hitting the search button. My personal preference is to tick on Legal Cover, Emergency Cover and Accidental Damage Cover with a £250 voluntary excess for both, buildings and contents. The selection needs to be identical across the board so that the results are homogeneous.

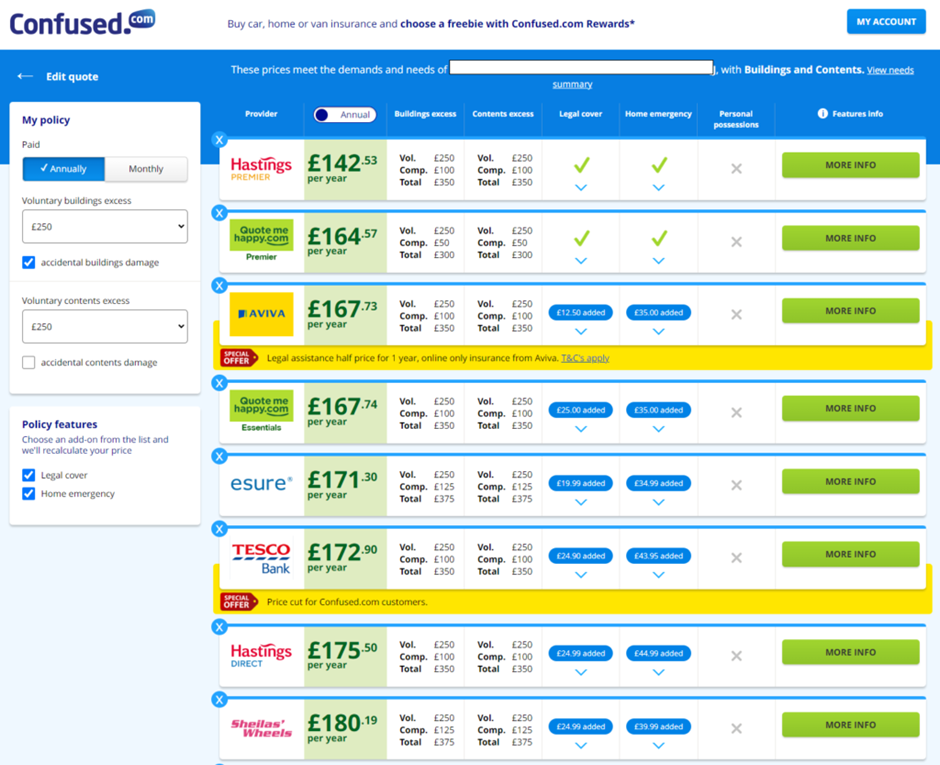

I have captured separate screen shots for each engine as search results are presented:

Quotes from Moneysupermarket

Quotes from GoCompare

Quotes from Comparethemarket

Quotes from Confused

There are two main candidates in the running: Policy Expert and Hastings quoting around the £145 mark. For some reason, Policy Expert only shows up on the Moneysupermarket search but that is not an impediment to be part of the mix. Trailing behind Quotemehappy and Aviva gravitating towards £170. Not worth considering as these prices are similar to my renewal quote and hence, no saving will be made.

Step 2 – Search cashback websites to gauge cashback deals

A Home Insurance switch is a fact now since I will be potentially saving £30 to £40 off my renewal quote based on my top two results: Policy Expert and Hastings. Now then, can I get cashback on top? I need to run queries on TopCashback and Quidco to find out. After doing so, they do not show as cashback merchants in neither of them implying that I would have to obtain cashback indirectly either via the cashback comparison engine o via the cashback website to the price comparison service. It sounds confusing but it is easy in practice. Let me show you.

Step 3 – Check comparison services on cashback websites to compare best package

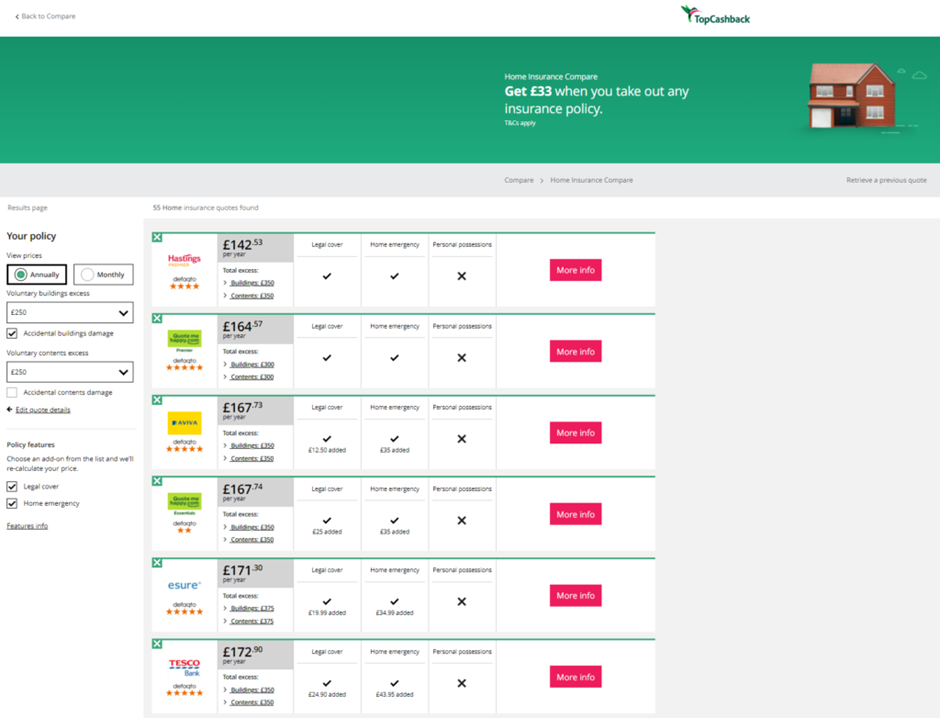

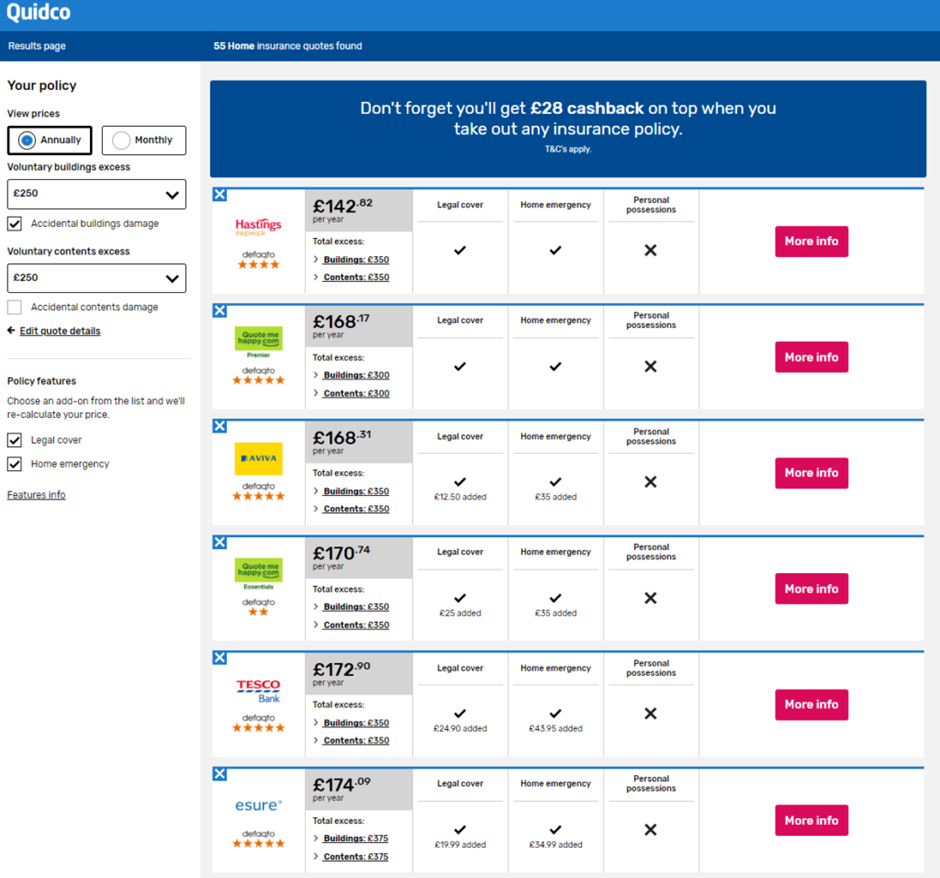

Quidco and Topcashback feature their own home insurance price comparison tools. This way, a double saving can be achieved: cheapest policy + cashback reward on top. So obtaining quotes from them both is a compulsory step in this process. Their results are strikingly similar as the following screen shots suggest.

Quotes from TopCashback

Quotes from Quidco

Hastings is the clear winner quoting £143 for my Policy. If I was to buy my Policy through Topcashback I would get £33 cashback, whereas Quidco would give me £28 for the same product.

At this point, I have all the information I require to make a decision as regards to the Insurance company I will select. I just need to pick in between Policy Expert for as low as £129 and Hastings for £143. Which one should I choose? I mean Policy Expert seems like the obvious choice but I never had any dealings with them and his brand is not all that familiar to me. I need some reassurances before I tip off the scales in their favour. The way I usually research this is by finding and reading reviews left by other users on the Internet. Trustpilot is a fantastic tool for the job offering a wealth of information about any service/company. I am glad to learn that Policy Expert is well regarded amongst the community and has been rated green and high by the immense majority of their customers. Based on this evidence, I decided that I will become a customer too.

Step 4 – Buy new Home Insurance Policy via Cashback Website

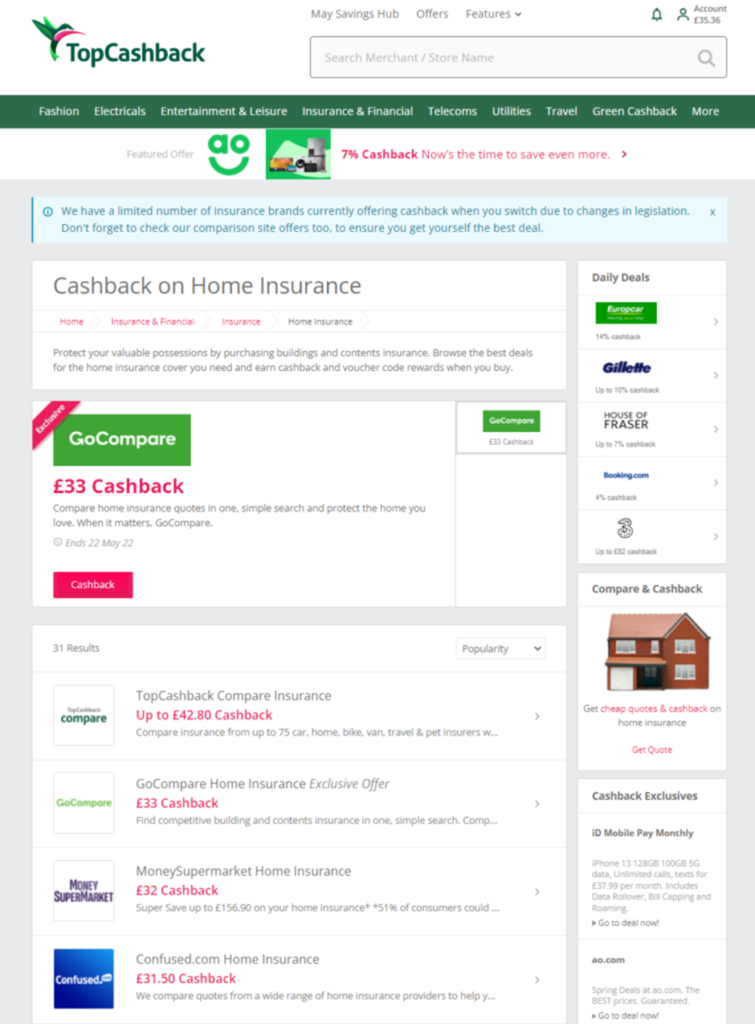

Since Policy Expert was quoted solely via Moneysupermarket, I will not need a matrix to visualize my options in order to select the highest cashback reward. I just need to pick in between TopCashback and Quidco for Moneysupermarket as a merchant. It should not be a surprise at this stage, but TopCashback beats Quidco hands down with a succulent £32 cashback reward.

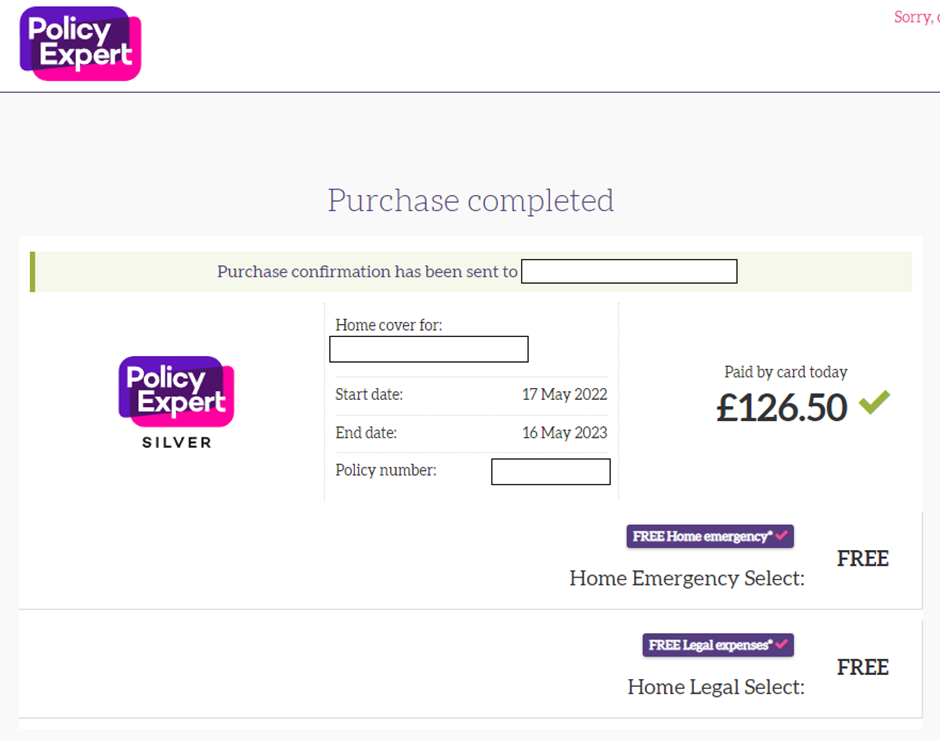

That’s it. I got to the finish line. The last step is to purchase my Insurance Policy making sure that I click on the link from Topcashback to Moneysupermarket and from Moneysupermarket to Policy Expert.

What is the size of the saving? Time to work out some numbers:

Home Insurance Policy cost (including accidental damage cover for contents) £126.50

Saving: £174.08-£126.50 = £47.58

Cashback: £32

Overall savings: £47.58 + £32 = £79.58

Mind due I managed to save £65 last year (£20 savings + £45 cashback). This is an improvement in terms of performance and a personal best so far. I am glad I am keeping a record of it in the public domain. Hope you enjoyed it as much as I have.

Recent Comments