July 2022 Free Cash Earnings Report £58 Free Money

Bank Rewards & Interests: £19

- Santander Lite Bank Account: £10

- Barclays Blue Rewards: £3

- RBS My Rewards: £3

- Natwest My Rewards: £3

Cashback: £39

- Home Insurance: £35

- Courier Services: £4

July 2022 Total: £58 (-£42 below £100 monthly target);

£118 to £1,200 year target.

| Bank Rewards | Cashback | Total | ||

| £19 | 33% | £39 | 67% | £58 |

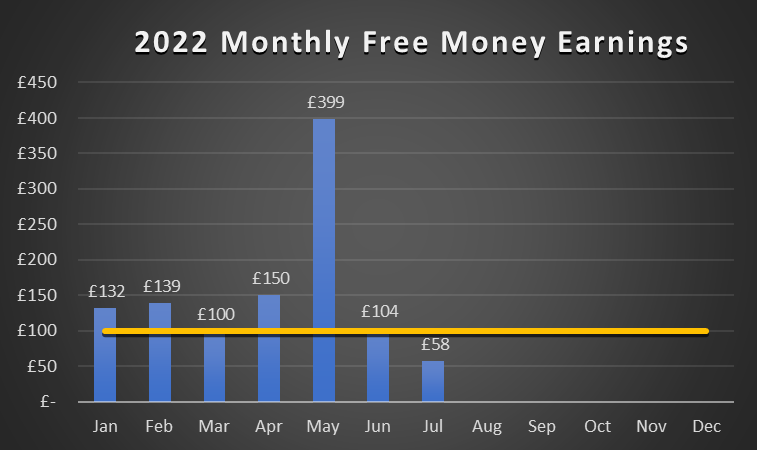

| Month | Free Cash Earnings | +/- Monthly Target (£100) | Accumulative | to Year End Objective (£1,200) |

| January | £132 | +£32 | £132 | £1,068 |

| February | £139 | +£39 | £271 | £929 |

| March | £100 | – | £371 | £829 |

| April | £150 | +£50 | £521 | £679 |

| May | £399 | +£299 | £920 | £280 |

| June | £104 | +£4 | £1,024 | £176 |

| July | £58 | -£42 | £1,082 | £118 |

July 2022 has been one the odd months during the year that I am unable to deliver on or above the £100 monthly target. It is not by chance that it coincides with my summer break. As it is usually the case, I am away from home and all things are left on stand by. Any Free Money making activities requiring my active action or physical presence are just not doable. I am purely relying on ‘pasive’ sources during this time. That clearly shows on my takings for the month of just £58.

Bank perks. A decent £10 cashback from my Santander Lite account direct debits. I am paying my dues including a water bill arriving every six months. That is a spike on my utilities bill which gets reflected on my Santander perks as money back. By contrast, I was unable to pick up any money from any of my two Halifax Reward accounts because all transactions were sistematically denied every time I attempted to use my debit cards. After spending one hour on the phone with their Fraud Team, I was explained that their systems identified my activities with the cards as suspicious and that by itself triggered a block on both cards automatically. Not sure how their algorythm works since I used the cards no differently than before. Just a bother really. Anyway, card block removed and I should be able to collect £5 from each from now on.

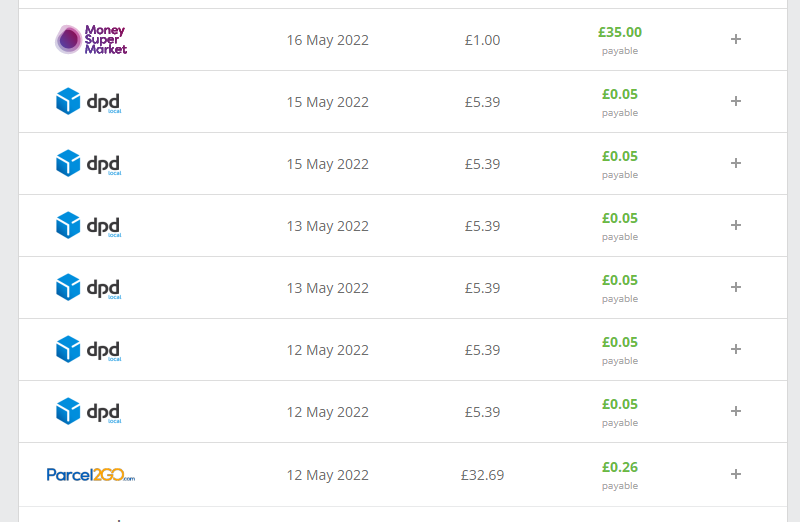

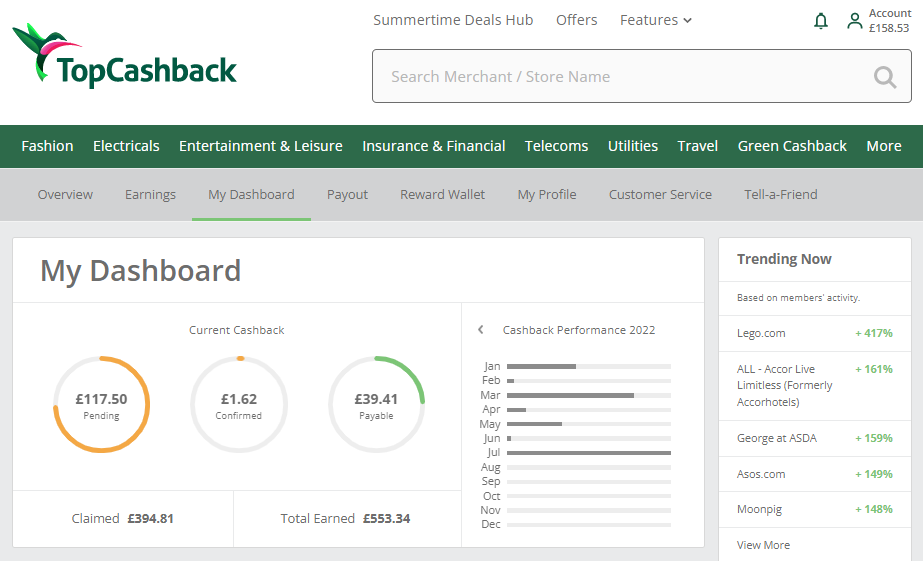

Cashback. I was expecting £32 cashback after switching home insurance providers (see post Best Cashback on Home Insurance + How to Save on Home Insurance – £32 Cashback + £48 Saving) but I was pleasantly surprised when the transaction was made payable for £35. It took a couple of months for it to mature and for the cashback to be made available for withdrawal. Overall, I can only class it as a prompt payment and a smooth process. Prime example of Cash 4 Nothing. Another £4 from courier services pushed my cashback earnings to £39 in July. £241 total cashback accrued this year up to this point. Bearing in mind that the bar was set at £250 (see post How to make £1,200 Free Money in 2022 – My Plan & Objectives) and the sheer amount of pending transactions in my account, I am in a position to state that my objective will be comfortably achieved.

First month I had not delivered Free Money over the minimum £100. In fairness, it has been two thirds of a month because I took a holiday from the 20th. Same to be expected in August as my break will extend to the 10th. That will be the time to pick up things where they were left off. Even though I have practically reached my Free Money Goal of £1,200 for the year, there is still some way to go in terms of sales and promotions. Approximately £400 to be accurate (see post £1,024 Free Money in the First Semester of 2022 – Time for a Review). Until then, I will allow myself to enjoy my break. Tada.

Recent Comments