I made £1,922 Free Money in 2023 + £285 Fund Gains

2023 is in the past now. Hard to believe how fast time goes by. It feels like yesterday but I set out one year ago with a realistic objective of making £1,500 from Free Money streams in 2023 using past performances as a baseline. I am happy to report that I actually gathered £1,922 to which I can add an additional £285 gains from having invested the Free Cash Fund in a diversified basket of ISAs (see post How to Invest the Free Cash Fund to target a 5% growth).

So, how did I do it? It is time for an End of Year Review.

Earnings vs Objectives

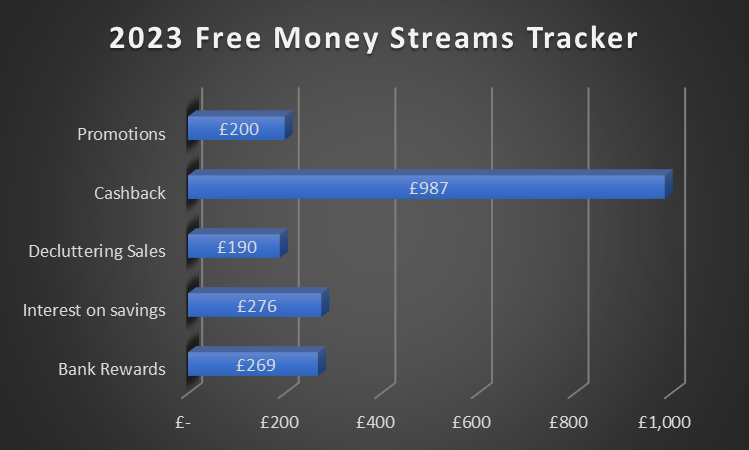

| Source | Objective | Actual | Difference |

| Bank Rewards | £250 | £269 | +£19 |

| Interest on Savings | £200 | £276 | +£76 |

| Decluttering Sales | £500 | £190 | -£310 |

| Cashback | £350 | £987 | +£637 |

| Promotions | £200 | £200 | -£ |

| Total | £1,500 | £1,922 | +£422 |

| Source | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | Total |

| Bank Rewards | £28 | £21 | £21 | £24 | £25 | £25 | £30 | £23 | £18 | £18 | £18 | £18 | £269 |

| Interest on Savings | £21 | £19 | £22 | £22 | £23 | £26 | £25 | £23 | £27 | £27 | £25 | £15 | £276 |

| Decluttering Sales | £48 | £43 | £21 | £23 | £26 | £19 | £10 | £190 | |||||

| Cashback | £27 | £2 | £103 | £250 | £142 | £85 | £22 | £350 | £6 | £987 | |||

| Promotions | £125 | £75 | £200 | ||||||||||

| Total | £124 | £42 | £146 | £464 | £211 | £159 | £77 | £396 | £71 | £120 | £62 | £50 | £1,922 |

| Free Money Income Stream | Contribution | % Weight |

| Bank Rewards | £269 | 14% |

| Interest on Savings | £276 | 14% |

| Decluttering Sales | £190 | 10% |

| Cashback | £987 | 51% |

| Promotions | £200 | 11% |

| Total | £1,922 | 100% |

Numbers do not lie. I owe more than half my earnings to a single contributor and that is Cashback Rewards as clearly shown by the tally chart. A less skewed distribution would have been ideal but that is how things panned out this year round. I was not expecting such a phenomenal performance in one area and a rather disappointing one in another (Decluttering Sales). I would assume that these figures are somehow down to statistical noise.

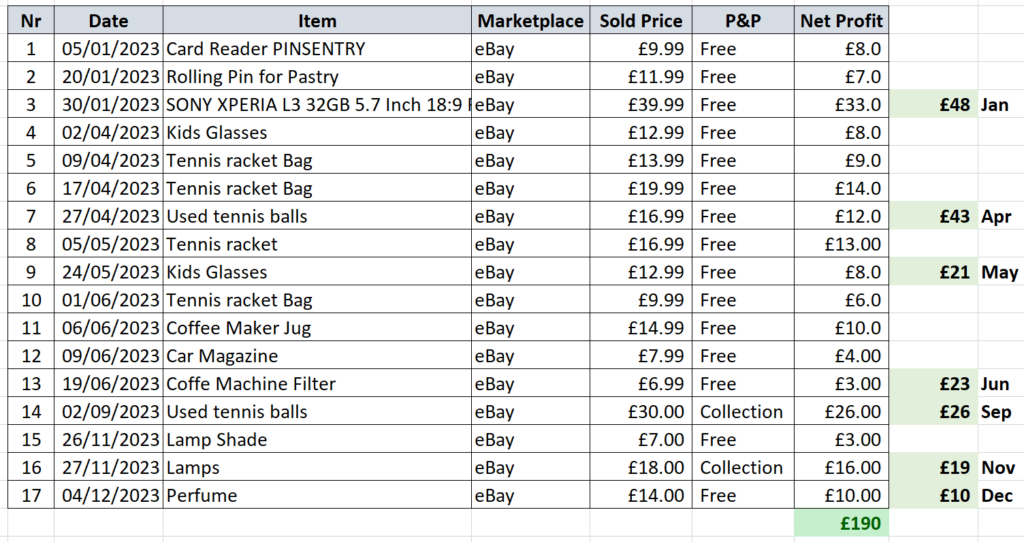

This is the first time in a long string of years that I have not sold at least £500 in a single year from my pool of pre-loved personal items. Not only that, I only managed 17 items for a net profit of £190 or £11 average per item (assuming that I manage to list and pack 4 items per hour, my hourly rate would be valued at £44).

Low number of items, low price tag, low average, low profits. Low everything. Unheard of and pretty much a write-off if I am honest. If I have to look at the reasons, I would point out mainly two: first, fewer items for sale, and second, lack of time on my side to rummage them out and list them. In any event, I am confident that I will be able to reverse the trend in 2024. I am already working on it.

On the bright side, I delivered on or above target in all other streams resulting in £422 more Free Money that initially planned (28% more to be accurate). Still a reason to remain upbeat.

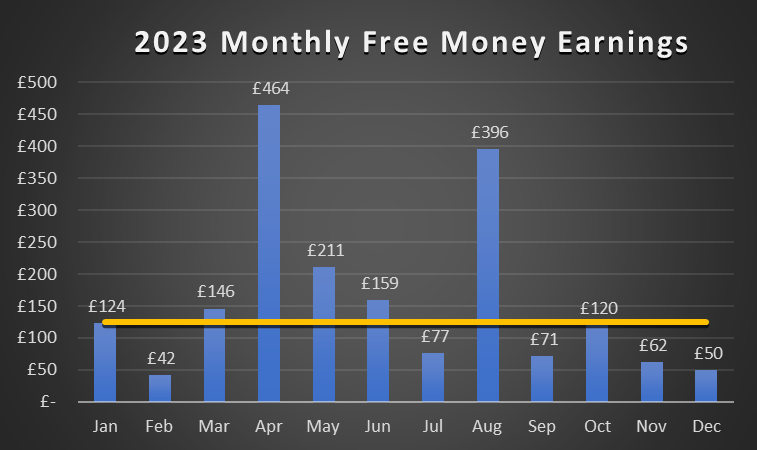

Monthly Earnings

As for the monthly earnings distribution, not quite a smooth ride anywhere close to an expected average target of £125. Five green months and seven on the red. Not particularly bothered as long as the end result is within expectations. Again, it would have been nice not to experience such a wild variation in earnings from month to month. More of a wish than an actual goal. Maybe I should be plotting an average as well to get a relevant dashboard indicator. Will see.

| Earnings Report | Free Money Earnings | Accumulative |

| January 2023 | £124 | £124 |

| February 2023 | £42 | £166 |

| March 2023 | £146 | £312 |

| April 2023 | £464 | £776 |

| May 2023 | £211 | £987 |

| June 2023 | £159 | £1,146 |

| July 2023 | £77 | £1,223 |

| August 2023 | £396 | £1,619 |

| September 2023 | £71 | £1,690 |

| October 2023 | £120 | £1,810 |

| November 2023 | £62 | £1,872 |

| December 2023 | £50 | £1,922 |

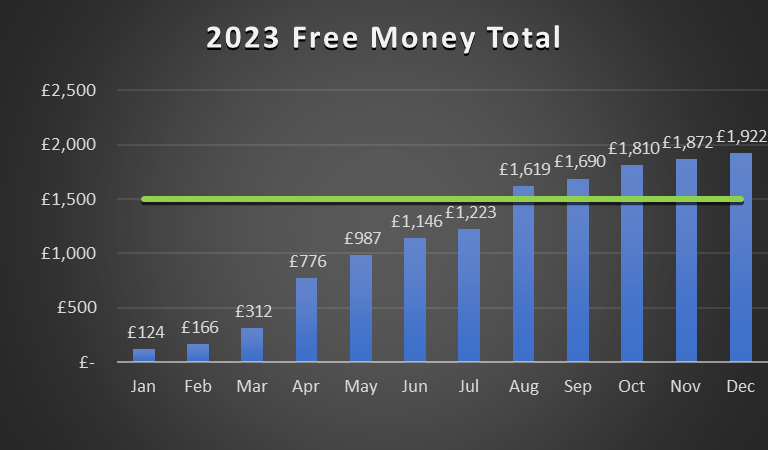

August was the breakout month when I reached the £1,500 objective for the year or four months earlier than expected. That shows in the remaining months since I put no pressure whatsoever on myself to drive earnings further. That is the way it is supposed to be anyways, as at the end day, my aim is to collect Cash for Nothing.

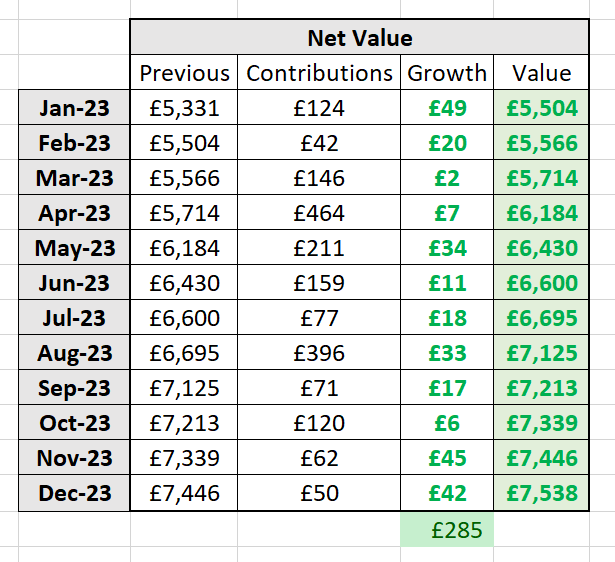

£285 Free Cash Fund Gains

Now then. My Free Money Earnings do not remain just parked loosing purchasing power due to inflation. They are all invested in a portfolio of different types of ISA accounts for them to generate additional tax-free profits.

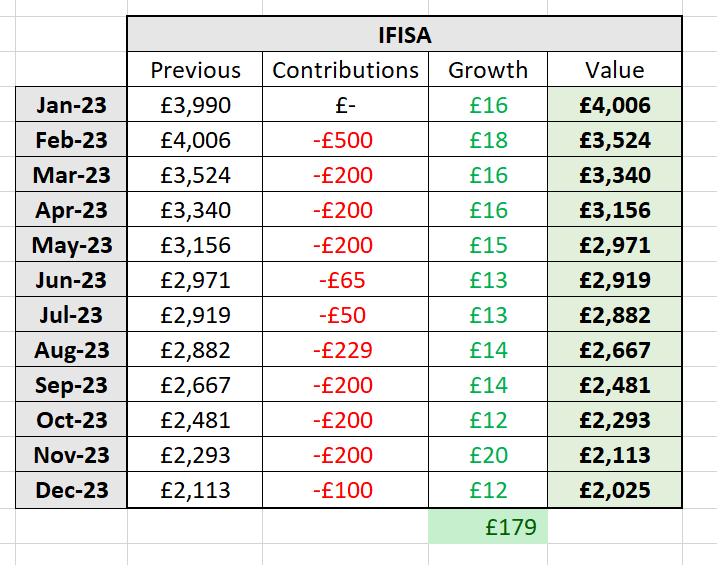

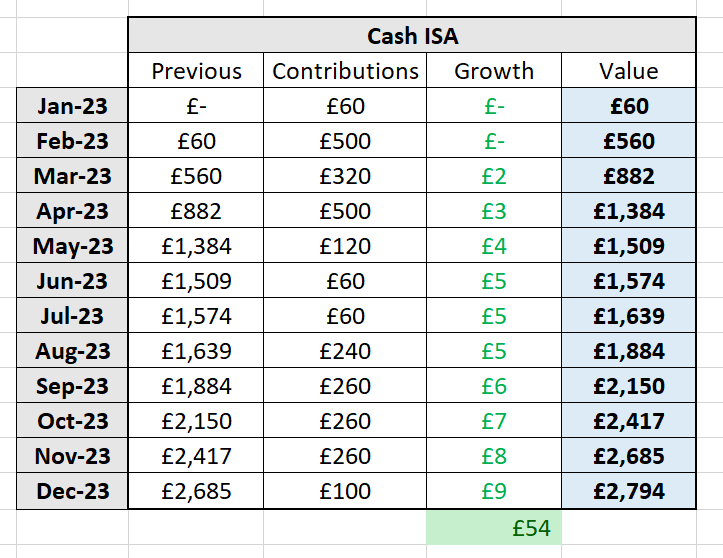

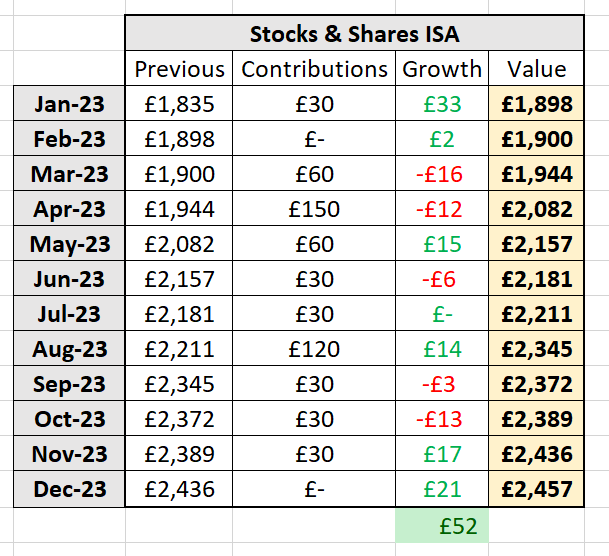

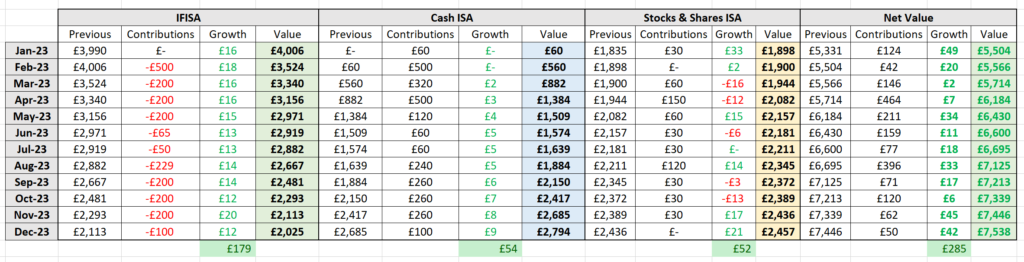

If I want to keep track of gains, I need to capture the value of my positions at the end of every month. Spreadsheets are coming handy for the task and yes, you guessed right, I have been tracking contributions and growth every month.

| Source | Gain | % Weight |

| IFISA | £179 | 63% |

| Cash ISA | £54 | 19% |

| Stocks & Shares ISA | £52 | 18% |

| Total | £285 | 100% |

With the rise in interest rates by the Bank of England, I made the decision to transfer moneys from my IFISA account towards a risk free Cash ISA back in December 2022 or exactly one year ago (see post 5% Savings Accounts are back. Time to ditch my CrowdProperty IFISA?). Nevertheless, my IFISA account carried the weight of the gains (63%), followed by the Cash ISA as it slowly builds up and delivers interest payments. Also, a somewhat modest appreciation in value from my set of S&S ISAs. Still a good performance from a balanced and diversified portfolio.

In essence, these gains are Free Money on top of Free Money bringing the actual figure to £2,207 in 2023. I will get blue in the face of stating this fact, but let me point out once again that I did virtually nothing to make this amount.

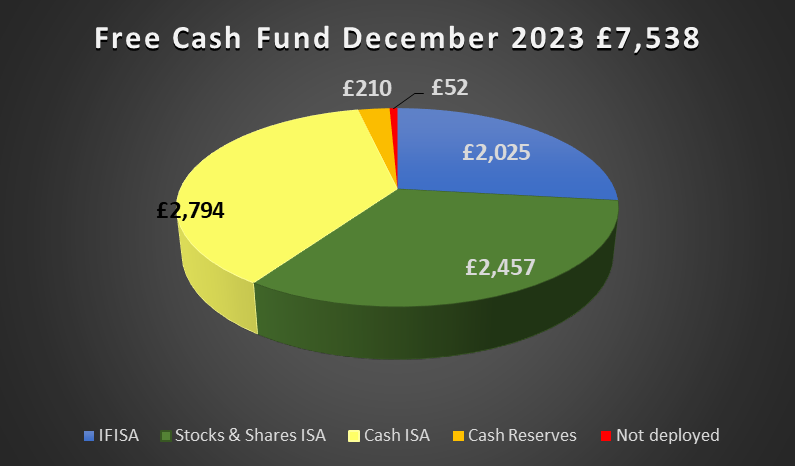

£7,538 in the Free Cash Fund

At this moment in time, I have made a total of £7,052 in Free Money since January 2021. By placing this money in ISA accounts, it has generated an additional £486 from capital gains, or a 6.9% Yield which is 1,9% more than my self-imposed 5% target. That is the reason why I keep two separate trackers: one purely for Free Money Earnings, and another one for a valuation of the Free Cash Fund. Please feel free to visit for regular updates.

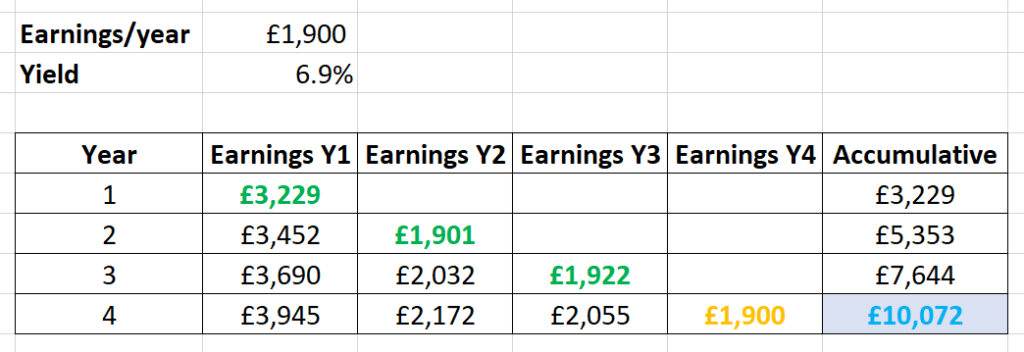

On the right track to £10,000 in the short term

How did this money came to be? Lets have a look at the numbers since the records began in January 2021.

| Year | Free Money Earnings | Accumulative | Free Cash Fund Value | Gains | % Yield |

| 2021 | £3,229 | £3,229 | £3,406 | £177 | 5.2% |

| 2022 | £1,901 | £5,130 | £5,331 | £201 | 3.9% |

| 2023 | £1,922 | £7,052 | £7,538 | £486 | 6.9% |

I am extremely pleased with the run I have had so far. More importantly, I get a sense of excitement about great things that are soon to come. What I mean by that is that if I am able to replicate the same performance in 2024 in terms of Free Money Earnings and Yield, then £10,000 is not that far fetched of a goal in the short term as per earnings projection shown bellow.

As the saying goes, past earnings are not a guarantee of future ones and I also need to keep my feet on the ground as to what is achievable within the remit and scope of this little project. On the other hand, I am not setting high limits with regards to what is actually possible. It will not be the first time where I find myself pushing the boundaries and taking earnings to the next level. The game is very much on. Are you happy to tag along and find out what 2024 brings about? To be continued…