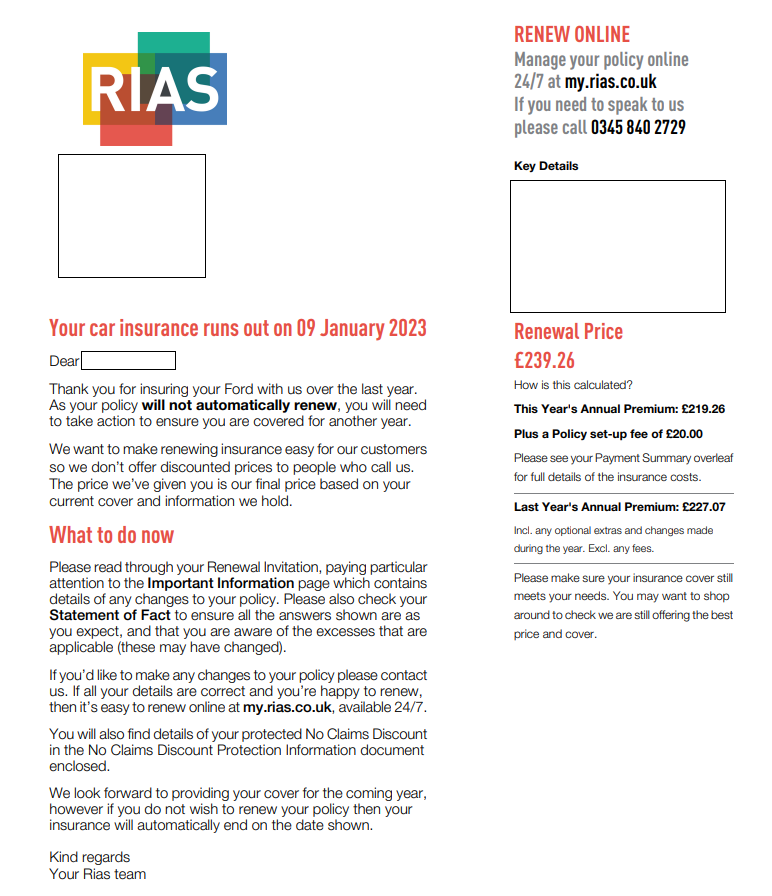

How to Save a 25% and Collect the Best Cashback on Car Insurance

It is now this time of the year when my car bills come in all at once on the anniversary of purchase. Alongside road taxing and servicing the motor, I need to renew my car insurance. Unavoidable expenditure I am afraid and a painful one for which there is no escape whatsoever unless I cycle everywhere. Not that I am not fit enough but I just need a car to survive. Probably the same situation for the immense majority of the members of the public and the vultures out there will not miss on the opportunity to milk us all out of our hard earned cash.

Ok. Now that I had my moan, it is time to accept reality and make the best out of this rip-off. I will not deviate from my script: rather than accepting the renewal offer from my current insurer, I will shop around in view to finding the best deal to then reward myself with some cashback on top. It is a tried and tested method that always works.

The Best Cashback on Car Insurance + Saving on Car Insurance Method. The four step System:

- Visit at least three different comparison websites and obtain quotes from each.

- Having selected the best quote or quotes, run searches on cashback websites to gauge available cashback deals.

- In addition to using comparison engines, run a query on comparison services from cashback websites to compare best package (switch saving + cashback reward).

- Saving and cashback reward considered to select Insurance Service, cancel old Policy and buy new Policy via cashback website.

No time to waste. Let’s do this quick as I need to make good use of my precious time in order get to the next level of Candy Crush.

Step 1 – Obtain quotes from Comparison Websites

Top Tip: For a list of Motor Insurance Comparison Tools, please visit the C4N Toolbox.

If you are not familiar with the drill, my aim at this stage is to get a taste of what the market has on offer for my custom. I do have accounts with the main insurance comparison websites and since my car details are already stored, all I need to do is to update my info (if need be), select my insurance criteria and run a search. Simple.

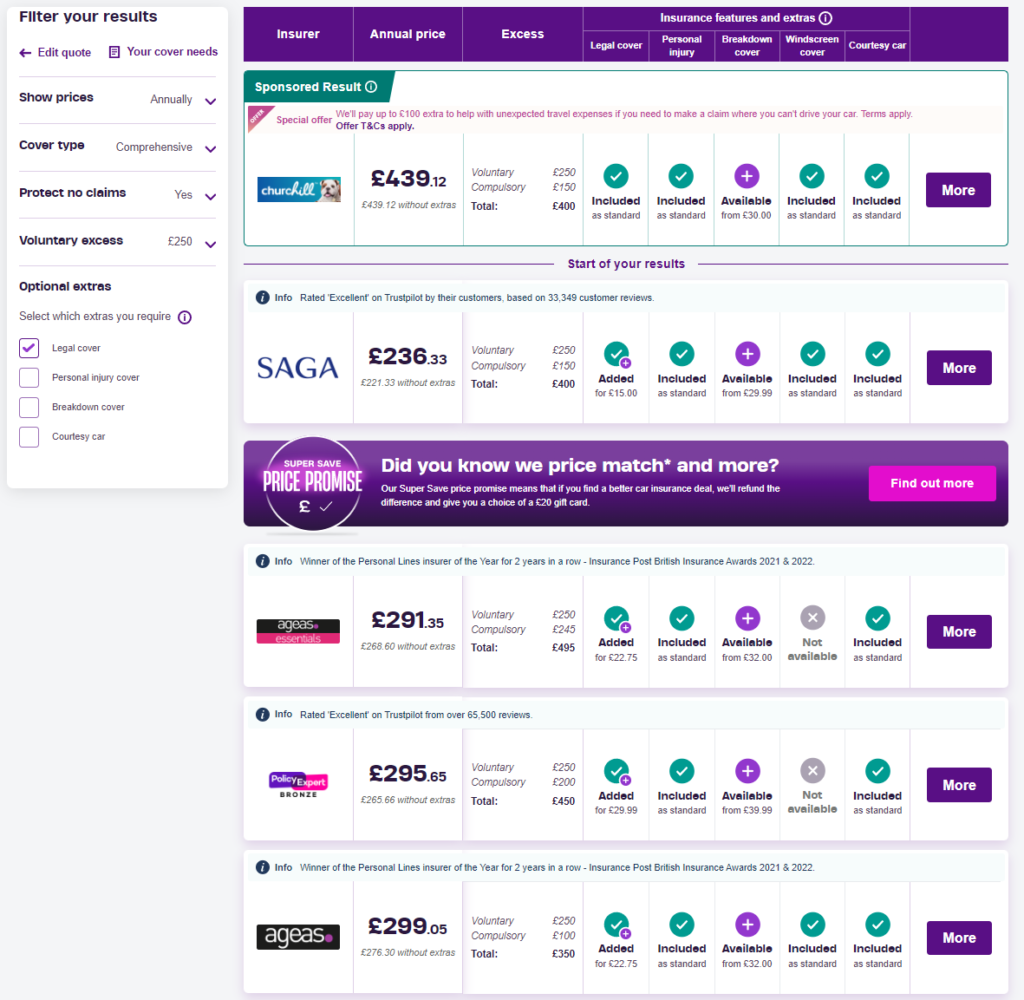

Car Insurance quotes from MoneySupermarket

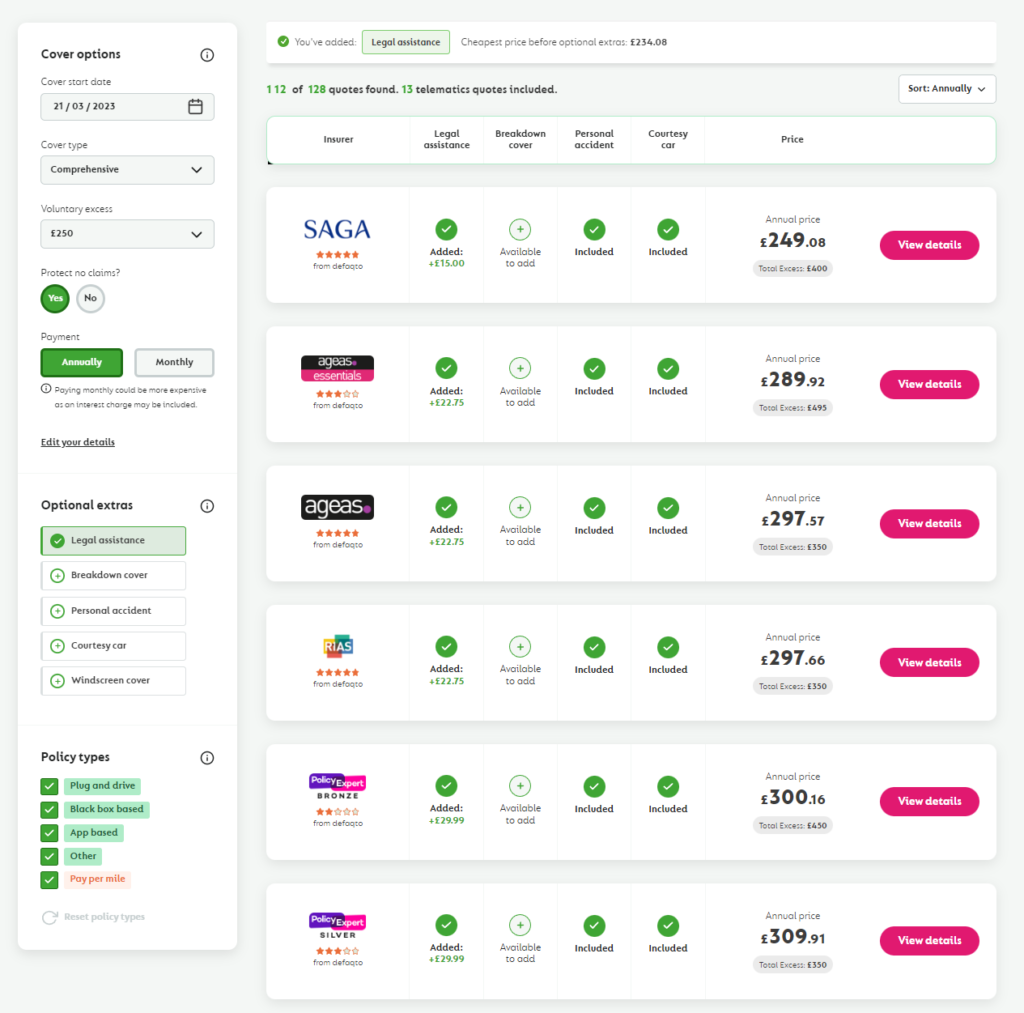

Car Insurance quotes from GoCompare

Car Insurance quotes from CompareTheMarket

Car Insurance quotes from Confused

There is unanimity across the board. There are two suppliers showing up consistently at the top: SAGA and Ageas. My quotation bracket is in between £211 and £290. It is not looking very promising in terms of a saving (hardly a surprise if we take into consideration inflation plus price hikes in 2023) but I still need to exhaust the process.

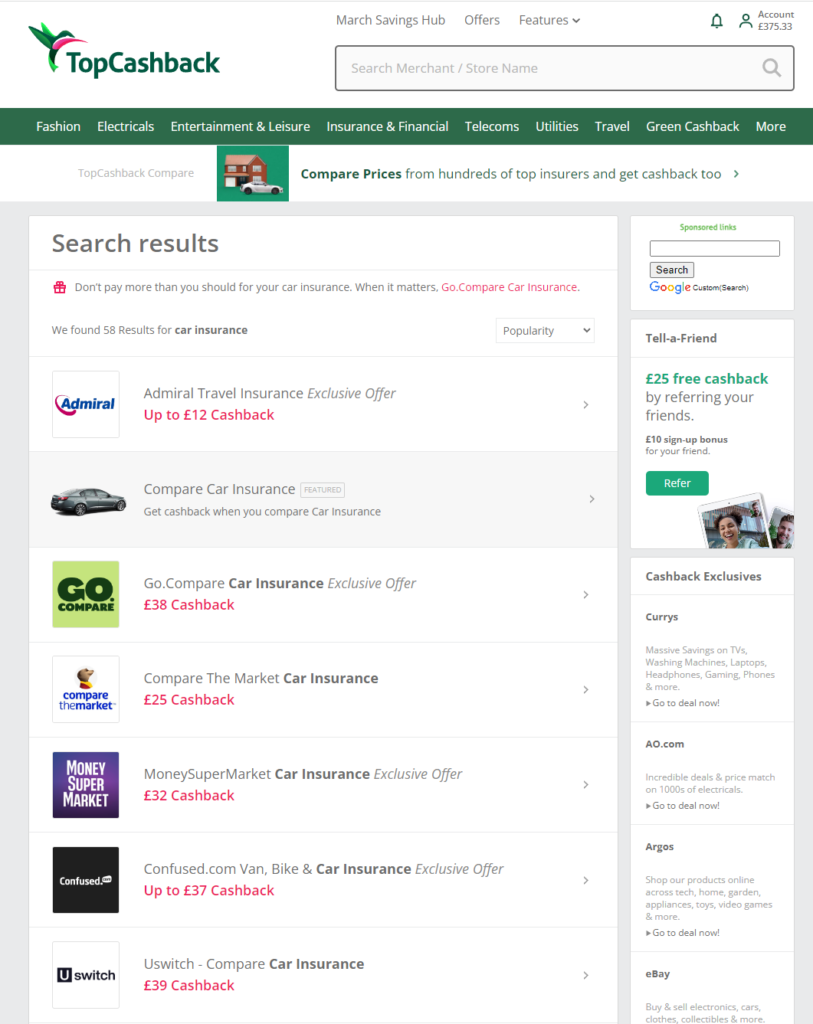

Step 2 – Search cashback websites for my selected providers

Can I get cashback from my selected suppliers? The short answer is a no as they do not show in the merchants result list when searched for individually.

Step 3 – Check comparison services on cashback websites to select best package

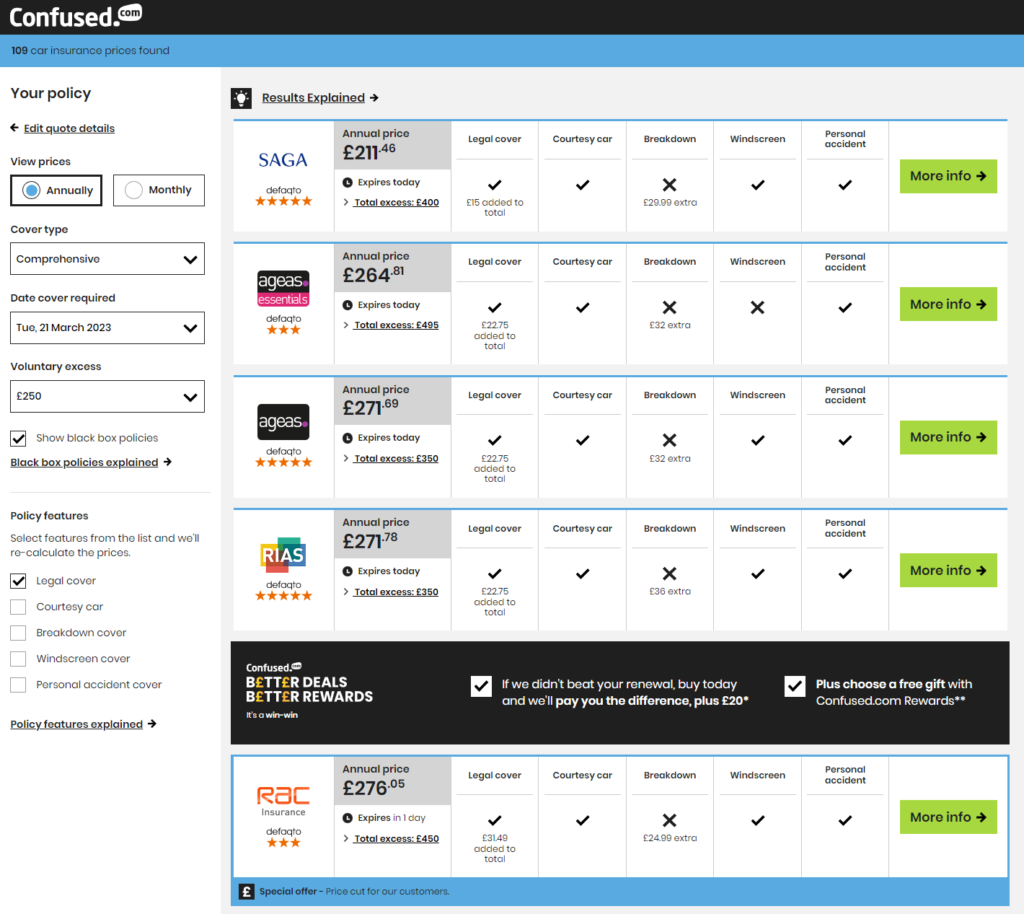

Right then. Is there a way I can still get cashback if I purchase a premium with any of my two nominated suppliers? Yes. There is. Topcashback provide with their own comparison service offering a £45 cashback reward for taking out an Insurance Policy (I will not even bother with Quidco as they use the same engine and cashback is always lower).

Car Insurance quotes from TopCashback

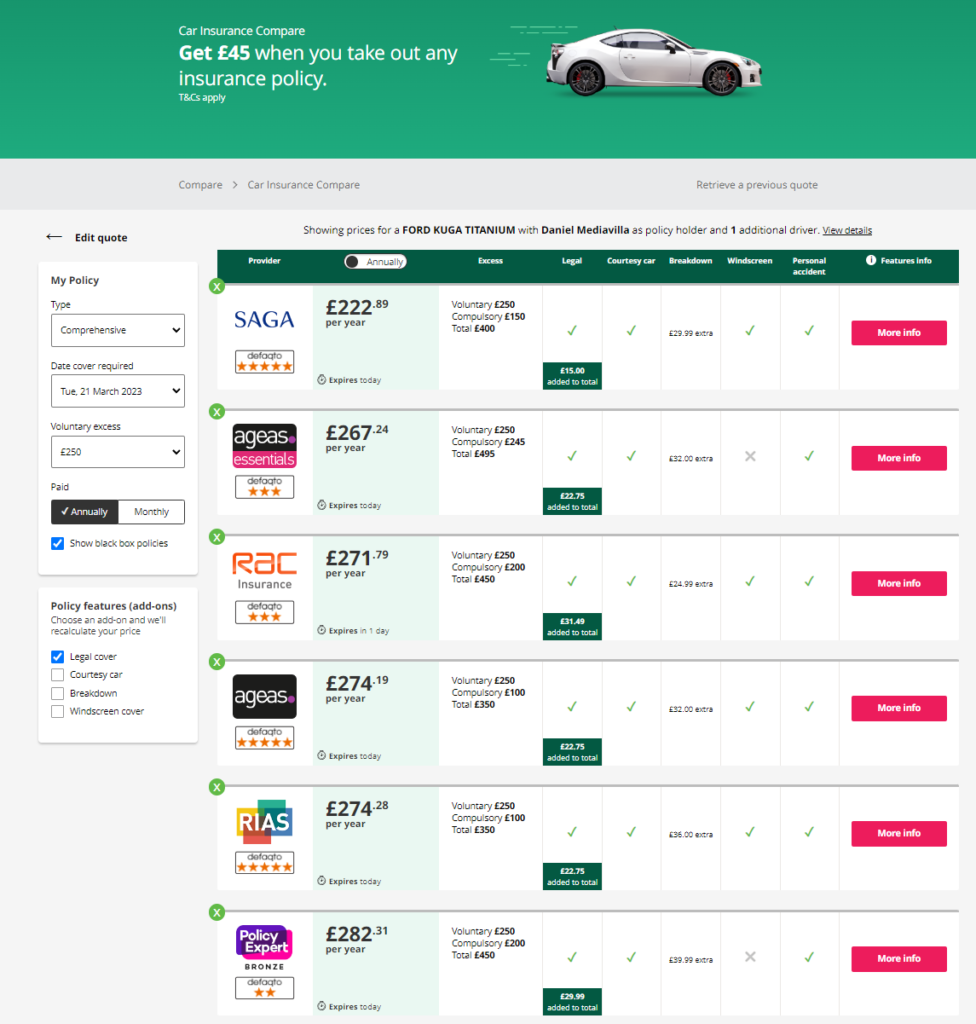

Two familiar providers fill the top two spots: SAGA £222.89 and Ageas £267.24 with a £45 cashback reward. It goes without saying that SAGA is the clear winner of this year’s competition.

Step 4 – Buy new Car Insurance Policy via Cashback Website

I am taking an Insurance Policy with SAGA. I just need to click on the link from TopCashback and purchase my premium on their website. Once the transaction is tracked and confirmed (8 week estimation), I will get £45 as Cashback available for payment. Easy, Free Money in exchange of a must do expenditure.

What is the total size of the saving? The gross saving is not particularly significant this year £239.26 – £222.89 = £16.37 (-7%) but it is still a saving nevertheless. If we add the cashback on top we get a Net saving of £61.37 (-25%) which is a much more attractive proposition in my books.

That’s it. Insurance sorted and cashback collected. £45 is almost a given year on year. Another automated process to collect Free Money from. Hope you have enjoyed it as much as I have. Ta-ta.

Recent Comments