How to make £250+ Cashback from an American Express Platinum Credit Card

Money as means of payment

So here I am, trapped in the Money Paradigm where money is the basic tool as a means of trading. Goods and services have a price tag attached to them and can only be acquired after disbursing the asking price in monetary units. What I am trying to get at is that money is required to cover for basic needs such as food and shelter and since I have not isolated myself from society just yet, I am in need of a payment instrument to get the family unit going.

The main theme of this post is that not any payment tool will do for me. I will be demanding to get something back for my custom. More so when we consider the fact that Credit Card Companies are greedy stakeholders in this scenario by keeping from 1.5% to 6% in fees per transaction (source: Forbes) and that, my friends, constitutes:

a) An actual and very real Consumption Tax which goes directly into private hands;

b) A proper definition of cash for absolutely nothing which actually parasites the real economy.

The direct result is that products end up being more expensive than they should basically because trillions are funnelled away from the many into the few. Beyond outrageous. They are pulling the wool over our eyes but this piece of information forms part of the fabric of our reality and will never reach mainstream media. Crypto currencies came along as an idealistic solution to the issue. Unfortunately, they are deemed as an speculation mechanism rather than a transactional one. I do wonder if this happened by chance… Sorry that I got carried away and I am rumbling on a bit. Not my intention to write a manifest here but I needed to get this out of my chest. Ok. Now that I had my moan, is time to get to the nitty gritty.

I want Money for my Money

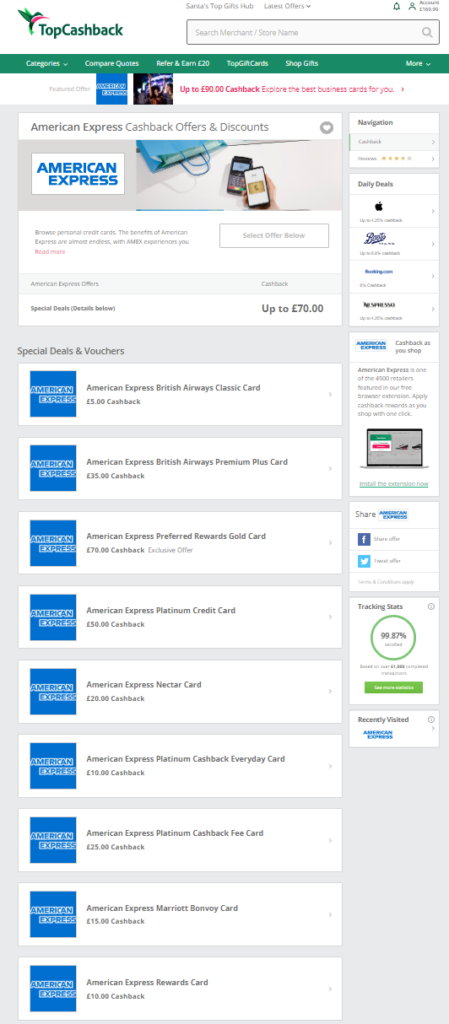

Since I live in a world where I need to spend in order to survive and function as a human being (ie: food, petrol, clothing, entertainment, holidays, travelling, etc.), I need to make use of some payment aid as cash is a thing of the past. The obvious option is a credit or a debit card, but, will I use just any card for the task? Absolutely not. It does need to be a card that gives something in return for the privilege of having me as a customer, and preferably, money rather than ‘loyalty points’ as bait to get me trapped into their corporate web. Sad fact is that there are not many out there and after some shopping around, the only one worth my while was the American Express Credit Card. Luckily for me, AMEX is a cashback paying merchant showing up prominently as a credit card provider in TopCashback meaning that I will be aiming for a double cashback whammy:

a) Cashback after a successful application.

b) Cashback as a percentage over purchases for using the credit card.

Ok. So there a number of different AMEX cards available, which one will suit me best (see list below)?

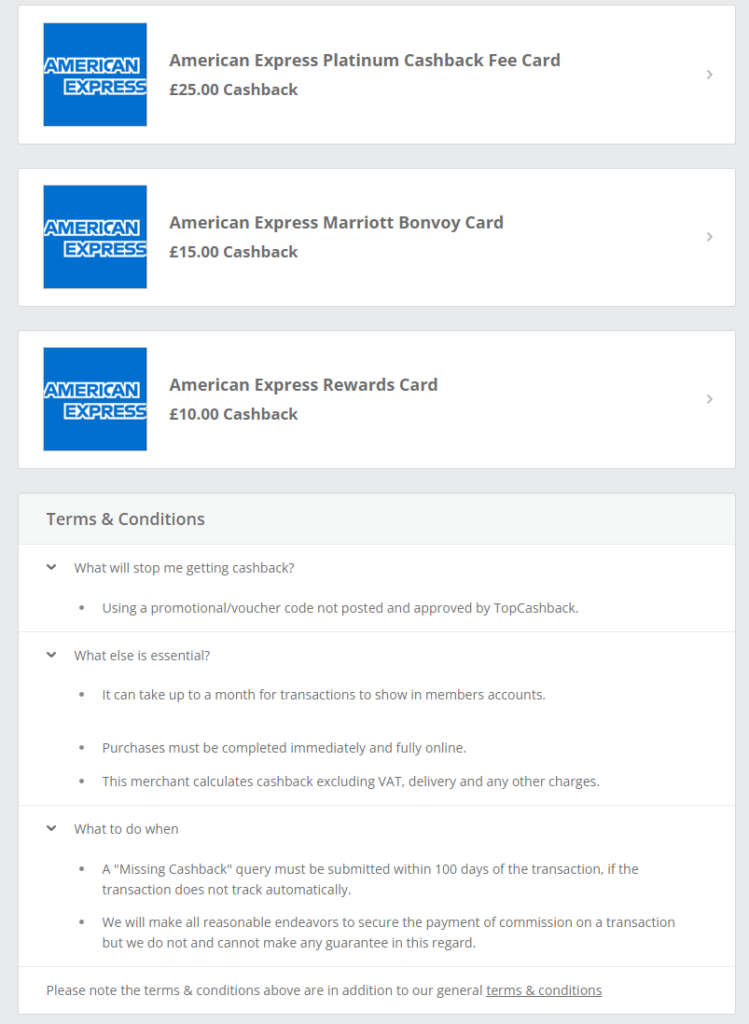

My basic sifting criteria is that I do not want loyalty points to be exchanged for expenditure with a selection of ‘partners’. I need to be paid in cash and that condition reduces the list down to three potential candidates.

Having filtered my preferences, I will obviously target the highest cashback amount on application which comes to be £25 and is attached to the AMEX Platinum Cashback Credit Card.

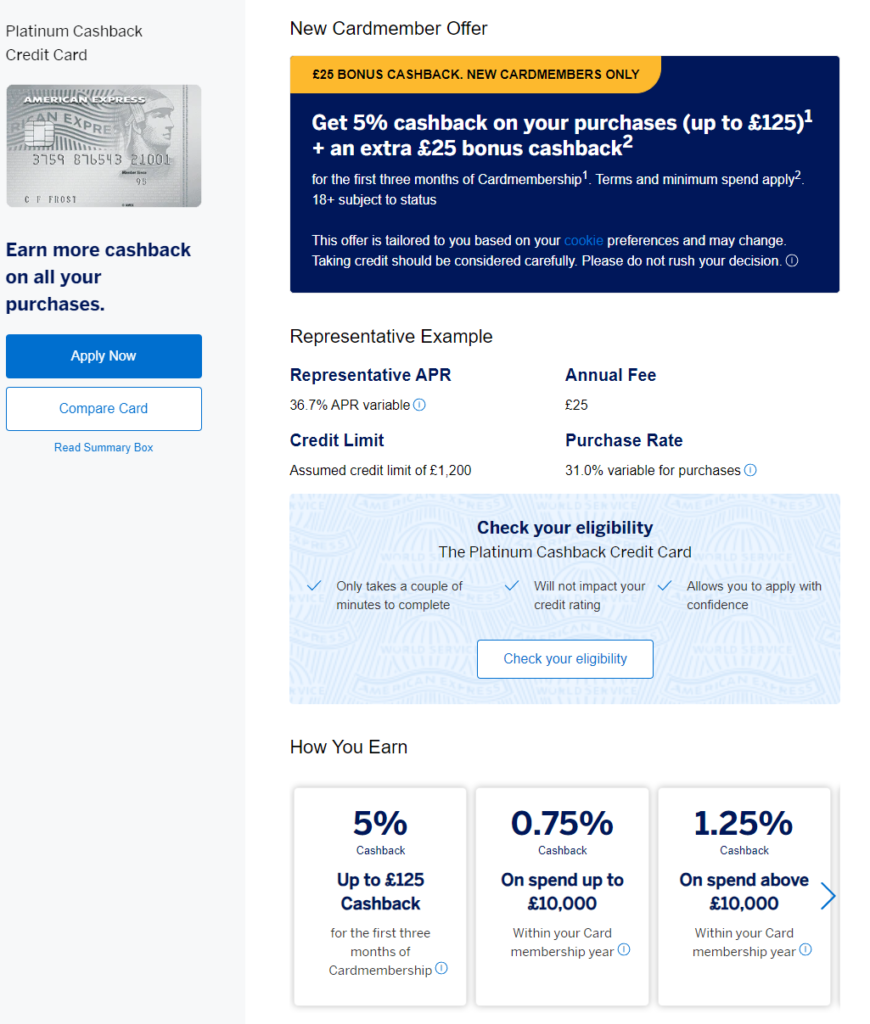

The AMEX Platinum Cashback Credit Card portrays itself as a very sweet offer. Allow me to explain:

- £25 cashback on application via TopCashback.

- 5% for the first three months up to a maximum of £125 (I will need to expend £2,500).

- 0.75% from £2,500 to £10,000 expenditure (annually).

- 1.25% after spending £10,000 with the card (annually).

- £25 annual card fee (to be deducted from cashback earnings).

Once again, it will be unwise not to opt-in. I am going to spend regardless, so why don’t treat myself by doing so?

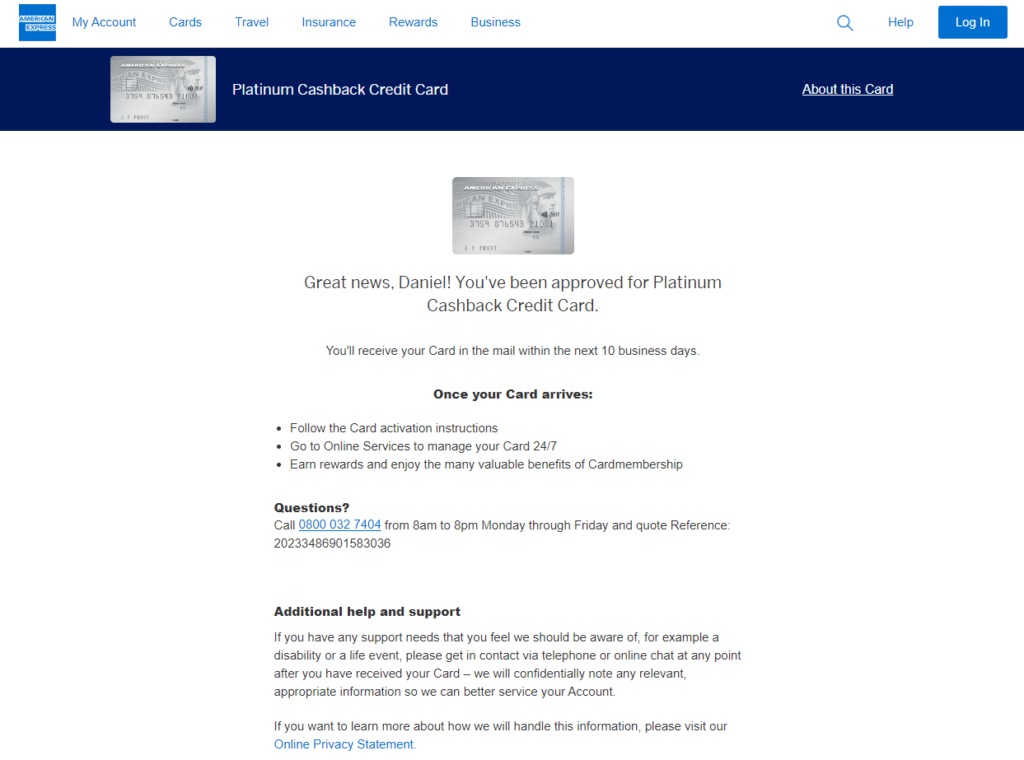

I invested five minutes of my time to complete the application process after which I received immediate confirmation in my inbox. The wheels are now set in motion and the card will be arriving by post shortly.

My intention is to use the card discretionally and for any personal purchase. Mind due some merchants do not accept AMEX for payments (probably because of their fees) but I can live with that as I have a number of other cards to my name. In any event, once the card was activated, I added it to my phone wallet and to my Paypal account with the idea of it being my main means of payment from now on.

How much Cashback from spending can I accrue in a single year?

Now then, how much cashback can I reasonably expect to collect from the card? Since the TopCashback reward and the annual card fee cancel each other out (£25 – £25 = £0), I just rely on my expenditure levels to collect cashback rewards. Allow me to calculate some figures so that I can place myself somewhere:

| Cashback Rate | Expenditure | Total | Accumulative |

| 5% | £2,500 | £125 | £125 |

| 0.75% | £2,500-£10,000 | £56 | £181 |

| 1.25% | £10,000-£20,000 | £125 | £306 |

I am not sure I will be spending £20k in a single year but I can most certainly guarantee that I will be saying goodbye to £2,500 in the short term. I am estimating my cashback proceeds to sit in between £200 and £300 but I will use hard numbers to accurately capture my position on the anniversary date.

I applied in December 2023 and it is now June 2024, how much money as Cashback so far?

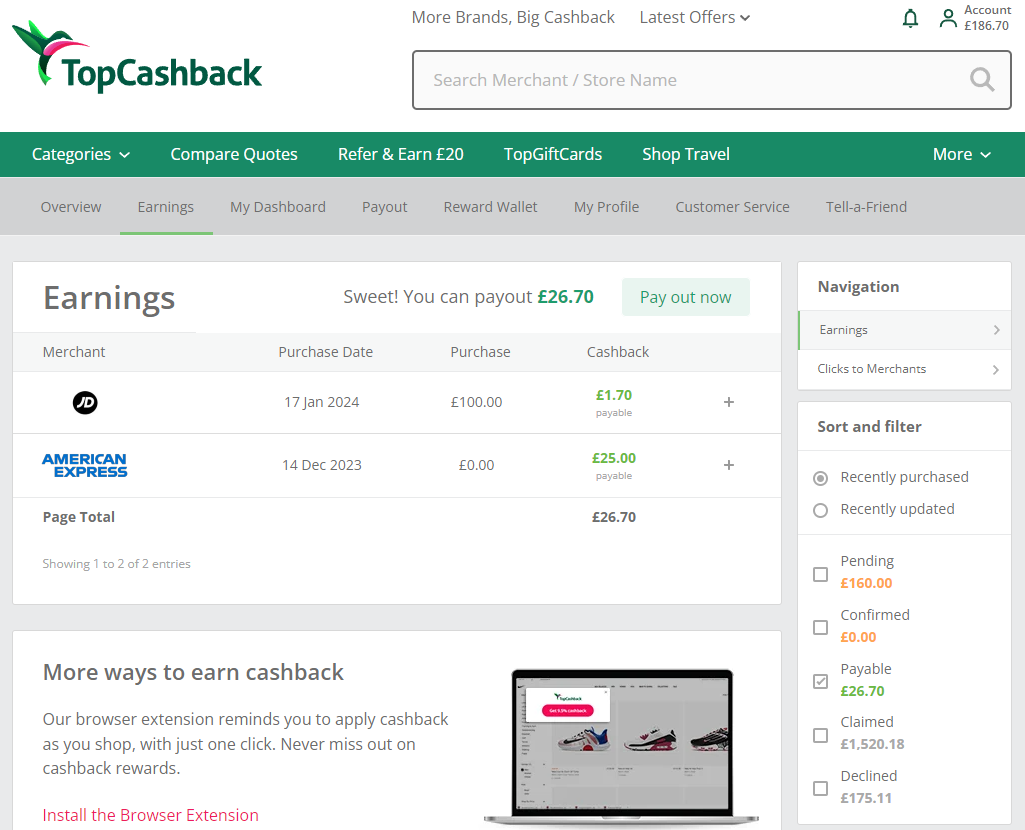

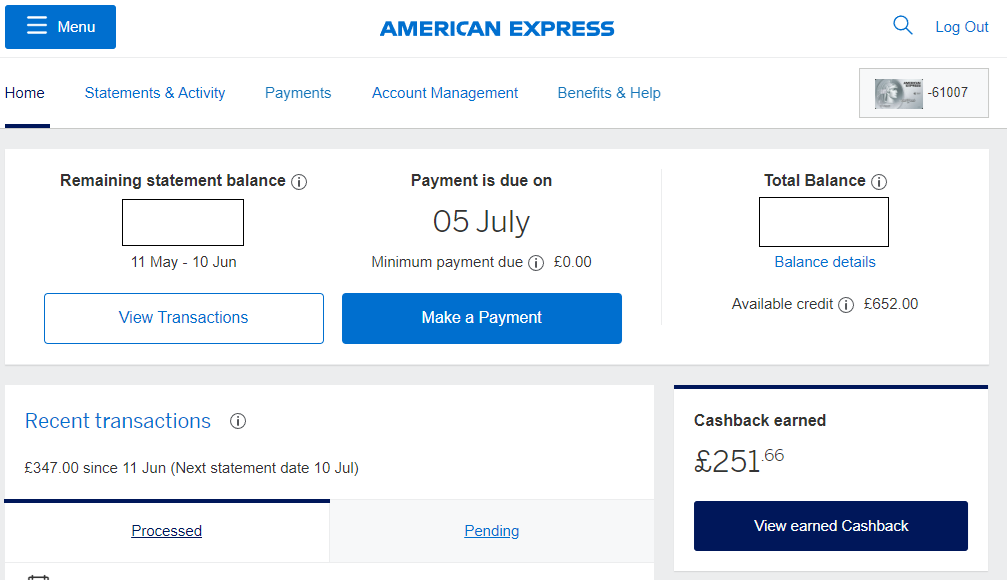

My TopCashback account was credited with £25 back in March 2024. It is mid June at the time of writing and having checked my credit card statement, I am finding £252 as total cashback earned which actually matches net earnings (£25 annual fee to be deducted). Make your own judgement but I am really pleased with this amount which came about from nothing as a matter of fact.

Is this offer doable for you?

Maybe or maybe not. Different people experience different circumstances and go about their lives with dramatically different spending habits. What I would say though is that there are certain occasions during the year and/or a number of life events where big expenditures will be incurred into. Let me enumerate some examples which are definitely relevant to me:

- Christmas Shopping.

- Holidays or short breaks (ie: hotels, flights, packages, cruises, etc.).

- Home refurbishment projects (ie: kitchen, bathroom, garden, etc.).

- White goods and appliances purchases (ie: boiler, fridge, oven, washing machine, TV, computer, smartphone, etc.)

- Car/bike/vehicle purchase.

Just giving you some food for thought. You cannot possibly escape the spending race, however, the choice to make Free Money out of it or not is undoubtedly yours. Happy spending either way.

Recent Comments