Lloyds Bank Account Switch £100 Cash Reward

After completing my first bank switch of 2021 with Nationwide (see post), I had to act swiftly to collect my second Bank Switch Cash Reward of 2021. Reason being the promotions are live for a limited period of time and I almost lost the window of opportunity to apply for a Lloyds Bank Account. I did so the day before the promotion would expire by pure chance. The learning point is to plan ahead of the game and set an alert in my calendar as a reminder of my Free Money gathering tasks for the year. This thought just gave me an idea: map out my activities in a calendar to bring visibility into my routine. Another entry in my To-Do lists.

How do I collect the £100 Reward?

If you have not had the chance to read my previous posts or are not familiar with this Free Money Source, please visit the Free Money Tracker Page. In any event, let me explain the process again.

As part of their marketing efforts to gain new customers, banks periodically offer switching incentives. Banks will give you hard cash for your custom on condition that you close your old bank account and open a new account with them (for the latest list of bank account switching rewards click here). The reward is awarded by applying for a new bank account and make use of the switching services provided (see box at end of post for more details about the Current Account Switch Service – CASS) to close the old account and transfer direct debits plus the remaining balance into the new bank account. Once completed, and subject to the Terms & Conditions of the promotion, the reward is credited in the new account within days.

From the current switching offers at the time of writing this post (October 2021), I believe that Lloyds is one of the few Banks I have never had an account with. The £100 cash reward is appealing enough for a few minutes of my time and having checked the Terms & Conditions, I find myself ticking all boxes to qualify for it.

Club Lloyds Bank Account Switching Bonus Requirements

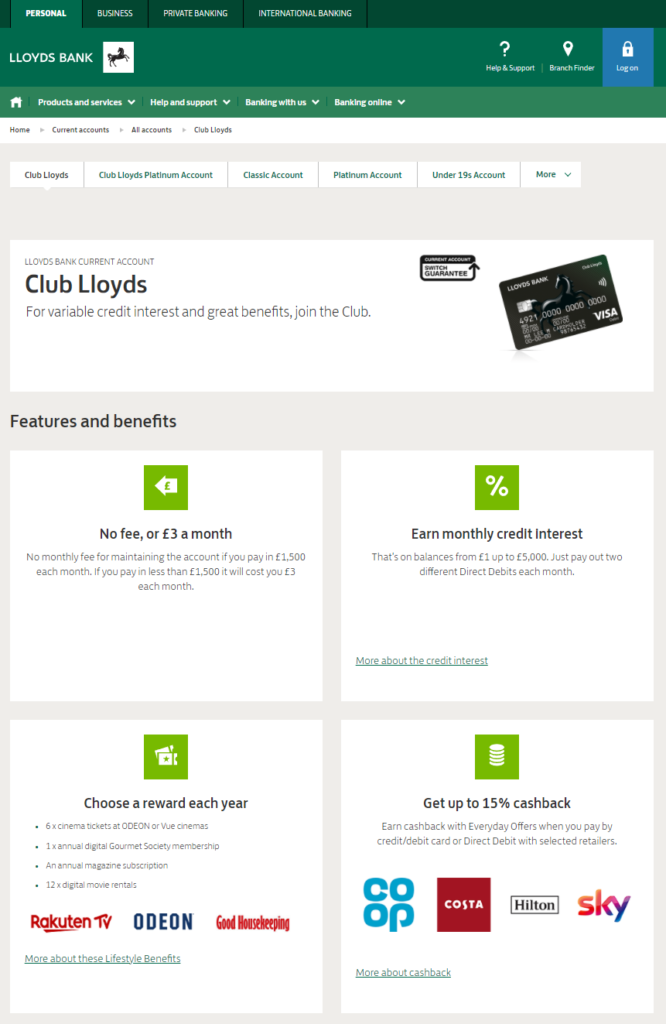

To get the Reward: New or existing customers opening a brand new Club Lloyds Account and applying for a full switch to the new account. The bonus is paid within 10 days of switch completion.

Minimum monthly pay-in and direct debits: exempt from minimum pay-ins or direct debits to qualify for the bonus or to keep the account. However, a minimum of two direct debits is necessary to accrue any interest in the account and a £3 fee will apply if pay-ins into the account are bellow £1,500 per month.

In-credit interest: 0.6% on balances up to £3,999.99 and 1.5% on any part of the balance between £4,000 to £5,000. Requires setting up a minimum of two direct debits.

Other annual Benefits: choice of six cinema tickets, a digital Gourmet Society membership, an annual magazine subscription, or 12 digital movie rentals through Rakuten TV.

My Co-Op Account as tool for the Switch

Going back to my August 2021 Income Report Post, I had serious doubts on whether or not to keep my Co-Op Bank Account after they cut down their rewards to just £1 per month. I would still need four direct debits and a minimum pay-in of £800 per month. A lot of work and tied up resources for a pitiful pound reward. Just not worth the effort. My Co-Op Account days were numbered from that moment onwards and the opportunity to ditch it just came up. I happily offered the Co-Op Account details for the switch. It was a relief and a positive because the Lloyds account T&Cs do not require direct debit transfers to get the switching reward and the end result is that I have freed up four direct debits I can use to qualify for future bank switches. That is a bonus on top.

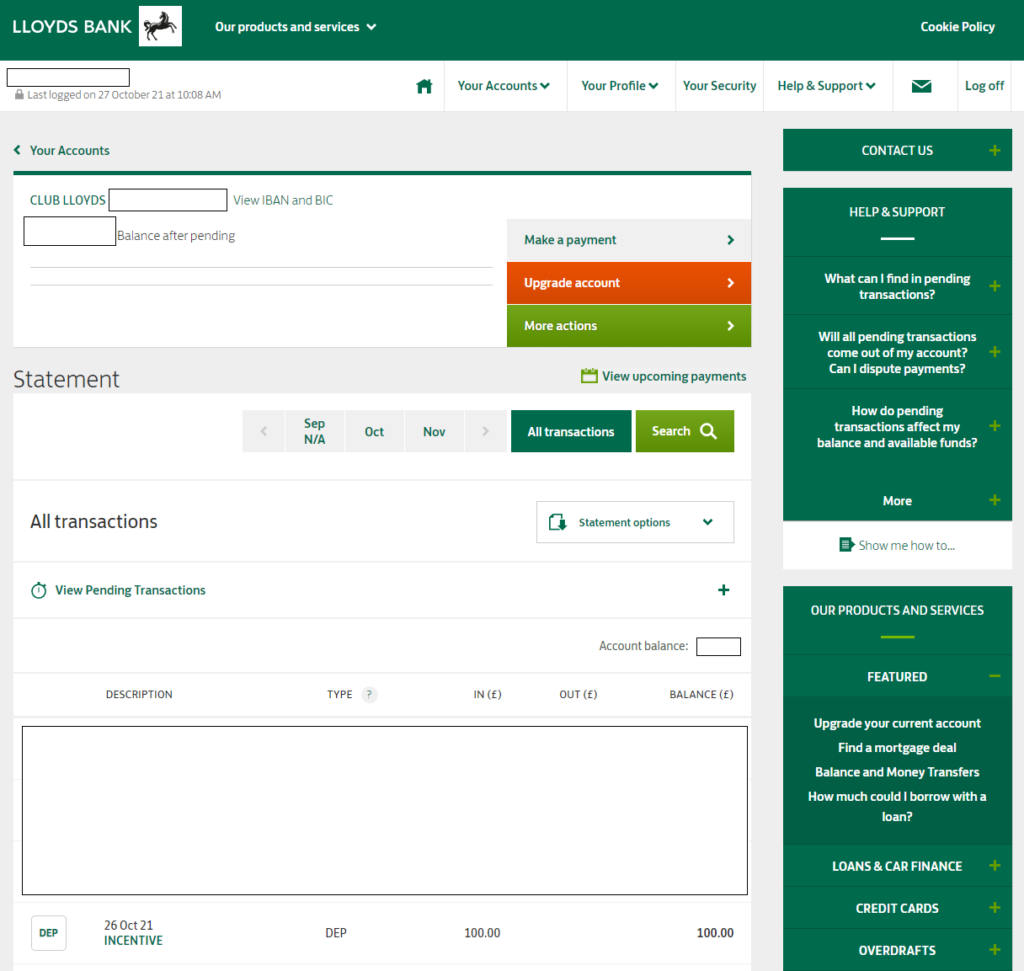

Switch Completed and £100 Bonus Credited

All is left to do is to apply online and carefully follow the steps during the application process making sure that CASS is selected and that my old Co-Op Bank Account details are introduced correctly. As with all online applications: always check at least twice and hit the continue button once.

I was pleasantly surprise as to how simple and quick the whole process was. It literally took me less than 10 minutes to complete. I applied on the 18th of October and the £100 reward was credited just eight days later on the 26th. By that time, I had received written confirmation, Internet login activation code and my debit card by post. By far the most efficient, fast and smooth bank account application (or otherwise) I have ever completed. Fair play to Lloyds.

That makes a grand total of £230 Free Cash from bank account switches and promos. I am proudly sitting £30 over my objective for the year. Mission accomplished. However, this is not the end of it just yet. There are still bank switch rewards available that need to be looked at. I might as well take the opportunity now because one never knows when the next wave of promotions will arrive. Let’s not forget that I had been waiting ten months for my first switch of 2021. An eternity by my standards. I am not sure if I am ready to wait that long for the next one.

Current Account Switch Service

The Current Account Switch Service (CASS) process is automatic and straightforward. All it takes is to request a switch during the application process at the time of opening a new account with the bank of your choice. Most banks are signed up to CASS, meaning that the switching service will work on the background closing the old account and moving money, direct debits, standing orders, payments (ie: salary), etc. to the new bank account. The process is completed in seven working days.

Should the unexpected happen, CASS makes sure that during the first three years after the switch, any moneys paid into the old account or mistakenly coming out of it will be transferred to the new account. Also, if there are charges involved due to an error during the switch process, they will be refunded by the new bank.