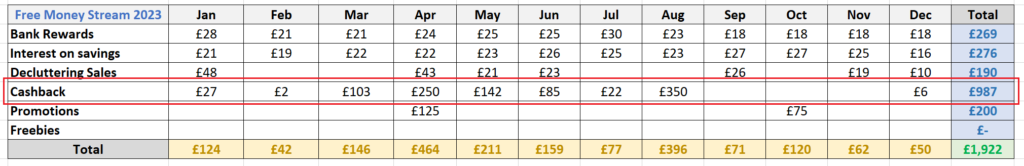

I made £987 from Cashback in 2023

2023 has been the best year for me in terms of Cashback. Ever. I nearly made £1K from cashback rewards paid out as hard cash via TopCashback. One might assume that I have been on a spending spree in order to collect cashback money. Well, quite the opposite. The basic premise in my book is that the cashback must be awarded as a result of purchases that I would have made anyway. Only then qualifies as Free Money, otherwise, is violating the rule and will not make it into the pot.

Top 5 Cashback Earners in 2023

How was I able to do it? I need to revisit my records and previous posts throughout the year to dig out the relevant figures. For my own benefit, it helps to rank earnings from highest to lowest so that I can visually map my Journey.

- £350 Cashback for opening a Stocks & Shares ISA

- £250 Cashback for opening a Junior ISA

- £180 Cashback for opening a Stocks & Shares ISA (2022)

- Fibre Broadband Switch £85 Cashback

- Car Insurance £45 Cashback

If my maths are right, that is £910 with the remainder £77 coming from casual purchases and bonuses. If I compare sources against earnings, a Pareto distribution emerges where 80% of the incoming money allocated to 20% of the pool of contributors. In other words, I made £780 out of £987 (79% of the total) just by opening ISA accounts.

Is not that kind of defeating the purpose? Well, not really in my view if I consider the following:

- My Investment Strategy dictates that I should invest 30% of my Free Money Earnings in a Stocks & Shares ISA. I have £2,500 in the S&S Pot as of December 2023. Why should I remain loyal to one S&S ISA provider when I can take advantage of juicy cashback offers year on year by moving these funds around? It would not be savvy not to do so.

- My kids received a lump sum from her Grandma each. The logical and sensible thing to do with it was to open a Junior ISA and transfer moneys into it from their defunct Child Trust Fund. I would have done it anyway. Thing is, I happen to make the most of it by collecting a succulent cashback reward.

Always check for Cashback Rewards before committing to any purchase

As for the rest, it will always be my intention to shop around for insurance and a better deal when contracts are due, so why not squeeze the lemon by saving a nice chunk and collecting cashback in the process? It just makes sense to me.

As a rule of thumb, whenever a purchase is required in the household, I always check for cashback before placing an order. More often than not, chances are that my merchant of choice will be offering a reward. However little it might seem, they all add up and build up into a relevant enough sum at the end of the year.

After all this logical reasoning, I feel more at ease with myself. No that I am looking for redemption in any shape or form, but it helps me to reinforce my point. 987 reasons are good enough.

2023 Cashback Calendar

As a wrap up, I have captured visual evidence of cashback earnings by month. For further elaboration, please feel free to visit income reports. Enjoy.

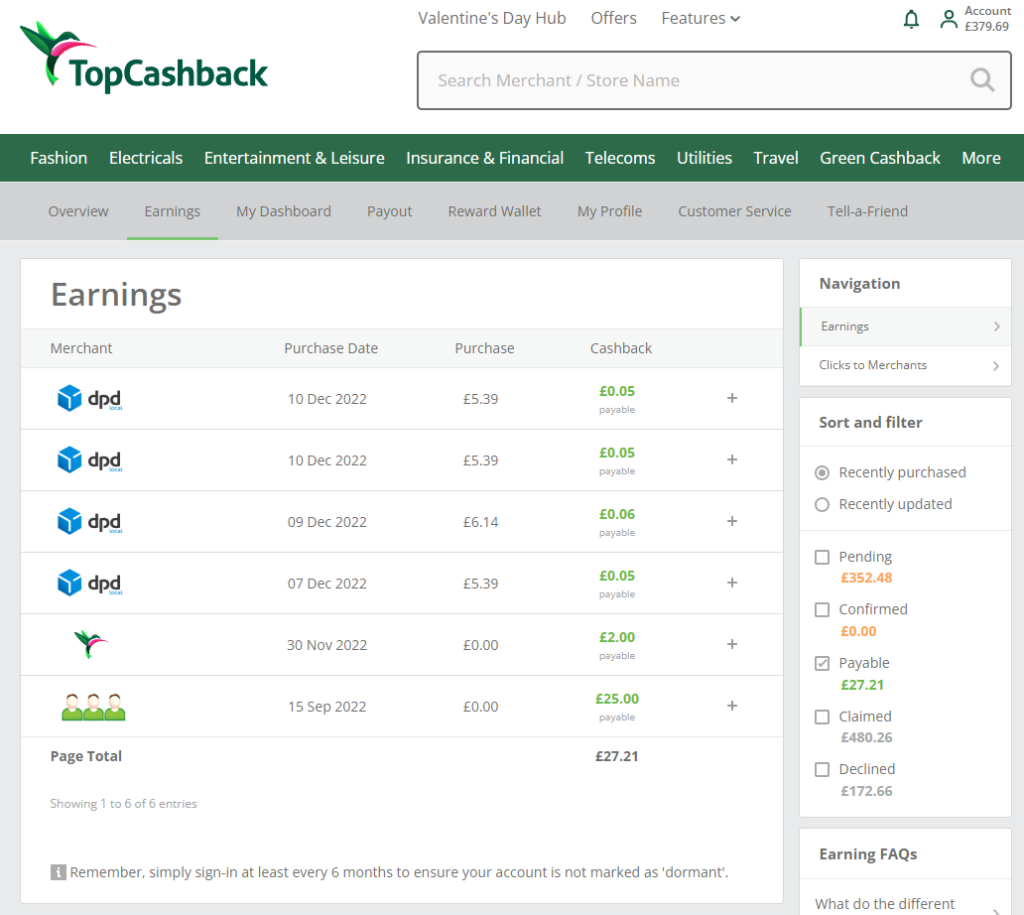

January

- Cashback bonus: £2

- Referral bonus: £25

February

- Cashback bonus: £2

March

- Stocks & Shares ISA: £100

- Courier services: £3

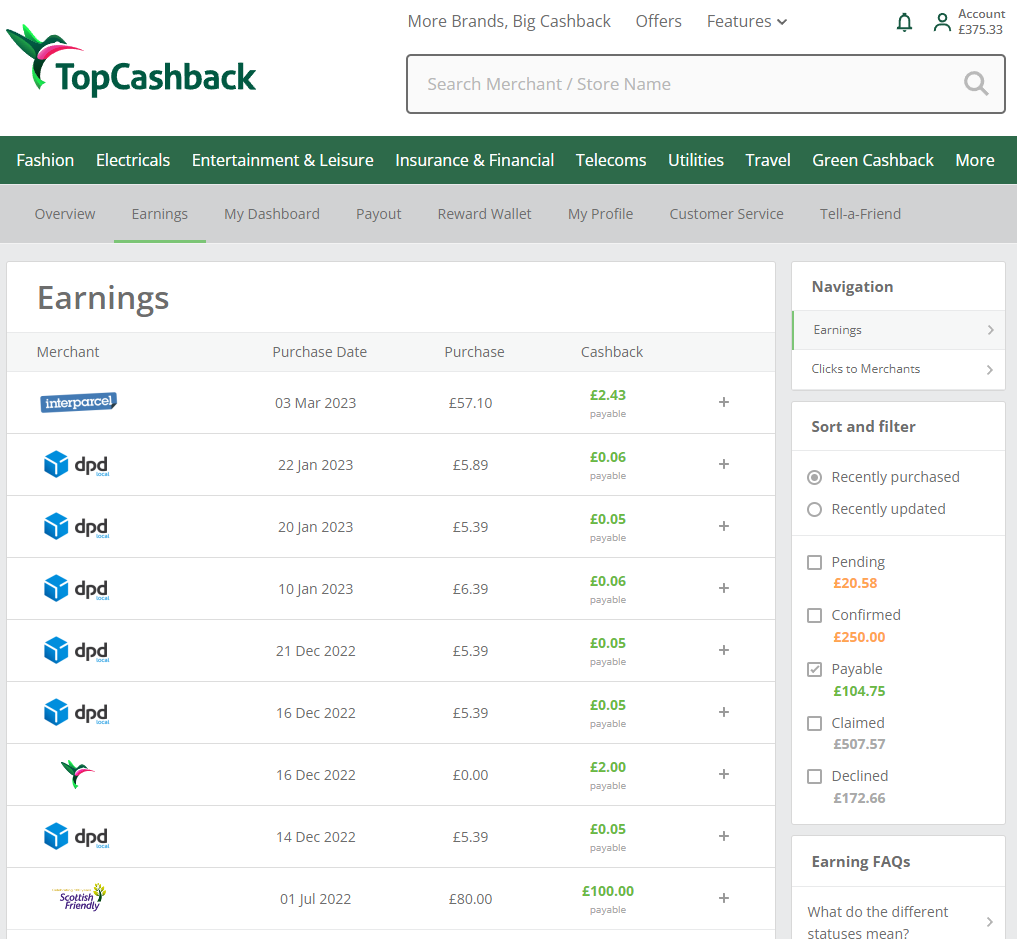

April

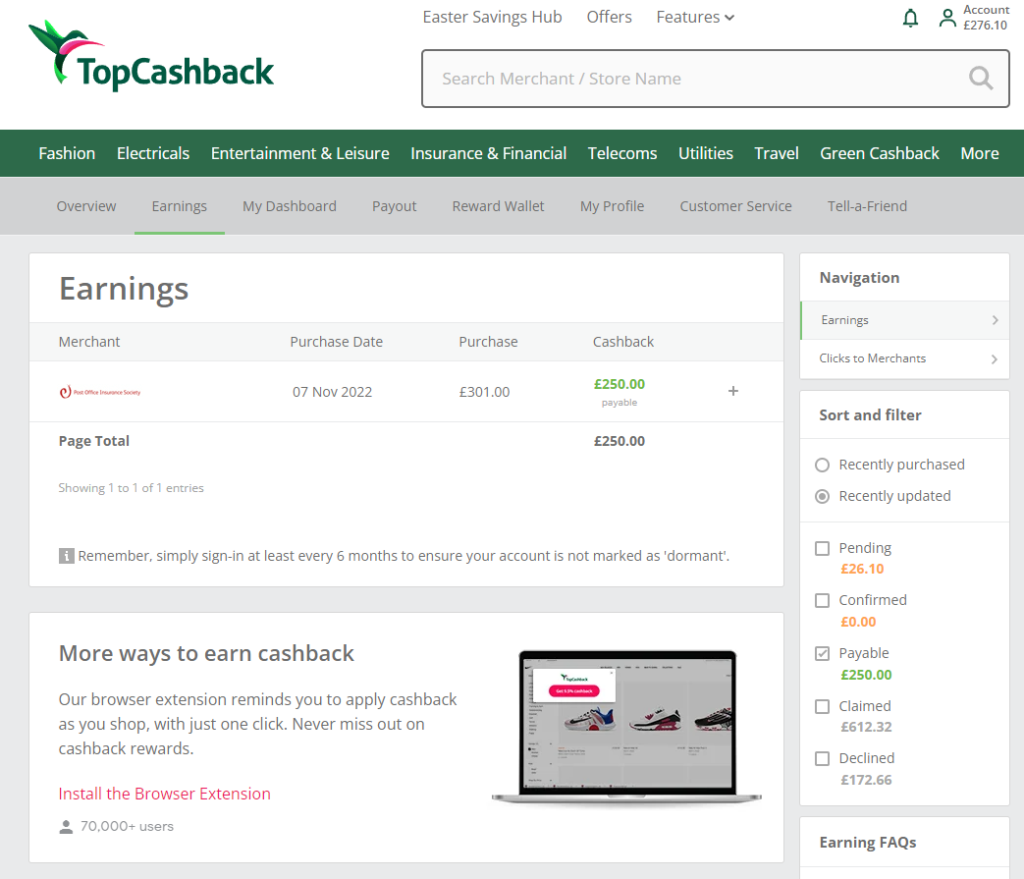

- Junior ISA: £250

May

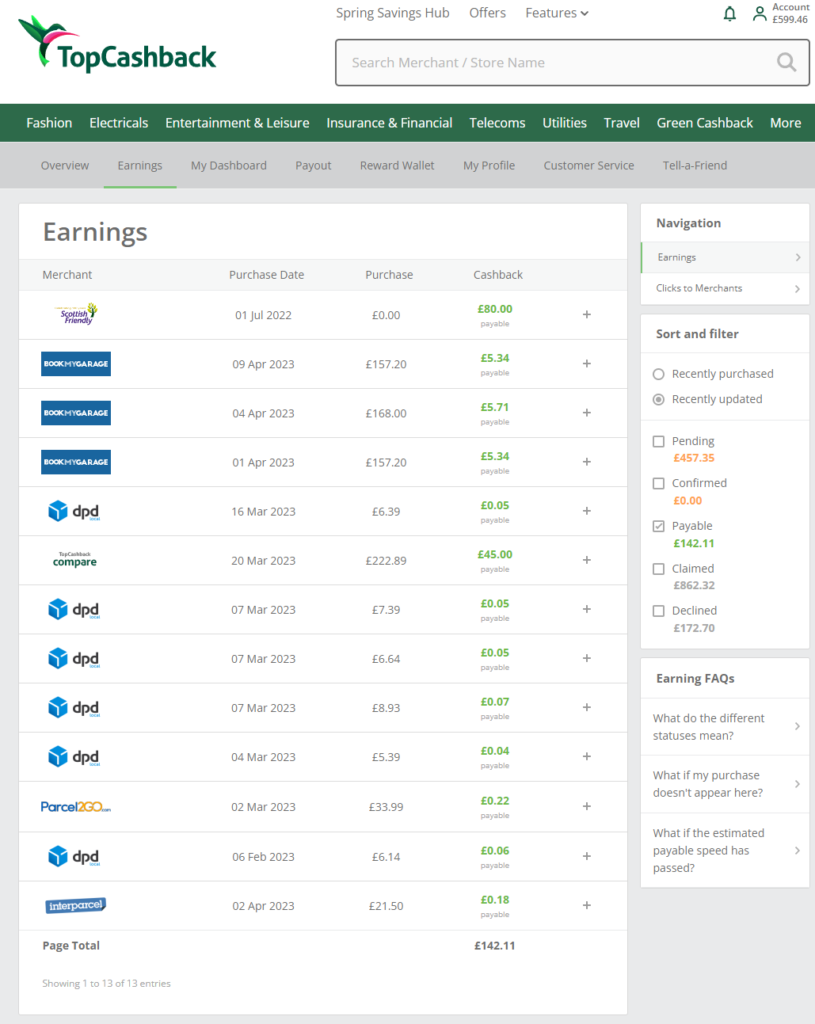

- Car Insurance: £45

- S&S ISA claim: £80

- Car servicing: £5

- Courier Services: £1

- Others: £10

June

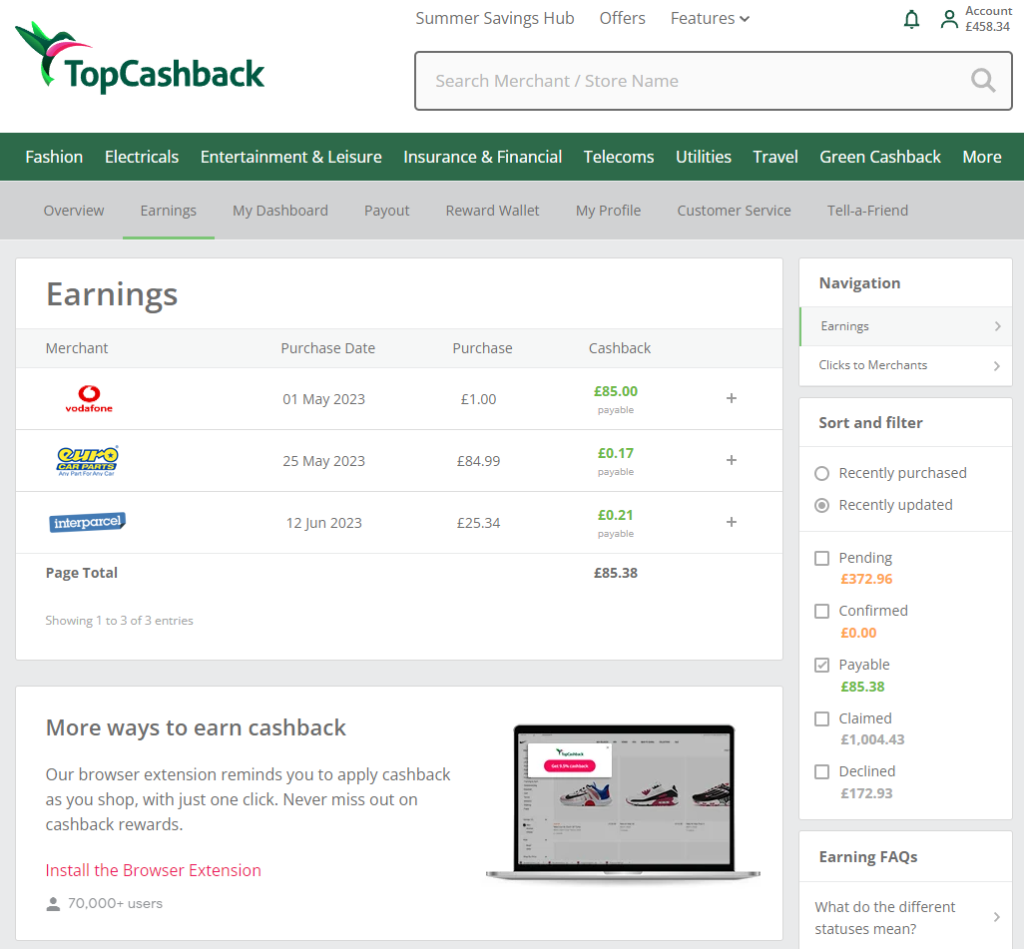

- Broadband switch: £85

July

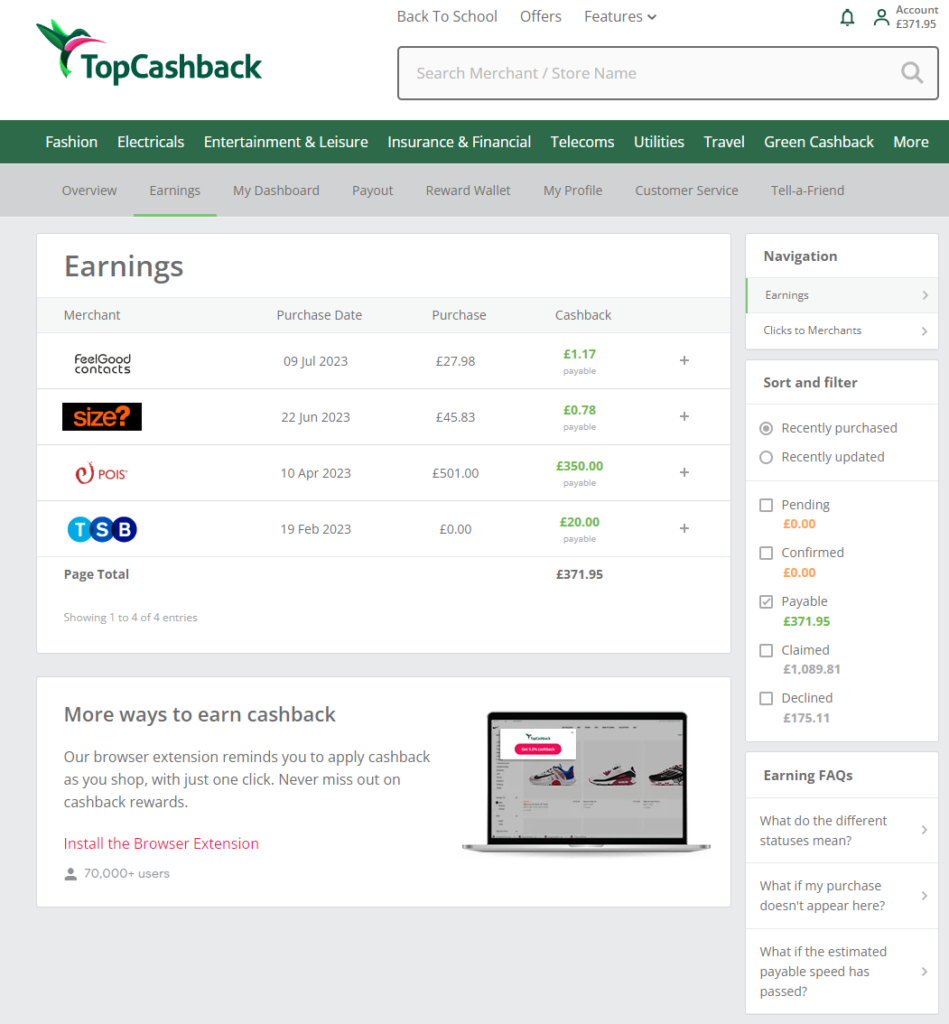

- TSB Bank Account: £20

- Casual purchases: £2

August

- Stocks & Shares ISA: £350

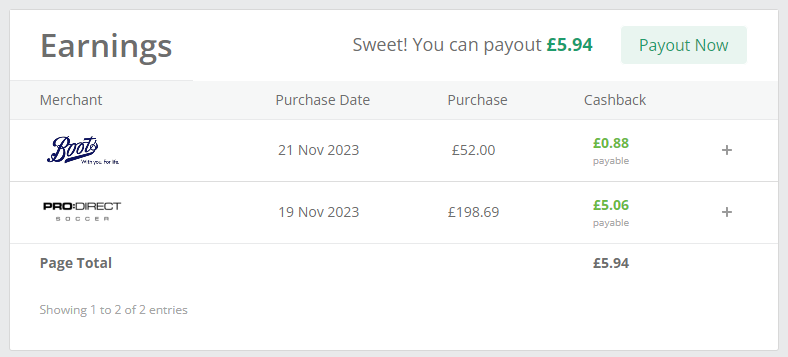

December

- Casual purchases: £6