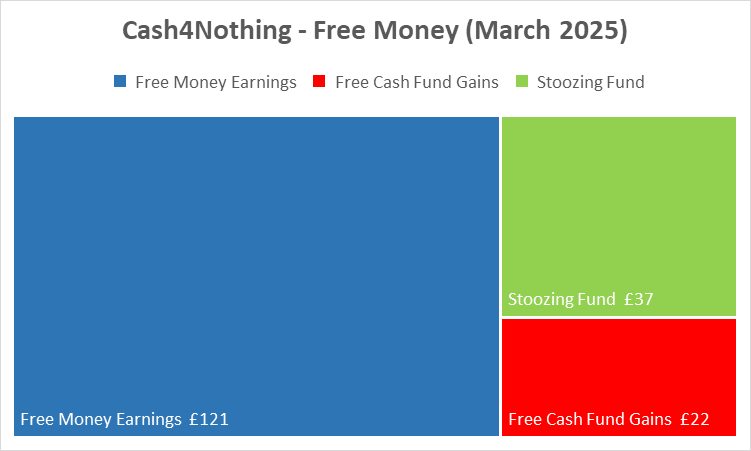

March 2025 Free Money Earnings Report £136

Free Money Earnings: £121

Free Cash Fund Gains: £-22

Stoozing Fund Profits: £37

March 2025 Free Money Earnings

Bank Rewards: £21

- Santander Lite Bank Account: £5

- Halifax 1 Reward Account: £5

- Halifax 2 Reward Account: £5

- RBS My Rewards: £3

- Natwest My Rewards: £3

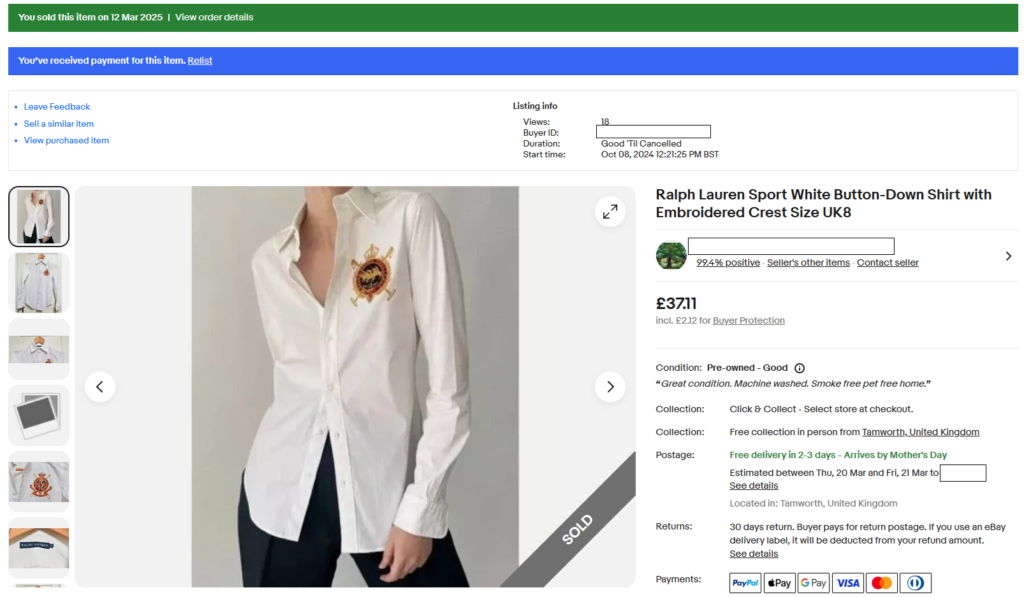

Decluttering Sales: £32

- Womens Shirt: £32

Interest on Savings: £8

- Personal savings accounts: £8

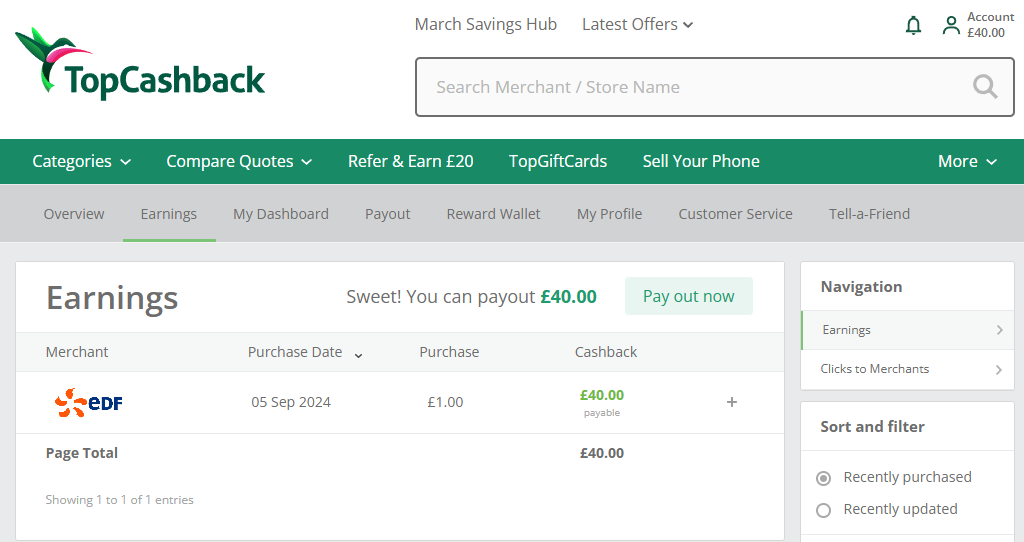

Cashback: £60

- AMEX credit card Cashback: £20

- TopCashback Energy Switch: £40

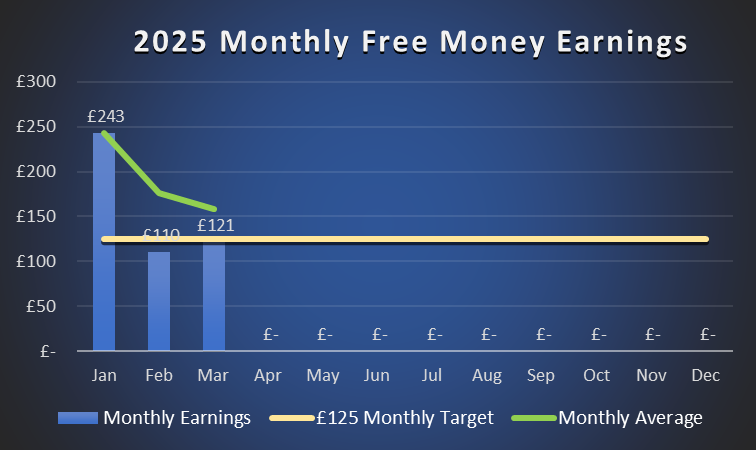

| Month | Free Money Earnings | +/- Monthly Target (£125) | Accumulative | to Year End Objective (£1,500) |

| January | £243 | +£118 | £243 | £1,257 |

| February | £110 | -£15 | £353 | £1,147 |

| March | £121 | -£4 | £474 | £1,026 |

£121 Free Money in March 2024. Only £4 down from £125 monthly target. The Free Cash Fund took a step back of -£22 mainly due to bad loans from my CrowdProperty IFISA account. By contrast, the Stoozing Fund delivered a steady profit of £37 in alignment with expectations. Combined together £136 on the positive which is not bad at all for doing absolutely nothing.

Bank Rewards. £21 from my nominated accounts. Slight increase but no significant changes for better or worse. £65 over the first three months of 2025 or £135 from £200 annual objective. On track.

Interest on Savings. I am saving towards growing the Stoozing Fund via a third credit card balance transfer. You see, with stoozing the easy part is the spending bit to attract a debt but the challenge remains in matching expenditure with savings. Without showing my hand yet, I will need £5,000 by November 2025 and I am not far off. Until then, I keep all these moneys in savings accounts. This month I collected £8 from interest payments. Not a great sum but every little helps to get to £100 for 2025. £33 since January leaves me £67 away from the finish line.

Cashback. I switched Energy suppliers back in September 2024. Idea being saving on my energy bill as well as collecting some cashback from the switch. The £40 cashback reward eventually matured in March 2025 and I wasted no time in cashing in by withdrawing earnings from my TopCashback account. More of this on a future post. I also got £20 cashback from using my AMEX credit card to pay for all my personal expenses during the month.

Decluttering. Just a single sale but for a good price. A top brand womens shirt fetched a decent price on eBay and left a £32 profit behind. I am sitting on £216 against a target of £500 for 2025. With nine months to go, I should have sufficient slack to manoeuvre (see £500 Decluttering Challenge for 2025).

Just a quick note on the Free Cash Fund for the record. My CrowdProperty IFISA account threw a loss of £38. I also feel that I got lucky to get away with only a £4 decrease in my Stocks & Shares ISA Pots as a result of the recent turmoil experienced in the stock markets. On the bright side, my Cash ISA increased in value by £19. That is a -£22 overall. I am not the one to bad mouth but I am really not happy with the CrowdProperty IFISA performance. They lost me £109 in December 2024 and now another £38. My honest advise, please do not touch with a bargepole. This lot are absolutely clueless. But please do not take my word for it and feel free to do your own research (ie: Trustpilot). I have been trying to withdraw my money for a year and it seems to be trapped in bad loans. An absolute disgrace. I have £762 with them as of April 2025 and I am not holding any expectations of rescuing this money any time soon (if at all). Even after all these hurdles, the Free Cash Fund is £40 on the green in the first three months of the year. I will leave on positive but delivering £1,000 in Capital Gains in 2025 seems like an uphill battle by now. Let’s keep going at it.