How to make Free Money from Credit Cards – Stoozing 2.0

Use our Stoozing Profits Calculator to assess 0% interest credit card offers

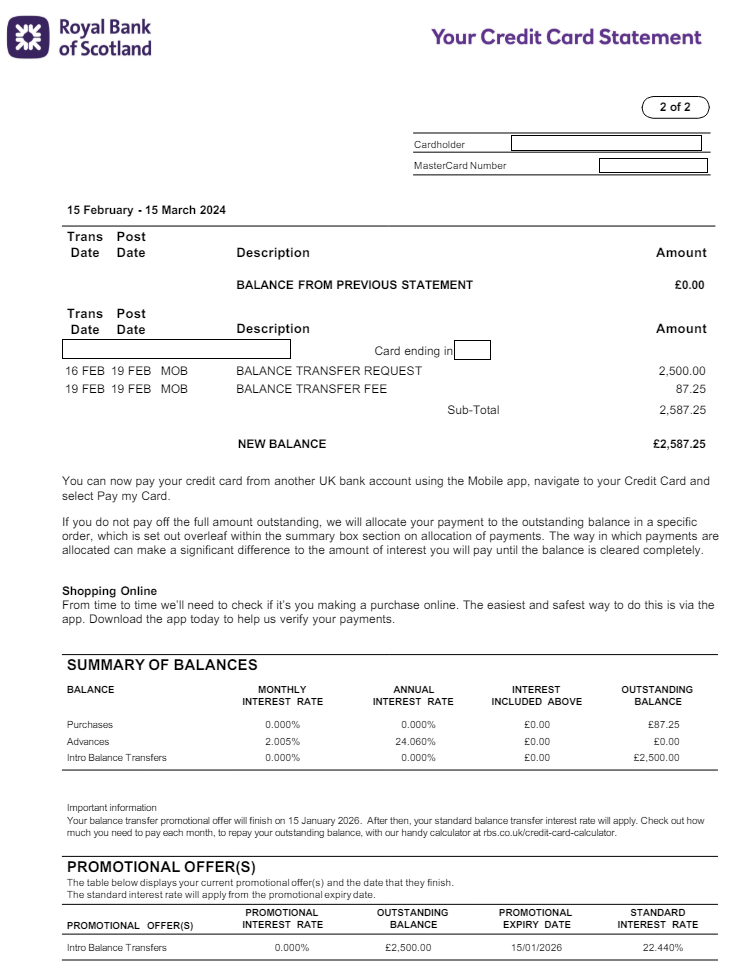

RBS Credit Card

Balance Transfer: £2,500

3.49% Balance Transfer Fee ; 1% Monthly Repayment

0% Interest Payments for 23 Months (March 2024 to February 2026)

Not sure of the exact date but it was some time in January when out of the blue, I received a letter on the post from RBS Bank offering me credit. That is a credit card balance transfer offer to shift my ‘debt’. I would normally shred the letter without giving it much consideration, but I stopped for a minute to read the conditions of the offer just in case. I am going to summarize them in bullet points for clarity purposes as I find it easier to visualize that way.

- Credit Limit: £2,700

- Balance Transfer Fee: 3.49%

- 0% interest payments for 23 months

- Monthly repayments: 1% of outstanding balance (minimum £25)

Ok. So how is this offer relevant in the context of making Free Money, or better posed, is it possible to make Free Money out of this offer?

How much Free Money can I make off a Balance Transfer Promotional Offer?

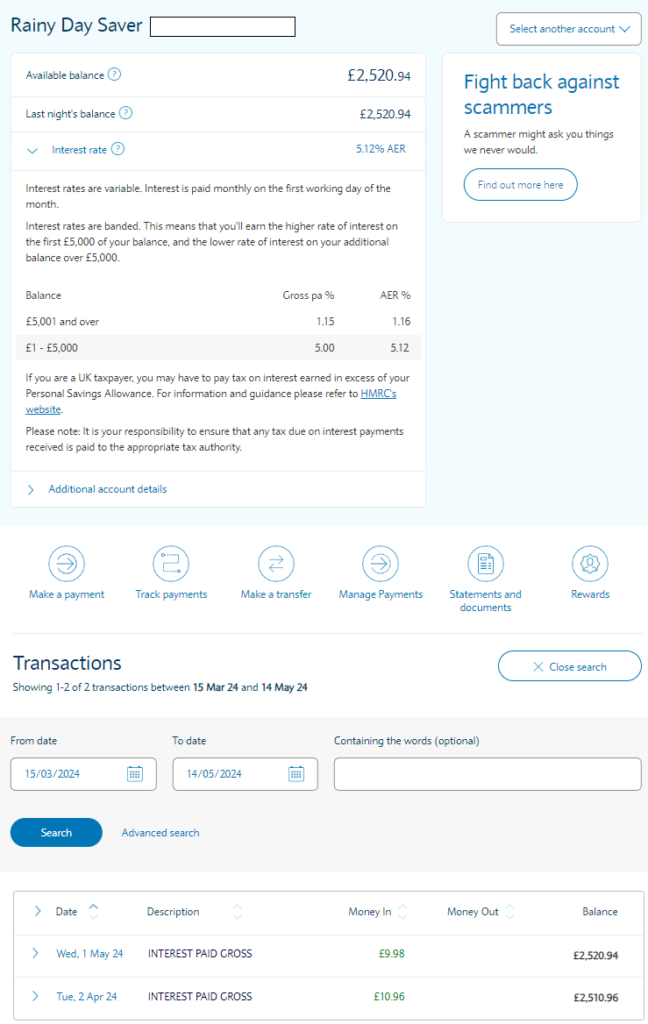

I need to run some numbers before I can comfortably answer that question, but first things first: if I had £2,500 (I am restricted to transfer 95% of the card credit limit) cash available to invest in a risk free vehicle for 23 months, what would I do with them? I would most definitely park this money in a high interest savings account such as my Barclays Rainy Day Savings Account with a guaranteed return of 5.12% per year.

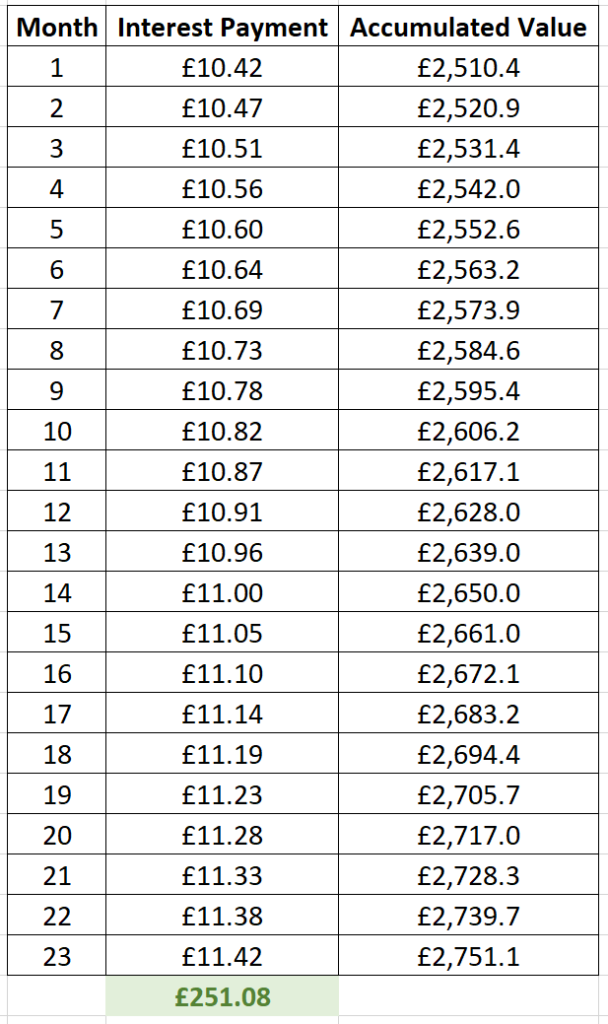

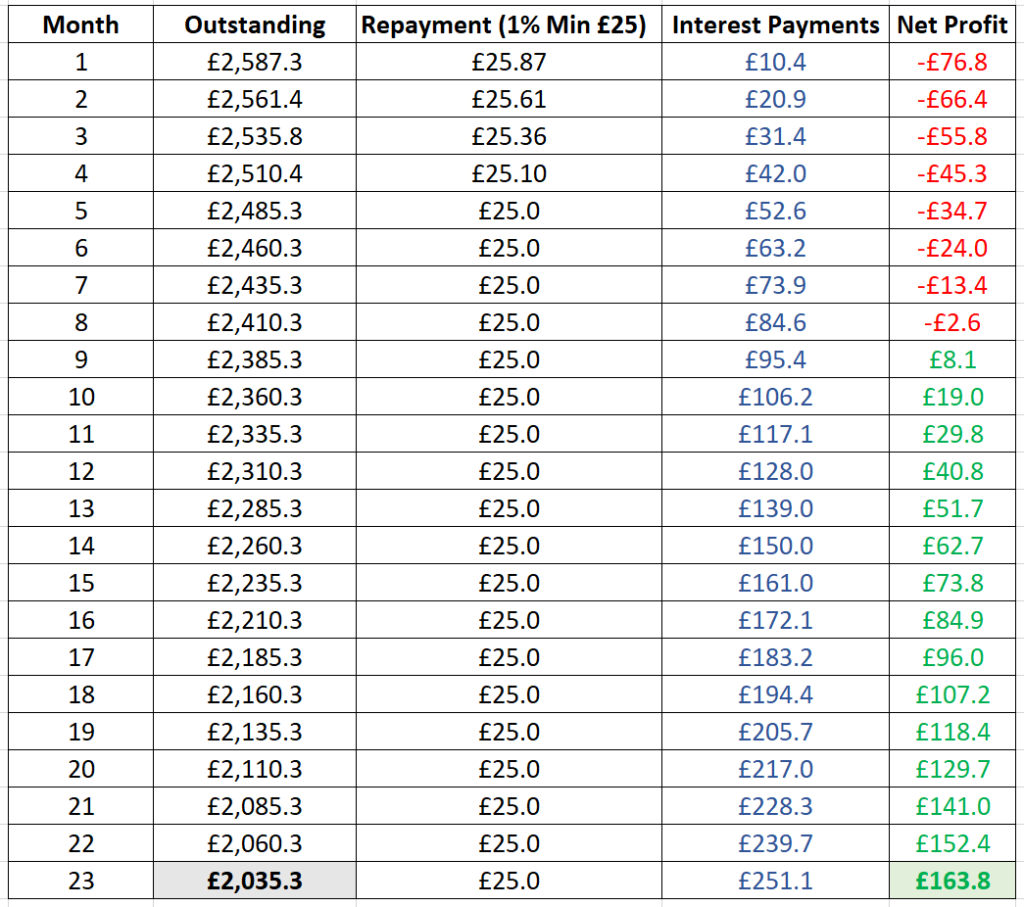

Is it possible to quantify how much money can be made over 23 months? Sure it is. Let’s make use of a spreadsheet to work out accrued interest payments on a month by month basis.

- Annual interest: 5.12% –> Monthly Compound Interest: 0.417%

- Investment: £2,500

The projection shows that depositing £2,500 in a savings account at an annual 5.12% interest rate will yield £251.1 in profit after 23 months.

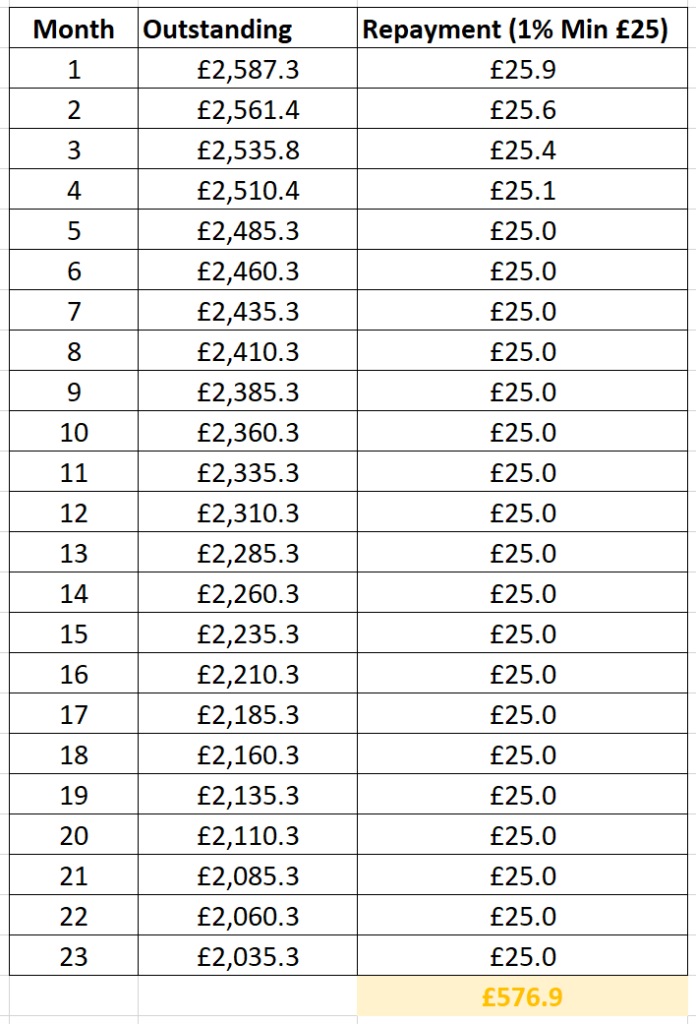

Credit Card Repayment Plan

So far so good but the next question is, how much of my acquired debt do I need to pay back on a monthly basis?

- Loan amount: £2,500 ; Balance Transfer Fee: £87.25 (3.49%) –> Total Debt: £2,587.25

- Monthly payment: 1% of the outstanding balance with a minimum of £25.

Under the terms and conditions of the offer, I am going to need a total of £576.9 to service the debt repayments for the whole duration of the promotional period (23 months) and the outstanding amount at the end of the offer will be £2,035.

Net Profit and Return on Investment

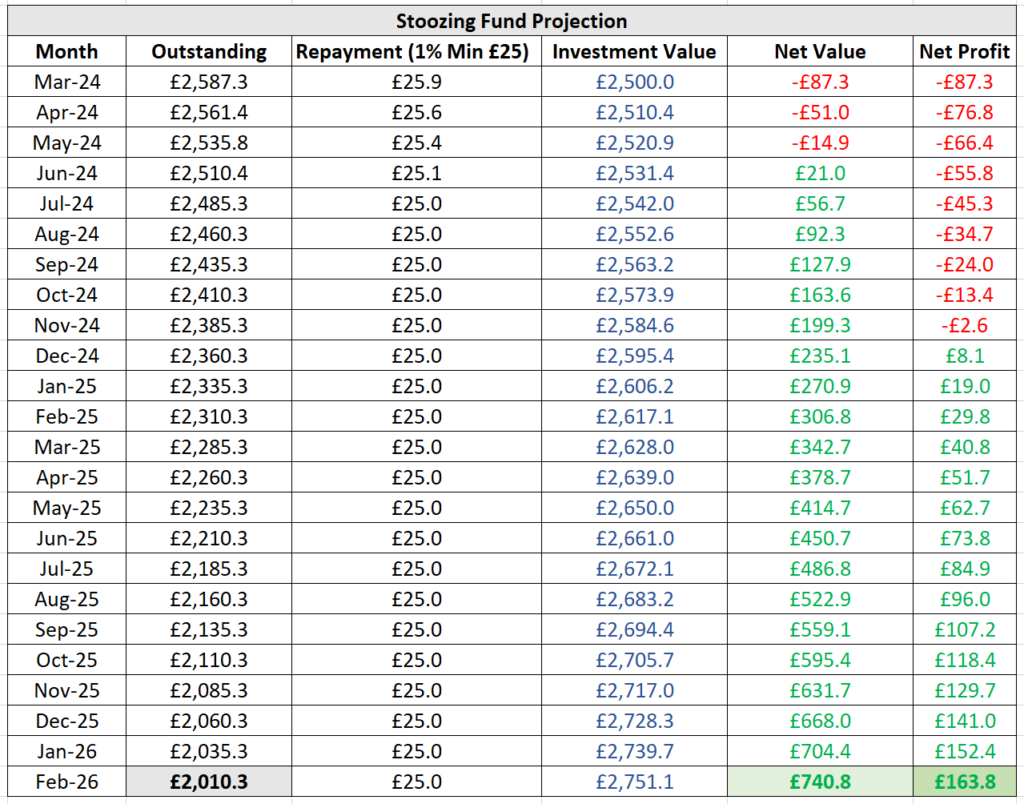

By merging the two previous spreadsheets into one, I can devise a timeline of projected cash flows and profits as a basic tool to assist me in capturing investment positions accurately.

I now have all the figures I need to calculate main indicators of this Financial Exercise:

- Gross profit: £251.1 ;

- Net Profit: £251.1 – £87.3 = £163.8

- Return on Investment (ROI) = Net Profit / Own Funds = £163.8 / £576.9 = 28.4%

- I will need to wait for 9 months to break even.

Stoozing is the way forward. Plan Formulation.

It should be plainly obvious at this stage that it will be extremely unwise for me to not pursue this Free Money Making Venture. Having made my decision, I now need to articulate a Plan. So, where are we so far in terms of resources?

- Credit Card Balance Transfer offer which I can take advantage off. Yes (RBS).

- Risk Free Investment Vehicle. Yes (Barclays Rainy Day Savings Account).

- Cash Reserves Pot Flows to cover monthly debt repayments. ???

- Available cash to deposit into Savings Account. ???

Cash Reserves Pot Flows.

At the time of committing to the offer (February 2024), the Cash Reserves Pot is valued at £270 which means that I am going to need £307 more (£576.9-£270) to fully cover repayment needs. Is this sum feasible as solely coming from Free Money Earnings Cash Reserves allocations? The short answer is yes and the reason is quite simple if we consider the fact that the estimated Free Money Earnings over a 23 month period will be over £3,000 based on my historic performance so far. Since 10% of Earnings are automatically classed as Cash Reserves (ie: £300), I know that I am not going to struggle to meet debt payment requirements. In addition, I will replenish the Cash Reserves Pot with the same amount used £577 (£740.8-£163.8) when the promotion comes to an end (see table below).

Cash Lump Sump Savings Deployment.

This particular offer is for a Credit Card Balance Transfer and not for a Money Transfer. Where is the cash going to come from in order for it to be made available for depositing in the Savings Account? The answer is from my spending money. As an individual, I do make use of two resources: 1) a credit card only for personal expenditure ; 2) a set amount of money for personal spending. On this basis, the process will be as straightforward as to transferring the promotional £2,500 balance into my spending credit card and then to move my spending money into the savings account. Job done.

A New Free Money Stream is born: The Stoozing Fund.

I need to measure the impact of Stoozing as a Free Money Stream into the Free Money Fund. In order for me to introduce this new line item, I need to measure its performance over time. How? Just by using the following formula:

Stoozing Fund Value = Investment Value – Liabilities

For instance, the Stoozing Fund value at the time of writing these lines (May 2024) is -£14.9 as liabilities are greater than value of investments. By contrast, I will be in positive territory from June 2024 onwards and this little Stoozing Project will turn profitable from December 2024 until it reaches its natural end in February 2026.

As for the Cash Reserves Pot Flows, I will rescue the monthly flow tracker to give a true representation of its value in the Free Money Fund.

Cash Reserves Pot Flows

| Month | Previous | Monthly Earnings | Repayments | Pot Value |

| April 2024 | £270 | +£30 | -£25.9 | £274.1 |

| May 2024 | £274.1 | +£20 | -£25.6 | £268.5 |

That’s it. I am all set. This is now a matter of invest and forget in full alignment with effortless Free Money making tradition. I hope you have enjoyed reading this post as much as I have writing it. Until the next one… Tada.