March 2024 Free Money Earnings Report £185

Bank Rewards: £16

- Santander Lite Bank Account: £2

- Halifax Reward Account: £5

- Barclays Blue Rewards: £3

- RBS My Rewards: £3

- Natwest My Rewards: £3

Interest on Savings: £12

- Barclays Rainy Day Savings Account: £8

- RBS Regular Saver: £2

- Natwest Regular Saver: £2

Decluttering Sales: £84

- 2x Mini Table Spotlight Lamps: £9

- Marshall Electric Guitar Amplifier: £64

- XBOX One Controller – SPARES: £11

Cashback: £73

- Moneybox Cash ISA account opening: £25

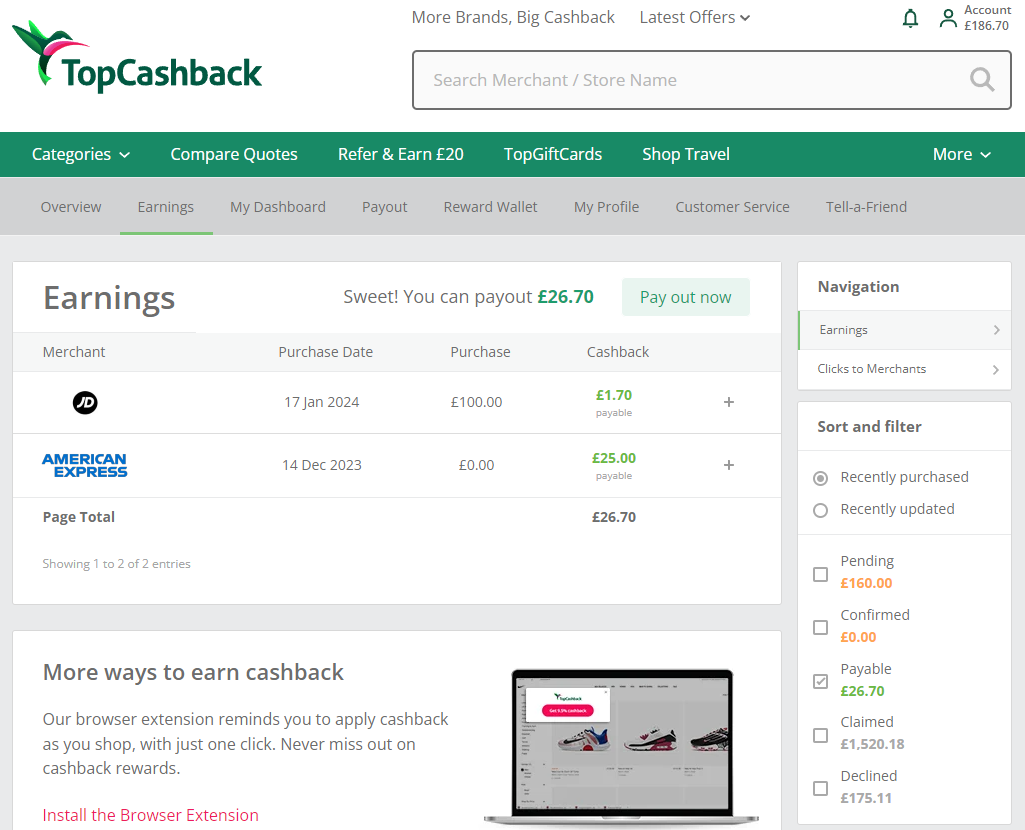

- AMEX Credit Card application via TopCashback: £25

- Casual purchases: £2

- AMEX Credit Card Cashback: £21

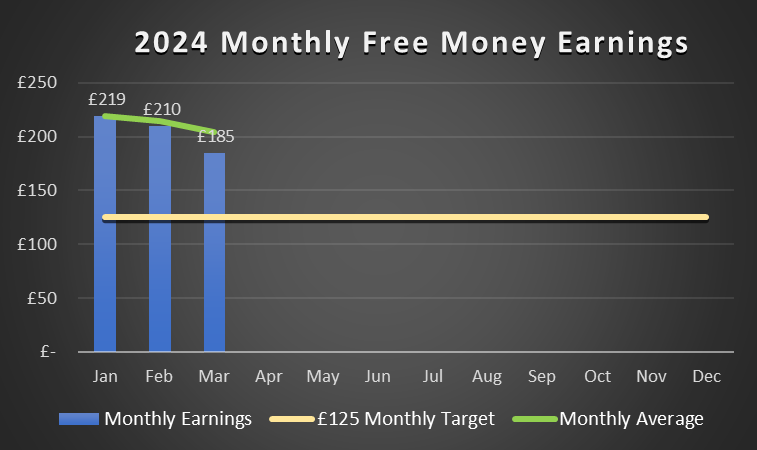

| Month | Free Money Earnings | +/- Monthly Target (£125) | Accumulative | to Year End Objective (£1,500) |

| January | £219 | +£94 | £219 | £1,281 |

| February | £210 | +£85 | £429 | £1,071 |

| March | £185 | +£60 | £614 | £886 |

£185 Free Money in March 2024 points to a downward trend in earnings but it is still £60 over monthly target nevertheless.£614 in the first three months of the year produces an average of £205 which, let’s not forget, comes out of nothing. I am not including Free Cash Fund gains which tally up to £90. To be discussed separately.

Bank rewards. March is a carbon copy of February. These two months should be the apex from which earnings will change direction into even more positive territory. A £16 addition into the pot is still ok for me.

Interest on Savings. From £8 in February to £12 in March does not seem like a lot but it is 50% gain. It will be a challenge to get to £150 by the end of the year. I just need to stick to my savings plan and keep chipping away at it. £35 so far.

Decluttering Sales. Sales are finally materialising. Three more items of clutter delivered a combined profit of £84. It is £275 in this first quarter so I need £225 more to deliver my £500 annual objective. I am vey much on track but as we know by now, flogging clutter is far from being an exact science. A good sign is that I have a backlog of personal items to tackle sooner rather than later. I will not be falling behind on the task.

Cashback. I am having a blast collecting cashback. £73 alone this month is taking earnings to £259 meaning that I am just £91 away from the £350 annual objective. Four line items are contributing to my earnings: £25 from switching my Cash ISA from Barclays to Moneybox, £25 from applying for an American Express credit card via TopCashback, £21 from personal spending using that very same American Express card, and £2 from casual purchases. Effortless flow of Free Money.

£614 is 40% of £1,500 in just three months. In addition, the Free Cash Fund value is £8,242 at this moment in time. How much longer before I need 5 figures to measure it? If I am able to keep this Cruise Speed, I will be over £10,000 very close to the end of 2024. Why not? It is perfectly possible one step at a time. I am definitely aiming for it. Stay with me.