£250 Cashback for opening a Junior ISA

As it happens, my two kids got a lump sum from her Grandmother of a thousand pounds £1,000 each. The intended use of that money is for saving rather than spending so that they get to enjoy it when they turn eighteen. I have made contributions into their Child Trust Fund since birth, but that investment vehicle is now long defunct and new products have taken its place such as Junior ISAs. Grandma handed over the money to me in view to making the most out of it for her grandkids so my job is to find a suitable account for it to be kept. On the other hand, I also see it as an opportunity to make Free Money collecting a Cashback Reward from opening an ISA account. I mean, every little I own will be inherited by them anyway so I might as well do my best to build up the Free Cash Fund whilst I can. In this sense, what I need to do first, is to get an understanding into the current Cashback Offers (let me point out that I completed this exercise back in November 2022).

Junior ISA Cashback Offers

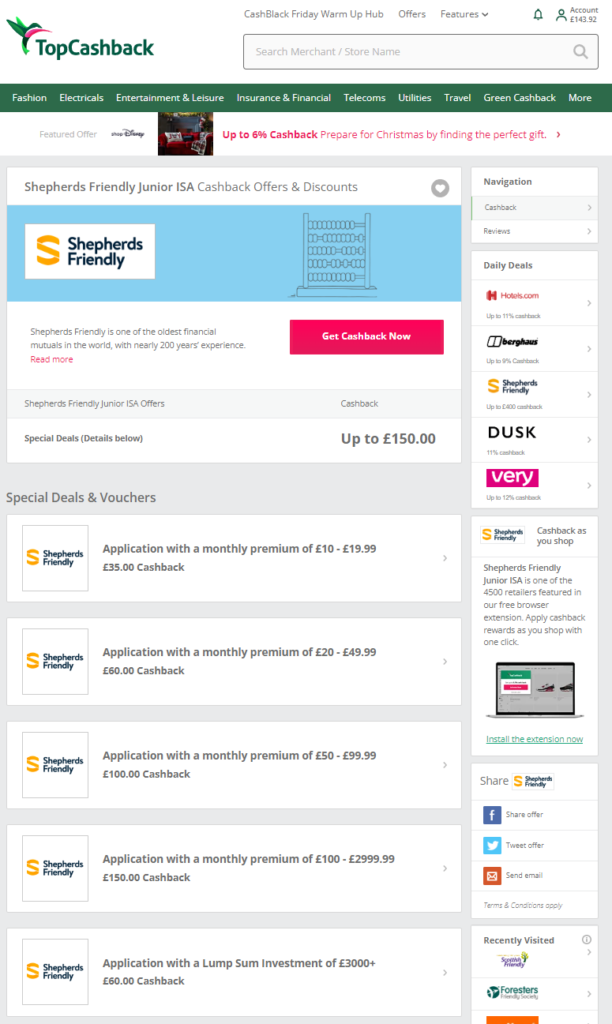

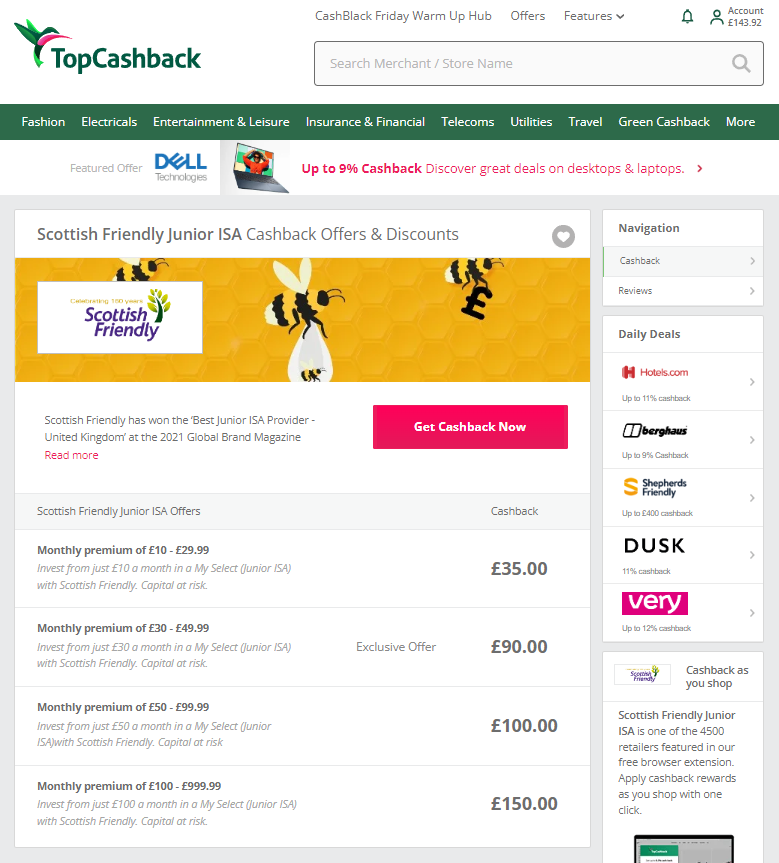

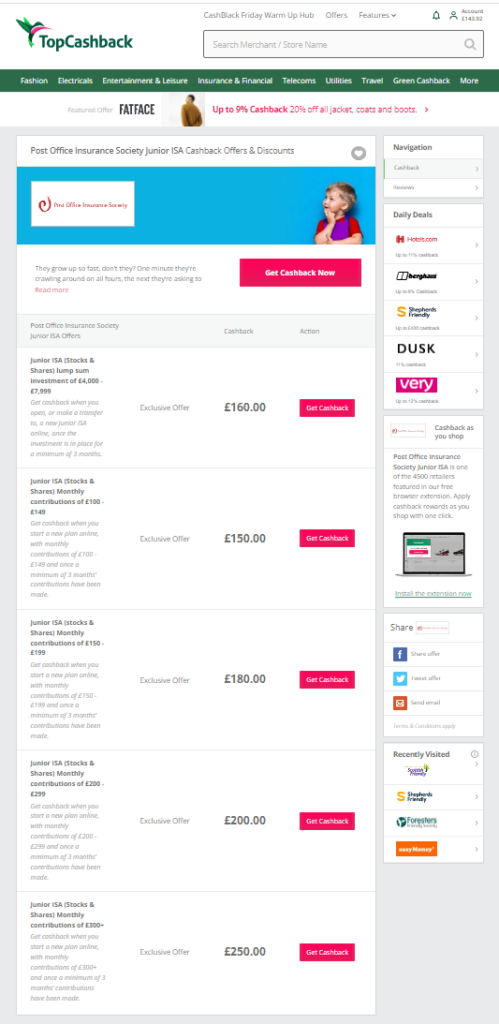

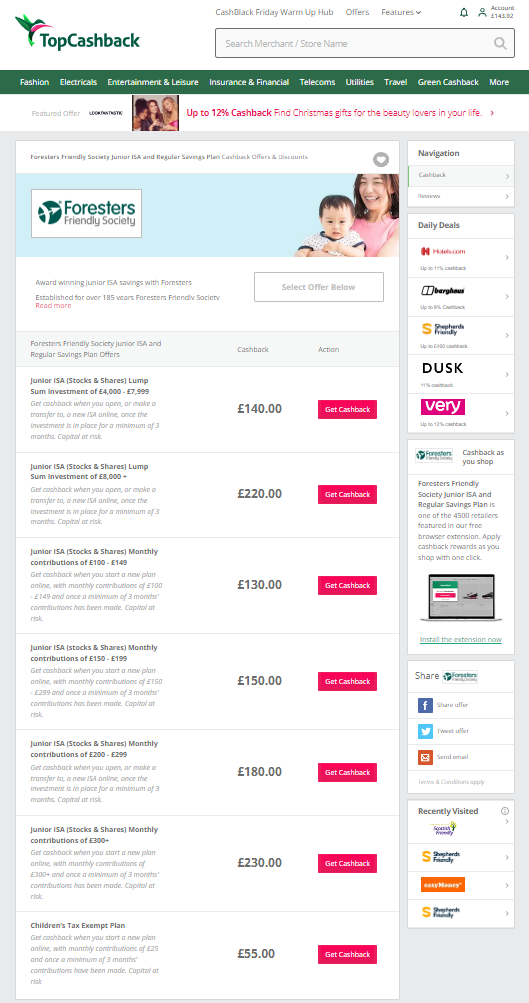

After running a search in TopCashback, I found four suppliers offering cashback in exchange of opening a Junior ISA account. As a rule of thumb, the rewards are estructured on a monthly premium scale meaning that the higher the monthly contribution into the ISA, the higher the Cashback up for grabs. My task is to target the maximum cashback reward based on my £1,000 budget. Every supplier works differently, so I need to take a closer look at each as I go through the list.

I can potentially get £150 from Shephers Friendly by contributing with £100 for ten months assuming cashback will mature during this time span.

Same situation with Scottish Friendly where £150 would land in my pocket should I invest £100 a month for ten months.

Much more interesting scenario here with the Post Office Insurance Society. If I contribute with £300 for a minimum of three months, I will be £250 better off. Really attractive offer and very much doable.

Meeting the same requirements as before (£300 for a minimum of three months), Forester Friendly Society comes £20 short of the Post Office Insurance Society with a £230 cashback offer.

Decision Time

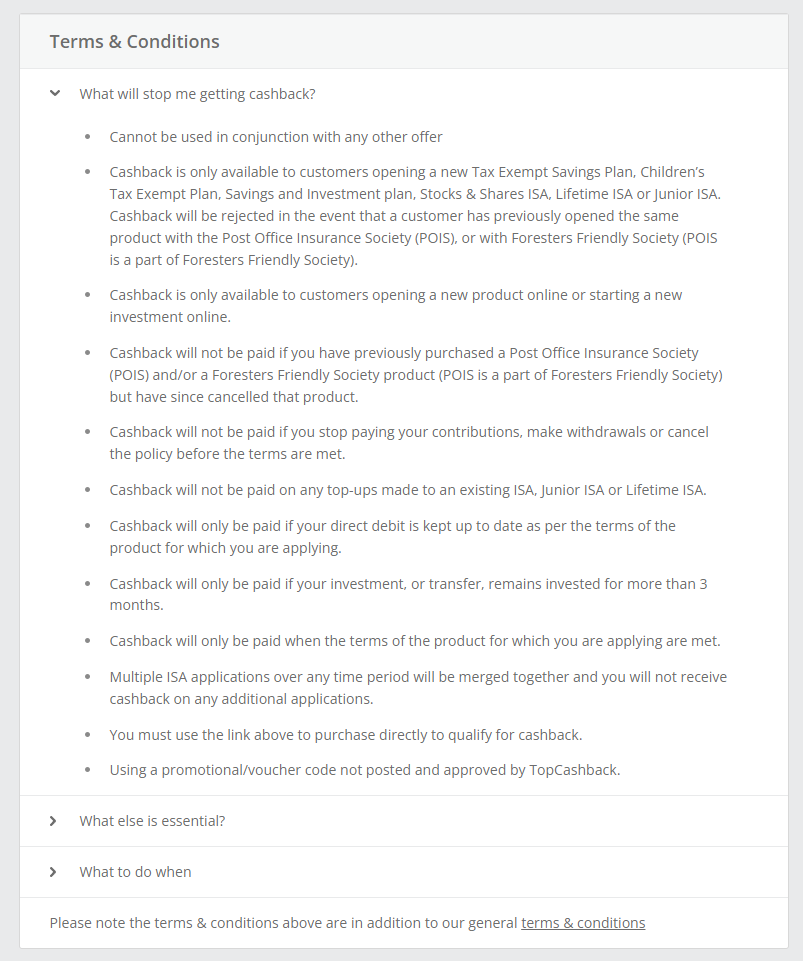

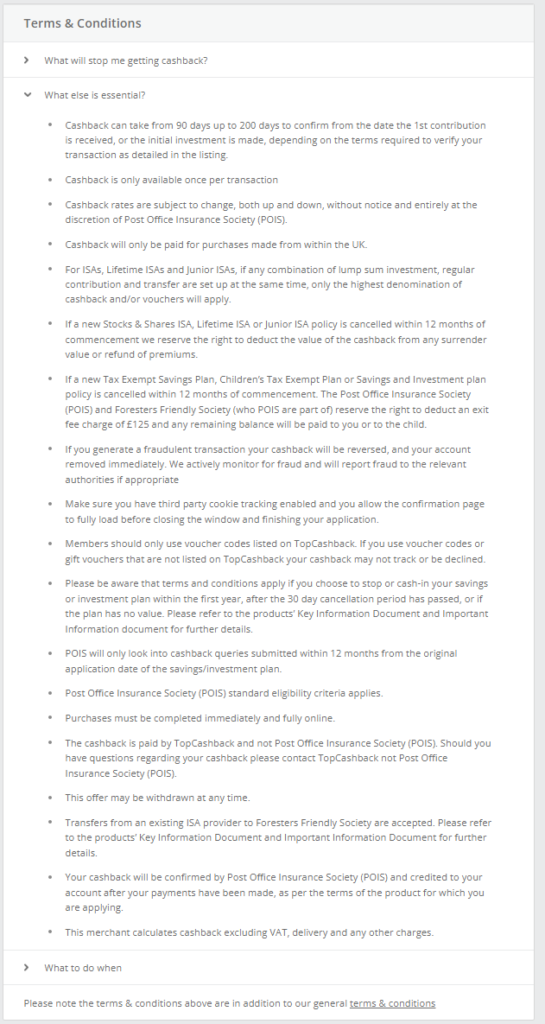

A no brainer really. I like following these basic steps as the decision is usually made for me at the end of it. It would be silly not to use Grandma’s Grand to open a Junior ISA account with the Post Office Insurance Society and collect a whopping £250 cashback in the process. Too good to be true? Having carefully read the T&Cs of the offer, I find no issue in going ahead with it since I qualify and tick every single box.

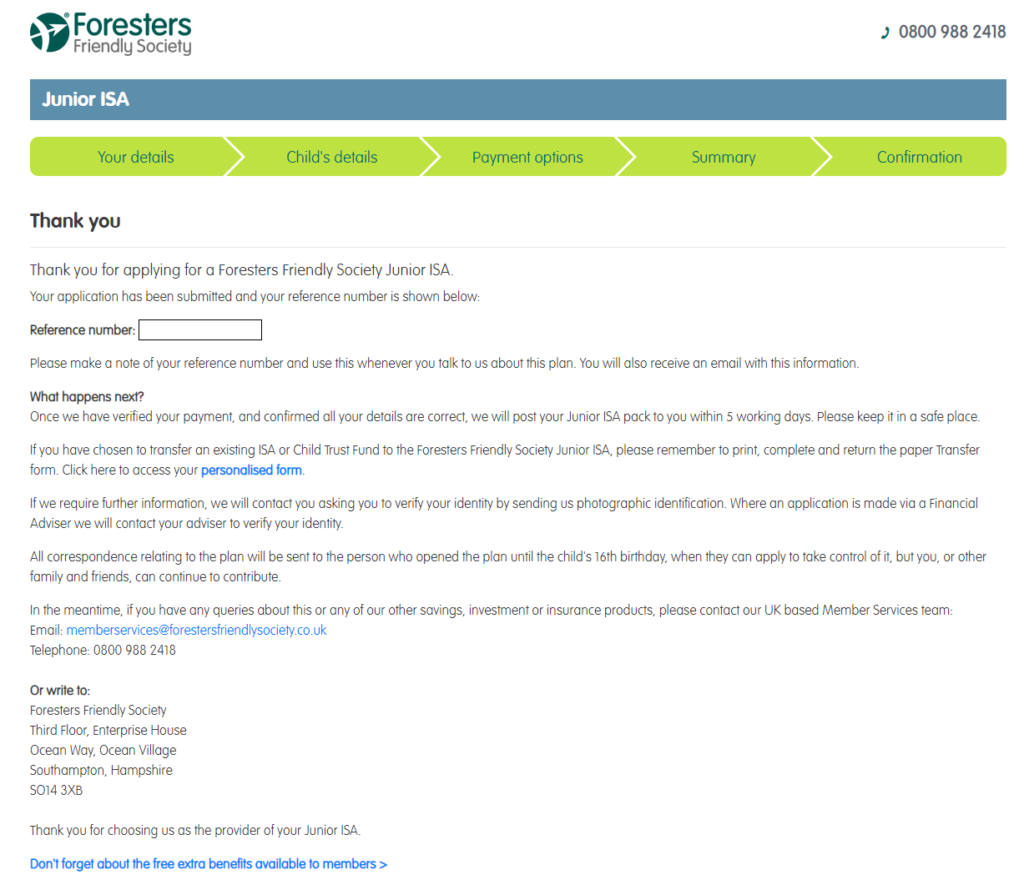

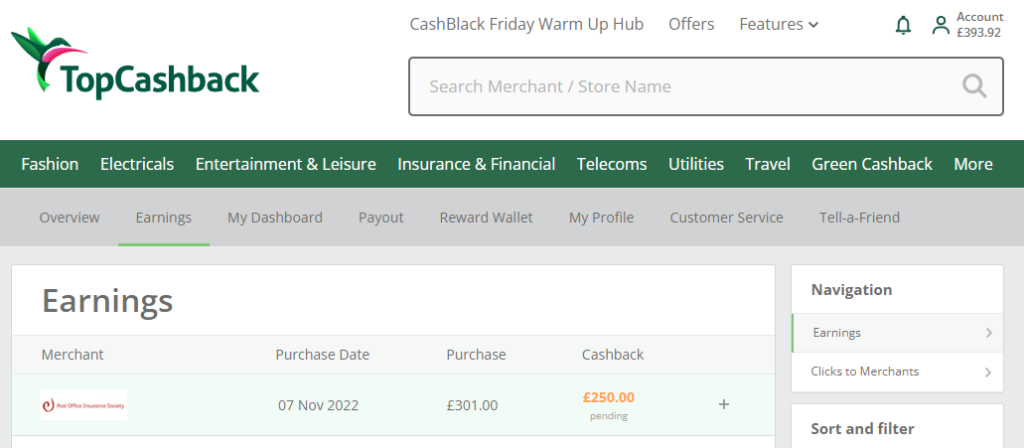

So I proceeded to opening the account which took me around 10 minutes only to find that behind the Post Office the actual ISA supplier is Forester. Not bothered as long as the cashback is awarded.

In truthness, it took a bit longer than expected and required slightly more active involvement from my end to get the business done. Reason being, I had to transfer funds from the Child Trust Fund and also provide with proof of identity. Some paperwork and email traffic which I class as non value added activities but a necessary evil to an end I suppose.

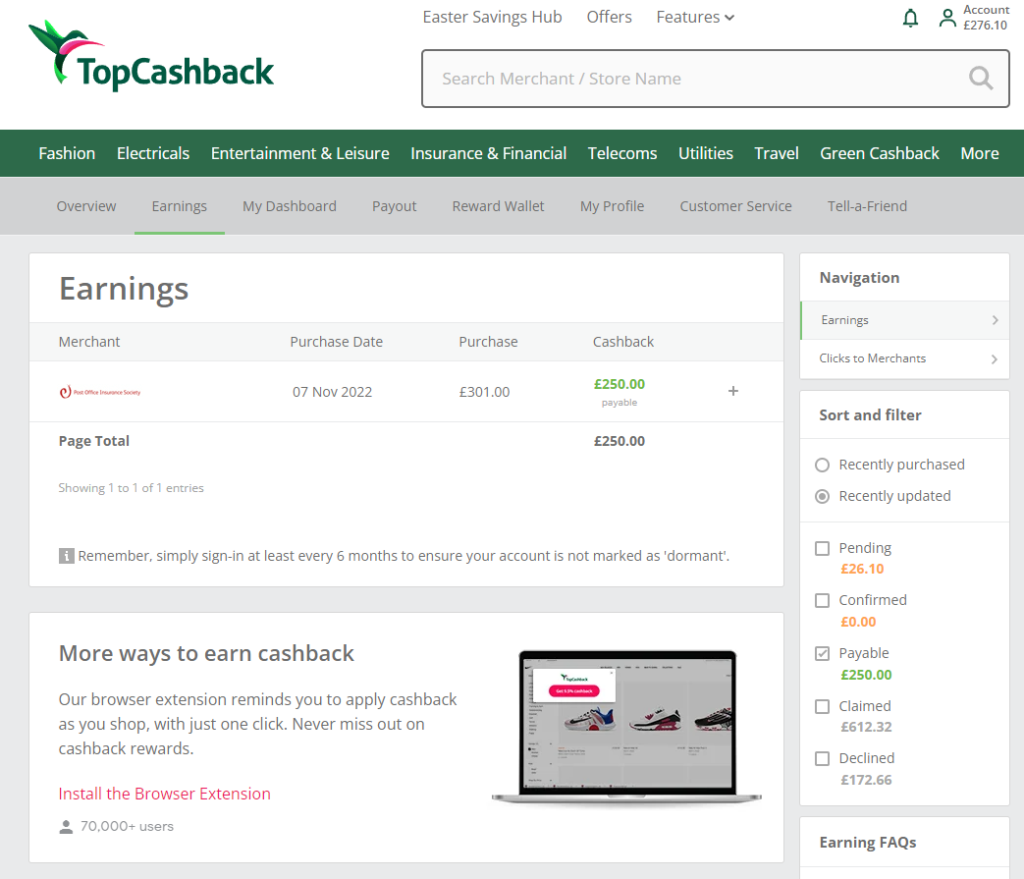

Fast forward to April 2023. Having contributed £300 per month into the Junior ISA for four months from January to April 2023 (£1,000 from Grandma and £200 more from Dad’s Bank), the transaction got greened up and £250 were made available for payment. Ecstatic with my payment and I believe this is probably the biggest single cashback reward I have ever obtained. At least this lot honoured their promises in stark contrast with Scottish Friendly (see post £230 Cashback for opening a Stocks & Shares ISA).

2023 is going to be a great year in terms of cashback takings. £350 already from ISA accounts only and I have not even touched car insurance, home insurance, energy or broadband. By the way, did I mention that I have two kids and another £1,000 left to invest for the youngest? To be continued…