Santander Bank Account Switch Offer £160 up for grabs

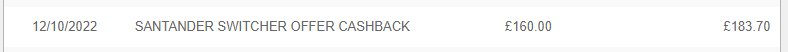

So here we go. Time for the second bank account switch of the year (in case you missed the first switch, see post Halifax Bank Account Switch £125 Cash Reward). This one was not forthcoming and it took nearly two months for the reward to get credited, but we got there in the end. I am writing these lines in November as a record of the Free Money events of October. The account was opened in late August so it is not hard to do the math. Eventually the free cash landed on the account and that’s all that matters on the issue at hand.

It is getting harder for me to find bank switch rewards since I have opened and closed a number of accounts over the years. Some accounts I also keep in view to cash in on perks. That is not to say that it has become an impossible task. It just means that I have to be patient and cease on the opportunity as soon as it comes by. Santander was the right one for me on this occasion. Even though I already have a Santander Lite Account, I was able to get around it as it seemed that I still qualified after carefully studying the Terms & Conditions of the offer.

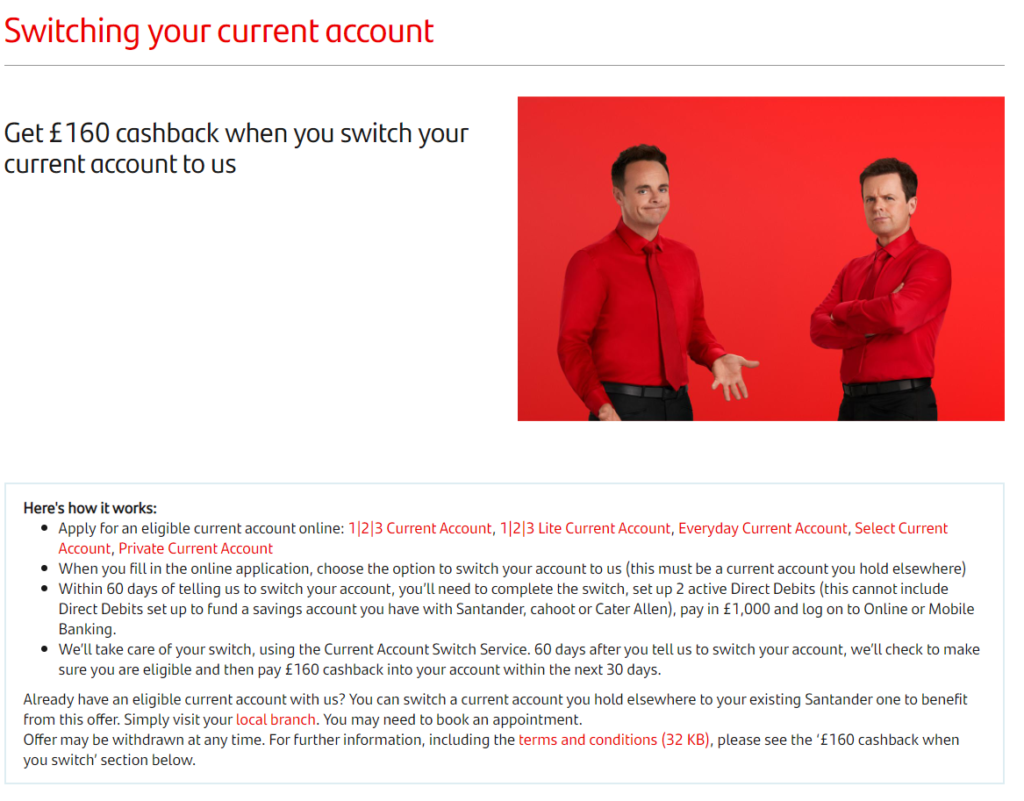

What were the requirements to qualify for the Santander switching offer?

Two active Direct Debits

The account I will be switching into will need to have two Direct Debits active at the time Santander run their eligibility checks (around 60 days after starting the switch).

The direct debits can be set up after the switch or can be directly moved from the old donor account I will be switching from.

A minimum deposit of £1,000

I will need to pay into the account at least £1,000 in the first 60 days. This amount can be credited as a single payment or several deposits. It is not mandatory that the money stays in the account. It can be spent or transferred elsewhere.

Check online banking

I will need to make sure that I log in to my account either online or via app banking at least once in the first 60 days.

What is the duration of the offer?

No deadline to apply was published by Santander at the time the offer was launched. In my world that means that the offer can be withdrawn at any moment without prior notice. I will need to act fast if I want to catch this train on time.

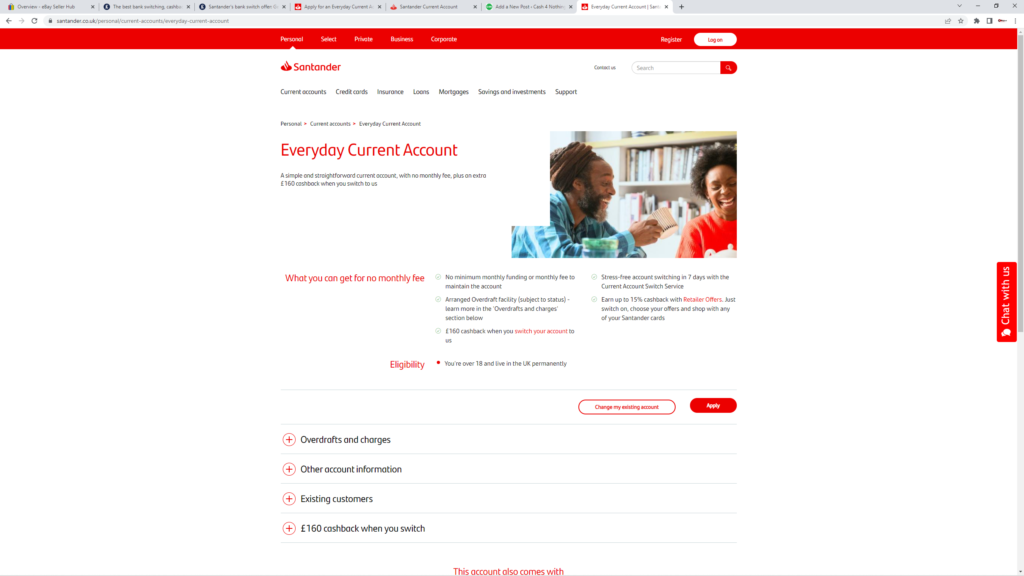

I am an existing Santander account holder. Can I still benefit from the offer?

Santander advised to set up an appointment and visit my nearest branch. Not really my thing so the way to get around this is by opening an additional account online. I already have a Santander Lite account I use to cash in on perks every month but there is the option to apply for an Everyday account, and switch to that one. That is the plan I will be sticking to.

How long until the reward gets paid?

They will be checking that the conditions have been met 60 days after the day the switch was started. Once that step is completed, they aim to pay the reward within 30 days. That is to say that it will take two to three months on paper.

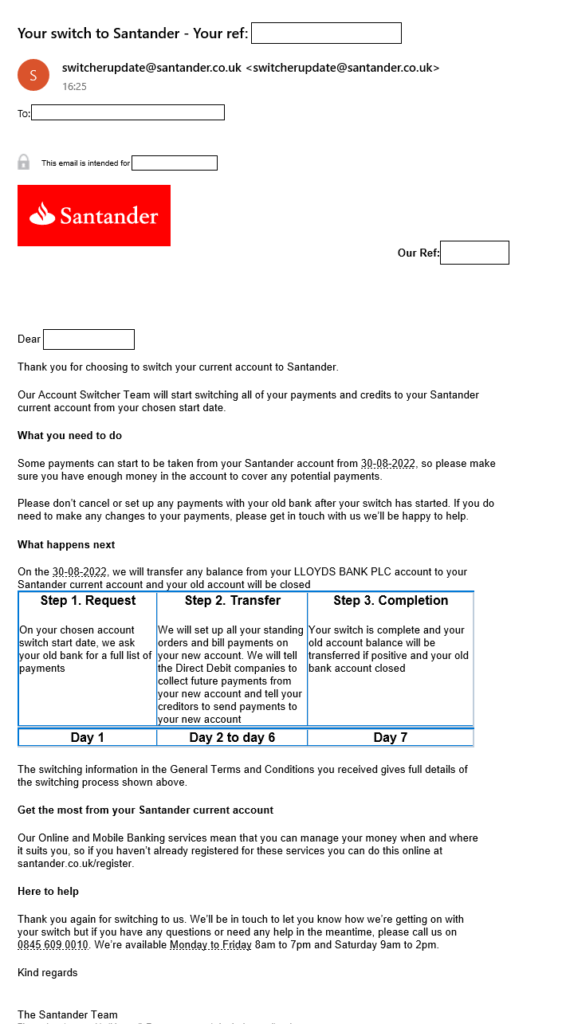

I have all the information that I need by now. All is left to do is to select a donor account I will be using for the switch and spare five minutes to apply online. As for the account nominated for the switch, that can be no other than my Lloyds current account (see Lloyds Bank Account Switch £100 Cash Reward). I opened this account exactly one year ago to take advantage of the £100 switch on offer at that time. Not much use to me since then other than to be traded for a switch. This is exactly the right moment to let it go.

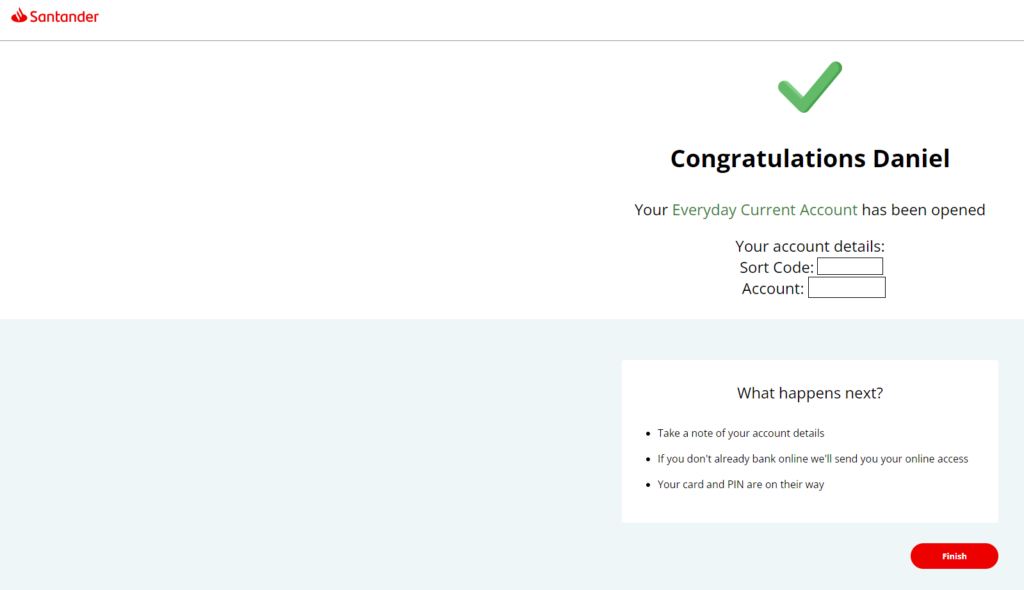

I completed the application in a matter of minutes and received email notification straight after. The happy day was the 19th of August 2022.

Good news is that it did not take 60 days for the switch money to be issued. I got really lucky and it was done on day 54. Either that or these guys are extremely efficient. Anyhow, thanks for the cash. This money propped me up to the £285 mark from Bank Switch Promotions as a Free Money stream for 2022. I was asking for £200 from switches this year (see post How to make £1,200 Free Money in 2022 – My Plan & Objectives) so I am proud to report that another objective has been delivered. I sometimes wonder if I deserve a bonus on top of a bonus. Food for thought.

Current Account Switch Service

The Current Account Switch Service (CASS) process is automatic and straightforward. All it takes is to request a switch during the application process at the time of opening a new account with the bank of your choice. Most banks are signed up to CASS, meaning that the switching service will work on the background closing the old account and moving money, direct debits, standing orders, payments (ie: salary), etc. to the new bank account. The process is completed in seven working days.

Should the unexpected happen, CASS makes sure that during the first three years after the switch, any moneys paid into the old account or mistakenly coming out of it will be transferred to the new account. Also, if there are charges involved due to an error during the switch process, they will be refunded by the new bank.