May 2023 Free Cash Earnings Report £211 Free Money

Bank Rewards: £25

- Santander Lite Bank Account: £6

- Halifax Reward Account 1: £5

- Halifax Reward Account 2: £5

- Barclays Blue Rewards: £3

- RBS My Rewards: £3

- Natwest My Rewards: £3

Interest on Savings: £23

- Barclays Rainy Day Savings Account: £17

- RBS Regular Saver: £3

- Natwest Regular Saver: £3

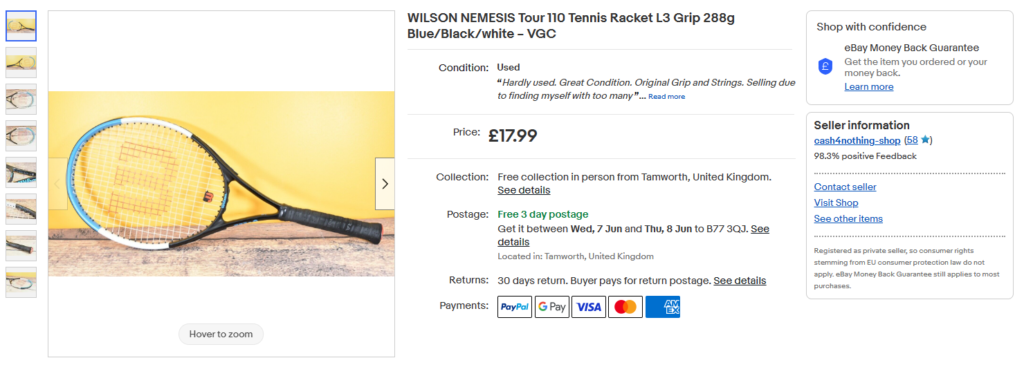

Decluttering Sales: £21

- Kids glasses: £8

- Tennis Racket: £13

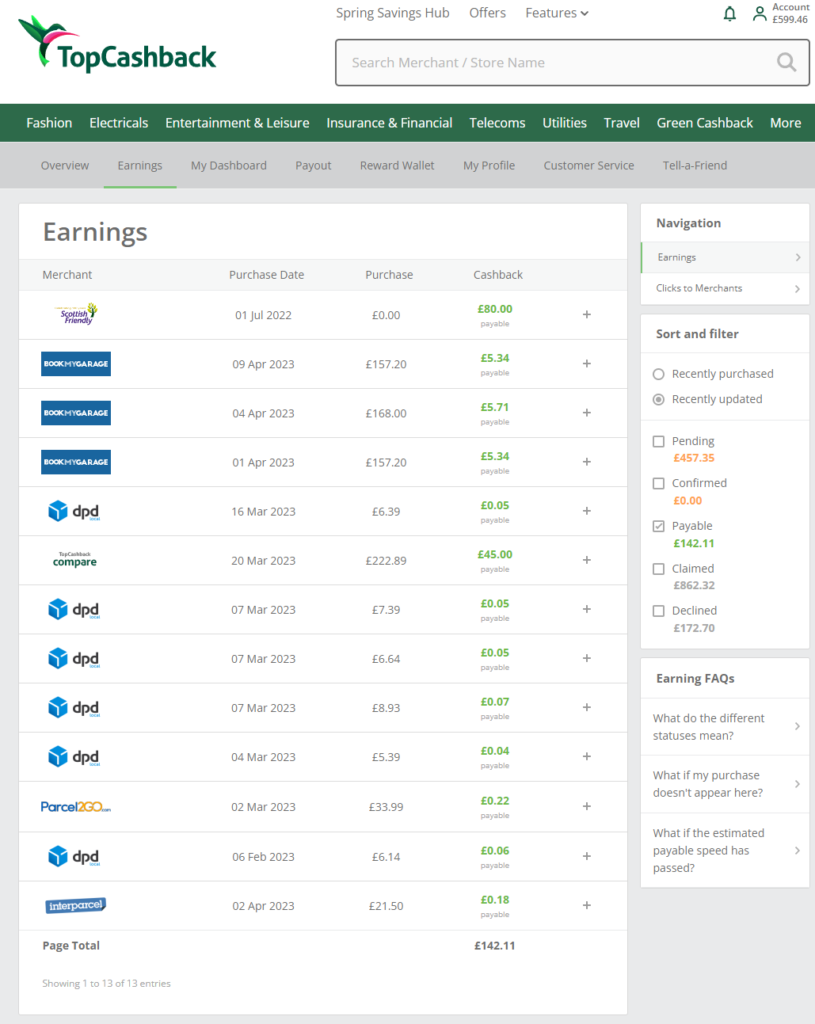

Cashback: £142

- Car Insurance: £45

- S&S ISA claim: £80

- Car servicing: £5

- Courier Services: £1

- Others: £10

| Free Money Income Stream | Contribution | % Weight |

| Bank Rewards | £25 | 12% |

| Interest on Savings | £23 | 11% |

| Decluttering Sales | £21 | 11% |

| Cashback | £142 | 66% |

| Total | £211 | 100% |

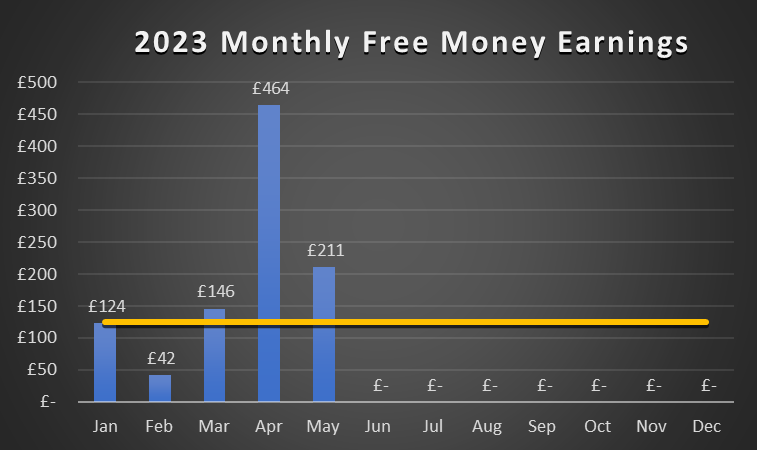

May 2023 Total: £211

£86 over £125 monthly target

| Month | Free Money Earnings | +/- Monthly Target (£125) | Accumulative | to Year End Objective (£1,500) |

| January | £124 | -£1 | £124 | £1,376 |

| February | £42 | -£83 | £166 | £1,334 |

| March | £146 | +£21 | £312 | £1,188 |

| April | £464 | +£339 | £776 | £724 |

| May | £211 | +£86 | £987 | £513 |

2023 Free Money Earnings: £987

£513 to £1,500 Annual Target

May 2023 brought in £211 pounds in Free Money, £86 pounds above £125 monthly target and £987 pounds up to this point since January. For some unknown reason, 2023 seems to be the cashback year. I collected another £142 pounds making a total of £524 so far. No only that, but there are £450 worth of tracked transactions in my TopCashback account. Assuming nothing goes wrong with them, I will be crossing the £1,000 mark at the end of the calendar year.

Banks rewards. Plain sailing. This time, bank perks accrual reached £25 pounds. A pound over expectation. Nice.

Interest on Savings. I am saving in different pots money to be deployed at the relevant time in the year. For as long as it is kept, it will generate interest payments. As a Free Money stream, I gathered £23 pounds for the month. Close to £50 a month in passive income. I am enjoying this ride.

Decluttering sales. Two items sold in May. A pair of glasses and a used tennis racket. I am aware that I am falling behind as it is only £118 collected against a £500 annual objective, but on the other hand, market forces are not on my side as my stuff for sale does not seem to shift. Not a lot I can do other than to keep listing and remain patient.

Cashback. A generous pay-out of £142 pounds. As it is traditionally the case, I get cashback from switching my car insurance at this time of the year. I am fishing for the best deal in order save myself a chunk of money in the process. As an added benefit, I get cashback on top. On this occasion, I collected £45 pounds from doing so. At the same time, service and MOT are due. Same logic applies, I browse the internet for the best deal and get myself a little bit of cashback on top. Lastly, I was paid £80 as a result of the claim lodged against Scottish Friendly for opening a Stocks & Shares ISA in July 2022. To cut a long story short: I should have received £230 cashback but I only got £100. I claimed. I got £80 paid in addition this month. Still £50 short of their promises. Claim is ongoing. For your interest, this topic is captured in full detail in the post £230 Cashback for opening a Stocks & Shares ISA.

Nearly a Thousand pounds Free Money after the first five months of 2023. I had them better but I am not dissatisfied at all. £500 pounds more and I will be meeting my 2023 objective. I need to check my indicators to understand my actual performance though. June breaks the calendar in half and it will be the right time for a review. Until then, let me enjoy the scenery.