Investing my Free Money in a Peer to Peer IFISA Account

Tax Free Returns via Individual Savings Accounts (ISAs)

The Free Cash Fund is growing away from the Free Money Pot. That is Free Money out of and on top of Free Money. Is it actually happening? Yes, it is and the difference is markedly positive (see FCF Value).

It does not happen by chance though, since I had to devise an Investment Strategy consistent with my goals. Let me revisit them:

- Diversification. Not all eggs will go in one basket. Goal: Spread and reduce risk.

- Passive Investment. I will not be actively managing my Fund. Goal: Invest and forget.

- Tax free. I want to avoid picking up a tax bill. Goal: Shield against taxes.

In this sense, I deem Free Money as money I can afford to lose, and the implication is that I can take a riskier approach when allocating the funds for investment. The second line of thought is that, in my mind, this is money that was not supposed to be there in the first place and hence, will never be needed in the short term. As a result, I am happy with it being invested away in a proposition that will require a reasonable amount of time to mature and/or to be released should there be a need to cash-in in the future.

All requirements and goals considered, I identified one investment vehicle ticking all the boxes which is the Individual Savings Account (ISA). There are six different types of ISAs: Cash, Stocks & Shares, IFISA, Help to Buy, Lifetime and Junior ISA. Out of these six, I do not qualify for the last three, and from the three remaining (Cash, Stocks & Shares and IFISA), the returns I would require from my investment rule out Cash ISAs (losing money proposition in practical terms against inflation).

I am left only two on the table: S&S ISAs and IFISAs delivering 8% and 5% historic returns. My breakdown allocation has been 30% of all Free Money Earnings towards S&S ISA and 60% in an IFISA.

The other important element to take into account is that even though I might have several ISAs and IFISA accounts with a number of different providers, the HMRC will only allow deposits (maximum £20,000 per year across all ISA Accounts) with one provider during the financial year. That means that whoever I choose, I will have to stick with them for the whole financial year (April to April).

What is an Innovative Finance ISA (IFISA)?

An innovative finance ISA will allow to invest your cash in peer-to-peer loans. Peer to peer lending matches investors with borrowers in the same fashion as a bank loan. The borrower will pay an interest on the money loaned from the investor which is proportional to the risk of the investment.

A peer to peer platform acts as an intermediary between individuals willing to lend money and other individuals or companies in need to borrow money. Both parties experience a benefit: lenders get a higher return for their money and borrowers obtain funds at more competitive rates. There are three main investment categories:

- Lending to individuals: borrowers take money from lenders. The loan plus interest is paid back over the agreed loan life span.

- Lending to companies: loans to finance businesses or working capital needs.

- Lending for property: loans to property developers to finance their development operations.

An Innovative Finance ISA (IFISA) is a type of ISA that allows to invest in peer-to-peer (P2P) platforms within a tax-free wrapper. This means that any interest earned within this wrapper will not be taxed. As an added benefit, it is important to note that it is also possible to transfer existing ISAs funds into an IFISA.

Choosing an IFISA Account compatible with my Investment Goals

As reminder of where things were left off (see post here), I had an IFISA account with ZOPA and my intention was to deposit 60% of all my Free Money earnings there. However, I encountered two main hurdles:

- Minimum investment requirement of £1,000.

- Queueing system. ZOPA was/is in high demand from investors and they instigated a system where all requests to invest have been put on hold.

In addition to these two, shortly after having joined their queue, I received an email from ZOPA to inform me that they will proceed to close my account on the basis that I had not made any deposits for a full year. I was left scratching my head: how am I supposed to make a deposit if you are not accepting any at the moment and on top of it, I have no choice but to join a queue for a discretional amount of time? Just ludicrous. But it did not matter. They did close my IFISA account shortly after.

Baffling and extremely arrogant, but that is their way of running their business. Make a note for the future.

The decision was made for me and I had to complete my due diligence in search of a new IFISA provider. There are a number of them to consider out there, however, I have shortlisted my picks to the following: MarketFinance, Lending Works, Assetz Capital, CrowdProperty and Folk2Folk. My criteria for selecting the right one for me will be:

- Expected returns.

- Risk vs Reward ratio.

- Established company and feedback available in the public domain.

All three considered, there is clear winner coming on top for every single parameter: Crowdproperty. Crowdproperty lends to property developers keeping the property as collateral, delivers up to an 8% return, and has been operating since 2014 gaining good feedback and positive reviews from the mainstream media and investment community alike.

Lending to Property Developers via Crowdproperty IFISA

Crowdproperty is a Peer to Peer Lending provider specialized in Bridge Loans for the Property Market. The money handed over for investment to Crowdproperty is used to Finance Property Development/Renovation Projects in the short term (from 6 to 24 months). As a P2P Provider Crowdproperty act as middleman matching investors and borrowers in this particular niche.

Why Crowdproperty?

The company has been operating for the last 7 years and has strong press exposure and Internet presence in the UK media plus hundreds of positive reviews left by satisfied lenders on trust pilot. As with every other P2P platform I used in the past, one has to take the plunge and start small before scaling the investment amounts. In addition, there were three main elements which tilted my decision towards them:

- Up to 8% returns.

- Pristine track record so far with 100% of Projects paid back.

- Investment backed by First Legal Charge meaning that a lender with a first legal charge over a property has a first call on any funds available from the sale of the property.

There is a fourth (and extremely important to me) factor to consider which is the Autoinvest tool. My strategy is to invest and forget because I am not an active fund manager. I also want to diversify my portfolio in order to reduce exposure and spread the risk. I also need for the returns to be reinvested automatically. Well, the Autoinvest feature fits like a glove to my needs.

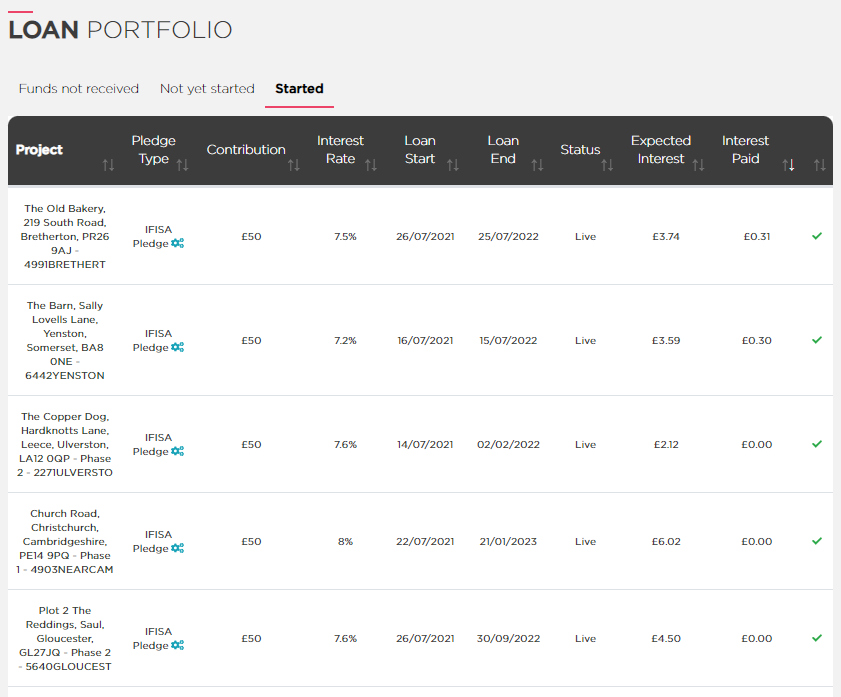

Autoinvest works by diversifying the funds deposited in Crowdproperty across different property projects so that the risk is reduced as much as possible. I can setup the maximum amount allocated for each project and turn on the reinvestment option to compound my earnings (see Compound Interest Post) which is a nice feature to have. So, rather than me spending time studying and selecting the projects and the amounts I will be investing in, I allocate my funds into the Autoinvest tool. What happens is that small chunks (£50) of my pot will be invested automatically across different projects as they are approved by the platforms team. It might be a slow process at the start but a safer one in the long run. In addition, I am expecting for the sums deposited to be modest and in the region of a £1,000 per year. This is a safe and passive investment proposition I am extremely comfortable with. My only part will be to deposit my portion of the free money earnings and their algorithm will take care of the rest. That is the way I like it.

What is the main disadvantage in comparison to other P2P Platforms?

Their investment process is time consuming. First, the project needs to be approved, then the money needs to be pledged, then the loan remains inactive until the project starts, at which moment, it will become active and start generating interest. According to the info provided by them, it can take from 1 to 8 weeks for the loan to turn active once pledged. All this time, the money is sitting idle not generating any interest. In summary, and due to the nature of their process, there are always going to be idle funds in the pipeline as the projects mature and the capital is returned. As to how much, it is dependent on the inflow of projects and the outflow of matured loans, but one thing is for sure, it is detrimental to the overall performance of the investment for the simple reason that the money only produces interest once lent and not while it is ‘waiting’ to be loaned. These void periods will hinder a consistent return over time and the only way to measure the actual return will be by obtaining a historic data set. I am the man for the job. I can assure you that I will post my findings on due course.

How much to start with?

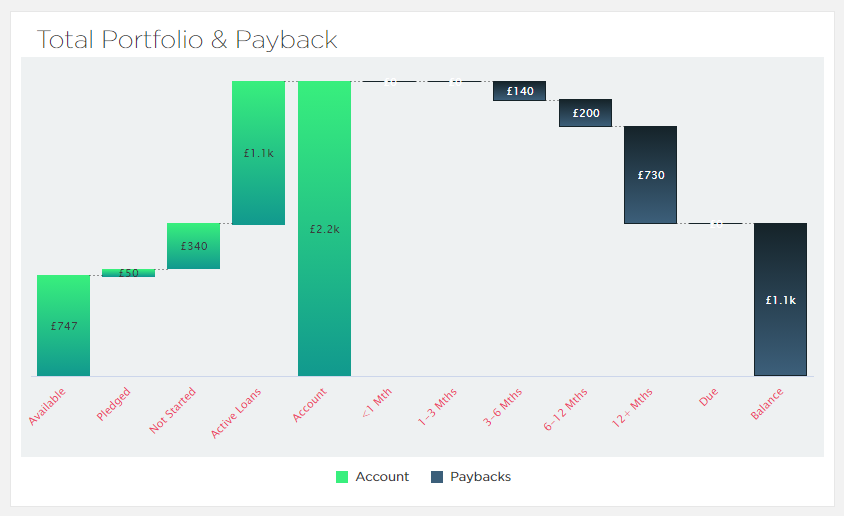

I transferred all my free money earnings deposited in my Moneybox General Investment Account (GIA) to the IFISA account I opened with Crowdproperty back in early July. Total amount was £1,366 at that moment in time. All funds are automatically managed by the Autoinvest tool which is good. The not so good thing is that, at a rate of £50 per project and up to an eight week wait from pledge to active, I am estimating three months before all the money is fully lent out and the interest payments start to come in.

Two months down the line (early September at the time of writing these lines), I have £1,100 in the ‘Active’ loan pot and £340 in the ‘Not Started’ Pot which seems consistent with my timeline. I have also received two interest payments of £0.30 and £0.31 making a grand total profit of £0.61 so far. Gosh. I really am so proud of myself.

Joking aside, for every £50 invested I can expect a 10 months x £0.31/month = £3.1 return per year (I am estimating a worst case scenario of a two month void period) or 6.2% tax free return. I can most certainly live with that.

I am happy with this new addition into my investment portfolio and I expect great returns over time, but at the moment, as with any investment, it is a bit of a question mark for me. If you want to find out how things pan out you are going to have to stick with me for a while. I am sure it is going to be a thrilling ride.