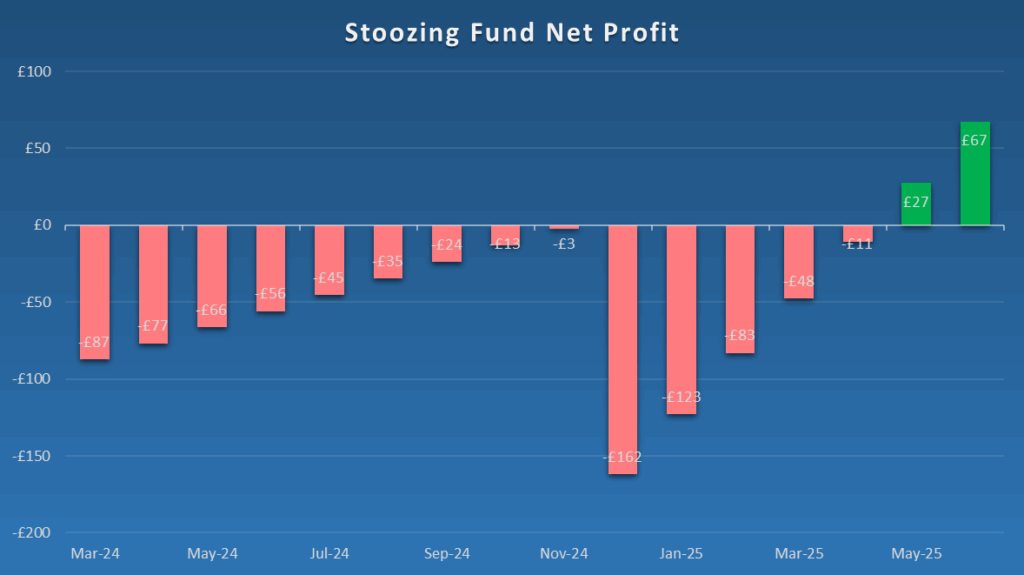

Stoozing Fund Value: £1,020 (£68 Net profit)

Free Money from Credit Cards. What is Stoozing?

Stoozing is a technique by which we will be using a 0% Credit Card Balance Transfer offer to make Free Money. The money transferred from the card will be deposited in a high interest savings account generating profits.

Use our Stoozing Profits Calculator to assess 0% interest balance transfer credit card offers.

What is the Stoozing Fund?

I have a number of credits cards I simultaneously use to make Free Money via Stoozing. The Stoozing Fund is the difference between total moneys in savings accounts and total credit card debt. The difference between total interests accrued and balance transfer fees is the Net profit.

| Month | Liabilities | Repayments | Interest | Investment Value | Net Value | Net Profit |

| March 2024 (*) | £2,587 | -£ | -£ | £2,500 | -£87 | -£87 |

| April 2024 | £2,561 | -£26 | +£11 | £2,511 | -£50 | -£76 |

| May 2024 | £2,536 | -£26 | +£10 | £2,521 | -£15 | -£66 |

| June 2024 | £2,510 | -£25 | +£11 | £2,532 | £22 | -£55 |

| July 2024 | £2,485 | -£25 | +£10 | £2,542 | £57 | -£45 |

| August 2024 | £2,460 | -£25 | +£11 | £2,553 | £92 | -£34 |

| September 2024 | £2,435 | -£25 | +£11 | £2,564 | £128 | -£23 |

| October 2024 | £2,411 | -£24 | +£10 | £2,574 | £163 | -£13 |

| November 2024 | £2,387 | -£24 | +£10 | £2,584 | £197 | -£3 |

| December 2024 (**) | £7,536 | -£24 | +£12 | £7,598 | £62 | -£162 |

| January 2025 | £7,409 | -£127 | +£39 | £7,636 | £227 | -£123 |

| February 2025 | £7,284 | -£125 | +£41 | £7,677 | £393 | -£83 |

| March 2025 | £7,162 | -£122 | +£35 | £7,712 | £551 | -£48 |

| April 2025 | £7,041 | -£118 | +£37 | £7,748 | £708 | -£11 |

| May 2025 | £6,923 | -£116 | +£39 | £7,788 | £865 | £28 |

| June 2025 | £6,807 | -£114 | +£40 | £7,827 | £1,020 | £68 |

(*) Credit Card 1 RBS £2,500 Balance Transfer into Fund, £87 Balance Transfer Fee;

(**) Credit Card 2 Virgin £5,000 Balance Transfer into Fund, £172 Balance Transfer Fee

Stoozing Fund Cash Flows

On a monthly basis, interests are paid into savings accounts increasing the fund value and credit cards are repaid decreasing total debt. Moneys kept in the Cash Reserves Pot are used to service credit card repayments.

| Month | Savings 1 | Savings 2 | Savings 3 | Cash Pot | Total Savings | Credit Card 1 | Credit Card 2 | Total Debt | Net Value | Net Profit |

| Dec 2024 | £4,338 | £2,000 | £2,000 | £740 | £7,598 | £2,363 | £5,172 | £7,536 | £62 | -£162 |

| Jan 2025 | £4,052 | £2,160 | £2,160 | £736 | £7,636 | £2,340 | £5,069 | £7,409 | £227 | -£123 |

| Feb 2025 | £3,783 | £2,322 | £2,322 | £749 | £7,677 | £2,317 | £4,968 | £7,284 | £393 | -£83 |

| Mar 2025 | £3,442 | £2,482 | £2,482 | £695 | £7,712 | £2,293 | £4,868 | £7,162 | £551 | -£48 |

| April 2025 | £3,103 | £2,644 | £2,644 | £642 | £7,749 | £2,270 | £4,770 | £7,041 | £708 | -£11 |

| May 2025 | £2,765 | £2,807 | £2,807 | £592 | £7,788 | £2,248 | £4,676 | £6,923 | £865 | £28 |

| June 2020 | £2,498 | £2,972 | £2,972 | £614 | £7,827 | £2,225 | £4,582 | £6,807 | £1,020 | £68 |

(1) Barclays Rainy Savings Account (5.12% AER) ; (2) Natwest Digital Regular Saver (6.17% AER); (3) RBS Digital Regular Saver (6.17% AER)

Cash Reserves Pot saved in Barclays Rainy Savings Account ; £300 Drip feed monthly (£150 + £150) to RBS and Natwest

Cash Reserves Pot Flows

The Cash Reserves Pot is deposited in a savings account to generate additional interest. With an initial value of approximately £1,000 in January 2025, 70% of all Free Money Earnings are deployed into the Cash Reserves Pot.

| Month | Previous | Monthly Earnings | Repayments | Pot Value |

| April 2024 | £270 | +£30 | -£26 | £274 |

| May 2024 | £274 | +£20 | -£26 | £269 |

| June 2024 | £269 | +£10 | -£25 | £253 |

| July 2024 | £253 | +£10 | -£25 | £238 |

| August 2024 | £238 | -£ | -£25 | £213 |

| September 2024 | £213 | +£60 | -£25 | £249 |

| October 2024 | £249 | +£40 | -£24 | £264 |

| November 2024 | £264 | +£10 | -£24 | £250 |

| December 2024 (*) | £740 | +£20 | -£24 | £736 |

| January 2025 | £736 | +£140 | -£127 | £749 |

| February 2025 | £749 | +£70 | -£125 | £695 |

| March 2025 | £695 | +£70 | -£122 | £642 |

| April 2025 | £642 | +£70 | -£118 | £592 |

| May 2025 | £592 | +£140 | -£114 | £614 |

(*) Withdrawal from IFISA £490

Credit Card 1 RBS

Expected Profit: £164 ; Return on Investment (ROI): 31%

£2,500 ; 3.49% Balance Transfer Fee ; 1% Monthly Repayment

23 Months (March 2024 to February 2026)

See Stoozing 2.0

| Month | Liabilities | Repayment (1%) | Interest | Investment Value | Net Value | Net Profit |

| March 2024 | £2,587 | -£ | -£ | £2,500 | -£87 | -£87 |

| April 2024 | £2,561 | -£26 | +£11 | £2,511 | -£50 | -£76 |

| May 2024 | £2,536 | -£26 | +£10 | £2,521 | -£15 | -£66 |

| June 2024 | £2,510 | -£25 | +£11 | £2,532 | £22 | -£55 |

| July 2024 | £2,485 | -£25 | +£10 | £2,542 | £57 | -£45 |

| August 2024 | £2,460 | -£25 | +£11 | £2,553 | £92 | -£34 |

| September 2024 | £2,435 | -£25 | +£11 | £2,564 | £128 | -£23 |

| October 2024 | £2,411 | -£24 | +£10 | £2,574 | £163 | -£13 |

| November 2024 | £2,387 | -£24 | +£10 | £2,584 | £197 | -£3 |

| December 2024 | £2,363 | -£24 | +£12 | £2,595 | £232 | £8 |

| January 2025 | £2,340 | -£23 | +£14 | £2,611 | £272 | £24 |

| February 2025 | £2,317 | -£23 | +£15 | £2,626 | £310 | £39 |

| March 2025 | £2,293 | -£23 | +£14 | £2,640 | £347 | £53 |

| April 2025 | £2,270 | -£23 | +£13 | £2,653 | £383 | £66 |

| May 2025 | £2,248 | -£22 | +£12 | £2,665 | £417 | £78 |

| June 2025 | £2,225 | -£22 | +£11 | £2,676 | £451 | £89 |

Credit Card 2 Virgin

Expected Profit: £469 ; Return on Investment (ROI): 21%

£5,000 ; 3.45% Balance Transfer Fee ; 2% Monthly Repayment

29 Months (December 2024 to June 2027)

See Stoozing 3.0

| Month | Liabilities | Repayment (2%) | Interest | Investment Value | Net Value | Net Profit |

| December 2024 | £5,172 | -£ | -£ | £5,000 | -£172 | -£172 |

| January 2025 | £5,069 | -£103 | +£25 | £5,025 | -£45 | -£148 |

| February 2025 | £4,968 | -£101 | +£26 | £5,051 | £83 | -£122 |

| March 2025 | £4,868 | -£99 | +£21 | £5,072 | £204 | -£101 |

| April 2025 | £4,771 | -£97 | +£21 | £5,096 | £324 | -£76 |

| May 2025 | £4,676 | -£95 | +£26 | £5,122 | £446 | -£50 |

| June 2025 | £4,582 | -£92 | +£29 | £5,151 | £569 | -£22 |