Bank Rewards – How I collect £15-£20 per month Free Cash

Banks will reward you for your custom

Banks want your money and your custom and they are willing to offer you hard cash in return. It is not uncommon for High Street and Online Banks to offer switching incentives to gain new customers and a host of different perks on top to keep fresh money flowing in into their accounts. Banks do not act out of kindness as they are in business to make a profit and generate a return for their shareholders. That is to say, that they will be getting a return out of these activities. Nothing wrong with that. By the same token, I will strive to earn a return out of my hard-earned cash.

For my purposes, there is a distinction in between switching incentives and perks for bank account holders. Bank switching free cash is a one-off action intended to pocket the reward whereas perk collection is an ongoing activity. The ideal scenario is a bank account promotion that offers both, so that I can get the switching moneys in the short term and piggy bank the cash perks in the medium to long term. Desirable but not always available. The perfect scenario is to collect cashback for opening the account, reward for a switch and perks for maintaining it. Not as rare as you might think.

Switching and perking gathering are two different avenues in terms of free cash and I will certainly make use of bank switching again at some point (more of this on future posts) but for now, I will concentrate on how my set up works to get £15 to £20 free cash per month out of bank perks.

Bank Perks. What do they consist of?

Main perks offered by banks are rewards, free cash, cashback, and interests on bank account balances. These do not come for free as there are a set of conditions to be met before the moneys are released. Good news is, they are not hard to meet in most cases. There will be a requirement for monthly deposits, direct debits and, in some cases, minimum expenditure on a card. Not so keen on expending, so my chosen ones will only involve moneys paid into the account and direct debit set up.

For example: Bank A requires £800 minimum only deposits and 2x direct debits to award £3 pounds per month. Bank B requires £1,000 pounds paid into the account and 4 direct debits for a £4 reward. Bank C gives %1 cashback for utility bills with minimum deposits of £500 per month.

Let me clarify this with actual real-life examples:

| Bank | Requirement_1 Deposits/month | Requirement_2 Direct Debits | Requirement_3 | Reward |

| Barclays Bank Account Blue Rewards | £800 | 2 | £8 (£12 minus £4 fee) | |

| Co-op | £800 | 4 | Opt-in for paperless statements. | £2 |

| Halifax | £1,500 | £500 spend on debit card/month OR keep minimum of £5,000 in account. | £5 | |

| Natwest & RBS | £1,250 | 2 (over £2 each) | £3 (£5 minus £2 fee) | |

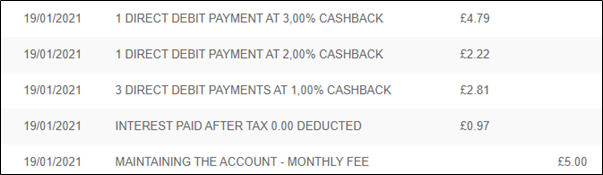

| Santander 123 | £500 | 2 | Log in to online or mobile banking at least once every three months. | Cashback: 3% back on water bills 2% back on gas, electricity, Santander home insurance and life protection 1% back on Santander mortgages, phone, broadband, mobile and TV bills and council tax £2 Fee ; cap of £5 cashback each. |

Interests on Bank accounts:

| Bank | Requirement 1 Deposits/month | Requirement 2 Direct debits | Interests |

| TSB Classic Plus | £500 | None | 0.30% (up to first £1,500) |

| Santander 123 | £500 | 2 | 0.30% (up to first £20,000) |

As it happens, this is my current set of bank accounts at the time of writing (February 2021). It is worth mentioning that these perks used to be a lot more generous (twice as much) and the requirements far less stringent. They are now and a marked downward trend.

The process I use to collect Bank Perks

As regards to deposits, it is important to note that there is no requirement to keep the money in the accounts. So once the deposit is made, the money can be moved at will. That means that money can be looped around between accounts to meet minimum deposit requirements. Prior to any funds being transferred, direct debits need to be in place.

The process works as follows:

- I will also need a ‘home’ account to start the flow of money from and to be the final recipient of funds once it has been circulated around.

- I will have to identify the highest deposit requirement.

- I will have to work out my total outgoings in terms of direct debits.

- I will have to set up standing orders in between accounts.

To put all this in practice, my home bank account will be the Santander 123 account because it offers the highest interests on balances up to £20,000. I will also set-up all my direct debits utilities-wise to capitalise on cashback offers. I will be using Barclays and Co-op to collect perks (It used to be five at some point but I am now down to these two). I have £100 worth of direct debits set up on each. The loop will be triggered by a standing order of £1,000 from Santander to Barclays on the 1st day of the month. I will allow for 2 days to cushion any delays and on the 3rd of the month £900 (£1,000 – £100 worth of direct debits) will be transferred via standing order from Barclays to the Co-op. To complete the loop, £800 will be moved back from the Co-op to Santander via standing order on the 5th of every month.

What are the benefits for me?

- I can plan and monitor monthly outgoings separately which in turn helps me budget for expenditure.

- No permanent capital tied-up in bank accounts.

- No other work involved other than the initial account set up process.

- At the end of the day, I need to pay my bills and I also need to keep some working capital. These are a must for me so it is nice to collect a tip in the process.

My current rewards

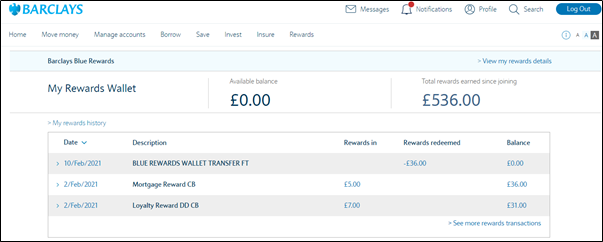

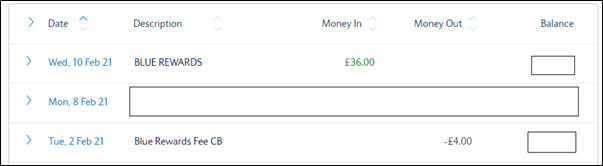

Barclays Blue Rewards: £8

I mortgage with them which boosts my rewards from £7 to £12.

Santander 123: £5 to £10

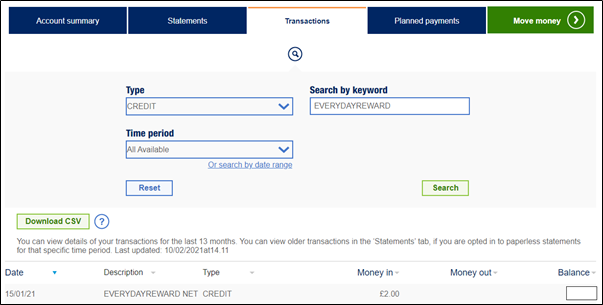

Co-op Rewards: £2

Expected monthly free money will fluctuate in between £15 and £20.

My next task will be to tidy up by closing no longer attractive bank accounts and by looking into new offers.