October 2024 Free Money Earnings Report £411

Bank Rewards: £20

- Santander Lite Bank Account: £4

- Halifax 1 Reward Account: £5

- Halifax 2 Reward Account: £5

- RBS My Rewards: £3

- Natwest My Rewards: £3

Interest on Savings: £14

- RBS Regular Saver: £7

- Natwest Regular Saver: £7

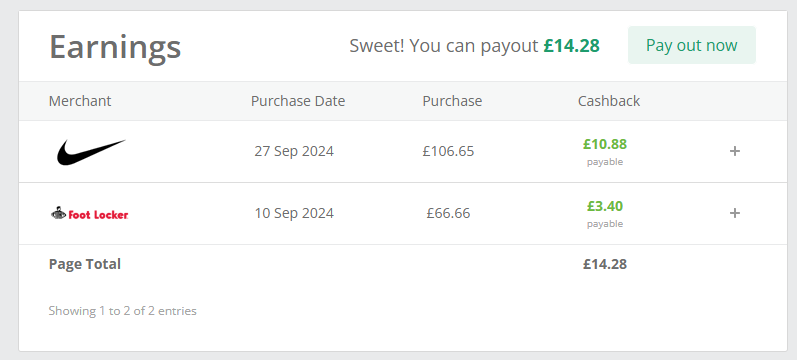

Cashback: £74

- AMEX Credit Card: £71

- Casual purchases: £3

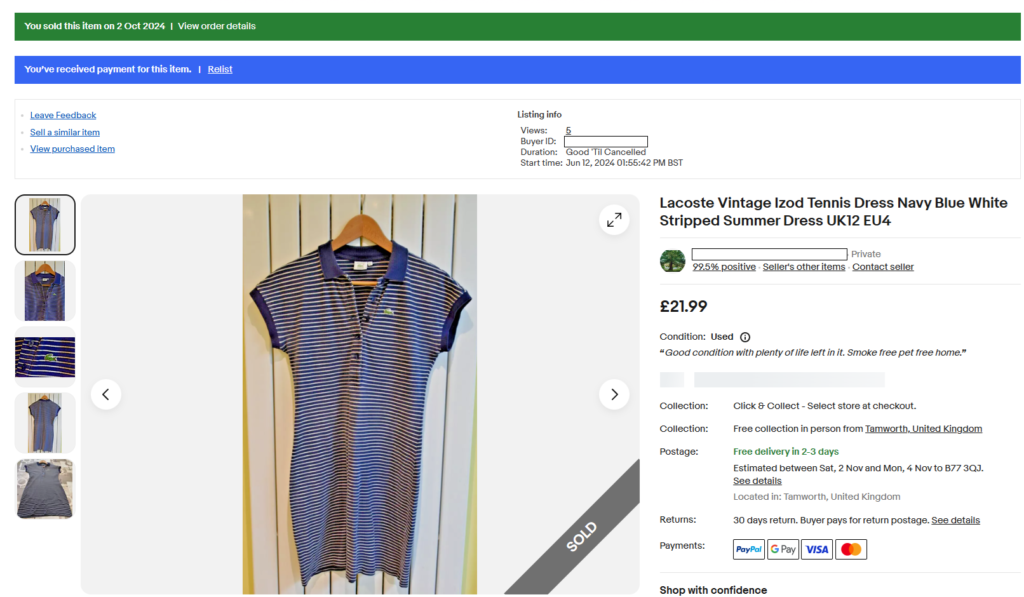

Decluttering Sales: £27

- Womens Tennis Dress: £18

- Bike Saddle Cover: £9

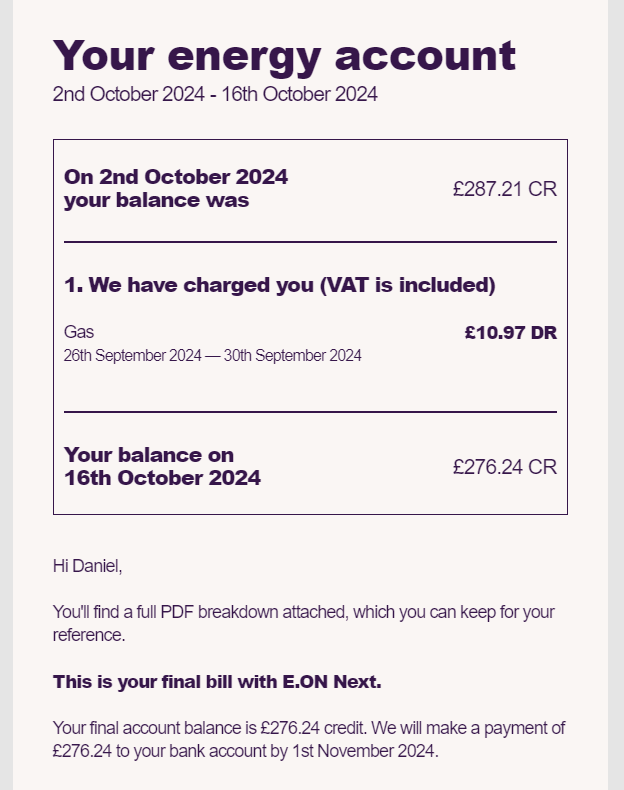

Freebies: £276

- E.ON Next refund: £276

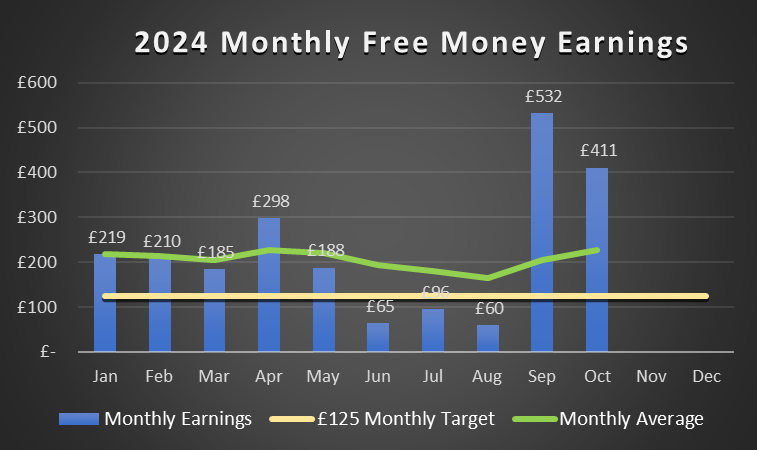

| Month | Free Money Earnings | +/- Monthly Target (£125) | Accumulative | to Year End Objective (£1,500) |

| January | £219 | +£94 | £219 | £1,281 |

| February | £210 | +£85 | £429 | £1,071 |

| March | £185 | +£60 | £614 | £886 |

| April | £298 | +£173 | £912 | £588 |

| May | £188 | +£63 | £1,100 | £400 |

| June | £65 | -£60 | £1,165 | £335 |

| July | £96 | -£29 | £1,261 | £239 |

| August | £60 | -£65 | £1,321 | £179 |

| September | £532 | +£407 | £1,853 | +£353 |

| October | £411 | +£286 | £2,264 | +£764 |

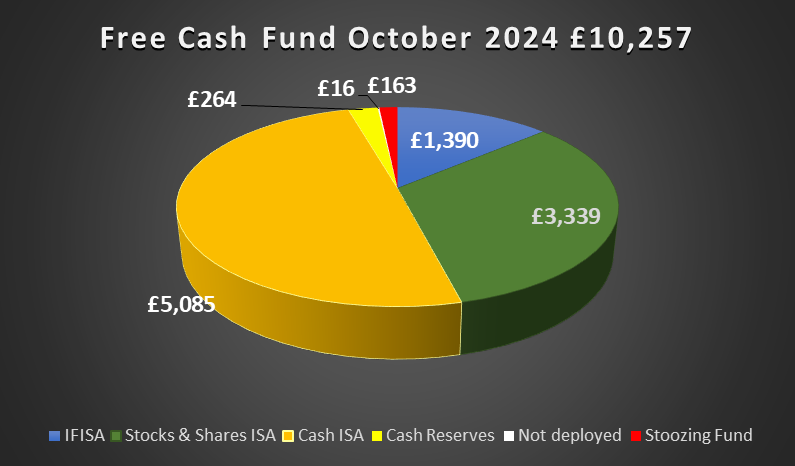

Oops, I did it again. £411 Free Money came my way in October 2024. I mean, I am not even trying. It just happens with hardly any interaction from my end. As it turns out, the £1,500 Free Money Objective for 2024 is in the rear mirror and not only that, the Free Cash Fund has now reached the 5 figures domain showing a balance of £10,257.

Wow, this is a serious enough sum of money now. I am not entirely sure if this figure is relevant for the general member of the public out there but it sure is for me. It is just a number to behold though. As I have stated numerous times throughout this Blog, this money does not exist in my realm. It is not supposed to be there in the first place and I did not have to work for it. You do not necessarily need to agree with me but that has been my philosophy since the beginning and I will stick to it.

I do know from previous experience that by playing my cards right, I can now expect hundreds more a year from my low-risk Investment Strategy. In addition, I can use this money to leverage additional earnings. I do not want to be getting a ahead of myself just yet but exciting times are coming. For sure. I have been there before. Is all mapped out in my head already. Watch it develop.

Bank Rewards. As per my expectation, £20 is the new floor after the Barclays Blue Rewards cessation (-£3) and the addition of my second Halifax account into the mix (+£5). Boring stuff, or not so much considering that this stream delivers £250 per year approximately just by collecting small perks on a monthly basis. Simple adding up math.

Interest on Savings. I am not touching my savings until the time is right (end of year). I will allow them to continue contributing into this pot at a pace of £14-£15 a month. That was the plan and things are developing accordingly.

Cashback. A £71 jump in the right direction just by using my AMEX credit card. I am ‘recycling’ money using the card and every time it goes through the system, it leaves a 1% behind for me. This is just a great way of collecting Free Money. In addition, £3.40 were credited to my TopCashback account as a result of casual purchases maturing.

Decluttering Sales. Two more eBay sales topped up earnings by £27. A ladies tennis dress discarded by my wife and a bike saddle pad which was bought two years back but never got to be used. It does not seem like a lot but I put £569 into the Decluttering Kitty so far this year.

Freebies. A £276 refund from my energy supplier E.On Next. Long due really. You see, I am annoyed by the fact that if I happen to use more energy than stipulated in the supply contract, they charge me immediately for the difference. By contrast, I will never get a refund if the opposite happens. They are quite content keeping my positive balance in their accounts as credit for a future ‘overuse’. I do not think that is neither fair nor right but energy suppliers get away with it consistently. That is billions of positive cash flows in their balance sheets for an unprovided good/service. Legal fraud in my eyes (same as banks lending your money 10-20 times to others and collecting interest for every single loan).

Anyway, I have stuck with my energy provider for the best part of two years and they have been annoying me with price increase emails for a while now. I know that the many will not be bothered but my reply has been to switch suppliers (locking fixed prices for a year by the way), collect cashback from the switch (more in a future post) and ask for my money back which was eventually credited into my bank account by mid October. Unexpected money and hence classed as a Freebie. I wished for a £100 from Freebies in January and I now have £370. Sweet.

In summary, £2,264 From January to October and £10,257 total value of the Fund. I am happy with this. More so because I was not sure at all whether or not I would be able to replicate past performances when I first embarked in this adventure, however, time has proven that a simple formula works: set a time bound goal, align resources, track, review and bridge the gaps. Keep going and keep focused: things will eventually happen. I am just a regular guy looking at 10 Grand which came out of nothing by following this basic recipe. I only walked the walk. I do fully intend to keep walking.