How to make Free Money from Credit Cards – Stoozing 3.0

Use our Stoozing Profits Calculator to assess 0% interest credit card offers

Virgin Credit Card

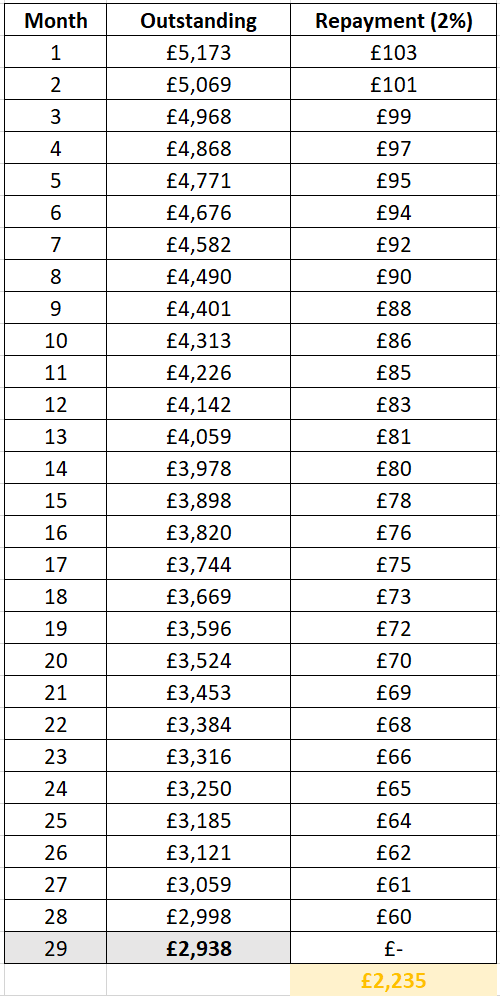

Balance Transfer: £5,000

3.45% Balance Transfer Fee ; 2% Monthly Repayment

0% Interest Payments for 29 Months (December 2024 to June 2027)

Ok. Here we go again. The Free Cash Fund has reached £10.5k and for me it only means that I can use that money as collateral to make even more Free Money. In this particular case via Stoozing. My philosophy has always been to start small and progress in baby steps but having a clear goal to scale up as soon as an opportunity becomes available. Time for a second go now.

What is Stoozing?

The idea is to use money from a third party to generate profits by placing borrowed funds in a risk free investment (ie: savings account). Since I will be contracting a debt, my aim will be to use as little as possible of my own money to service repayments. At the end of the loan, I will be paying off the remaining debt, recovering my deployed funds and raking the rest as profit.

More specifically, what we will be doing is using a 0% Credit Card Balance Transfer offer to make Free Money. It works by transferring an existing balance from a different credit card and saving that money away for the duration of the 0% promotional offer. The money in the savings account will be generating interest and in the interim, we will need to make minimum monthly payments.

Stoozing is yet another one of my Free Money Income Streams. The difference with this one is that it requires a certain amount of funds to cover for debt repayments. Having accrued nearly £1,000 in the Cash Reserves Pot, I am finally in a position to build up a Stoozing Fund. In this post, I will document my methods and my line of thought. I hope that you find them useful for your own purposes.

What do I need to make money from Stoozing?

Making money from Stoozing is like following a recipe: you need a number of ingredients and a process to follow in order to deliver the desired outcome.

Stoozing resources:

- A Credit Card 0% Balance Transfer Promotional Offer (the longer the duration, the higher the profits).

- Funds to invest (unless you opt for a Money Transfer instead of a Balance Transfer).

- A savings account to park borrowed money so that it generates interest over time.

- A pool of your own money to cover for credit card monthly payments.

Having those in place, the process consists of:

- Balance transfer the relevant amount to then deposit an equal amount of money in a savings account.

- Set up minimum monthly payments on the credit card.

- Watch the savings account grow and make sure monthly payments are met so that no disruptions are experienced.

- At the end of the 0% promotional offer: cancel off the remaining debt, pay yourself back and collect your profits.

- Repeat.

Stoozing Round 3: an addition of £5,000 to the Stoozing Fund

My previous stoozing exercise involved £2,500 (see post How to make Free Money from Credit Cards – Stoozing 2.0). By now, things will be evolving at twice the speed. This story begins by me having £5,000 of credit card debt and an equal amount of £5,000 sitting idle in my bank account. The way I perceive things, I feel that I have three basic options:

1. Spend £5,000 and keep the £5,000 debt.

2. Pay off my £5,000 debt.

3. Make Free Money out of my £5,000 debt.

And the winner is… Option number 3. I know. I know. Not much of a surprise really. Well, let’s forget about originality awards for a minute and concentrate on the task at hand.

The Virgin Credit Card 0% Balance Transfer Promotional Offer

Right. It goes without saying that the most important ingredient of the recipe is the Balance Transfer offer. No offer available means no Stoozing. As simple as that. Also a not good enough offer means there is no business case. So not any offer will do and we need to run some numbers first. In my personal case, I do wait for the one that best suits me to come along. As it turns out, these are the main parameters of the Virgin Credit Card 0% Balance Transfer Offer:

- Credit Limit: £12,000

- Balance Transfer Fee: 3.45%

- Monthly repayments: 2% of outstanding balance

- 0% interest payments for 29 months

Can I balance transfer more than £5,000? Yes, I can. But I will take one step at a time and will stick to £5,000 for the time being. Hopefully my logic will make sense to you by the time you finish reading.

If I balance transfer £5,000 how much Free Money can I make?

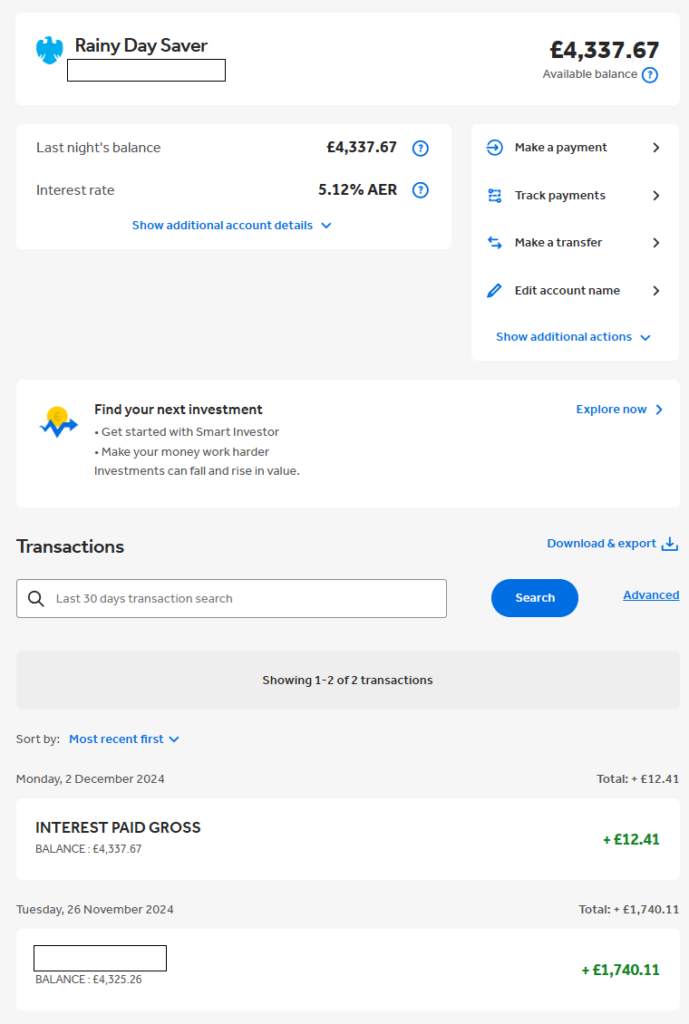

In other words, how much money from interest payments can I expect over 29 months by depositing this money in a savings account? All things remaining equal over time, the best option available to is me is the Barclays Rainy Day Savings Account which offers an annual interest of 5.12% (Monthly Compound Interest: 0.417%). Using these inputs, the projection thrown by my spreadsheet looks as follows:

The projection shows that depositing £5,000 in a savings account at an annual 5.12% interest rate will yield £641 in gross profit after 29 months.

Credit Card Repayment Plan Projection

Is not all about profits I am afraid. For this system to work smoothly, we need to make sure that monthly repayments are made. It is fairly simple to produce a cash flow projection with the help of a very basic spreadsheet.

- Loan amount: £5,000 ; Balance Transfer Fee: £172.50 (3.45%) –> Total Debt: £5,172.5

- Monthly payment: 2% of the outstanding balance.

In summary: I will to need a total of £2,235 to cover for credit card repayments over 29 months. The outstanding amount at the end of the offer will be £2,938.

Net Profit, Break Even and Return on Investment

Three more indicators are required to assess this investment exercise. To obtain them, a full cash flow plan can be developed from the two previous projections.

£,5000 BT Virgin Credit Card Stoozing Summary

Expected Gross profit: £641

Expected Net Profit: £641 – £172 = £469

Return on Investment (ROI) = Net Profit / Own Funds = £469 / £2,235 = 21%

Break Even: 8 months

Indicators ticked off. Final step is Resource Planning.

A risk free money stream providing with a 21% return on investment using someone else’s money is an absolute no brainer in my book. However, I need to make sure the way is paved so that no bumps are expected further ahead. By that, I mean that I need to ensure that I have sufficient funds in the Cash Reserves Pot to satisfy monthly debt payment requirements.

Cash Reserves Pot Flows to meet monthly credit card repayments.

December 2024 is the date I picked to give a boost to my Stoozing Fund. This is not by chance. Since this is the second Balance Transfer I incur into, I need to understand in full detail my monthly outgoings over the next 12 months.

The calculation shows that I am going to have to come up with a total of £1,379 or an average of £115 per month from Free Money Sources in 2025.

As of December 2024, I have £740 sitting in the Cash Reserves Pot. That is to say that I will be £640 short this time next year if I do nothing. Knowing that I am planning to make £1,500 Free Money every year, allocating £150 to the Cash Reserves Pot (10%) will just not do. Not only that, I will need a surplus to cover for next years repayments.

Al in all, this new scenario demands a change in investment strategy where at least 50% of my Earnings end up in the Cash Reserves Pot. I sure can do that but let me worry about it when I devise my plan for 2025. For now, suffice to say that I am well in the clear. On the other hand, let’s not forget that at the end of every promotional offer I will recoup my funds and automatically replenish the Cash Reserves Pot with them (£534 in February 2026 and £2,235 in June 2027).

The Ball is Rolling. What’s next?

First and foremost, a new tracker is required to follow my Stoozing position by the minute. In this sense, The Stoozing Fund Tracker is officially live as of December 2024.

The Stoozing Fund will be split in three different Savings Accounts.

Second, I am capturing for the record the balance transfer transactions as well as my the savings accounts I will be using exclusively for Stoozing.

The three nominated Savings Accounts are as follows:

- Barclays Rainy Savings Account (5.12% AER)

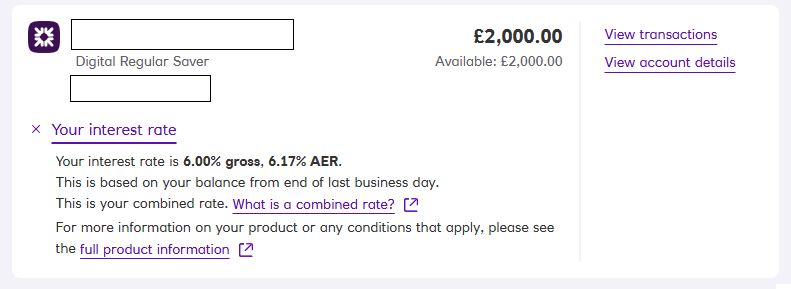

- Natwest Digital Regular Saver (6.17% AER)

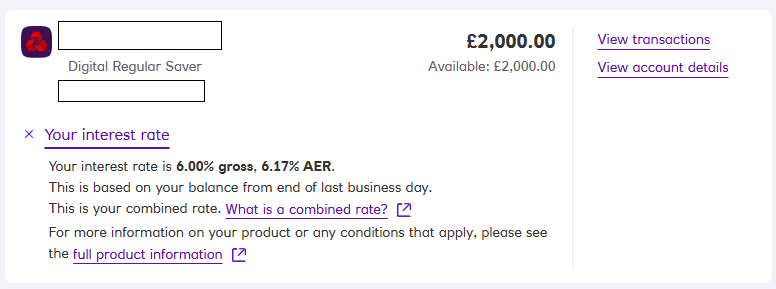

- RBS Digital Regular Saver (6.17% AER)

Why this split?

Obviously Natwest and RBS provide with a higher interest yield, problem is I can only deposit a maximum of £150 per month on each. I saved up during 2024 ending up with a nice round amount of £4,000 (£2,000 + £2,000). And yes, you guessed right: I have always had a goal in mind of using these two savings accounts for stoozing at the end of the year by offsetting debts with savings.

As for the Barclays Rainy Savings Account, this is the second best option at my disposal where I can deposit up to a maximum of £5,000 returning an interest of 5.12%. I placed the initial £2,500 from the first Balance Transfer there (see post How to make Free Money from Credit Cards – Stoozing 2.0). The remaining £1,000 alongside the £740 from the Cash Reserves Pot have also been transferred into this account to maximise interest earnings.

My Plan is to drip feed £300 on a monthly basis (£150 + £150) to the other two savings accounts and also withdraw as of when required to meet credit card repayments from the Cash Reserves Pot.

Balance Transfer Transactions and Fees.

Lastly, balance transfer transactions and fees are shown below as evidence. I shifted my previous existing debt from another two credit cards in two chunks of £4,000 and £1,000 attracting fees of £138 and £34.5 respectively.

As a result, a newly acquired liability of £5,172.5 comes to be.

| Month | Savings 1 | Savings 2 | Savings 3 | Cash Pot | Total Savings | Credit Card 1 | Credit Card 2 | Total Debt | Net Value | Net Profit |

| Dec 2024 | £4,338 | £2,000 | £2,000 | £740 | £7,598 | £2,363 | £5,172 | £7,536 | £62 | -£162 |

That’s it. Second Stoozing round is completed. Needless to say that my mind is set into growing the Stoozing Fund as much as possible for as long as possible. It will not happen overnight but rather one step at a time. Slowly but surely. Stay with me to find out how far I can get. In the meantime, happy stoozing.