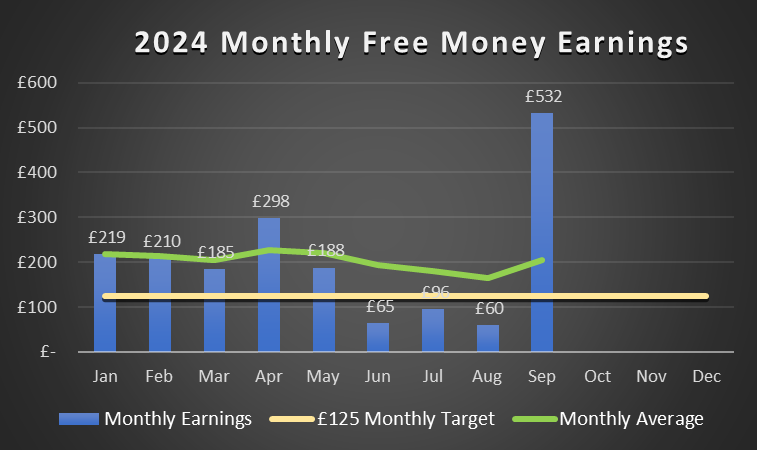

September 2024 Free Money Earnings Report £532

Bank Rewards: £18

- Santander Lite Bank Account: £4

- Halifax Reward Account: £5

- Barclays Blue Rewards: £3

- RBS My Rewards: £3

- Natwest My Rewards: £3

Interest on Savings: £14

- RBS Regular Saver: £7

- Natwest Regular Saver: £7

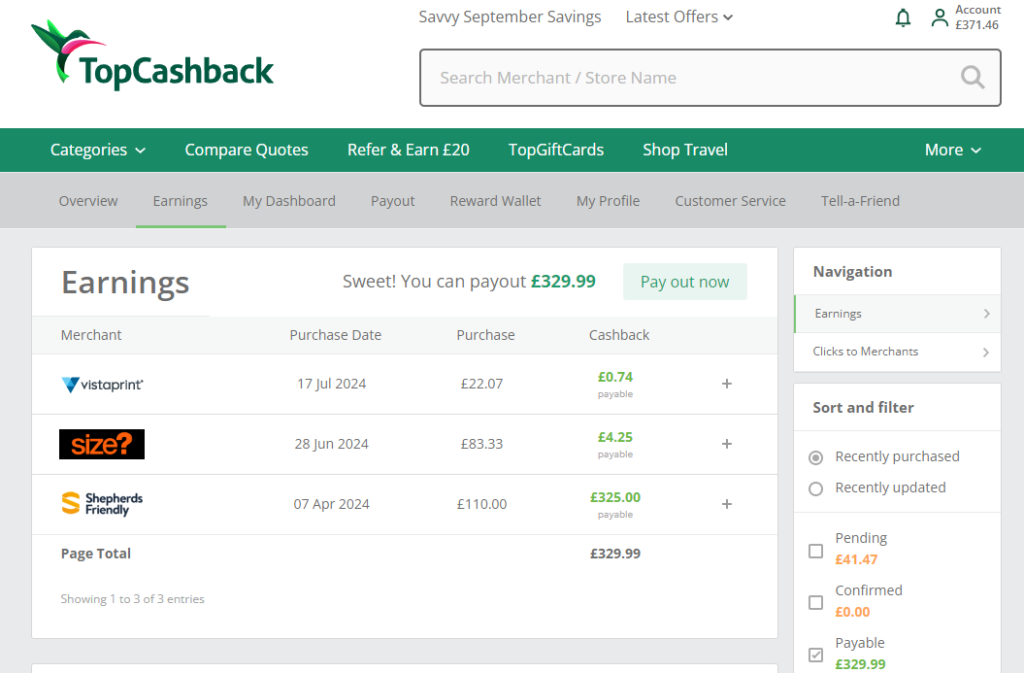

Cashback: £344

- Stocks & Shares ISA: £325

- AMEX Credit Card: £19

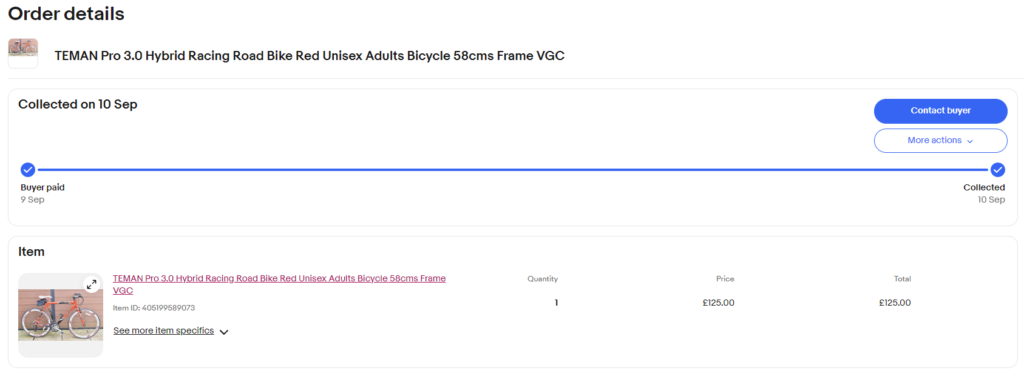

Decluttering Sales: £108

- Road Bicycle: £108

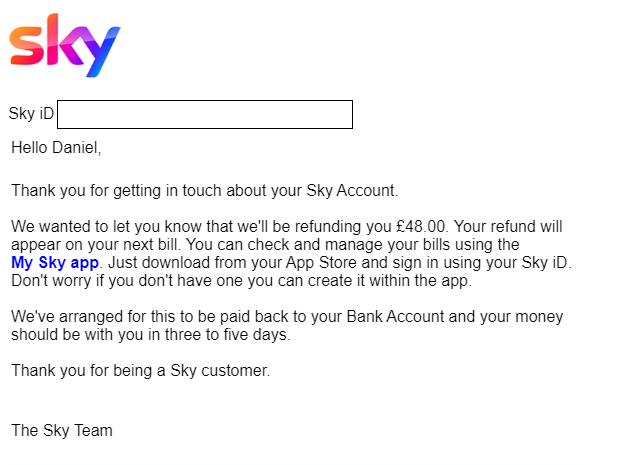

Freebies: £48

- Sky TV refund: £48

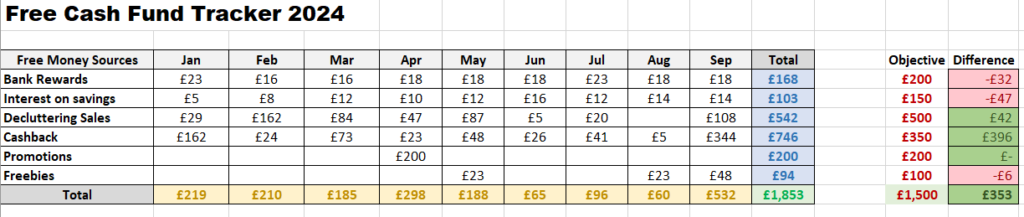

| Month | Free Money Earnings | +/- Monthly Target (£125) | Accumulative | to Year End Objective (£1,500) |

| January | £219 | +£94 | £219 | £1,281 |

| February | £210 | +£85 | £429 | £1,071 |

| March | £185 | +£60 | £614 | £886 |

| April | £298 | +£173 | £912 | £588 |

| May | £188 | +£63 | £1,100 | £400 |

| June | £65 | -£60 | £1,165 | £335 |

| July | £96 | -£29 | £1,261 | £239 |

| August | £60 | -£65 | £1,321 | £179 |

| September | £532 | +£407 | £1,853 | +£353 |

Off the charts earnings in September 2024. Literally. £532 are not only the highest monthly takings this year but also signify a yearlong achievement. I have smashed the annual £1,500 objective already with a Grand Total of £1,853 Free Money Earnings from January to September. Job done. It works out at an average monthly earnings of £206 and remember, it has been virtually zero work for this money to land into my lap.

Bank rewards. £18 is my monthly motto from Bank Perks. Barclays stopped its Blue Rewards Cash payment as of September 2024. Having collected the last one for now, I have managed to opt back into cash rewards with my second Halifax Account. The net result should be a +£2 if we consider that I am saying good bye to £3 from Barclays but welcoming £5 from Halifax almost simultaneously. I should see whether or not £20 is the new baseline from October 2024 on.

Interest on Savings. I am not breaking away from £14 here. On a personal level, I am now in a position where I have breathing space to start new savings pots on top the Natwest/RBS duet. I will strive to scratch every single pound available to me in order to meet my £150 annual objective for this stream. Three more months to go and I am trailing £47 behind. At a £15-ish monthly rate it is going to be close.

Cashback. Huge £325 pay-out as a result of opening a Stocks & Shares ISA. Cracking reward arriving sooner than expected. I explained it all in my post I made £325 Cashback by opening a Stocks & Shares ISA. Worth a reading. In addition, I resumed using my AMEX Credit Card resulting in an additional £19 cashback reward. I have made £746 from Cashback alone in nine months. Feeling tremendous about this.

Decluttering Sales. I sold my road bicycle for £125 on eBay which left a £108 profit after fees. A reluctant sale to be honest as it was a beautiful bike but a necessary one since I truly lack the motivation or the willingness to cycle around anymore. There was no sense in it rusting away so I reasoned that it was for the better to find a new home where it could be given purpose and use. Needless to say that the new owner was absolutely thrilled with the purchase. The bike had very little use and was in great condition. Shame really but time to move on with my sporting interests. I will not shed any tears but I must admit that I did not experience a happy feeling letting it go. Anyways, the ledger shows £542 after nine months of activities selling my personal items. That is £42 over a £500 annual objective. Another tick in the box.

Freebies. A £48 refund from Sky. I have no clue where it comes from or why it is due. I most certainly have not claimed it but it was credited back nevertheless. I will not challenge their decision. You see, that is the thing with Freebies: they just happen and one cannot predict when or where from. I am counting £94 from freebies in total. I need another £6 to deliver a £100 annual objective.

In summary, I do not need to worry about a £1,500 annual objective anymore. It has been left well behind in a single go. However, I set out 2024 with a number of quantifiable Free Money Streams Objectives to be met. How far am I as regards to delivering all of them? The Tracker shows 50/50 with the most relevant ones in terms of volume already achieved (sales, cashback and promotions). I need an ever so small effort for bank rewards, interest on savings and freebies. Mind due I have very little room to manoeuvre considering the fact that the three of them are almost passive income. In any event, I am confident that things will pan out well. Not long to find out though.

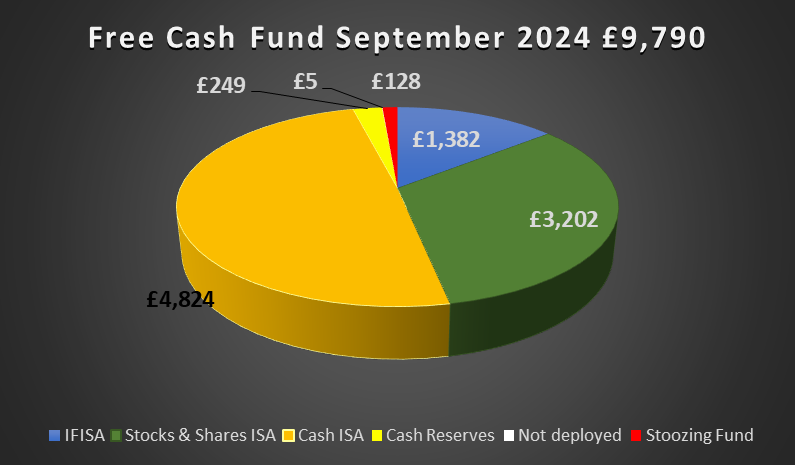

What about the Free Cash Fund?

I am looking at a value of £9,790 as a result of having invested £8,905 in a basket of ISAs. Main point for me is that a mere £210 is what separates me from the £10,000 milestone figure. Just one month’s worth of average earnings. I do not mean to come across as cocky but I can clearly visualise that money in my pocket before 2024 comes to an end. Can’t wait to close this gap… TBC.