Save Thousands by using Free Money to Pay-off your Mortgage

Am I better off saving or paying-off my mortgage?

Is it a good financial decision to pay-off your mortgage early?

How much can I save if I repay my mortgage?

All these are perfectly valid questions and the answer to them might be down to personal choice or opinion to a certain degree. However, unless the choices are quantified and be made comparable in financial terms, it will not be possible to assign a weight to different money allocation options. I will try to bring some light into the actual costs of having a mortgage so that with the figures at hand, an informed decision can be made.

How much do I pay in interest cost over the life of a Mortgage?

For illustration purposes, let me use the average mortgage parameters in the UK at the time of writing these lines (Source: https://www.mortgageable.co.uk May 2021):

Length of Mortgage: 25 Years

Annual Mortgage Interest Rate: 2.48%

Mortgage Value: £162,000

Monthly Payments (Capital Repayment + Interest): £723

Should all things remain equal throughout the life span of the mortgage, a simple calculation will provide us with an indication of the overall sum to be paid back.

£723 per month x 12 months per year x 25 years = £216,900

The difference in between this figure and the mortgage value is the actual mortgage interest cost (other fees and costs not considered):

£216,900 – £162,000 = £54,900

In other words, you will end up paying nearly 34% more than the value of the mortgage. These proceeds will be pocketed by your lender as operational profit (no need to be selfish here). Should anything go wrong at any point during the duration of the mortgage agreement (ie: finding yourself unable to meet your financial commitments towards the bank), the lender can exert the option to take your house as collateral to pay off the debt. Not a bad business model at all.

Bear in mind that we are going through a period of historically low interest rates. That is to say, that it is highly unlikely that interest rates will remain as low as they are at present over a 25 year period. Chances are that interest will rise at some point and they will keep this uptrend. That will obviously imply a higher interest cost than the one shown. To get a better understanding of the costs involved, the table below exemplifies different scenarios of total mortgage payments with different interest rates and different mortgage life spans for a Mortgage Value of £162,000.

| Mortgage Length | 2.50% | 3.00% | 4.00% | 5.00% |

| 35 | £ 242,213 | £ 260,318 | £ 298,352 | £ 338,586 |

| 30 | £ 229,580 | £ 244,608 | £ 276,030 | £ 309,128 |

| 25 | £ 217,338 | £ 229,445 | £ 254,614 | £ 280,975 |

| 20 | £ 205,493 | £ 214,841 | £ 234,143 | £ 254,212 |

The first obvious conclusion is that the lower the interest rate and the lower the duration of the Mortgage, the lower the overall cost. The monthly payment will determine the outgoing the family unit is comfortable with in terms of finding the right spot in the matrix.

At one end: £856 monthly payment over 20 years at 2.5% interest £43,493 Mortgage Costs

At the opposite end: £806 monthly payment over 35 years at 5% interest £176,586 Mortgage Costs (4.5 times more expensive).

The second not so obvious conclusion is that paying-off your mortgage early can save you thousands of pounds in interest costs. The longer the time span and the higher the interest, the greater the saving (see obvious conclusion one). The next question is: how much can I actually save?

How do Mortgages work and How is the Interest Cost calculated?

In short, a Mortgage works by accepting a Lump Sum from a Lender and entering a legal contract which will require to pay it back in considerably smaller monthly payments over the duration of the Mortgage Agreement. Once the last payment is made (years into the future) the debt is settled.

Considering by default a capital repayment mortgage (the most common type of residential mortgage), the montly payment gets split into two components: one goes towards paying back the initial sum lent or capital repayment, and the second one goes towards paying the interest of the debt.

One might assume that this is a 50/50 split, 50% of the monthly payment is destined to pay back the mortgage value and 50% of the monthly payment is used to pay for the interest. Well, not quite. The mortgage lender makes a profit by keeping the second portion of that monthly payment, and that portion size depends on the outstanding capital amount pending, the agreed interest rate and the length of the mortgage.

As time goes by and we gradually pay off the mortgage value, the interest portion of the monthly payment decreases, and the capital repayment portion increases. This process remains somehow hidden because the monthly payment stays the same and we are just happy because ‘we are paying the mortgage off’. Well, hold tight and brace yourself for a surprise. Let me show you what actually do happen inside the Average UK Mortgage Black Box.

The interest portion of the montly payment

Length of Mortgage: 25 Years

Annual Mortgage Interest Rate: 2.48%

Mortgage Value: £162,000

Monthly Payments (Capital Repayment + Interest): £723

First of all, how do they work out the interest portion of the monthly payment? Two numbers are needed: the first one is the outstanding debt (ie: £162,000) and the second one is the equivalent monthly interest rate which is obtained from the annual interest rate (2.48% annual is translated into a 0.204% monthly interest rate).

So, if we multiply £162,000 x 0.0020435, we come up with £331.

So, out of our first monthly payment of £723, £331 will go towards interest payments and the remaining £392 towards paying off the mortgage value reducing the debt to £161,608.

The second monthly instalment break down will work like this:

£161,608 x 0.0020435 = £330 Interest

£723 – £330 = £393 Capital Repayment

Outstanding Debt = £161,608 – £393 = £161,215

The third monthly payment:

£161,215 x 0.0020435 = £330 Interest

£723 – £330 = £393 Capital Repayment

Outstanding Debt = £161,215 – £393 = £160,822

And so on… until one fine day 299 months down the line, you meet your last payment made of £1.5 interest and £722.5 Capital Repayment. Good luck with that.

You pay significantly more interest in the first years of the Mortgage

But let’s concentrate on the first year of the Mortgage. Interest payments: £3,919 ; Capital Repayment: £4,755

Almost a 50/50 split in the first year of payments. Problem is we have not paid back as much as we hoped for and things are not going to change dramatically over the following first years. See table below:

| Year | Remaining | Interest | Capital | Total |

| 1 | £ 157,245 | £ 4,241 | £ 5,157 | £ 9,397 |

| 2 | £ 152,372 | £ 8,032 | £ 10,039 | £ 18,072 |

| 3 | £ 147,378 | £ 11,703 | £ 15,043 | £ 26,746 |

| 4 | £ 142,261 | £ 15,249 | £ 20,171 | £ 35,421 |

| 5 | £ 137,016 | £ 18,668 | £ 25,427 | £ 44,095 |

| 6 | £ 131,642 | £ 21,957 | £ 30,812 | £ 52,769 |

| 7 | £ 126,134 | £ 25,112 | £ 36,331 | £ 61,444 |

| 8 | £ 120,489 | £ 28,131 | £ 41,987 | £ 70,118 |

| 9 | £ 114,705 | £ 31,009 | £ 47,784 | £ 78,793 |

| 10 | £ 108,777 | £ 33,743 | £ 53,724 | £ 87,467 |

| 11 | £ 102,702 | £ 36,331 | £ 59,811 | £ 96,142 |

| 12 | £ 96,476 | £ 38,767 | £ 66,049 | £ 104,816 |

| 13 | £ 90,096 | £ 41,048 | £ 72,442 | £ 113,491 |

| 14 | £ 83,558 | £ 43,171 | £ 78,994 | £ 122,165 |

| 15 | £ 76,858 | £ 45,131 | £ 85,708 | £ 130,839 |

| 16 | £ 69,991 | £ 46,925 | £ 92,589 | £ 139,514 |

| 17 | £ 62,954 | £ 48,548 | £ 99,640 | £ 148,188 |

| 18 | £ 55,743 | £ 49,997 | £ 106,866 | £ 156,863 |

| 19 | £ 48,353 | £ 51,266 | £ 114,271 | £ 165,537 |

| 20 | £ 40,779 | £ 52,351 | £ 121,860 | £ 174,212 |

| 21 | £ 33,018 | £ 53,249 | £ 129,637 | £ 182,886 |

| 22 | £ 25,064 | £ 53,953 | £ 137,607 | £ 191,560 |

| 23 | £ 16,913 | £ 54,460 | £ 145,775 | £ 200,235 |

| 24 | £ 8,560 | £ 54,764 | £ 154,145 | £ 208,909 |

| 25 | £ 721 | £ 54,861 | £ 162,000 | £ 216,861 |

What does it look like at the end of year 12 (halfway through the life span of the mortgage)?

- Remaining debt: £96,476

- Total interest paid: £38,767

- Total capital returned: £66,049

- Payments made: £104,816

Let’s have a closer look at theses figures so that we can interpret them on a different context:

- 60% (£96,476) of the debt is still outstanding.

- We have paid the lender an obscene £38,767 in interest (or 70% of the total £54,861 projected interest figure).

- Approximately 40% of the total payments made have been used to service the interest of the debt.

I am not sure what you make of this, but to me, this is totally and utterly outrageous. More so, if you take into consideration that we are looking at a mere 2.48% annual interest mortgage. Monthly payments are designed in such a way that you make the biggest contributions towards interest payments in the first years of the mortgage life. Why not the other way round (more contributions towards capital repayment and less towards interest)? To put it bluntly, because the game is rigged in favour of the lender. Take it or leave it.

You can save thousands by paying-off your mortgage early

On the light of these figures, is it worth it to pay-off your mortgage early?

If you want to save thousands in interest payments, then the answer is yes. If you are ok with the lender making money out of thin air by pocketing your hard earned cash, then the answer is I could not be bothered. As for me, I will do anything in my power to pay it off as soon as possible for the following reasons:

a) To save myself a fortune in interest payments.

b) To reduce my exposure and my risk. The sooner the debt is settled, the less likely the chance that the lender will take that asset from me.

c) To increase my wealth. If my house goes up in value and my debt gets diminished, my Personal Net Value will be significantly higher.

d) To maximise the opportunity cost of my available investment opportunities.

e) To find peace of mind. No need to elaborate on this one.

I firmly believe that my reasons are solid and that my logic is undeniable (I heard that somewhere and I liked it). However, let me run some numbers based on different what if scenarios, so that they can do the talking for me.

Scenario 1: pay £100 back per month or £1,200 per year

Projection is shown on the table below:

| Year | Remaining | Interest | Capital | Total |

| 1 | £ 156,045 | £ 4,238 | £ 5,153 | £ 9,392 |

| 2 | £ 150,009 | £ 7,998 | £ 9,996 | £ 17,994 |

| 3 | £ 143,893 | £ 11,610 | £ 14,919 | £ 26,528 |

| 4 | £ 137,696 | £ 15,070 | £ 19,922 | £ 34,992 |

| 5 | £ 131,420 | £ 18,377 | £ 25,005 | £ 43,381 |

| 6 | £ 125,065 | £ 21,529 | £ 30,166 | £ 51,695 |

| 7 | £ 118,632 | £ 24,524 | £ 35,405 | £ 59,929 |

| 8 | £ 112,123 | £ 27,360 | £ 40,720 | £ 68,080 |

| 9 | £ 105,541 | £ 30,036 | £ 46,109 | £ 76,145 |

| 10 | £ 98,886 | £ 32,550 | £ 51,569 | £ 84,118 |

| 11 | £ 92,164 | £ 34,899 | £ 57,097 | £ 91,996 |

| 12 | £ 85,377 | £ 37,083 | £ 62,688 | £ 99,771 |

| 13 | £ 78,531 | £ 39,099 | £ 68,339 | £ 107,438 |

| 14 | £ 71,632 | £ 40,947 | £ 74,041 | £ 114,989 |

| 15 | £ 64,688 | £ 42,625 | £ 79,788 | £ 122,414 |

| 16 | £ 57,709 | £ 44,133 | £ 85,569 | £ 129,702 |

| 17 | £ 50,707 | £ 45,469 | £ 91,372 | £ 136,841 |

| 18 | £ 43,698 | £ 46,633 | £ 97,179 | £ 143,812 |

| 19 | £ 36,705 | £ 47,625 | £ 102,969 | £ 150,594 |

| 20 | £ 29,756 | £ 48,447 | £ 108,711 | £ 157,158 |

| 21 | £ 22,893 | £ 49,099 | £ 114,362 | £ 163,461 |

| 22 | £ 16,178 | £ 49,585 | £ 119,855 | £ 169,441 |

| 23 | £ 9,717 | £ 49,910 | £ 125,078 | £ 174,988 |

| 24 | £ 3,718 | £ 50,082 | £ 129,788 | £ 179,870 |

| 25 | £ 313 | £ 50,124 | £ 133,200 | £ 183,324 |

You will end up saving £4,737 (54,861 – 50,124) pounds in interest payments.

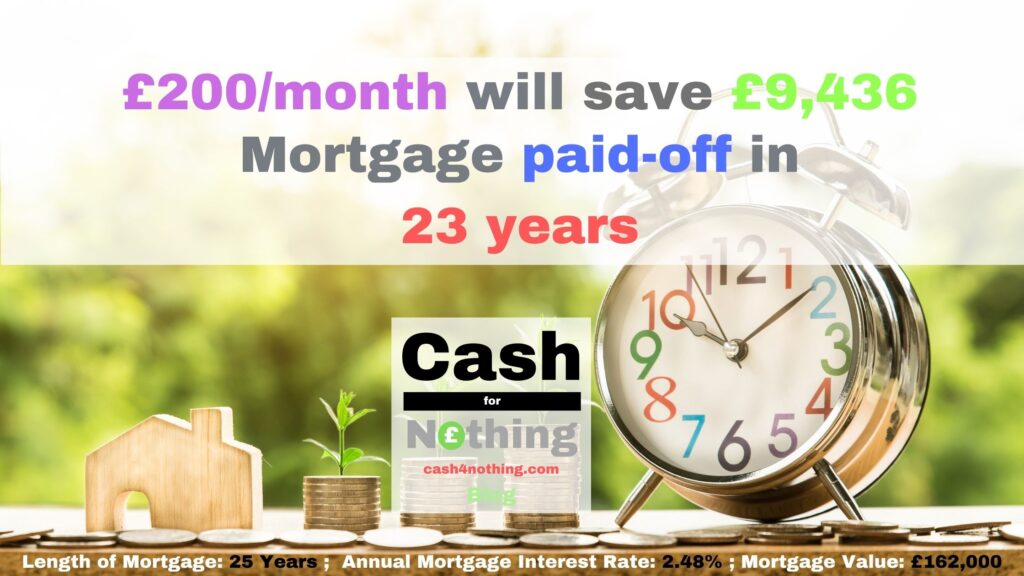

Scenario 2: pay £200 back per month or £2,400 per year

| Year | Remaining | Interest | Capital | Total |

| 1 | £ 154,845 | £ 4,236 | £ 5,150 | £ 9,386 |

| 2 | £ 147,646 | £ 7,965 | £ 9,952 | £ 17,917 |

| 3 | £ 140,408 | £ 11,516 | £ 14,794 | £ 26,311 |

| 4 | £ 133,132 | £ 14,890 | £ 19,672 | £ 34,563 |

| 5 | £ 125,824 | £ 18,085 | £ 24,583 | £ 42,668 |

| 6 | £ 118,488 | £ 21,100 | £ 29,520 | £ 50,620 |

| 7 | £ 111,131 | £ 23,935 | £ 34,479 | £ 58,414 |

| 8 | £ 103,758 | £ 26,590 | £ 39,453 | £ 66,043 |

| 9 | £ 96,377 | £ 29,063 | £ 44,434 | £ 73,497 |

| 10 | £ 88,996 | £ 31,356 | £ 49,414 | £ 80,770 |

| 11 | £ 81,626 | £ 33,468 | £ 54,382 | £ 87,850 |

| 12 | £ 74,278 | £ 35,399 | £ 59,327 | £ 94,726 |

| 13 | £ 66,966 | £ 37,151 | £ 64,235 | £ 101,385 |

| 14 | £ 59,706 | £ 38,724 | £ 69,089 | £ 107,812 |

| 15 | £ 52,518 | £ 40,119 | £ 73,868 | £ 113,988 |

| 16 | £ 45,426 | £ 41,340 | £ 78,550 | £ 119,890 |

| 17 | £ 38,459 | £ 42,389 | £ 83,104 | £ 125,493 |

| 18 | £ 31,654 | £ 43,269 | £ 87,492 | £ 130,761 |

| 19 | £ 25,057 | £ 43,985 | £ 91,666 | £ 135,651 |

| 20 | £ 18,733 | £ 44,542 | £ 95,561 | £ 140,103 |

| 21 | £ 12,767 | £ 44,950 | £ 99,086 | £ 144,036 |

| 22 | £ 7,292 | £ 45,217 | £ 102,104 | £ 147,321 |

| 23 | £ 2,520 | £ 45,360 | £ 104,382 | £ 149,742 |

You will save £9,436 in Interest Payments and the mortgage will be paid after 23 years and 8 months.

Scenario 3: pay £300 back per month or £3,600 per year

You will save £14,026 in Interest Payments and the mortgage will be paid after 21 years and 7 months.

Pay-off Saving Scenarios from £4,700 to £21,700 Saving

| Paid Back/Month | Paid Back/Year | Saving | Mortgage paid off in |

| £ 100 | £ 1,200 | £ 4,737 | 25 yrs |

| £ 200 | £ 2,400 | £ 9,436 | 23 yrs 8 months |

| £ 300 | £ 3,600 | £ 14,026 | 21 yrs 7 months |

| £ 400 | £ 4,800 | £ 18,130 | 19 yrs 4 months |

| £ 500 | £ 6,000 | £ 21,690 | 17 yrs 3 months |

Am I really better off saving?

One might say “I am not convinced. If I had £1,200 available, I will save it away in a Cash ISA at 1% per year.”

Down to personal choice. As for me, the numbers are clear. A £1,200 mortgage part redemption payment in the first year, will reduce my mortgage monthly payments from £722.87 to £717.35, a £5.52 saving per month or £66.24 per year.

That is equivalent to saying that paying off £1,200 in your first year will deliver a 5.52% return in terms of a saving for 24 years

To me, 5.52% are 5.52 higher than 1%. Truth to be told, I will have to wait until I sell the property to recoup the money but I still have 5 powerful reasons to use my available cash to clear off my biggest debt.

We can look at it from a different perspective: only if I can find a tax free risk free investment delivering over 6% per year, I will be incurring in an opportunity cost. Otherwise, I am much better off using that £1,200 spare cash to pay-off for my mortgage.

A £1,200 mortgage part redemption payment in the second year, will reduce my mortgage monthly payments from £717.35 to £711.66, a £5.69 saving per month or £68.32 per year for 23 years. A return of 5.69%.

An so on…

| Years | Monthly Payment | £1,200 Saving Return |

| 25 | £ 722.87 | |

| 24 | £ 717.35 | 5.52% |

| 23 | £ 711.66 | 5.69% |

| 22 | £ 705.77 | 5.89% |

| 21 | £ 699.68 | 6.10% |

| 20 | £ 693.35 | 6.33% |

| 19 | £ 686.76 | 6.59% |

| 18 | £ 679.88 | 6.88% |

| 17 | £ 672.68 | 7.20% |

| 16 | £ 665.12 | 7.56% |

| 15 | £ 657.14 | 7.97% |

| 14 | £ 648.70 | 8.45% |

| 13 | £ 639.71 | 8.99% |

| 12 | £ 630.08 | 9.63% |

| 11 | £ 619.70 | 10.38% |

| 10 | £ 608.41 | 11.29% |

| 9 | £ 596.02 | 12.39% |

| 8 | £ 582.24 | 13.78% |

| 7 | £ 566.68 | 15.56% |

| 6 | £ 548.74 | 17.94% |

| 5 | £ 527.46 | 21.27% |

| 4 | £ 501.19 | 26.27% |

| 3 | £ 466.58 | 34.61% |

| 2 | £ 415.30 | 51.29% |

| 1 | £ 313.96 | 101.33% |

In practical terms, I will diversify my money allocation but there are no mistakes to be made. On the light of these figures and from a personal perspective, paying-off my mortgage comes at the very top of my list. I do not expect for everyone to hold the same opnion as regards to mortgages. What I do hope is that this post helps you understand the actual cost of a mortgage and whether or not you should take any kind of action to save some money in interest payments.

Bookmark & Subscribe

If you do not want to miss on any of it, please bookmark this page and subscribe to our newsletter for the latest developments, money making hints & tips, financial education and saving & investment strategies.

For the record and just in case you are wondering, the financial formula to obtain the equivalent monthly interest rate (m) from the annual interest rate (i) is as follows:

1 + i = (1 +m)^12

m = (1+i)^(1/12) -1