Investing the Free Cash Fund for Growth

My Plan is coming to fruition and working as expected in two ways: I am building a Free Money Pot and I have also created the basic foundation for the free cash streams to consistently contribute to its growth. It could be a case of just piggy banking my free cash, set it aside and drip-feeding it as the money flows in from my different free money income sources. It will be not be the most effective proposition in the long term, because I will be clearly missing out on opportunities for further growth and the Money Pot will have its value reduced over time due to inflation.

Investment Requirements

In order to make a transition from a Free Cash Pot to a Free Cash Fund, the Money needs to be put to work so that it grows far beyond the individual cash contributions as time goes by. On the other hand, I am not a broker or a trader and I certainly do not intend to monitor my fund on a multiscreen setup 24/7, so it is important to clearly identify my needs beforehand to define a consistent investment strategy. In this sense, there are three basic requirements that need to be met:

- Diversification. Not all eggs will go in one basket. Goal: Spread and reduce risk.

- Passive Investment. I will not be actively managing my Fund. Goal: Invest and forget.

- Tax free. I want to avoid picking up a tax bill. Goal: Shield against taxes.

Let me highlight again that this is Free Money by definition. There are two basic implications on that statement. First is that it is Money I can afford to lose meaning I can take a riskier approach when it comes to allocating the funds for investment. Second is that is Money that will not be needed in the short term, and as a result, I am comfortable with it being ‘stashed’ away in an investment proposition that will require a reasonable amount of time to be released should there be a need to cash-in in the future.

Individual Savings Accounts ISAs

All things considered, there is one mechanism which will satisfy my saving and investment criteria: the Individual Saving Account or ISA. The ISA will allow me to save tax-free into a saving or investment account. There are a number of different types of ISAs: Cash, Stocks & Shares, IFISA, Help to Buy, Lifetime and Junior ISA. Since I am already a home owner and I would require for my fund to be available for me at any given time, I can automatically rule out the last three of the previous list as I do not meet the criteria or they do not align with my strategy.

I am left with three ISA types to allocate the fund: Cash ISA, Stocks & Shares ISA and Innovative Finance ISA. A brief description follows for each one of them.

Cash ISA. Works as a savings account except that there is a limit of £20,000 deposits per year. As an ISA, no tax is paid on interests accrued.

Stocks & Shares ISA. An investment account where all capital gains and income are protected from tax. It can be actively managed by a third party in which case it will attract management fees, or it can be managed by the account holder. Again, a limit of £20,000 deposits per year applies.

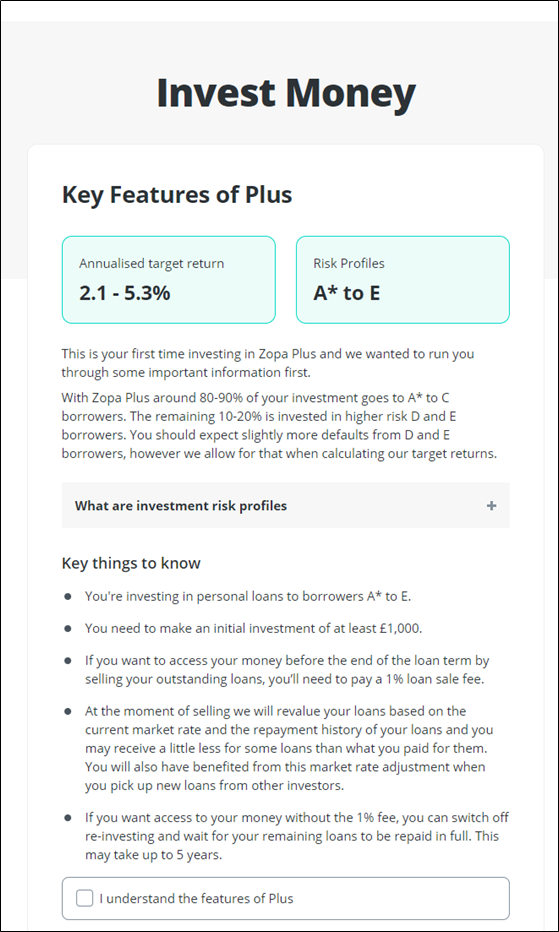

Innovative Finance ISA (IFISA). An innovative finance ISA will allow to invest your cash in peer-to-peer loans. Peer to peer lending matches investors with borrowers in the same fashion as a bank loan. The borrower will pay an interest on the money loaned from the investor which is proportional to the risk of the investment. The same £20,000 investment limit per year is applicable.

At the time of writing (March 2021) Cash ISAs offer a return from 0.5% 1 year fixed to 1.15% 5 year fixed. Assuming an inflation rate of 2% to 3%, it means that any money deposited in a Cash ISA will be losing purchasing power over time. Cash ISAs are risk free investments, but from my perspective, I am better off paying off my debts or my mortgage.

Stocks & Shares ISA and Innovative Finance ISA

I have narrowed down my selections to just two no risk-free options: S&S ISA and IFISA. I am aiming for 8% and 5% historic returns respectively. I fully understand that my investment will be at risk but my free money premises underlined previously are indicative of my profile: it is money I can afford to lose and it is money that I will not be needing in the short term.

I am aware of the fact that I could invest in lower or higher risk propositions such as stocks, precious metal commodities or Cripto-Currencies (ie: via Revolut), but at this moment in time, I will be avoiding these vehicles based on my criteria of Tax-Free Passive Investment requirements.

With regards to the risk spread, I will be investing 60% of my Free Cash Flows in an IFISA, 30% in a Stocks & Shares ISA, and finally, I will be keeping a 10% as cash reserves in view of future free money generation activities which will make use of this cash pot.

As an example of my strategy, for every £1,000 pounds invested at the beginning of the year, I will be expecting to obtain a return of £54 = £30 (£600*0.05) + £24 (£300*0.08) 1 year down the line. In practical terms, I will be happy with a 4% to 5% annual return on my Free Money.

Given the modest sums involved at the start of my new venture, I am confident that I will not go over my £20,000 allowance for the year in the short term. I am hoping to make things more challenging in this department in the not so distant future.

Criteria, Strategy and Portfolio defined, it is time to articulate them into an action plan. I have two accounts opened and ready for this purpose:

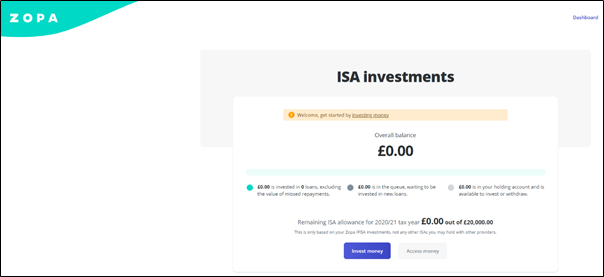

- ZOPA Peer to Peer IFISA.

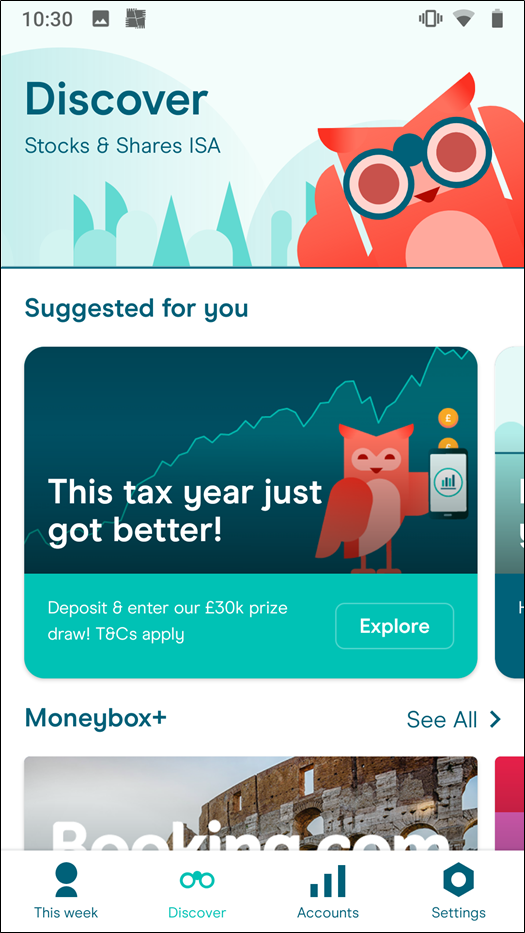

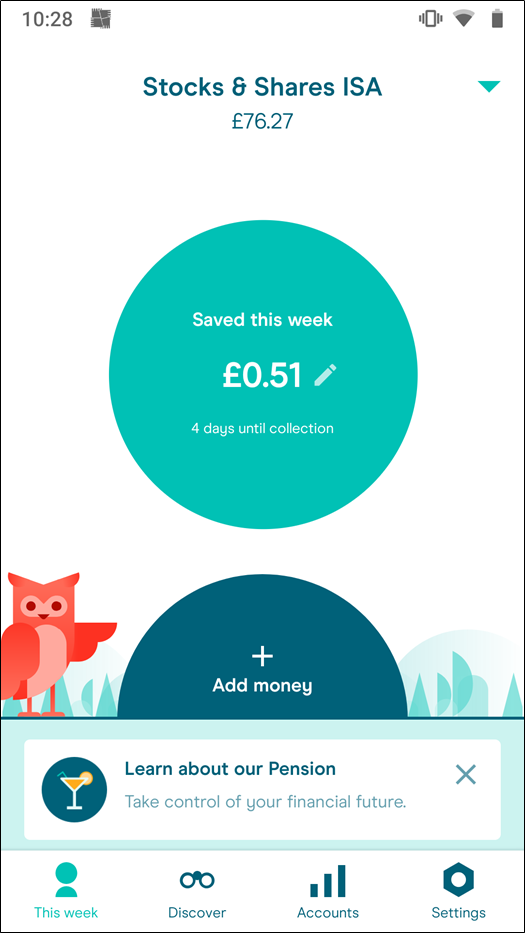

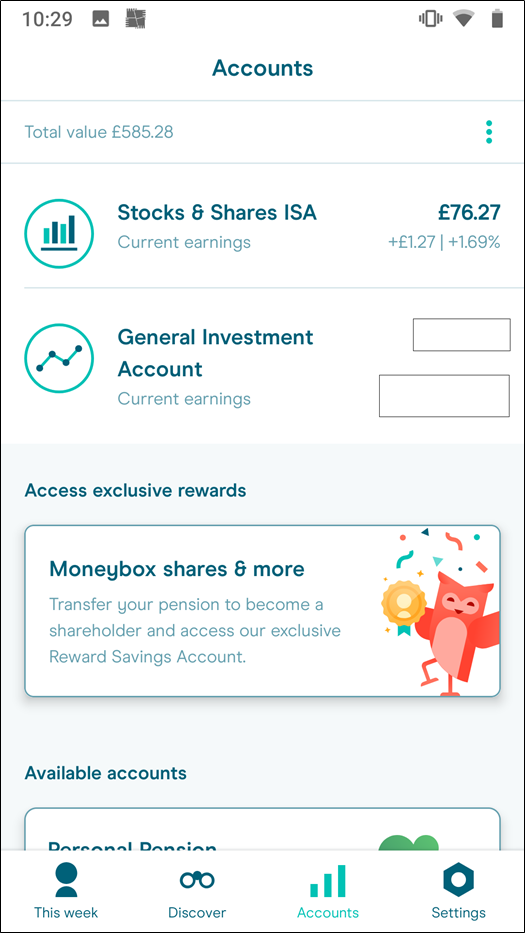

- Moneybox Stocks & Shares ISA.

My logic for selecting these two providers is mainly based on available public feedback and reviews and also my own experience using them. In this sense, ZOPA is not the only P2P services provider but they have been around for the longest period of time and have built a solid, professional and serious reputation.

As for Moneybox, they were one of the first personal investment apps to be launched in the market. Initially intended as a digital piggy bank to save your spare change and/or top up to grow your savings, it offers an interesting range of investment products to allocate your cash: from savings accounts to ISAs and Pensions. I happen to use this app quite regularly for a few years now and I have developed an appreciation for its products and its user-friendly interface.

My Free Money pot is £300 meaning a breakdown of £180 to IFISA, £90 to S&S ISA and £30 in cash reserves. There is a small problem though, as ZOPA requires a minimum investment of £1,000.

Can I ask for a loan to myself and pay it back with free money as it flows in? Yes, I guess I can but it would defeat the purpose of this exercise as the whole point is that I would not tie up any of my own cash. Can I get access to 0% interest cash and pay it back in instalments with my Free Cash? Yes. I most certainly can. But still early days. My Plan is to make use of this source as soon as I grow my Cash Reserves and my Free Cash Fund to a size that allows me to cover the payments for the loan for the duration of the promotion. Until then, the IFISA pot will be saved in my Moneybox General Investment Account (historic return of 4%) alongside my Emergency Fund of £1,000. In summary:

Free Cash Fund Allocation

- £180 Moneybox General Investment Account.

- £90 Moneybox Stocks & Shares ISA.

- £30 Cash Reserves.

We are evolving one step further as I have a Fund and not a Cash Pot anymore. To understand the distinction, we will have two indicators: Free Cash Accrued and Free Cash Fund. The bigger the positive value discrepancy between them two, the better the Fund Investments will be performing.