I made £325 Cashback by opening a Stocks & Shares ISA

April is the time of the year which triggers the start of the new fishing season. That is to say that coinciding with the beginning of the financial year and in alignment with my Investing Strategy, I will be looking at opening a fresh Stocks & Shares ISA in view to maximising my cashback reward in the process.

It is a clear and cut method consisting of three main steps:

- Compile a list of potential suppliers with a cashback offer attached.

- Shortlist main candidates using availability of funds to invest as deciding factor.

- Select provider based on funding plan and cashback reward for grabs.

Step 1 – Stocks & Shares ISA Providers

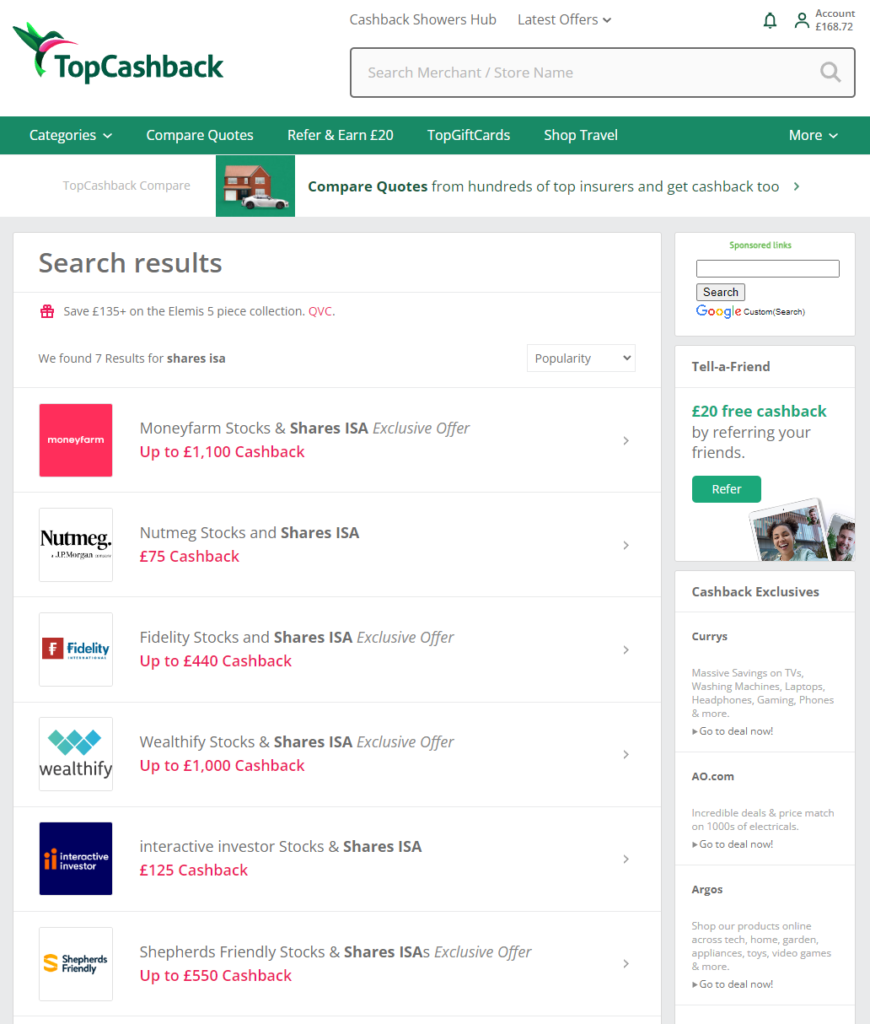

Not the most difficult of tasks really. Just typing ‘Stocks & Shares ISA’ in the TopCashback search box will do. This time I was presented with a list of six providers offering a variety of cashback rewards (see list below).

Step 2 – Shortlist S&S ISA Providers compatible with my availability of investment funds

I will need to click on each single one of the providers in the list to study the conditions to qualify for cashback individually. As for my S&S ISA funds are approximately £600 per year (£2,000 x 30%) coming from Free Money earnings alongside £2,700 I do have invested with other S&S providers (ideally, I do not want to withdraw or transfer any moneys).

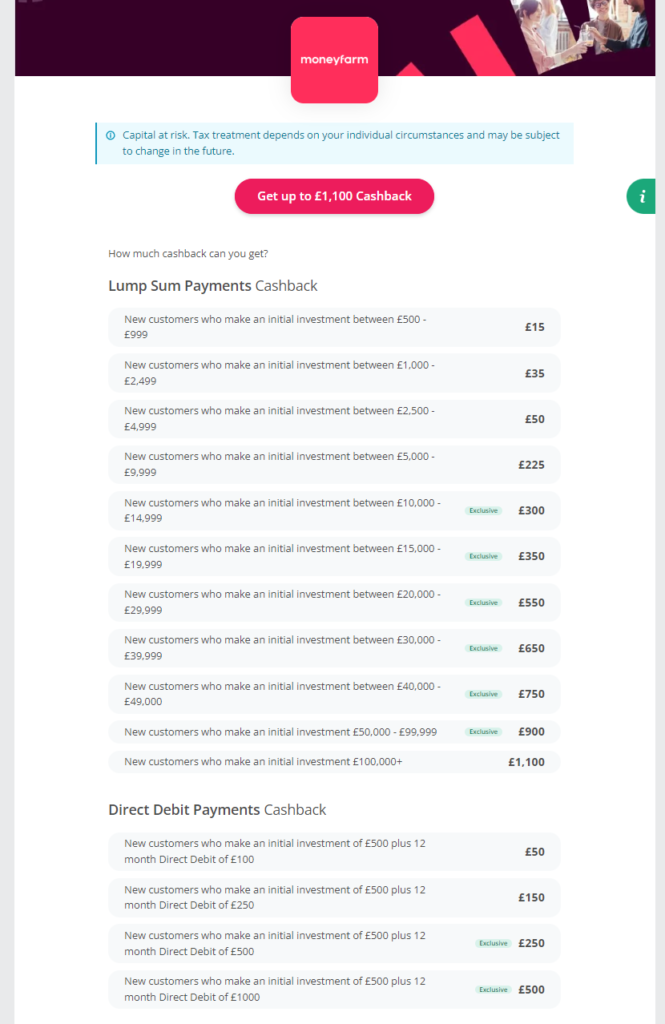

Moneyfarm requires investing thousands of pounds or hefty monthly contributions before qualifying for any relevant enough cashback reward. I will not be pursuing this avenue.

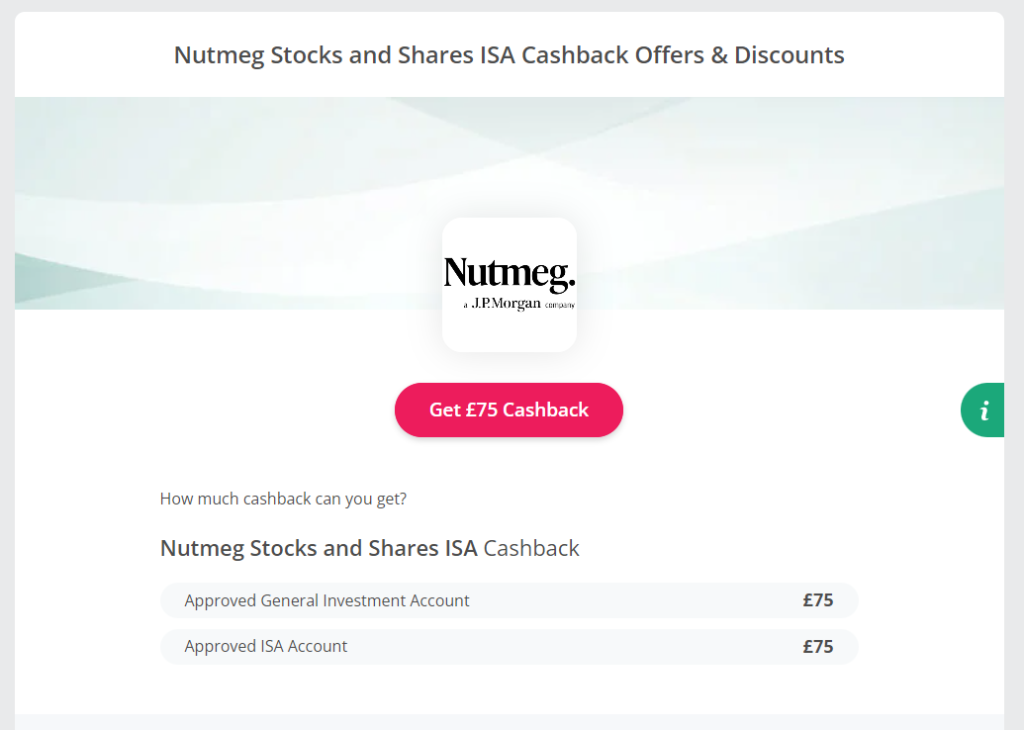

Nutmeg does not offer a massive reward nor the conditions are clear enough to me. It is a definite maybe.

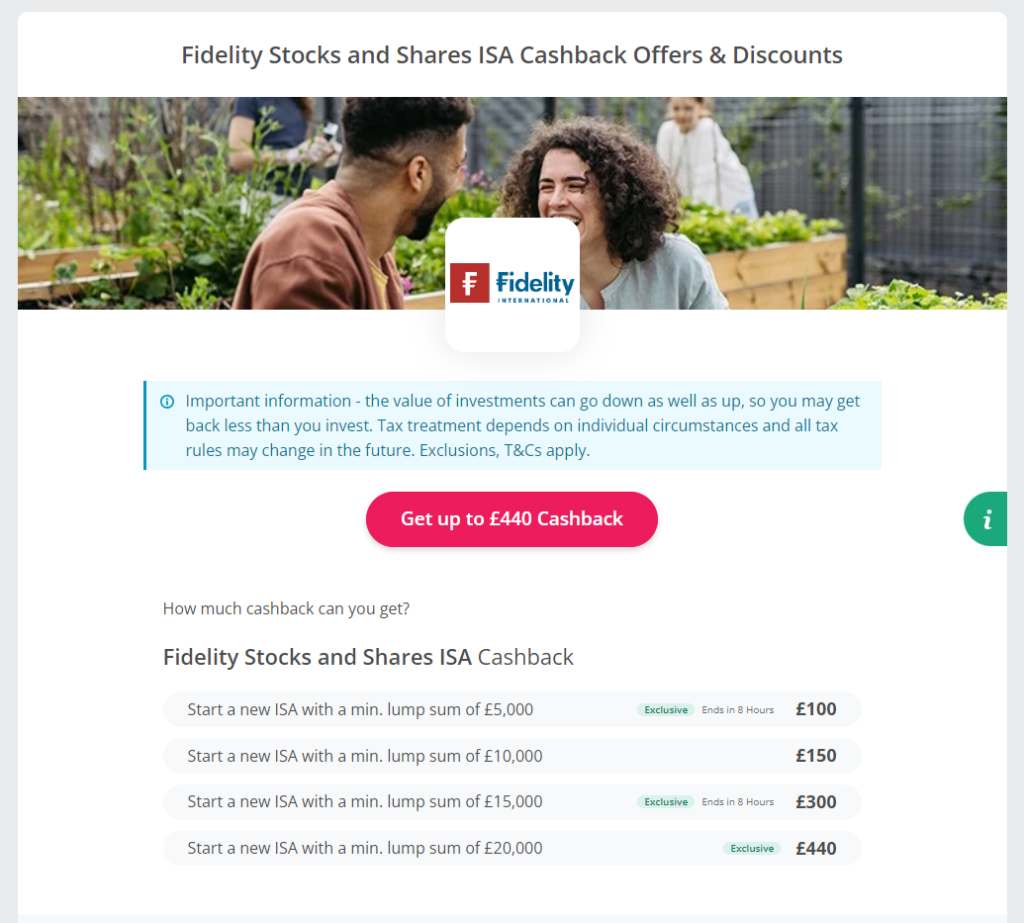

Fidelity is asking for a minimum of £5,000 lump sum. I am afraid is a no.

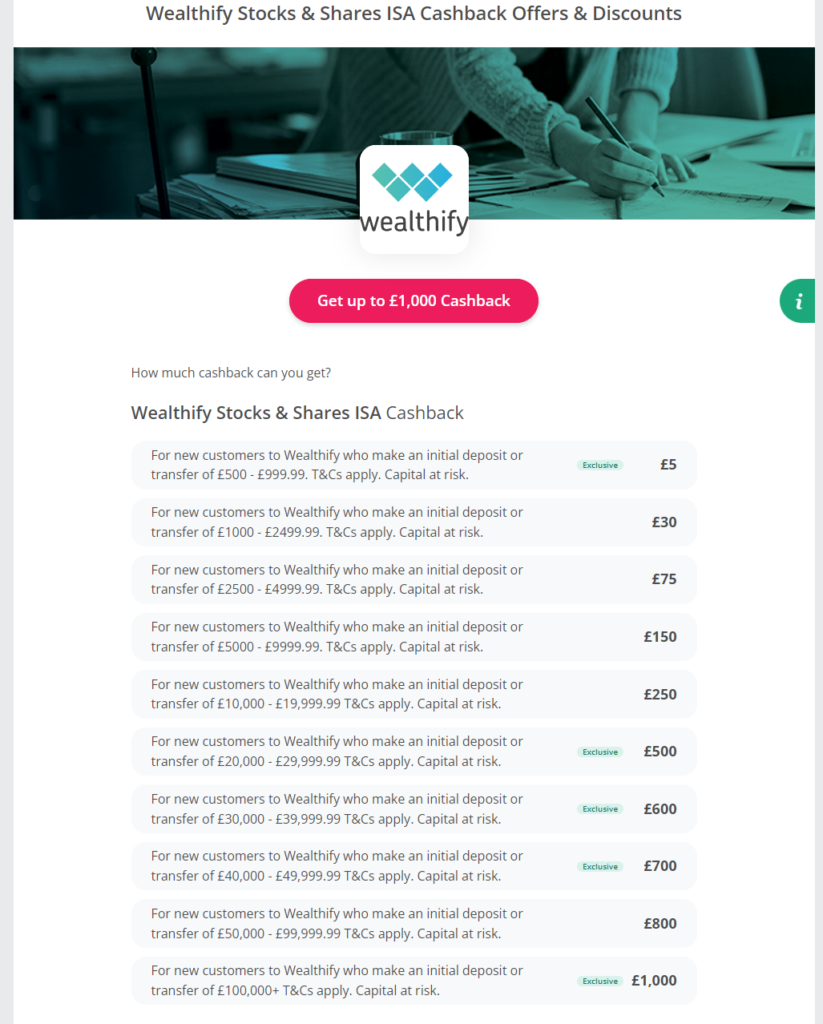

It looks to me that Wealthify is really targeting wealth investors just by the wording of their T&Cs. I am not one of them so I am sorry but I am out.

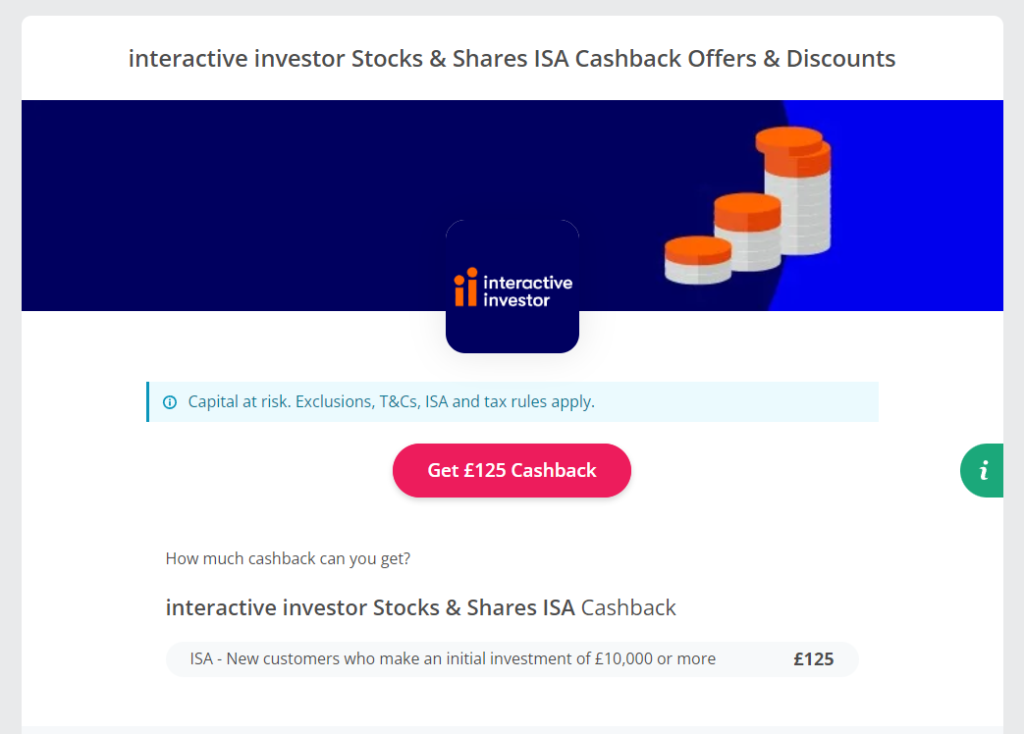

Interactive Investor is asking for £10k before even considering giving cashback away. Not appealing at all to be honest.

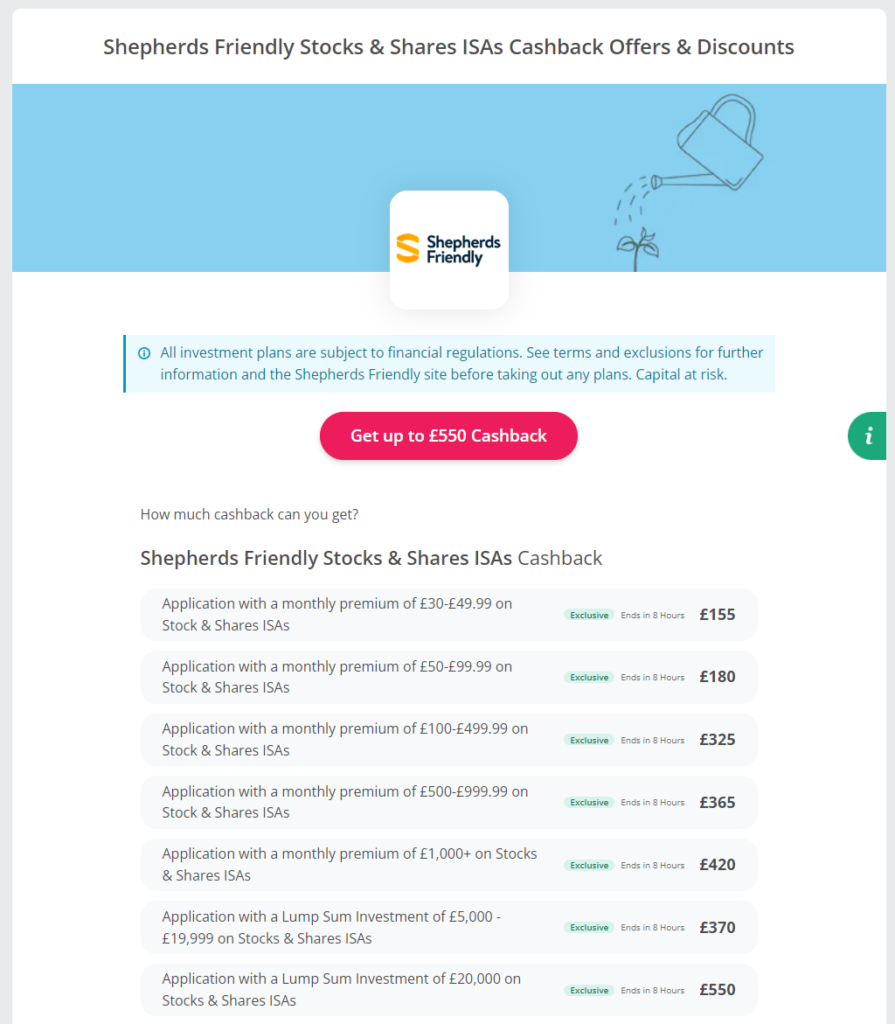

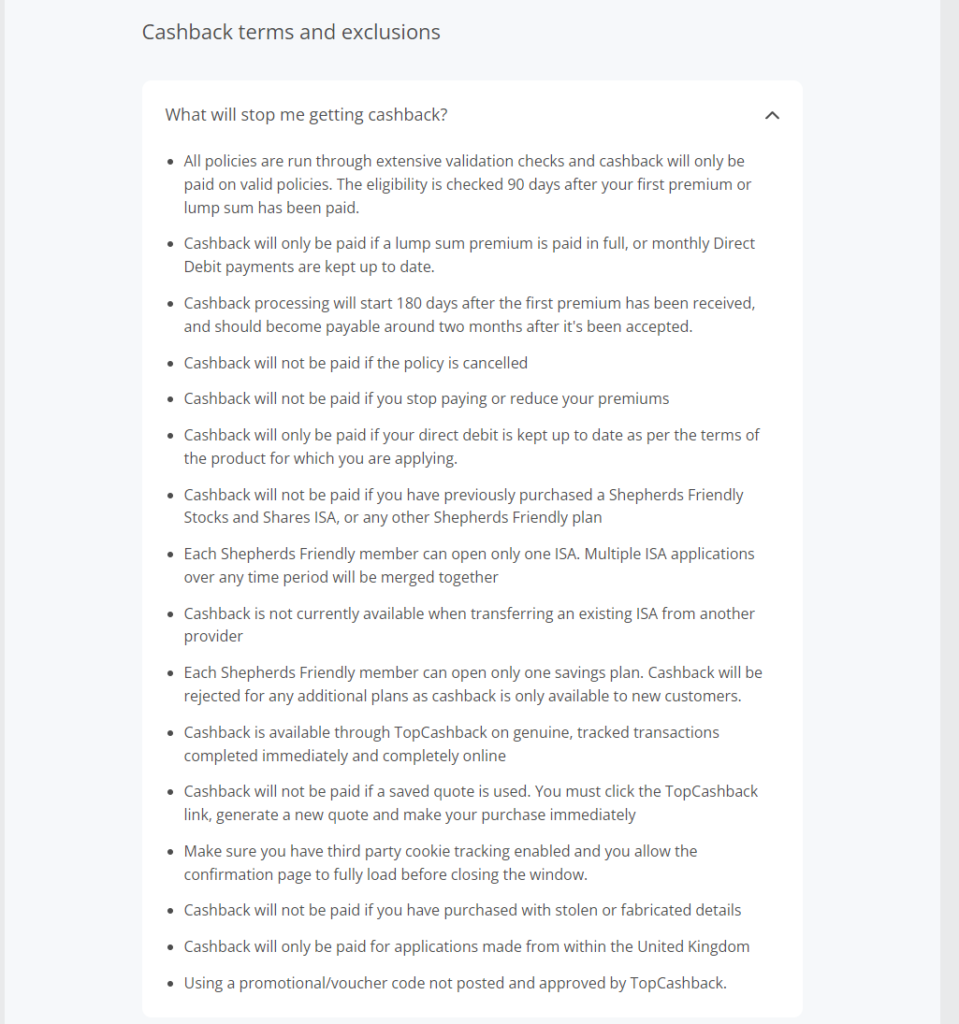

Shepherds Friendly is definitely within my reach and offers the most generous cashback reward of the lot. They are making my life easier as this is a no brainer. Their most basic reward is £155 and requires a £30 monthly investment for six months. That is far better than the other five I looked at. My decision is made by now and I will be opening a S&S ISA with Shepherds Friendly.

Step 3 – Devise Funding Plan to Qualify for highest Cashback tier

The S&S ISA will be opened with Shepherds Friendly and the highest cashback tier I can reasonably target is in the £100-£499.99 monthly premium bracket. Since the incubation period before cashback is paid is six months, that is roughly £600 I am going to need to make it happen. How am I going to make this money available for monthly deposits? From two main sources:

- From Free Money Earnings. I have made £600 in April meaning I need another £900 to meet the £1,500 end of year objective. Since 30% of earnings are automatically allocated to the S&S ISA Pot, I will be putting £300+ on the table to be invested.

- If this amount of money is not enough, I will withdraw from my other S&S Plans as needed. I trust that the £260 I have in deposit with Scottish Friendly S&S ISA will be sufficient.

Just to be on the safe side, I have decided that I will be contributing with £110 per month. I am expecting six months of contributions amounting to £660 in total. I am not foreseeing any issues in coming up with the monthly premiums timely.

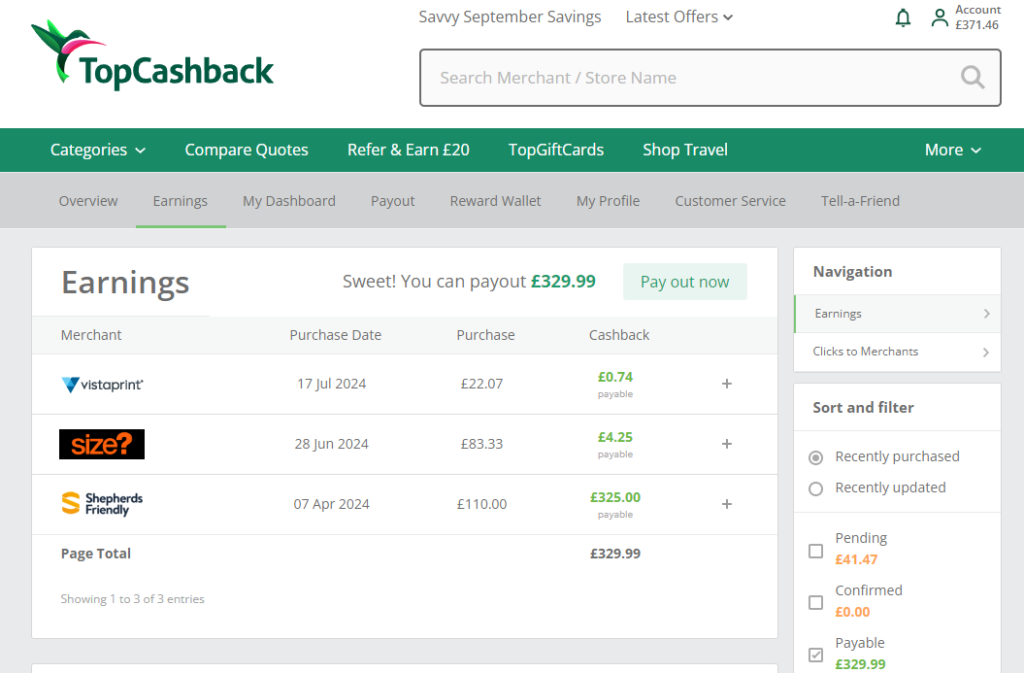

September 2024 – £325 Cashback is made available for payment

It is now September and I am glad to report that £325 cashback have been greened up and are available for withdrawal. Wonderful news. I did not even need to wait for six months. It has been really that simple. As soon as the money is in my bank account I will bring down my direct debit contributions to £30 in line with my predicted money allocation for the S&S ISA Pot. Easiest Free Money ever.

That’s it. Another happy story with an even better happy ending. Hope you have enjoyed. Until the next one… tada.