I managed to make £22,750 from Free Money Sources

In the early days…

I always saw myself as a money savvy individual but not particularly structured as regards to personal finance. That changed on the 1st of January 2015 when I decided to be a little bit more methodical as a New Year’s Resolution. From then on, at the start of every year, I will assign myself a ‘conservative and realistic’ set of financial goals and objectives. At the end of the day, that is the way a business operates, so why not adopt the same philosophy to my personal income and outgoings?

For instance: I would assign an objective in terms of paying-off my mortgage, one for credit card debt repayment, one for my pension, one for savings and another one for collecting ‘free cash’ available to me. I would keep a diary of all cash flows, and at the end of every month, I would record an aggregated summary and measure the gap against the objective being set. If the objective was met before the end of the year, I would cross it off and write down the date. I was sceptic at first, but I just kept going at it. To my surprise, I found that these objectives were achieved from as early as February to as late as August. From that moment on, I would just stop and enjoy or just kept going if I felt like it. Year on year, I would raise the bar a little bit higher as a way of challenging myself to reach further.

I am not an accountant and by any means, I am not advocating for every individual to do the same, but for me, the benefits were remarkably obvious:

- I knew where I was and where I wanted to be.

- I had to devise some sort of a plan to get myself there.

- I had to monitor results against objectives on a timely basis and re-evaluate my actions if needed.

- At a subconscious level, I was keeping the focus on the task at hand and making myself accountable in the process.

In summary, planning and monitoring is not a must in order to get results but improves and facilitates your chances of success significantly.

My Free Cash Earnings from 2015 to 2020

“Great stuff. Fantastic. Well done you. Thanks a million.” You might think. “But what are your actual figures in terms of ‘Free cash’?” I have gathered for you, my fellow reader, and for my own benefit as well, some numbers in the table below over the last five years (2015 to 2020):

| Year | Personal Objective | End of Year |

| 2015-2016 | £1,500 | £3,339 |

| 2016-2017 | £1,500 | £2,702 |

| 2017-2018 | £1,500 | £3,063 |

| 2018-2019 | £2,100 | £2,308 |

| 2019-2020 | £1,200 | £2,017 |

| Total | £13,429 |

Peer to Peer Returns

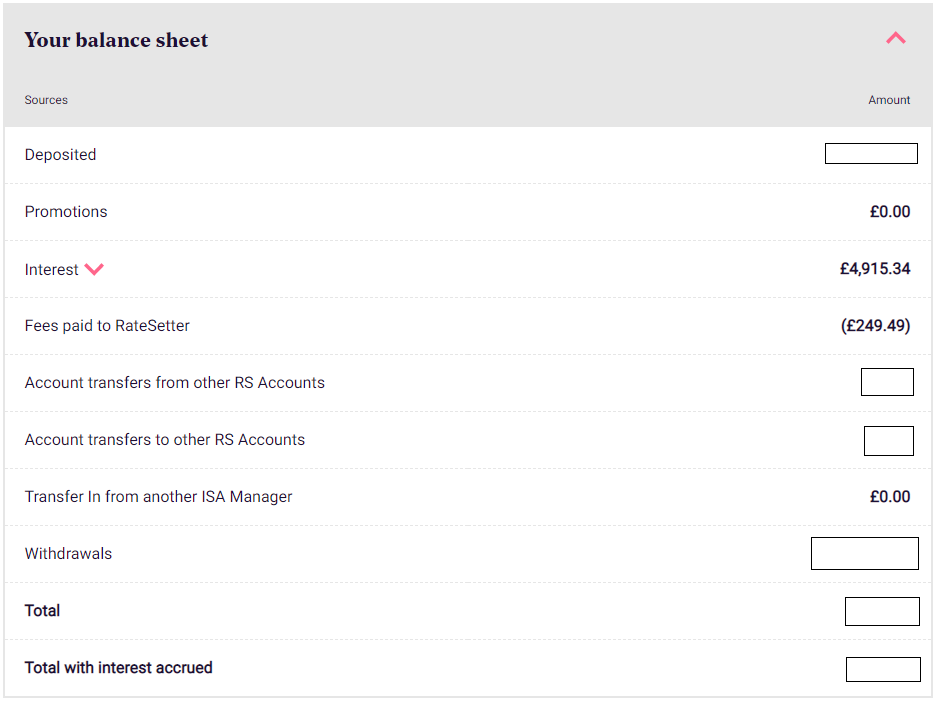

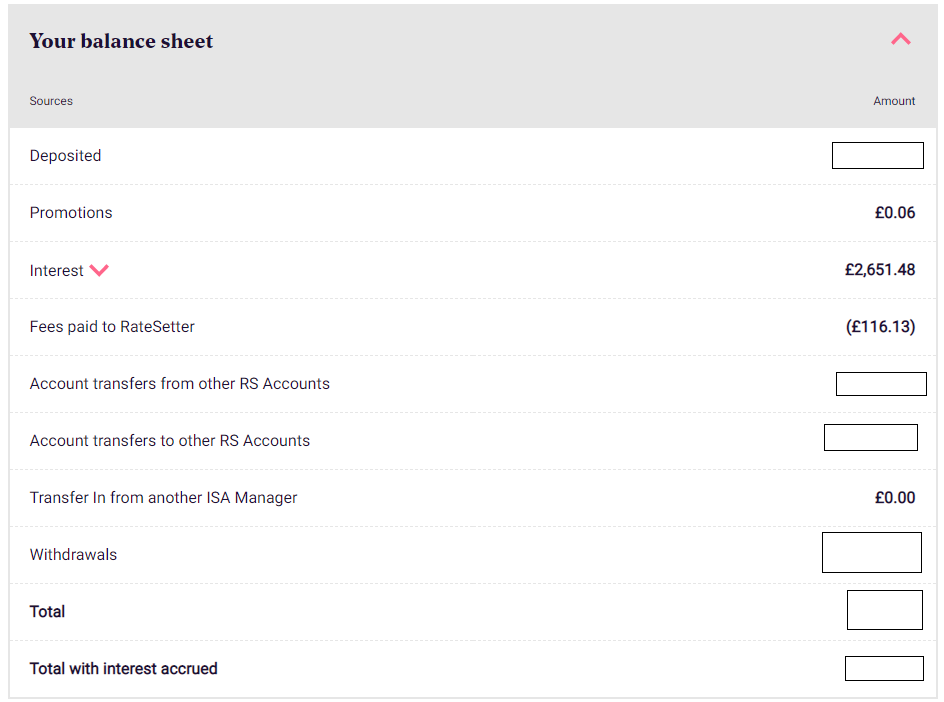

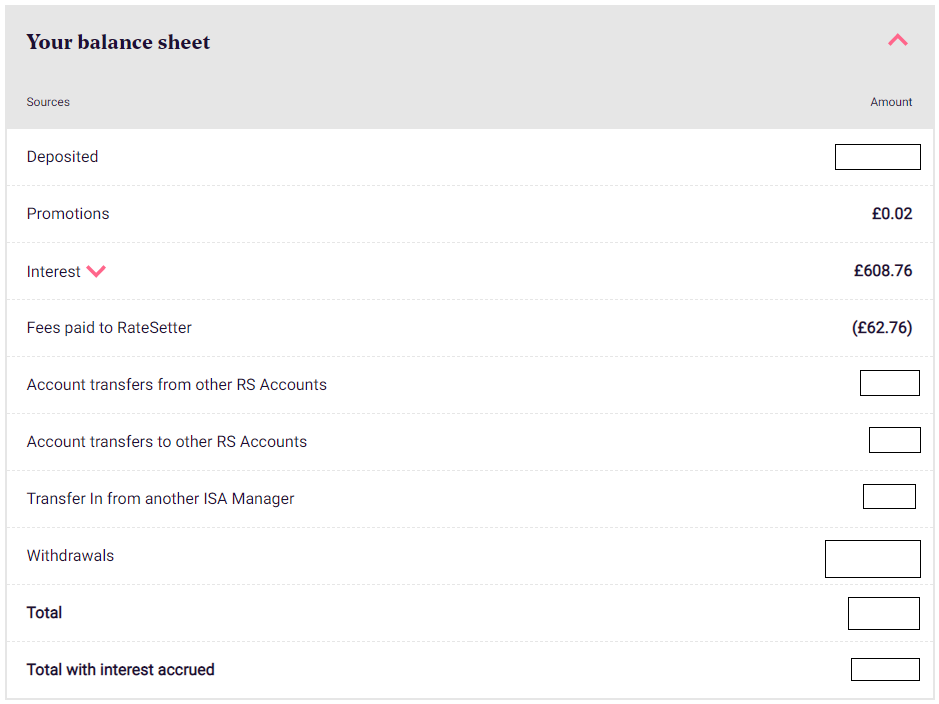

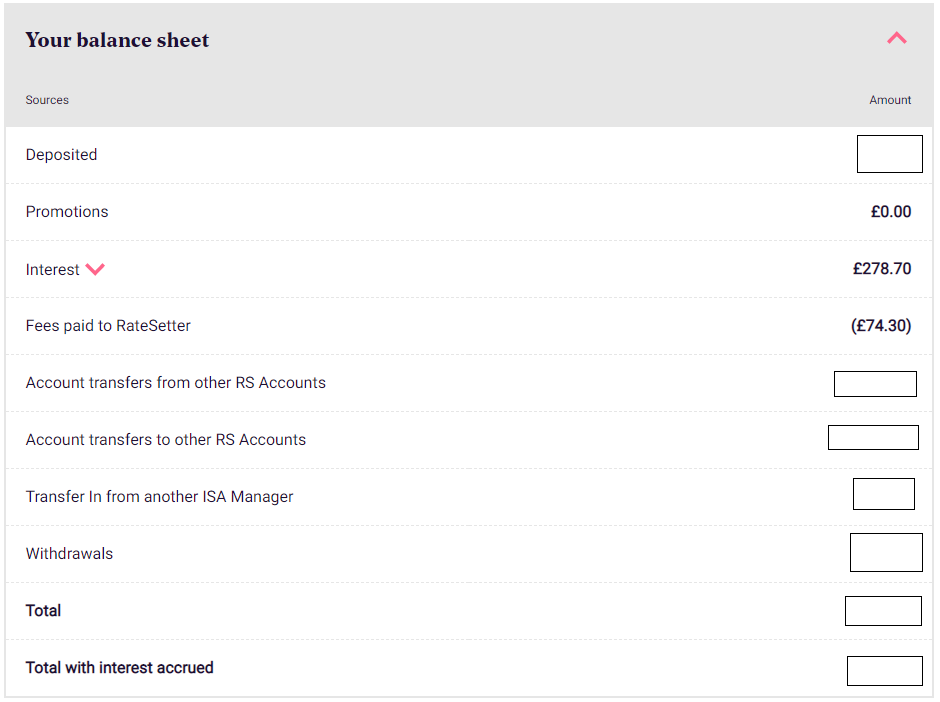

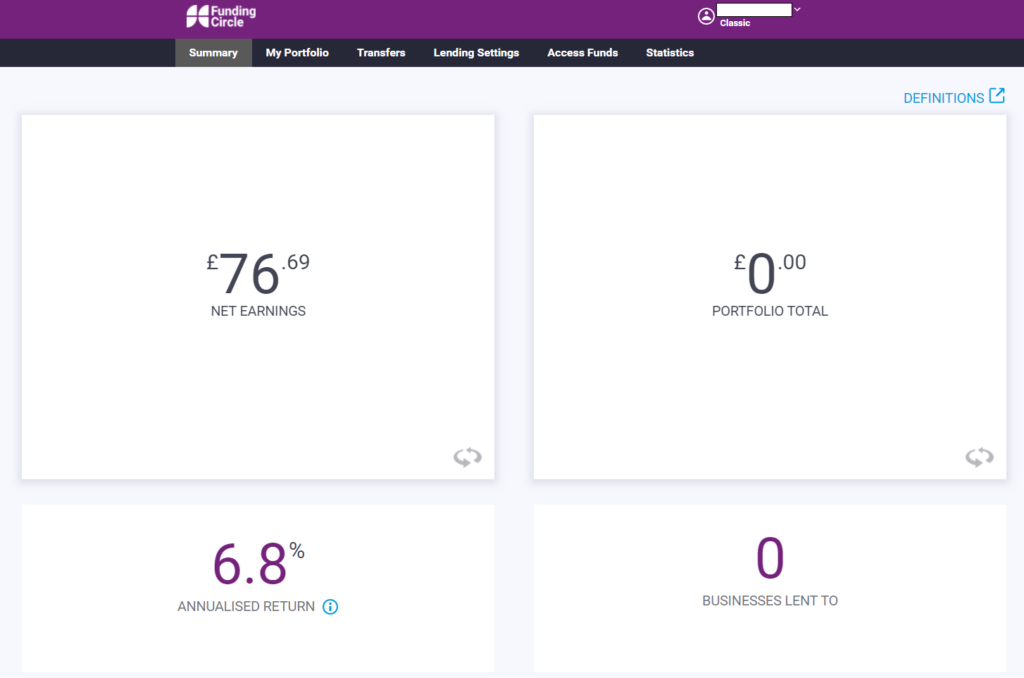

That cash was not sitting idle in a bank account or generating pennies in a savings account. I put to it to work alongside some of my own money and 0% interest borrowed money in Peer to Peer (P2P) Lending Platforms. Interest compounded I experienced excellent returns over the years (see pics below).

| Peer to Peer Platform | Interest Earnings |

| ZOPA (Opened 2006) | £1,294 |

| Ratesetter Account 1 (Opened 2015) | £4,666 |

| Ratesetter Account 2 (Opened 2013) | £2,535 |

| Ratesetter Account 3 (Opened 2017) | £546 |

| Ratesetter Account 4 (Opened 2018) | £205 |

| Funding Circle (Opened 2015) | £77 |

| Total | £9,323 |

I am oblivious to the fact of how much these figures could or could not be relevant to you or the average individual out there. However, let me elaborate on the reasons why they are extremely important to me:

- It all arrived and felt as cash for nothing. I was a passive subject or invested little time to obtain the returns. -Minimum Effort-.

- I did not have to commit any funds or tie up any moneys whatsoever. -No Investment-.

- It did not involve a Masterplan articulated in a A0 sheet with hundreds of milestones and gateways. Quite the opposite. A clear, plain and simple path of action. -Little Planning & Simple Execution-.

- It quickly took a life of its own and interest compounded in a relatively short period of time into a five-digit figure. -Short/Medium Time Horizon-.

- I paid myself a nice little bonus at the end of road (£22,752 to be specific). As silly as it sounds, it provided me with a sense of achievement and why not, a good deal of pride. -Tangible Results-.

Back to square one

All these earnings have now been put to good use in the shape of brick and mortar. It only means that I am now back to square one and will have to start all over again. I am far from feeling disheartened though, as I am equipped with some valuable knowledge and experience that I was lacking of in the early days. Whether or not I will be able to match past performances is a big question mark as the Real Challenge begins now. Let’s see what the future brings…