£997 in the First Quarter of 2021 – Time for a Review

Four months into my Free Money earnings activities, it is time for a review of my progress with regards to objectives set at beginning of the year. I do not intend on rediscovering the wheel and so I apply a simple four step process:

- Objectives set.

- Update indicators to measure progress against objectives.

- Understand performance gaps vs objectives.

- Take action to close the gap.

This flow of tasks works nicely for me. I will elaborate further on this post and explain the logic behind every topic in detail.

Step 1 – Objectives Set

We need to revisit the objectives, tools and breakdown allocation for every single Free Money Contributor to obtain the full picture. Detailed below, I have captured the summary box detailing three main line items.

2021 Objective: £1000 Free Money.

Tools: Bank rewards, cashback deals & rebates, eBay & casual sales, promotional sign-ups, interests over savings and any other unexpected source of free cash.

Objective Breakdown:

- Banks rewards and Interests over savings: £250.

- Cashback: £250.

- Promotions: £200.

- No longer needed items Sales: £300.

For an in-depth explanation of the system and the identification of free cash sources, click here to revisit full post.

Step 2 – Update indicators to measure progress against objectives

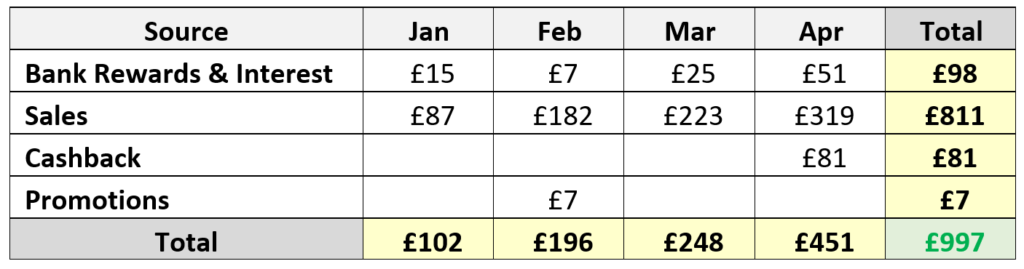

In order to understand where we are in relation to where we need to be, it is necessary to record our progress over time. In this sense, I have put together a simple spreadsheet to track my earnings by source on a monthly basis.

This data is made directly available from the Income Reports produced at the end of every calendar month. There are three obvious pieces of information that can be extracted from this table:

- Steady uptrend in earnings month by month for all line items.

- Approximately 80% of Free Money Earnings are attributed to sales, 10% to cash rewards and 10% to cashback pay outs. A markedly imbalanced contribution against objectives is clear.

- In practical terms, the objective for the year has been achieved in the first four months with a single month (April) accounting for nearly 50% of the total Earnings so far.

Step 3 – Understand performance gaps vs objectives

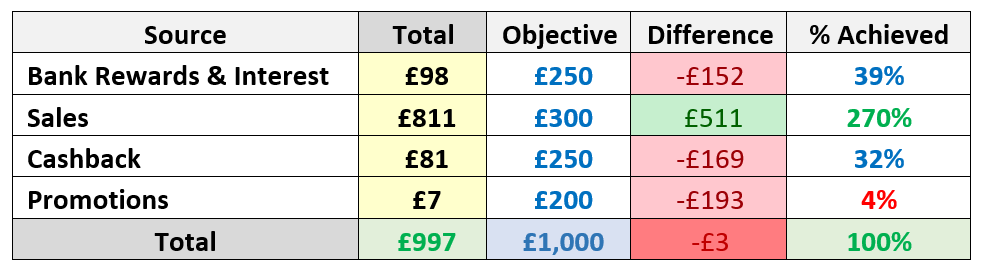

Having total figures at hand, a calculation of performance against objectives is a straight forward process just by taking away accumulative sums from objective values. I have added two additional columns to the spreadsheet to assist in this task. See summary table below:

How can these numbers be interpreted?

We have made £98 Free Money in Bank Rewards and Interests so far. We need to make another £152 to hit our £250 End of Year Target. We have accomplished 39% of our objective in 4 months or 33% of the time window given for the task. It means that if we keep this trend for the remainder of the year, we will surpass the £250 objective. On target.

We have smashed our number in the Sales department. We have delivered 2.7 times the £300 target for the year with a £811 Free Money Earnings. We have well overperformed and that means that we can focus our attention in other areas. Objective achieved.

We need to make another £169 in Cashback to reach the £250 mark. We have made 32% (£81) in 33% of the time meaning that we are sitting marginally below target. We need to keep earning cashback at the same pace in the following months. On target.

Nowhere near where we need to be as regards to Promotions. There has been no sign ups and no steps have been taken to make a dent on this income source. Well below target but we have eight months ahead of us to make a change.

Step 4 – Actions to close Gaps vs Objectives

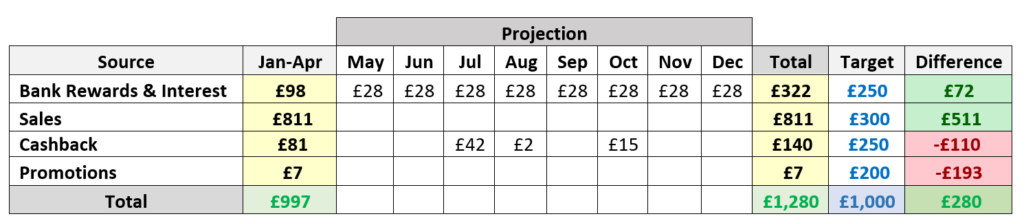

Are we happy so far or do we need to take further action to reach individual objectives? To answer this question, we need to look at the areas and the projected in-flows of cash for the months to come. It is also important to differentiate in between steady consistent spread of earnings such as Banks Rewards and occasional earnings such as Cashback and Promotions.

In the case of Bank Rewards, I have taken corrective actions and automated a process to ensure a pay out of £23 per month should Terms and Condition remain unchanged (see Bank Account Perks Review Post). By contrast, Interest over Savings will be a variable element linked to investment performance. I have made £22 in interest over savings up to this point which translates into an average of approximately £5 per month. There will be ups and downs along the way but I can reasonably expect a £5 performance per month. Adding both figures up together, my expectation is £28 in-flow per month or £224 from May to end of December. Should these numbers come to fruition, I will be over delivering in my EOY Target. The other way of seeing it is that I have room for a £72 deviation from my projected earnings. No Action.

I have £60 worth of Cashback pay-outs estimated to be sent before the end of the year. That brings me £110 short of my Year end Objective. The purpose is not to find excuses to spend in order to collect Cashback but to look for unavoidable or must-make expenditures to get Cashback from (see £45 Cashback Home Insurance Switch post). The challenge is to make these purchases sooner rather than later because Cashback usually take months to mature. Action: identify purchases with Cashback Rewards attached.

I have not completed a Promotion or a Sign-up yet for the simple reason that I have not concentrated my efforts on searching for them. I can now take my foot off the pedal on decluttering and look for opportunities to cash in on Promotions. Action: compile a list of available promotions and devise a plan for signing-up to the most relevant ones.

I have compiled results so far and projected earnings from May to December. It looks like even if I take no action whatsoever, I will comfortably beat my £1,000 Objective for the year by £280. Not a bad result but still not good enough for me since I have not reached my earnings targets for Cashback and Promotions. Encouraging but still some way to go.

Red boxes identified and having defined relevant actions, I need to prioritise which ones will be tackled first. The criteria is set for me by using deviation from target ratio. Numbers say that I should look for Promotions first and for Cashback sources second. No doubt that I am no short of materials for upcoming posts. Game on.

Recent Comments